- سبتمبر 6, 2021

- Posted by: ForexTradeOn

- Category: Axi Full Review

Ranks (of 5):

- Safety: 4.5

- The offering of investment: 4

- Account opening: 4

- Fees: 4.5

- Deposit and withdrawal: 5

- Platforms and languages: 4

- Research: 3

- Customer service: 4.5

- Education: 5

- Overall: 4.3

Pros

Segregated clients’ funds, regulated by top-tier financial authorities, negative balance protection, client protection amounts, over 14 years of trading experience, over 60,000 clients, Forex and CFD trading, demo account, Islamic account option, available in over 100 countries, no minimum deposit required, low trading fees, no deposit and withdrawal fees, various deposit and withdrawal methods, various base currency options, no inactivity fees, available on various trading platforms, and good educational materials.

Cons

Not listed on the stock exchange, limited trading instruments, slow account opening process, limited research tools, and no 24/7 customer support.

Introduction

AxiTrader or simply Axi is an Australian Broker that has over 60,000 clients worldwide. Axi is basically a Forex and CFD broker, and you can also trade other instruments like commodities and cryptocurrencies. Axi has negative balance protection and is also regulated by top-tier financial authorities like FCA and ASIC. Axi has high-quality educational materials as well as a demo account to help you start trading as soon as possible.

Disclaimer: CFDs have a high risk of losing money rapidly. About 80% of retail investor accounts lose money due to leverage when trading CFDs with this provider. Please note that CFDs are not complying with the Islamic religion. And if you want to trade in CFDs you should consider a swap-free account to follow Islamic rules. Learn more about CFDs for Muslims.

Safety

|

Pros |

Cons |

|---|---|

|

|

Is Axi regulated?

The Axi broker is regulated by many financial authorities like:

- FCA: the Financial Conduct Authority in the UK

- ASIC: the Australian Securities and Investments Commission

Is Axi a scam?

Axi safety is divided into 2 parts, the safety of the broker itself and the safety of the client.

Broker safety

Axi has a long tracking record of 14 years in the trading market. It passed many financial disasters up till now. Axi is also trusted by more than 60,000 clients from 100 countries. On the other side, Axi is not listed on the stock exchange.

Client protection

Axi has client protection amounts under some regulators in order to protect its clients’ funds if anything goes wrong. Axi also holds a comprehensive Client Money Insurance policy that provides its retail clients with protection up to US$1,000,000. This insurance coverage comes at no additional cost to you and automatically applies to all retail accounts with balances above US$20,000.

Axi Legal Entities Table

|

Country |

Protection amount |

Regulator |

Broker’s Legal Entity |

|---|---|---|---|

|

The UK and the EU |

£85,000 |

FCA |

AxiCorp Limited |

|

Australia |

No protection |

ASIC |

AxiCorp Financial Services Pty Ltd |

Luckily, Axi has negative balance protection to protect your balance in your account from going beyond zero.

Offering of Investments

|

Pros |

Cons |

|---|---|

|

|

Axi provides different categories to trade including Forex, CFDs, energies, metals, natural, and cryptos. On the other hand, the trading instruments are so little, and there is no mutual funds trading.

Disclaimer: CFDs have a high risk of losing money rapidly. About 80% of retail investor accounts lose money due to leverage when trading CFDs with this provider. Please note that CFDs are not complying with the Islamic religion. And if you want to trade in CFDs you should consider a swap-free account to follow Islamic rules.

Learn more about CFDs for Muslims.

Axi Offering of Investments

|

Category |

Number of Products |

|---|---|

|

Currency Pairs |

66 |

|

CFD |

16 |

|

Metals |

6 |

|

Natural |

4 |

|

Energies |

4 |

|

Crypto |

5 |

Note:

Please note that some of the trading options may depend on your account type and/or your country of residence according to governmental rules.

Account Opening

|

Pros |

Cons |

|---|---|

|

|

Countries available

Axi is available in 100 countries around the world including the UK, Germany, and Spain. There are some restricted countries like the US.

Account types

There are two main account types at Axi:

- Standard Account

- Pro Account

In addition to that, you can also open an Islamic account if you want.

