- يوليو 12, 2021

- Posted by: ForexTradeOn

- Category: BDSwiss forex

|

Pros |

Cons |

|

|

Introduction

BDS or BDSwiss broker is one of the biggest brokers out there with over 1.5 million accounts and an average trading volume of $84 billion. It’s regulated by a lot of top regulators including CySE, NFA, FSC, and more. BDSwiss was initially founded in 2012 and has over 9 years of experience. It offers a variety of trading instruments including forex, CFDs, shares, and commodities. The biggest advantage that BDS has is the Ultra-Low spreads and commissions among the competitors. BDS also offers good research tools as well as educational materials for its clients.

Countries Available

BDSwiss is available in a lot of countries around the world. Currently, it has clients from 186 different countries. Note that there are some exceptions as you can not open an account if you are from the USA.

Account Types

BDS offers 3 different account types which are:

- Classic

- Raw

- VIP

In addition to the previous account types, BDS also offers an Islamic account option for traders who want to have a swap-free account.

BDSwiss – Account comparison

|

Classic |

Raw |

VIP |

|

|

Spreads |

From 1.5 pips |

From 1.1 pips |

From 0.0 pips |

|

Commissions |

$0 on all pairs $2 on indices & 0.15% on shares |

$5 on all pairs $2 on indices & 0.15% on shares |

$0 on all pairs $0 on indices & 0.15% on shares |

|

Min. deposit |

$100 |

$3,000 |

$5,000 |

|

Islamic Account |

Yes |

No |

Yes |

BDSwiss also provides a demo account with 0 fees if you want to experience the trading platform with no risk.

There’s an option to join the BDSwiss affiliate partner program if you want as well.

How to Open Account

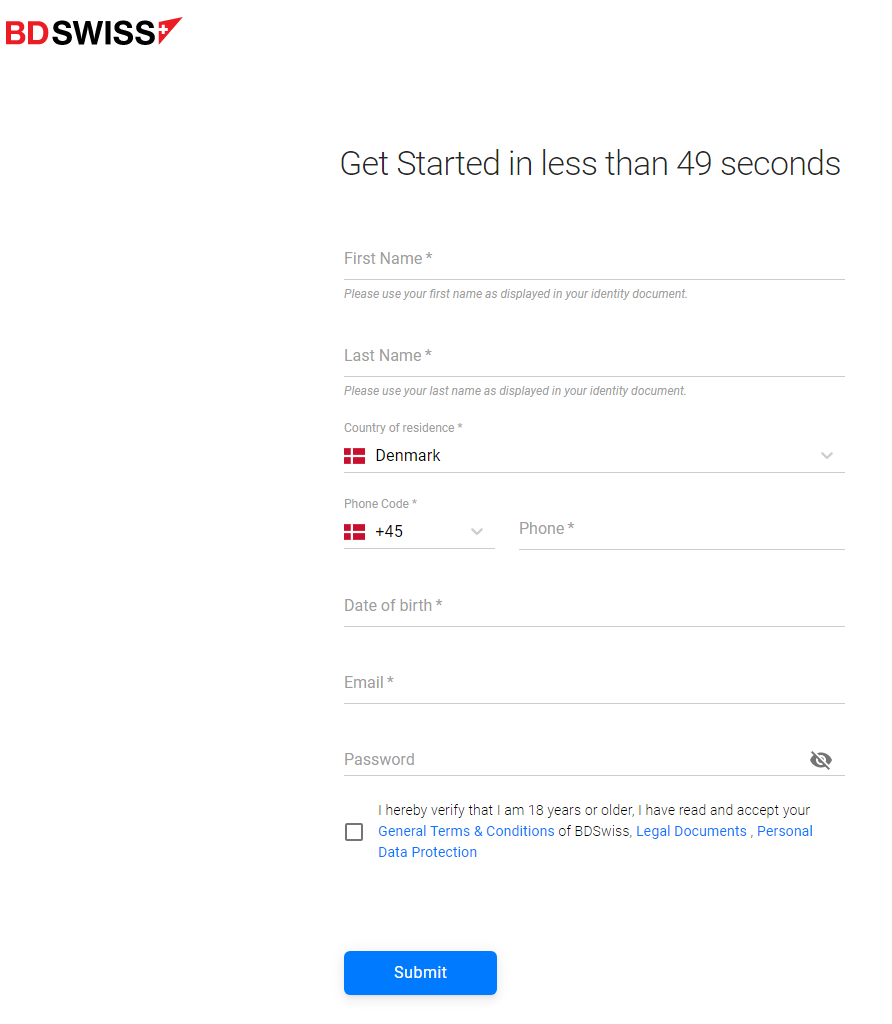

You can open a BDSwiss account in minutes through these steps:

- Open the BDS mobile application.

