CMC Markets Full Review

CMC Markets Full Review

CMC Markets, is a UK forex and CFD broker that was founded in 1989 and has over 80,000 clients worldwide. CMC markets is also regulated by top-tier financial authorities like FCA, the Financial Conduct Authority in the UK. With over 11,000 trading instruments, CMC Markets beats a lot of other brokers in the number of products.

Disclaimer: CFDs have a high risk of losing money rapidly. About 80% of retail investor accounts lose money due to leverage when trading CFDs with this provider. Please note that CFDs are not complying with the islamic religion. And if you want to trade in CFDs you should consider a swap-free account to follow islamic rules.

Learn more about CFDs for Muslims.

CMC Markets Full Review - Key Statistics

Safety

Offering of Investments

CMC Markets provides a variety of trading instruments with more than 11,000 instruments including 5,000 shares and ETFs only. It also has currency pairs, CFDs, bonds, commodities, and cryptocurrencies for trading. As an extra, CMC Markets also offers Treasuries for trading. The treasuries market includes government debt instruments such as gilts, bunds, bonds and treasury notes. There are over 45 treasury CFDs from across the globe, including both cash and forward products. Disclaimer: CFDs have a high risk of losing money rapidly. About 80% of retail investor accounts lose money due to leverage when trading CFDs with this provider. Please note that CFDs are not complying with the islamic religion. And if you want to trade in CFDs you should consider a swap-free account to follow islamic rules. Learn more about CFDs for muslims. CMC Markets Offering of Investments

Note:

|

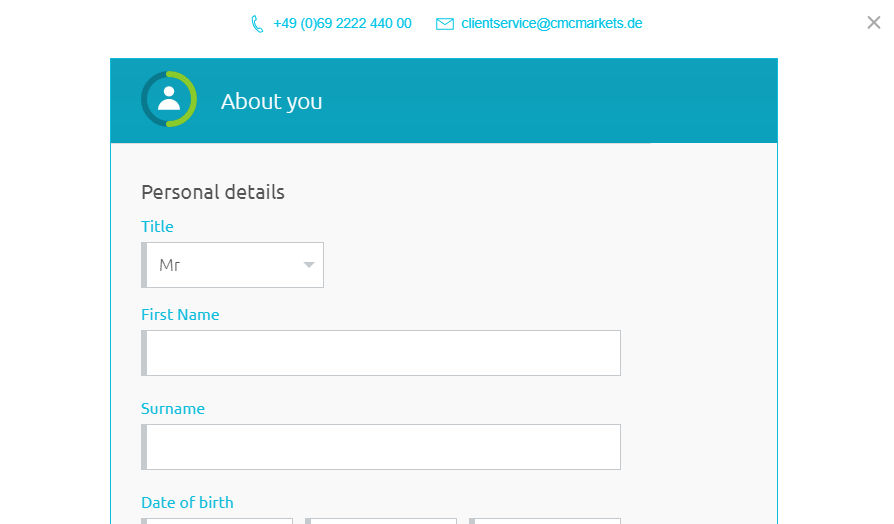

Account Opening

Countries availableCMC Markets is available in over 80 countries including, but not limited to Australia, Cyprus, and the UK. On the other hand, CMC Markets is not available in the USA. Account typesCMC Markets provides three main account types which are:

Each one of the three has its own specifications and features as the following table shows. CMC Markets - Account comparison

CMC Markets also provides a demo account with 0 fees if you want to experience the trading platform with no risk using any account type. Unfortunately, there’s no islamic account option as CMC Markets to trade CFDs with a swap-free option. In addition to the previous account types, CMC Markets also provides another account type which is the Professional Account which you should meet some specifications to register for it. These specifications are:

This account type offers you a number of features that are available in any other account type like the Cash rebates for shares. Min depositThe minimum deposit for spread betting, CFD, and the corporate account is $0. How to open an accountYou can open an CMC Markets account in minutes through these steps:

CMC Markets - Account opening

|

Fees and Commissions

Please note that CMC Markets charges commissions according to the account type you have. So, please read this section carefully to understand the fee and commissions structure. CommissionsCMC does not charge any commissions on the spread betting account type whatever the instrument you’re trading on. On the other hand, there are commissions on CFD and corporate account types starting with $10 for trading shares only. Commissions by Account Type

Trading FeesThe trading fees of CMC Markets instruments differ from account to another as the following: Spread Betting AccountThe spreads for this account type are as the following table shows. Spread Betting Account - Spreads and Margins

CFD AccountThe spreads for this account type are as the following table shows. CFD Account - Spreads and Margins