Axi – Account Comparison

|

Feature |

Standard Account |

Pro Account |

|---|---|---|

|

Setup cost |

Free |

Free |

|

Spreads |

From 0.4 pips |

From 0.0 pips |

|

Commission |

None |

$7 round trip (USD) |

|

Minimum Trade Size |

0.01 lots |

0.01 lots |

|

Minimum deposit |

0 |

0 |

|

Products |

140+ FX pairs, Metals CFDs |

140+ FX pairs, Metals CFDs |

|

Pricing |

5 digit pricing |

5 digit pricing |

|

Mobile trading |

Yes |

Yes |

|

MT4 NextGen |

Yes |

Yes |

|

Base account currencies |

AUD, CAD, CHF, EUR, GBP, HKD, JPY, NZD, SGD, USD |

AUD, CAD, CHF, EUR, GBP, HKD, JPY, NZD, SGD, USD |

|

Demo period |

30 days |

30 days |

|

EA compatibility |

Yes |

Yes |

|

VPS |

Free |

Free |

|

Autochartist |

Free |

Free |

|

myfxbook Autotrade |

Free |

Free |

|

PsyQuation |

Free |

Free |

|

PsyQuation Premium |

Free |

Free |

Axi also provides a demo account with 0 fees if you want to experience the trading platform with no risk.

Min deposit

There is no minimum deposit required to open an Axi account.

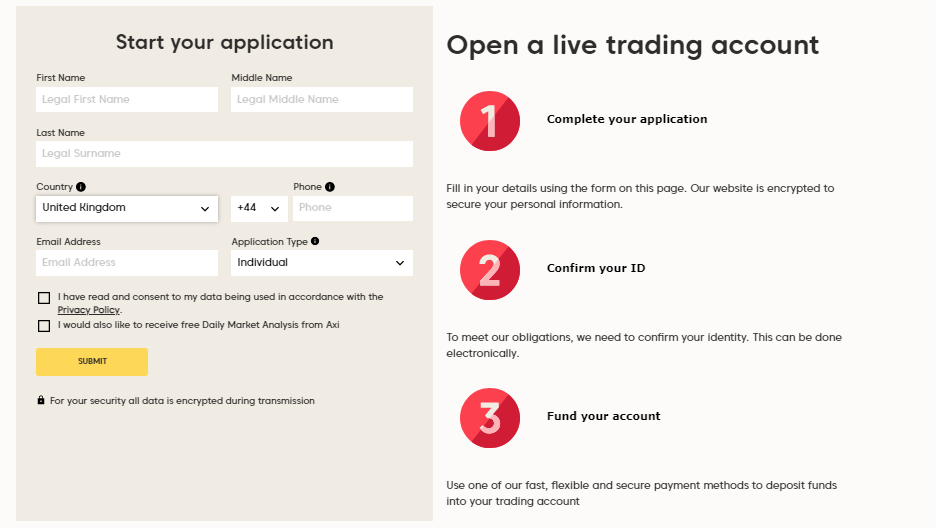

How to open an account

You can open an Axi account in minutes through these steps:

- Enter your email address and country of residence

- Choose the account type.

- Add your trading experience.

- Verify your identity and residency.

- Deposit and start trading.

Axi – Account opening

Notes: the verification process takes from 2 to 3 business days to be done.

Fees and Commissions

|

Pros |

Cons |

|---|---|

|

|

Commissions

Axi charges commissions on the Pro account only. The commission value is $7 per round trip.

Trading Fees

Note that the spreads differ from one account type to another. So, make sure to read the following section carefully.

Forex fees

The average spread for trading EUR/ USD is:

- Standard Account: 1.2 pips per lot

- Pro Account: 0.1 pips per lot

Index fees

The average spread for trading US 500 is 50 pips per lot for the standard account.

Disclaimer: CFDs have a high risk of losing money rapidly. About 80% of retail investor accounts lose money due to leverage when trading CFDs with this provider. Please note that CFDs are not complying with the Islamic religion. And if you want to trade in CFDs you should consider a swap-free account to follow Islamic rules.

Learn more about CFDs for Muslims.

