- يونيو 29, 2021

- Posted by: ForexTradeOn

- Category: FP Markets broker review

|

Pros |

Cons |

|

High withdrawal fees for some options |

Introduction

‘First Prudential Markets’ or ‘FP Markets’ for simplicity is an Australian forex and CFD Broker that has a long tracking record from 2005 with the largest trading options and lowest fees.

Account Currencies

The FP Markets account has a number of base currencies like EUR, GBP, USD, AUD, CAD, SGD, HKD, JPY, NZD, CHF.

Notes:

- You will not be charged with conversion fees if your account has the same currency with your bank account or when you trade assets with the same currency of your account.

- If you want to avoid being charged with conversion fees, you can open a multi-currency bank account at a digital bank.

- You can open a sub-account under your main account, each one of the sub-accounts can have its own currency.

Deposit

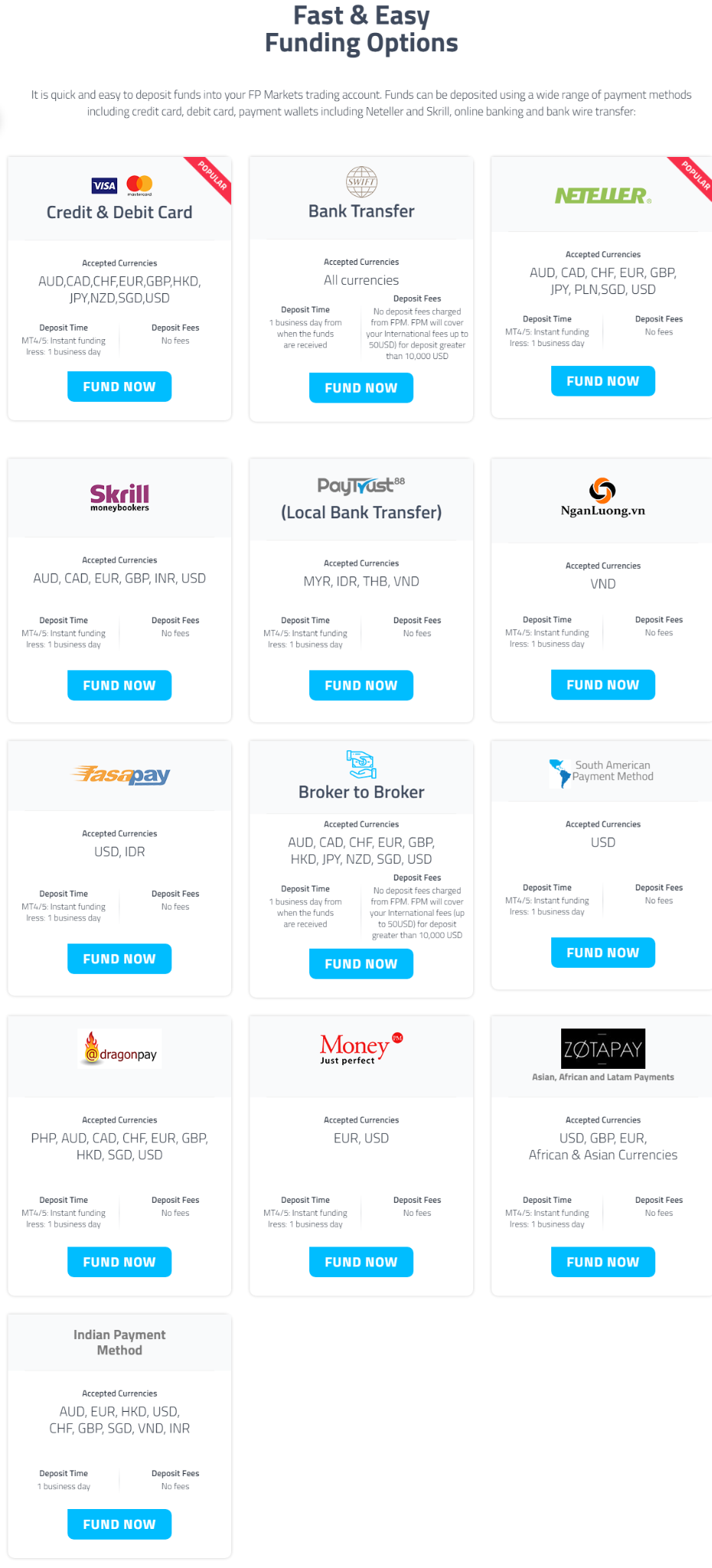

FP Markets does provide a variety of options for depositing money. The following table shows the fees and commissions of each option.

FP Markets deposit methods

|

FP Markets |

|

|

Credit cards |

Yes |

|

Bank Transfers |

Yes |

|

Electronic wallet |

Yes |

FP Markets supports depositing using different methods such that:

- Visa and Mastercard

- Bank Transfers

- BPay

- Poli

- PayPal

- Neteller

- PaySafe (formerly Skrill)

- FasaPay

- PayTrust

- Nganluong.vn

- South American Payment Method

In addition to the previous deposit options, FP Markets offers an option to transfer your money from another broker as you want.

Fees

FP Markets does not charge any deposit fees except for the bank transfers, FP Markets will cover your International fees (up to 50USD) for deposits greater than 10,000 USD.

Time

All of the deposit options happen instantly except for some options that may take about 1 business day to be completed.