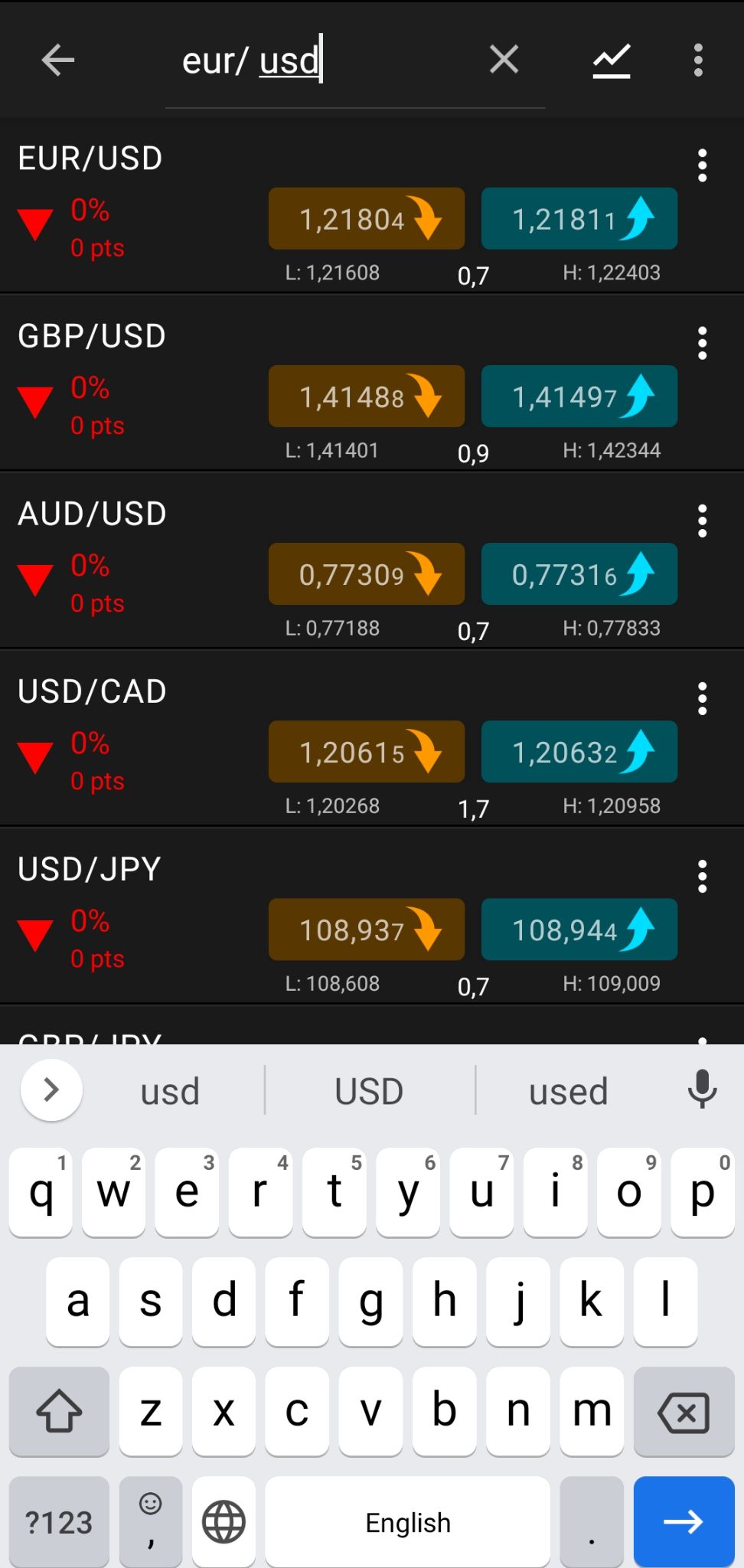

As the previous table shows, the spreads for the CFD and spread betting are the same, we will discuss each instrument on its own. ForexThe minimum spread for trading EUR/ USD is as low as 0.7 points. SharesThe minimum spread for trading US shares is starting from $10. IndicesThe minimum spread for trading UK 100 is as low as 10 points. Disclaimer: CFDs have a high risk of losing money rapidly. About 80% of retail investor accounts lose money due to leverage when trading CFDs with this provider. Please note that CFDs are not complying with the islamic religion. And if you want to trade in CFDs you should consider a swap-free account to follow islamic rules. Learn more about CFDs for muslims. ETFsThe minimum spread for trading 3D Printing is 32 points. CommoditiesThe minimum spread for trading crude oil is as low as 6 points. CryptocurrenciesThe minimum spread for trading Bitcoin/ USD is 100 points. TreasuriesThe minimum spread for trading Euro Bund - Jun 2021 is 2 points. Non-trading fees

(you can check the full withdrawal fees in withdrawal fees section)

|

Deposit and Withdrawal

Account CurrenciesThe CMC Markets account has 10 account base currencies as the following: GBP, EUR, USD, AUS, CAD, NOK, NZD, PLN, SEK, SGD Notes:

Deposit1. OptionsCMC Markets supports depositing using different electronic wallets such that:

CMC Markets Deposit Methods and Fees

Please note that the previous table shows the fees and transfer time for deposit in an USD account. Withdrawal1. OptionsCMC Markets provides withdrawal using credit/ debit cards, electronic wallets, and bank transfers. CMC Markets withdrawal methods and fees

2. FeesTransferring funds to an account in Singapore typically incurs no charge, while overseas telegraphic transfers charges may be levied by the receiving bank. 3. TimeTransferring funds to an account in Singapore typically takes 1-2 working days, while overseas telegraphic transfers can take 3-4 working days. |

Platforms and Languages

|

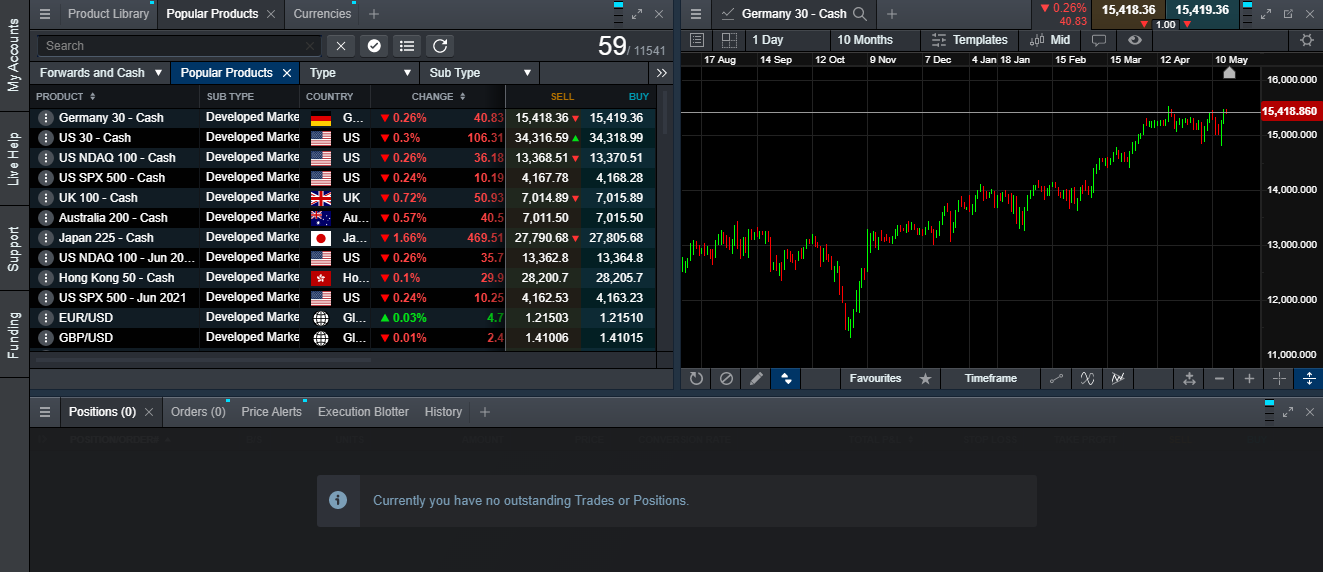

CMC Markets works on MT4 and its customized CMC Market platform that works on mobile and web trading platforms. Unfortunately, CMC Markets is not available on the MT5 trading platform. In this section, we will discuss each one of the two available platforms in detail. Web Trading Platform

LanguagesCMC Markets web application is available in 9 languages like Chinese, English, French, German, Italian, Norwegian, Polish, Spanish, and Swedish. User interface (UI)The User Interface of CMC Markets has a professional look that might seem hard-to-use for the first time, but when you try it, you will find it clear and much easier than what you think.