Energy fees

The average spread for trading US Oil is 3 pips per lot for the standard account.

Stock and ETF CFDs

The average spread for trading XAU/ USD is:

- Standard Account: 17 pips per lot

- Pro Account: 10 pips per lot

Natural

The average spread for trading Coffee is 30 pips per lot for the standard account.

Cryptocurrencies

The average spread for trading BTC/ USD is 4655 pips per lot.

Non-trading fees

- Account fee: $0

- Deposit fee: $0

- Withdrawal fees: $0

(you can check the full withdrawal fees in the withdrawal fees section)

- Inactivity fee: $0

Deposit and withdrawal

|

Pros |

Cons |

|---|---|

|

|

Account Currencies

The Axi account has 10 base currency options:

- AUD

- CAD

- CHF

- EUR

- GBP

- HKD

- JPY

- NZD

- SGD

- USD

Notes:

- You will not be charged with conversion fees if your account has the same currency as your bank account or when you trade assets with the same currency of your account.

- If you want to avoid being charged with conversion fees, you can open a multi-currency bank account at a digital bank.

Deposit and Withdrawal

1. Options

Axi supports depositing/ withdrawal using different methods such that:

- Credit/Debit Card

- POLi

- Bank Transfers

- FasaPay

- Sofort

- GiroPay

- iDeal

- Neteller

- Bitcoin

- Skrill

- Boleto

- Brazil Internet Banking (TED)

- Chinese Internet Banking

- Thailand Internet Banking

- Vietnamese Internet Banking

- Indonesian Internet Banking

- Polish Internet Banking

- Hong Kong Internet Banking

- Malaysian Internet Banking

- Singapore Internet Banking

- Philippines Internet Banking

- South African Internet Banking

- Nigerian Internet Banking

- Kenyan Internet Banking & MPESA

- Ghana Internet Banking & Mobile Money

- Cambodian Internet Banking

- Laos QR Payments

- Myanmar QR Payments

- Global Collect

Axi deposit and withdrawal methods

|

Axi |

|

|---|---|

|

Credit cards |

Yes |

|

Bank Transfers |

Yes |

|

Electronic wallet |

Yes |

2. Fees

Payments are free for both depositing and withdrawal from Axi. Please note that for withdrawal, there is a minimum amount to withdraw for each method.

3. Time

Payments are processed instantly for all methods, except for the bank transfers that may take 3 to 5 business days.

Notes:

- AxiCorp is required by statutory anti-money laundering and counter-terrorism financing obligations to report any activity by an individual, company, or trust that could be construed as suspicious to the Australian Transaction Reports and Analysis Centre (AUSTRAC).

- Axi does not charge any fees for deposits or withdrawals, for any payment method. However, please be aware that you may incur fees on payments to and from some international banking institutions and that AxiCorp accepts no responsibility for any such bank fees. Please also note that your bank may view payment to Axi as a cash advance and bill you according to your cash advance rules.

- If there is sufficient evidence that deposits made are not for trading purposes, Axi reserves the right to pass on the deposit fees at the time of withdrawal.

- Axi does not charge any fees for the first $50,000 deposited each month. If you exceed this monthly Fee Free Limit, Axi reserves the right to pass on your Neteller and Credit card transaction fees. If you have further questions, please contact your account manager.

Platforms and Languages

Axi works on various trading platforms including MT4, MyFXBook, and Zulutrade. In this article, we will test the MT4 platform on mobile.

MT4 Trading Platform

|

Pros |

Cons |

|---|---|

|

|

Languages

MetaTrader 4 is available in several languages like:

MT4 Languages

|

Arabic |

Bulgarian |

Chinese |

Croatian |

Czech |

Danish |

|---|---|---|---|---|---|

|

Dutch |

English |

Estonian |

Finnish |

French |

German |

|

Greek |

Hebrew |

Hindi |

Hungarian |

Indonesian |

Italian |

|

Japanese |

Korean |

Latvian |

Lithuanian |

Malay |

Mongolian |

|

Persian |

Polish |

Portuguese |

Romanian |

Russian |

Serbian |

|

Slovak |

Slovenian |

Spanish |

Swedish |

Tajik |

Thai |

|

Traditional Chinese |

Turkish |

Ukrainian |

Uzbek |

Vietnamese |

User interface (UI)

MT4 has a very customizable UI that you can adjust according to your needs and preferences. On the other hand, it seems hard to find some of the features inside.