FP Markets – Deposit Options and Fees

Withdrawal

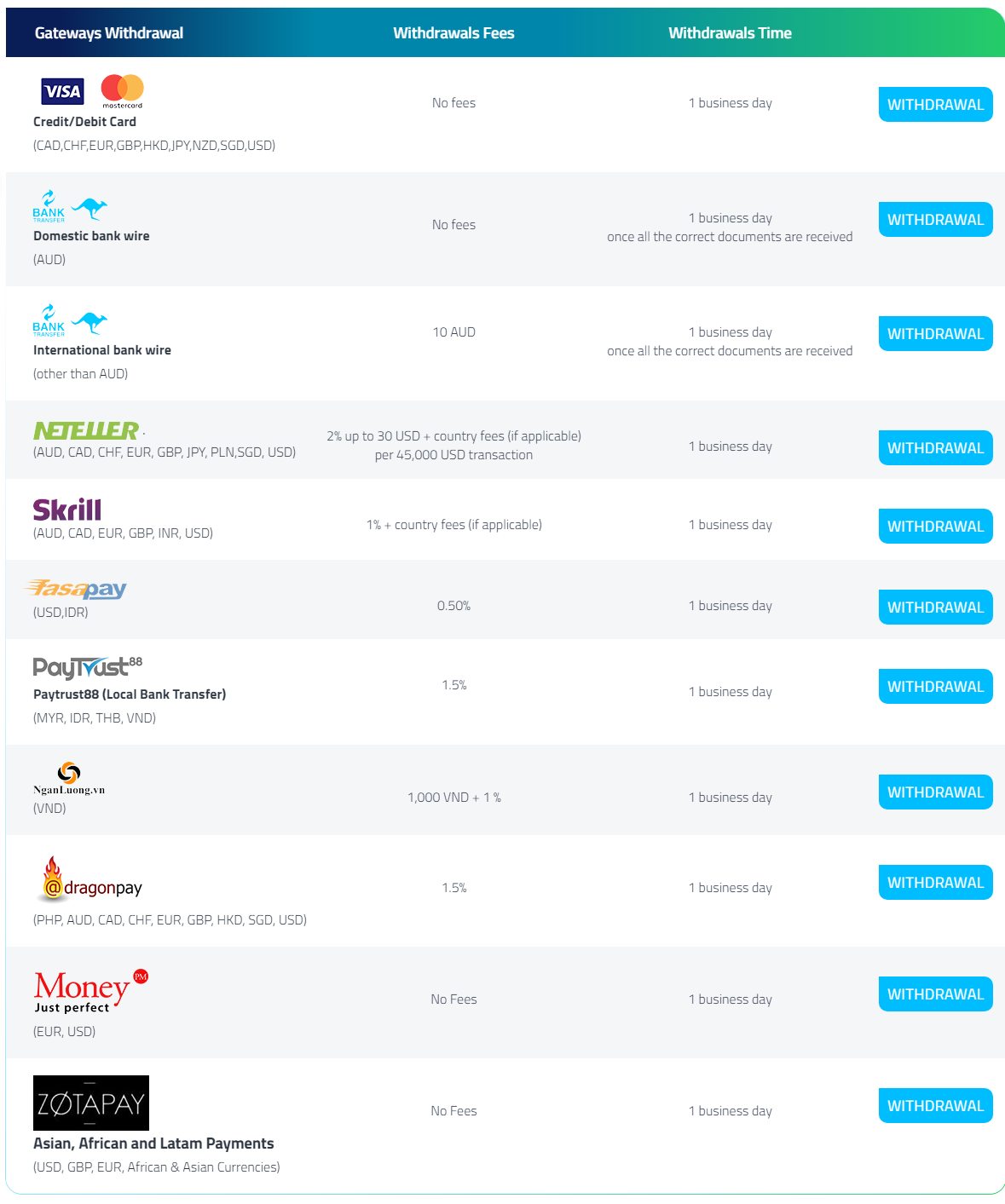

FP Markets does provide a variety of options for withdrawing money, some of them have fees as the following table shows.

FP Markets withdrawal methods and fees

|

FP Markets |

|

|

Bank Transfers |

Yes |

|

Credit cards |

Yes |

|

Electronic wallet |

Yes |

|

Fee |

Start from $0 |

Notes:

Please note, the withdrawal amount will need to be the same amount as your deposit and via the same withdrawal method. Once deposits have been withdrawn, you can use an alternative method to withdraw profits.

FP Markets Withdrawal Options

Fees

The FP Markets Withdrawal fees are as the following:

FP Markets – Withdrawal Options

|

Withdrawal Method |

Fees |

|

Credit/ Debit card |

$0 |

|

Domestic bank wire (AUD) |

$0 |

|

International Bank Wire |

10 AUD |

|

Neteller |

2% up to 30 USD + country fees (if applicable) per 45,000 USD transaction |

|

PaySafe (Skrill) |

1% + country fees (if applicable) |

|

FasaPay |

0.50% |

|

PayTrust |

1.50% |

|

1,000 VND + 1 % |

|

|

PayPay |

$0 |

|

Online Pay (Chinese) |

$18 |

|

South American Payment Method |

2% |

Time

The withdrawal happens within 1 business day for all the options.

Note:

For security reasons, you may have to verify your identity with the payment department for the first time through the registered email or the phone number.

FAQs

- Can I open more than one trading account?

- Yes, you can open sub-accounts under your main account. Each sub-account can have its own base currency.

- Does FP Markets allow bot trading?

- Yes, it does.

- Does FP Markets give a bonus?

- Unfortunately, FP Markets does not offer bonuses on trading accounts.

- Does FP Markets allow scalping?

- Yes, FP Markets does allow scalping and hedging.

- Where is my money held?

- Client funds are held with a AAA rated bank such as National Australia Bank or Commonwealth Bank of Australia. All client funds are held in segregated accounts.

- Is the swap-free account option available?

- The swap-free account option is available on both our Raw and Standard account types on the MT4 and MT5 trading platforms.

- Does FP Markets accept payments from third parties?

- FP Markets does not accept payments from third parties and will only accept funds that we receive directly from the named trading account holder.