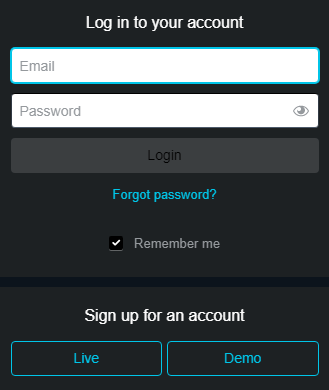

CMC Markets - Web Trading Platform - UI Login and SecurityThe CMC web trading platform has only one-step verification which is very disappointing as the mobile platform has it.

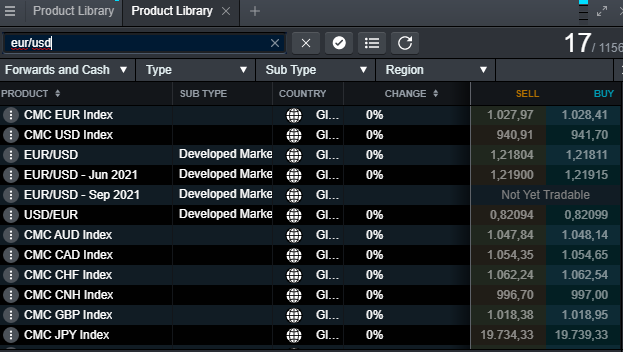

CMC Markets - Web Trading Platform - Login SearchingThe searching function within the platforms works fine as you can type the name of the instrument as well as browsing the full list of instruments in each category. The negative part here is that the search function needs improvements as it does not show the right instrument typed at the top of results.

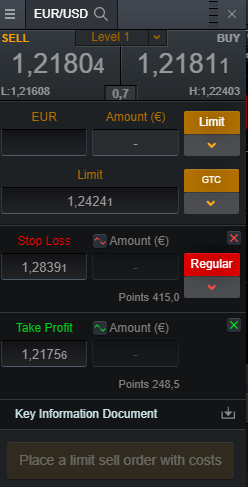

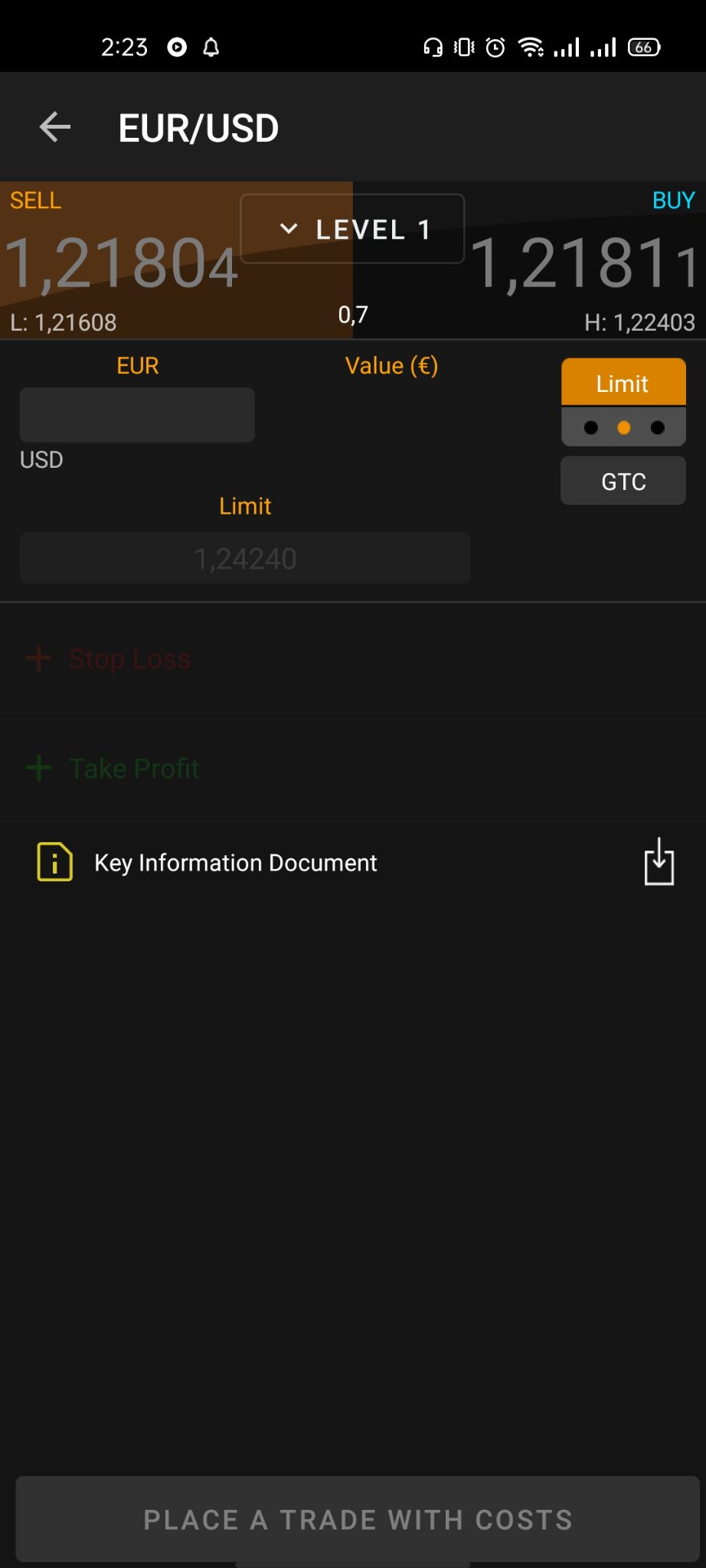

CMC Markets - Web Trading Platform - Searching Placing ordersCMC Markets provides 5 types of orders on its platform which are:

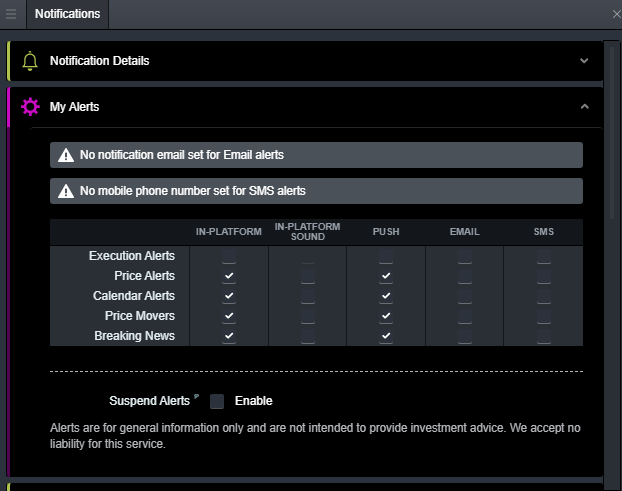

CMC Markets - Web Trading Platform - Place Order Notifications and alertsThe web trading platform has a good notification and alert system that helps you along with your trading.

CMC Markets - Web Trading Platform - Notifications Portfolio and reportsThe portfolio and reports within the web trading platform is clear with a track of all activity within the account. You can find it at the bottom within the ‘History’ tab. CMC Markets (Mobile)

LanguagesThe mobile trading platform is available in the same languages as the web trading platform which are Chinese, English, French, German, Italian, Norwegian, Polish, Spanish, and Swedish. User interface (UI)The UI of the mobile trading app looks simple with the ability to navigate within the app freely and easily. The UI helps the user as well to find the right function in the right place without complications.

CMC Markets - Mobile Trading Platform - UI Login and SecurityFortunately, the mobile trading app of CMC Markets has a two-factor authentication method for login which is much safer. Also CMC Markets provides a Touch and Face ID verification for more safety.