MT4 – Mobile Version – UI

Login and Security

Unfortunately, the MT4 does not provide a two-step verification method for logging in, and it does only support a one-step login.

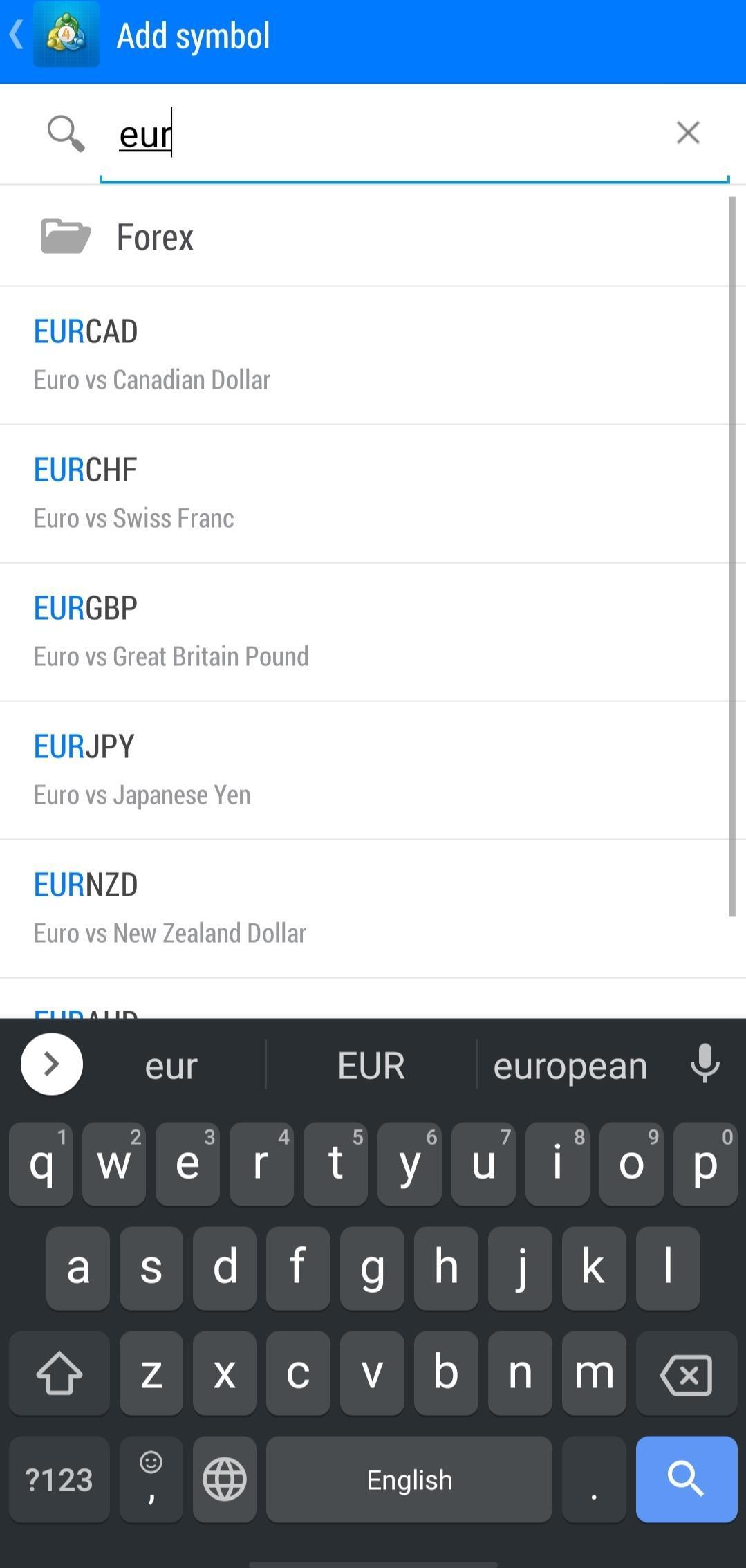

Searching

Searching using the MT4 platform has two different options:

- You can search by category and find assets.