- Enter your name, email, and password.

- Enter the country of residence and your phone number.

- You will receive an email shortly to activate your account and choose the trading platform.

- Verify your identity and make a deposit.

- Start trading freely.

BDSwiss – Account opening

Notes:

- The verification process takes from 1 to 2 business days.

- Due also to the requirements of the regulatory bodies that supervise BDSwiss, it is necessary that in order to operate with your account you send them proof that proves your identity and another proof that proves your current address.

- Identity document: You must send a copy of your ID, passport, or driving license. It has to be an official document that clearly shows your identity and that it is valid (the document you send cannot be expired). You can scan any of these documents and send it in PDF, JPG, GIF, or take a photo with your mobile if it is more comfortable for you. In any case, the image must have good quality and be completely readable, otherwise, it may give you problems verifying it.

- Proof of address: This is to send a document that shows your current address. You will have to send a recent utility bill (not exceeding 3 months) for electricity, water, gas, landline, or Internet (many brokers do not accept, for example, mobile phone bills). You can scan and send it in PDF, JPG, GIF, or take a photo with your mobile. Like the previous document, all the data must be legible and have sufficient quality.

FAQs

- How long does it take to verify my account?

- It takes about 1 to 2 business days to verify your BDSwiss account.

- Can I open more than one trading account?

- Yes, BDSwiss allows up to 5 different trading accounts, 3 Classic, one VIP, and 1 Raw account.

- Does BDSwiss allow bot trading?

- No, it does not.

- Does BDSwiss give a bonus?

- Yes, BDSwiss offers a %30 bonus of your first deposited amount up to $500. This offer is available within the first 30 days from your registration time. You can also check the Terms and Conditions of the Bonus Campaign.

- Does BDSwiss allow hedging?

- Yes, it does, but it does not allow scalping.

- Does BDSwiss provide the swap-free option in my account?

- Yes, it does.

- How do I log in using the MT4 mobile platform?

- Steps:

1. Go to ‘Settings’

2. Click on ‘Manage Accounts’ or ‘Settings’

3. Then click on the small plus sign or select ‘New Account’

4. Then select ‘Log in to an existing account

5. Search for the broker name

6. Select the server your account was set up on

7. Enter your login credentials and password

8. Click on ‘Sign In’

- Can I log in to more than one account from the same computer?

- Yes, you can do such a thing by using the MT4 Multi Terminal.

- Can I log in to the same account through different devices?

- Yes, you can log in to the MetaTrader 4 platform using the same password and username through different devices.

- Can I open a joint account at BDSwiss?

- To open a joint account with BDSwiss, each person must first open an individual BDSwiss account and then fill a Joint Account Request Form which can be obtained by contacting the Customer Support Team at support@bdswiss.com. Both individuals have to ensure to proceed with successful verification of their respective individual accounts before the merge will be possible. This includes but is not limited to, provision of KYC documents, completion of Appropriateness test, and Economic profile.

- Why can’t I open a BDSwiss account?

- You can’t open an account on BDSwiss if one or more of the following conditions apply:

- I am a U.S. citizen (including dual citizen) or resident

- My birthplace is in the U.S.

- I have a current U.S. mailing or residence address (including a U.S. post office box or U.S. “in-care-of” address)

- I have a current U.S. telephone number

- I have standing instructions to transfer funds to an account maintained in the United States

- I have currently effective power of attorney or signatory authority granted to a person with a U.S. address

- I have an “in-care-of” or “hold mail” address that is the sole address for the Account Holder. The Investor needs to note that in the case of a Pre-existing Individual Account that is a Lower Value Account, an “in-care-of” address outside the United States is not to be treated as U.S. indicia.

- I possess a U.S. TIN (hereafter “Tax Identification Number”).