CMC Markets - Mobile Trading Platform - Login

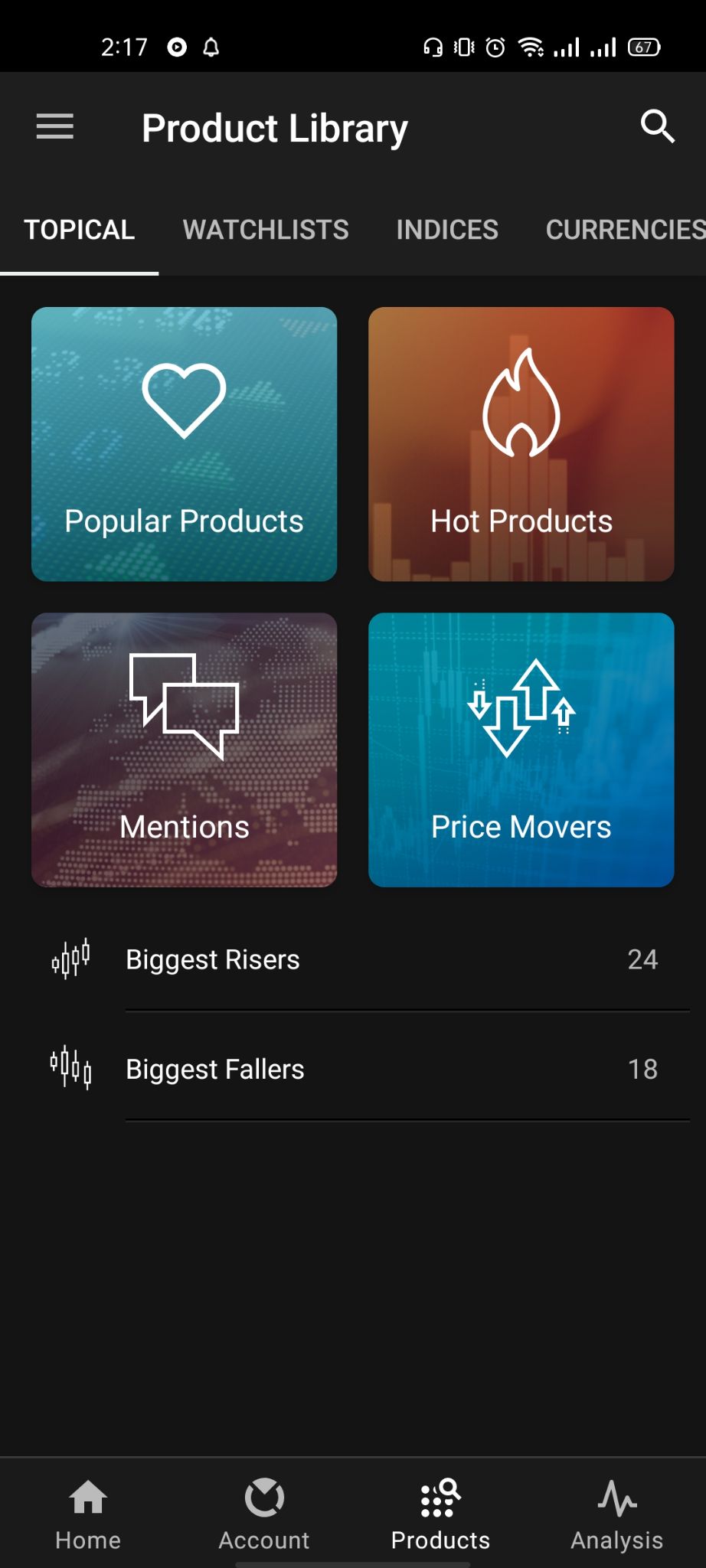

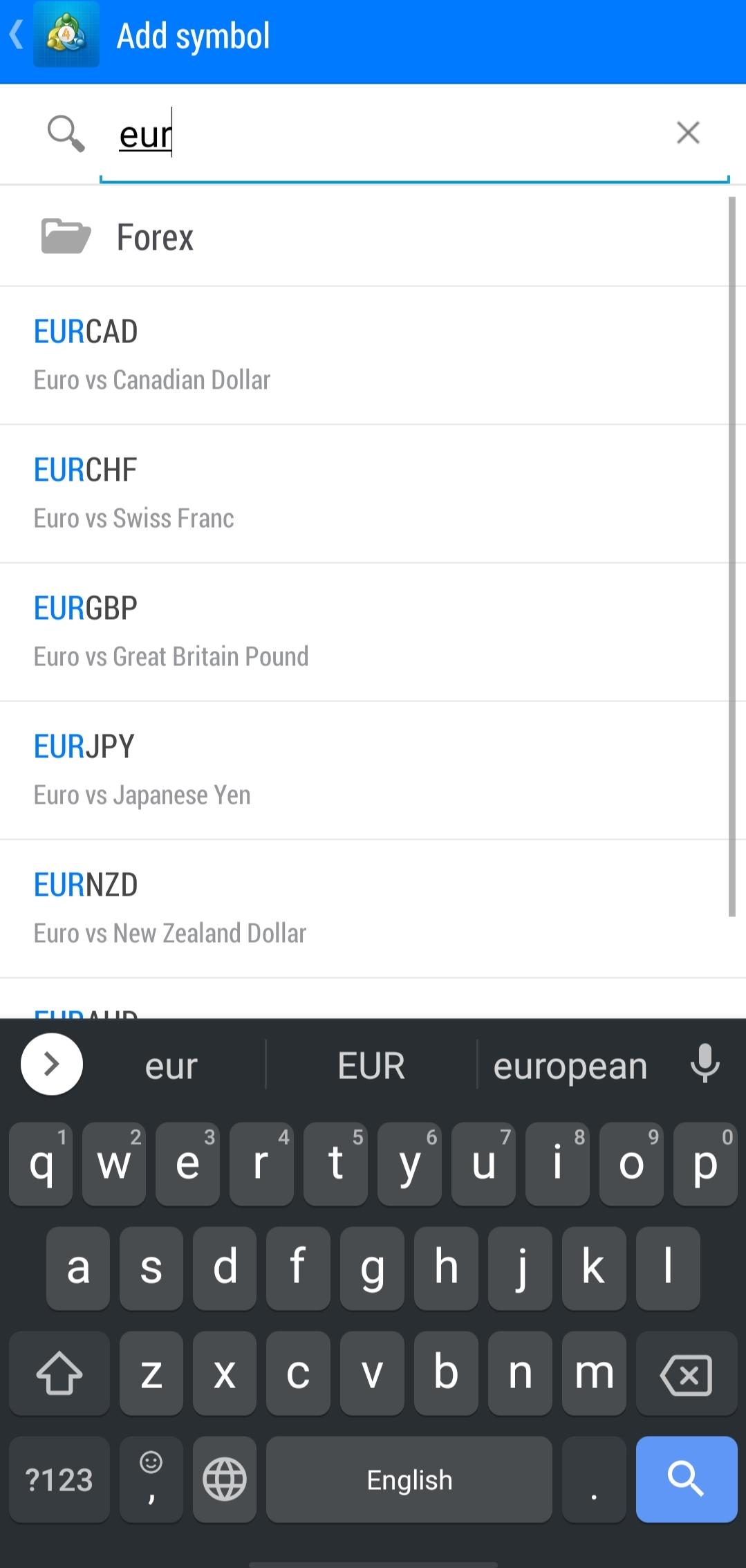

CMC Markets - Mobile Trading Platform - Touch ID Verification SearchingCMC Markets has a good searching function on its mobile trading app, but needs some improvement as it does not show the right instrument at first. You can also navigate in the application within all product categories like indices, currency pairs, forex indices, commodities, shares, ETFs, crypto, and treasuries.

CMC Markets - Mobile Trading Platform - Searching Placing ordersCMC Markets provides 5 types of orders on its web platform which are:

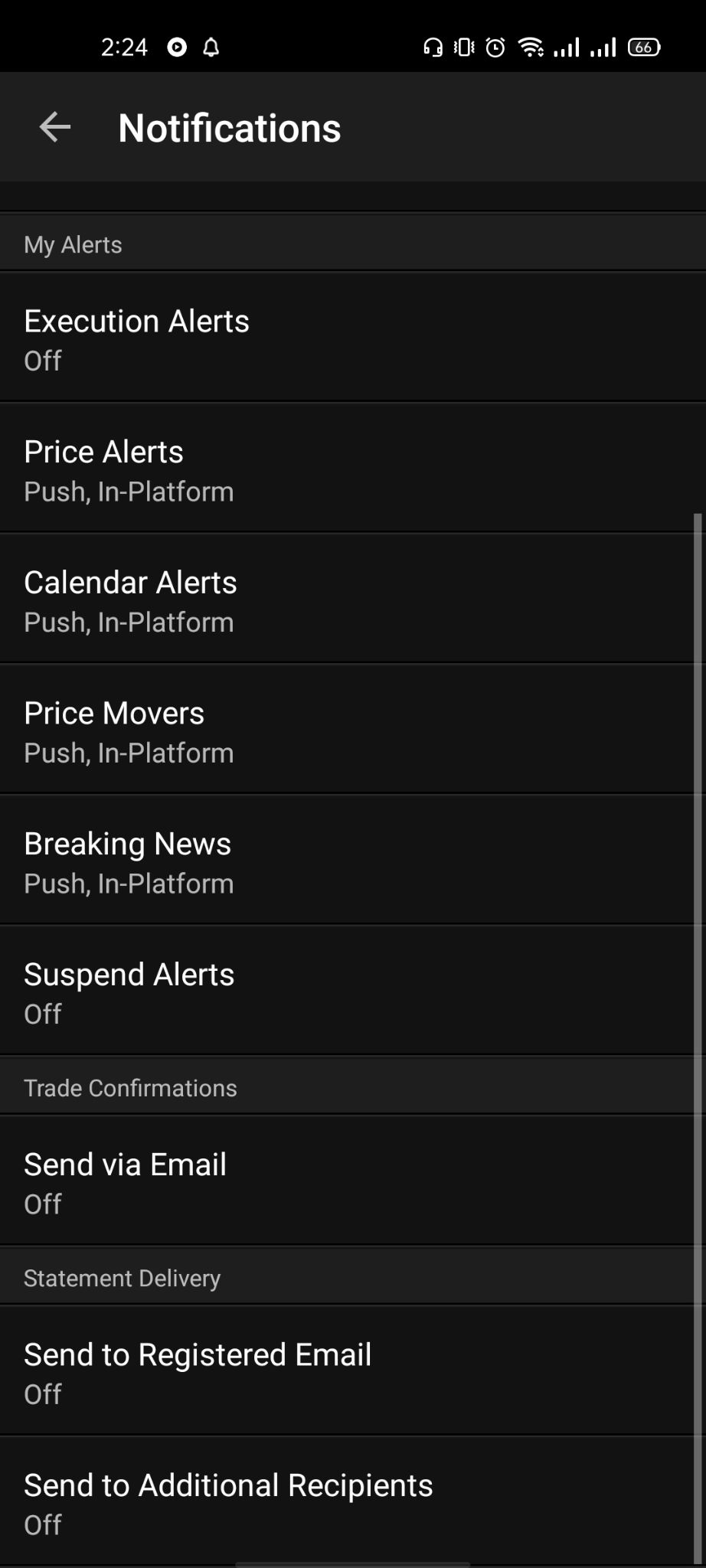

CMC Markets - Mobile Trading Platform - Place Order Notifications and alertsThe mobile trading app has a good notification and price alerts that helps you trade productively.

CMC Markets - Mobile Trading Platform - Notifications Portfolio and reportsThe mobile application has a clear portfolio and fee reports and you can find them by going to Account > History MT4 Platform

LanguagesMetaTrader 4 is available in a number of languages like: MT4 Languages

User interface (UI)MT4 has a very customizable UI that you can adjust according to your needs and preferences. On the other hand, it seems hard to find some of the features inside.

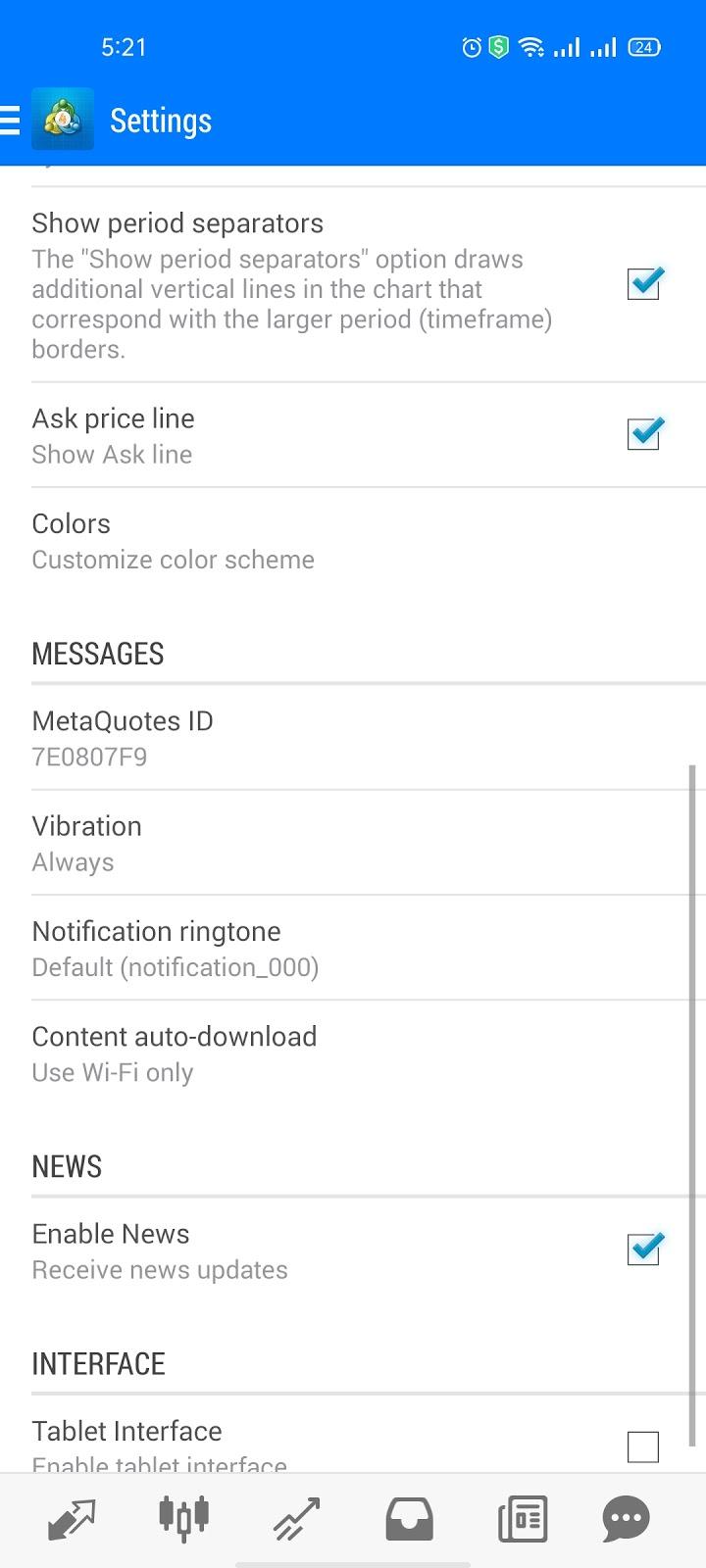

MT4 - Mobile Version - UI Login and SecurityUnfortunately, the MT4 does not provide a two-step verification method for logging in, and it does only support a one-step login. SearchingSearching using the MT4 platform has two different options:

MT4 - Mobile Platform - Search Placing ordersMT4 has a simple order types which are:

In addition to those 4 types, there are other orders which are the time limit ‘Good ‘til time’ (GTT) and ‘Good 'til canceled’ (GTC). There’s also an order confirmation feature in MT4. Notifications and alertsUnfortunately, the MT4 web trading platform does not have an option to set price alerts and notifications unlike the desktop and mobile versions.

MT4 - Mobile Version - Notifications Settings Portfolio and reportsUnder the ‘History’ tab, you can find your portfolio reports with a clear fee description.