- You can also type the name of the asset and search for it manually.

MT4 – Mobile Platform – Search

Placing orders

MT4 has simple order types which are:

- Market

- Limit

- Stop

- Trailing stop

In addition to those 4 types, there are other orders: the time limit ‘Good ‘til time’ (GTT) and ‘Good ’til canceled (GTC).

There’s also an order confirmation feature in MT4.

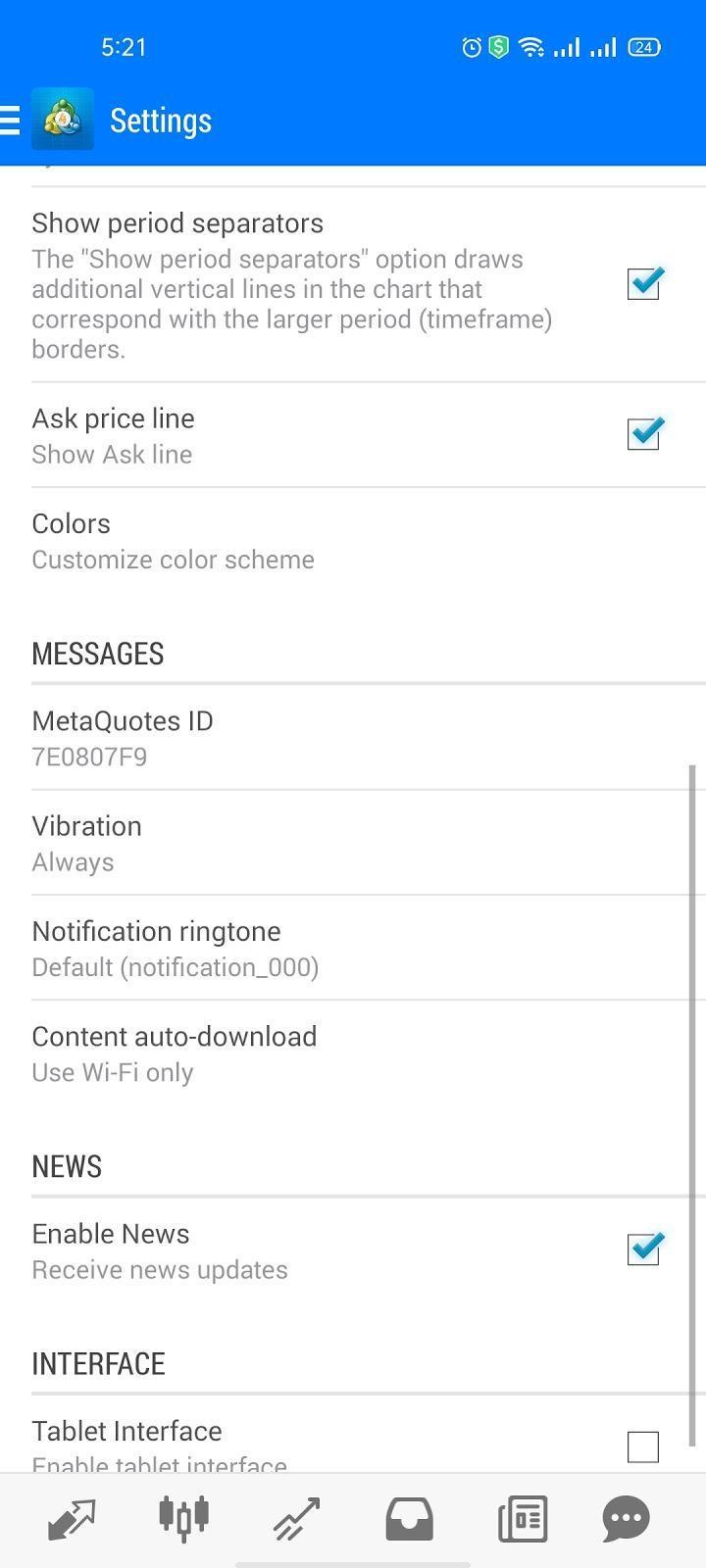

Notifications and alerts

Unfortunately, the MT4 web trading platform does not have an option to set price alerts and notifications unlike the desktop and mobile versions.