MT4 - Mobile Version - Portfolio |

Research Tools

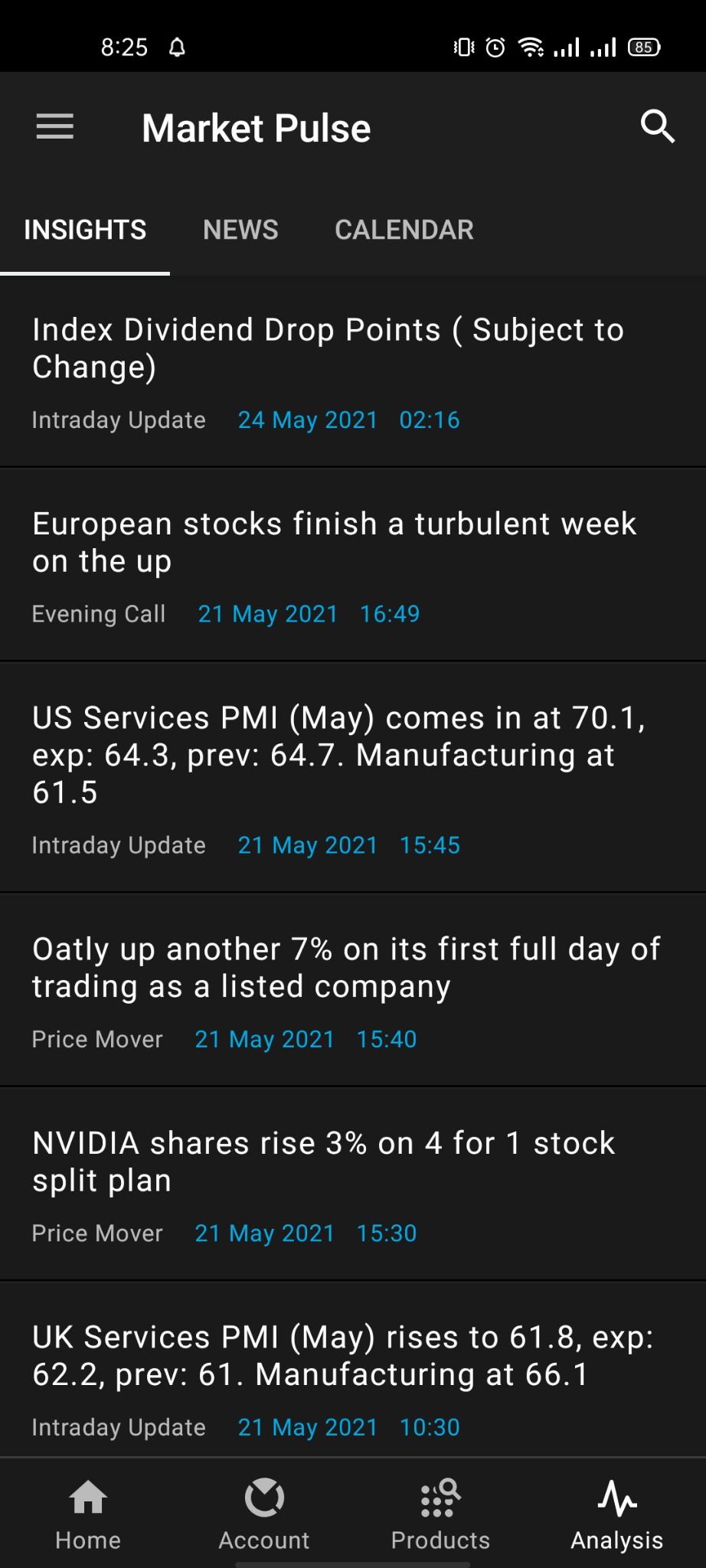

SourcesCMC Markets provides geed research tools and reports through its website or its mobile trading application. Most of the research tools are easy-to-use, helpful, and accurate. Trading ideasThe trading ideas tool within CMC Markets is very helpful as it helps you get a good look into the markets in a glance to discover more opportunities and options.

CMC Markets - Research - Trading Ideas Fundamental dataCMC Markets provides helpful fundamental data through its live accounts that includes all the information you need to know. ChartingWith 115 indicators, the charting tool within CMC Markets becomes easier and easier to customize to look for patterns and forecast the future possibilities.

CMC Markets - Research - Charting NewsfeedKeeping track of all financial news becomes much easier than before as the Market News tool at CMC Markets helps you be up-to-date with the latest news in the financial industry to never miss one.