MT4 – Mobile Version – Notifications Settings

Portfolio and reports

Under the ‘History’ tab, you can find your portfolio reports with a clear fee description.

MT4 – Mobile Version – Portfolio

Research Tools

|

Pros |

Cons |

|---|---|

|

|

Sources

The research tools come from 3 main places:

- Axi website

- MT4 platform

- PsyQuation

Charting

Axi provides a good charting tool with over 30 indicators to help you plot and make predictions. You can also use the charting tool to develop and improve your trading strategies.

MT4 – Research – Charting

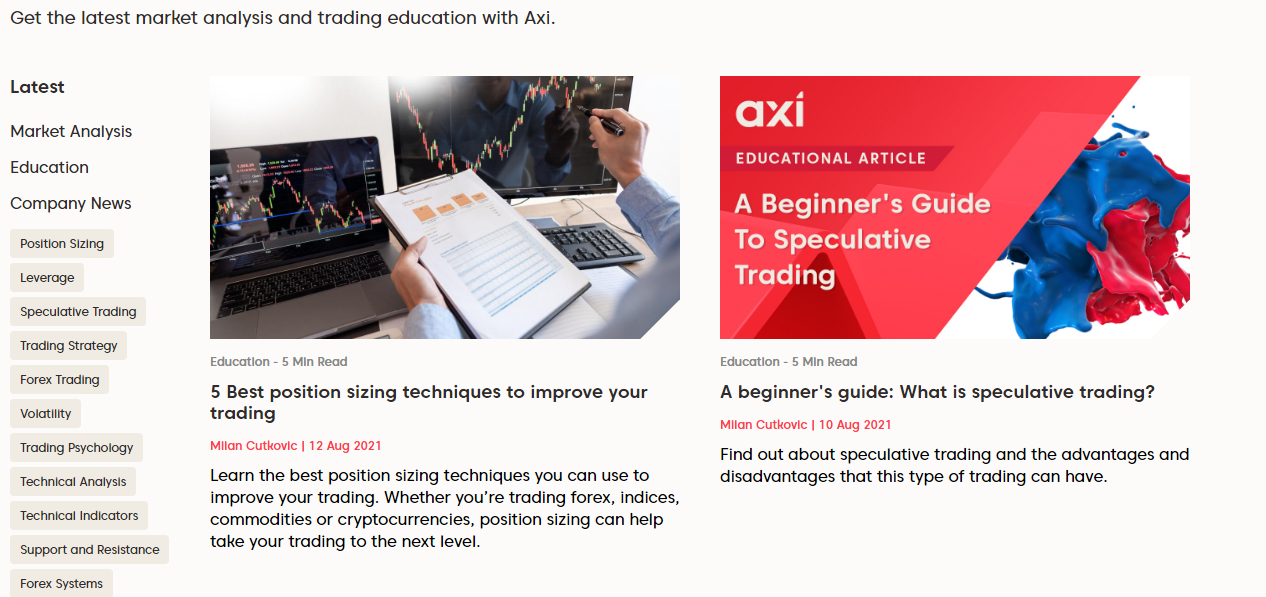

Newsfeed

There are 2 sources of news, the MT4 trading platform, and the Axi website. The MT4 news tool lacks visual elements, on the other hand, the Axi website provides a quality newsfeed with media and links that look much more informative than the MT4’s.