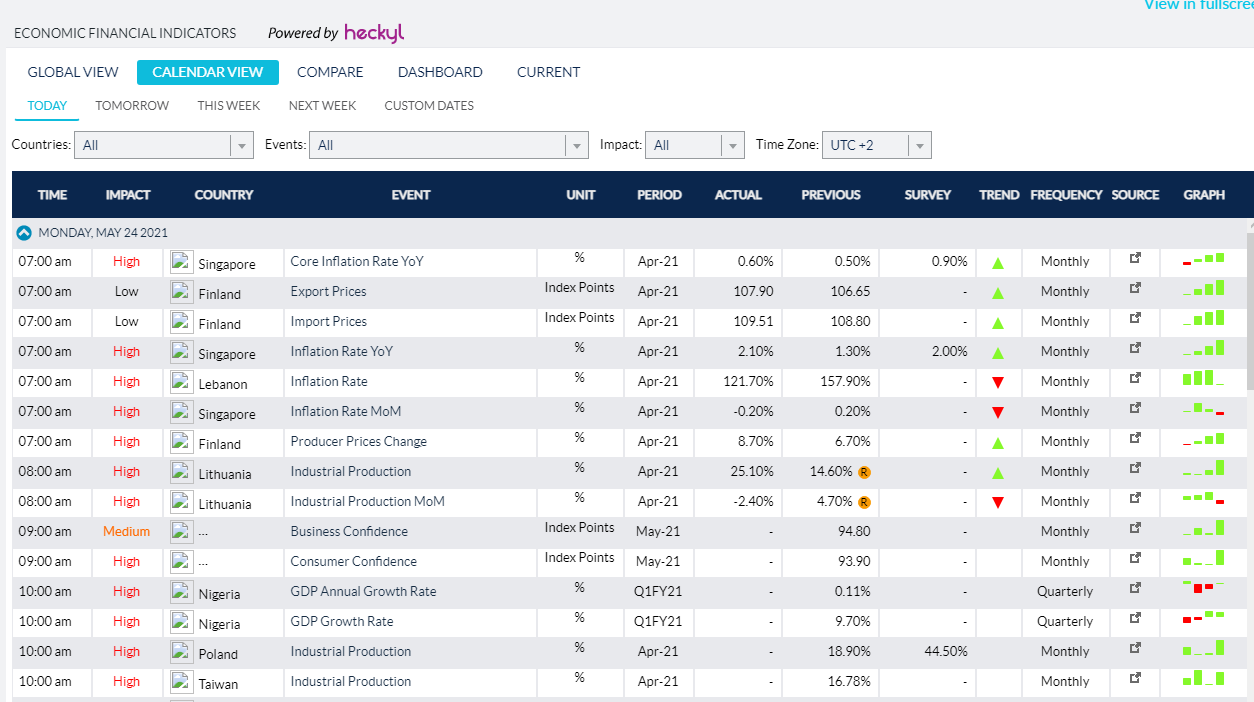

CMC Markets - Research - Newsfeed Other toolsCMC Markets also provides other helpful tools like the Economic Calendar which keeps track of all the important upcoming financial events.

CMC Markets - Research - Economic Calendar |

Customer Service

OptionsCMC Markets supports different customer service channels like:

In addition to the previous options, CMC Markets also provides support through all its branches all over the world like the UK, Australia, Canada, France, Germany, Ireland, Italy, New Zealand, Norway, Poland, Singapore, Spain, and Sweden.

CMC Markets - Customer Support Although the live chat option is not available at this review time, it makes it easier for customers to get the answers they want quickly. LanguagesThe languages available for customer service are many with the support of major languages like Chinese, English, French, German, Italian, Norwegian, Polish, Spanish, and Swedish |

Education

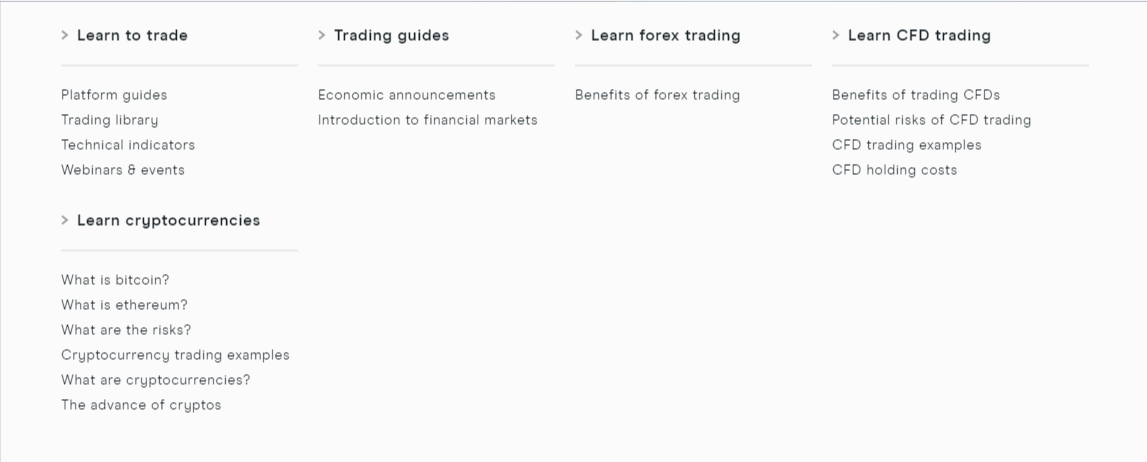

CMC Markets has a lot of helpful educational materials for beginners and professionals in trading which pave the way for them to better trade and understand trading techniques and strategies. Those educational materials are:

This includes a series of videos about the trading platform and how to use and interact with it to access features and products as well.

The objective of this trading library is to understand trading strategies as well as getting some tips on trading and analysis.

Charting is easy, but how to understand the meanings behind it. Well, CMC Markets provides a tutorial that makes you able to use it professionally and understand the critical indicators that help you show patterns in charts.

CMC Markets provides technical webinars and events with its clients from the top trading experts to help them with their trading as well as answering their questions.

With a wide range of trading products, CMC Markets provides trading tutorials for the most important ones like forex, CFDs, and more. Those tutorials help you better understand their products and start trading on them.

This is one of the trading tutorials provided from CMC Markets that are made especially for cryptocurrencies and learn more about them.

|

FAQs

1. Go to ‘Settings’ 2. Click on 'Manage Accounts' or 'Settings' 3. Then click on the small plus sign or select 'New Account' 4. Then select 'Log in to an existing account' 5. Search for the broker name 6. Select the server your account was set up on 7. Enter your login credentials and password 8. Click on 'Sign In'

|

CMC Markets Full Review - Reviews

CMC Markets Full Review - Review Conclusion

- Pros: negative balance protection, listed on stock exchange, over 11,000 products

- Cons: no islamic account option, deposit fees, inactivity fee

- Best for: beginners and professional traders

- Regulated by: FCA and FSCS

- Headquarters: UK

- Foundation year: 1989

- Min Deposit: $0

- Deposit and withdrawal methods:credit cards, bank transfer, electronic wallets

- Deposit fees: $0 (for cheques)

- Withdrawal fees: $0

- Base currencies: GBP, EUR, USD, AUS, CAD, NOK, NZD, PLN, SEK, SGD

- Offering of investments: forex, CFDs, ETFs, shares, bonds, commodities, cryptocurrencies, treasuries

- Number of users: over 80,000 clients

Conclusion:

- Pros: negative balance protection, listed on stock exchange, over 11,000 products

- Cons: no islamic account option, deposit fees, inactivity fee

- Best for: beginners and professional traders

- Regulated by: FCA and FSCS

- Headquarters: UK

- Foundation year: 1989

- Min Deposit: $0

- Deposit and withdrawal methods:credit cards, bank transfer, electronic wallets

- Deposit fees: $0 (for cheques)

- Withdrawal fees: $0

- Base currencies: GBP, EUR, USD, AUS, CAD, NOK, NZD, PLN, SEK, SGD

- Offering of investments: forex, CFDs, ETFs, shares, bonds, commodities, cryptocurrencies, treasuries

- Number of users: over 80,000 clients