MT4 – Research – News

Other tools

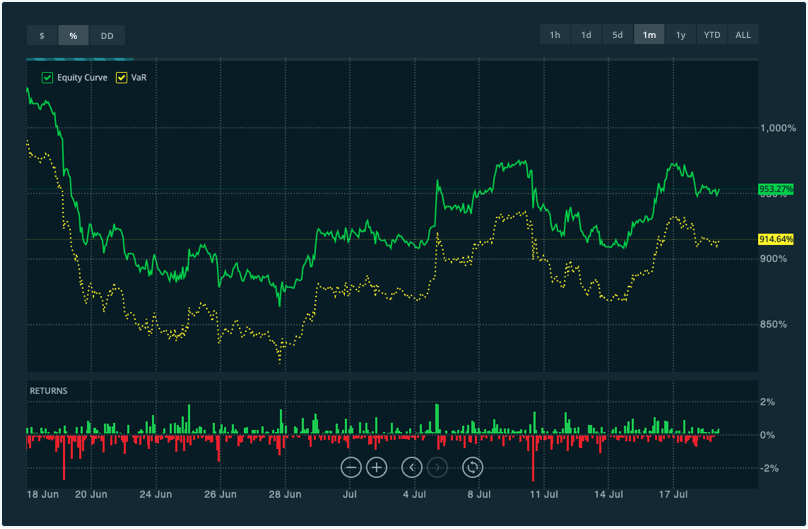

There are several other research tools that are available at PsyQuation, an AI-driven premium platform. Those tools include, but are not limited to charts, tables, benchmarks, and more.

PsyQuation – Research – Charting

Customer Support

|

Pros |

Cons |

|---|---|

|

|

Options

Axi supports different customer service channels like:

- Phone call

- Live chat

Languages

The languages available for customer service are many with the support of major languages like German, English, and Spanish.

Axi – Customer Support

Education

|

Pros |

Cons |

|---|---|

|

|

Axi Provides a variety of educational materials including:

- Guides

- Ebooks

- Blogs

- Tutorials

- Webinars

- Events

In addition to that, Axi provides a demo account to learn to trade and test your trading strategies.

Axi – Education

FAQs

-

- How long does it take to verify my account?

- It takes about 2 to 3 business days to verify your Axi account.

- Can I open more than one trading account?

- Yes, by logging into the Axi Client Portal and selecting New Trading Account. You will be able to set the account type, and currency before you submit your request.

- Does Axi allow bot trading?

- Yes, through Expert Advisors (EAs).

- Does Axi give a bonus?

- Axi Broker offers a $50 No Deposit Bonus to start live Forex without any initial investment.

- Does Axi allow scalping and hedging?

- Yes.

- Where is my money held?

- In segregated bank accounts far away from Axi’s own funds.

- How to enable the swap-free option in my account?

- Simply contact Axi’s Client Services team and they’ll help you through the process. Please note that approval to open an Islamic trading account is the sole discretion of Axi.

- How do I log in using the MT4 mobile platform?

- Steps:

1. Go to ‘Settings’

2. Click on ‘Manage Accounts’ or ‘Settings’

3. Then click on the small plus sign or select ‘New Account’

4. Then select ‘Log in to an existing account

5. Search for the broker name

6. Select the server your account was set up on

7. Enter your login credentials and password

8. Click on ‘Sign In’

-

- When will my demo account expire?

- After 30 days.

- When trading forex, will you lose more than your initial deposit?

- MetaTrader 4 is set to automatically close your positions when your margin requirement reaches 100% (stop out level).

- Please note that this process is automated and does not guarantee that your account will not enter into a negative equity situation. You should keep a balanced amount in your account above your required margin.

- Can I log in to more than one account from the same computer?

- Yes, you can do such a thing by using the MT4 Multi Terminal.

- Can I log in to the same account through different devices?

- Yes, you can log in to the MetaTrader 4 platform using the same password and username through different devices.

- Does Axi accept payments from third parties?

- Payments should be from an account that holds the same name as yours.

Conclusion:

- Pros: segregated client funds, negative balance protection, low trading fees

- Cons: not listed on the stock exchange, limited trading instruments, and no 24/7 support

- Best for: MT4 traders

- Regulated by: FCA and ASIC

- Headquarters: Australia

- Foundation year: 2007

- Min Deposit: $0

- Deposit and withdrawal methods: credit cards, bank transfers, electronic wallets

- Deposit and withdrawal fees: Free

- Base currencies: AUD, CAD, CHF, EUR, GBP, HKD, JPY, NZD, SGD, USD

- The offering of investments: Forex, CFDs, commodities, cryptos, metals, energies

- The number of users: 60,000 clients