- يونيو 29, 2021

- Posted by: ForexTradeOn

- Category: FP Markets broker review

|

Pros |

Cons |

|

|

FP Markets fees may vary from account type to another. Please read the following sections for more information. Also, FP Markets have competitive trading fees and no inactivity fees within all brokers.

Introduction

‘First Prudential Markets’ or ‘FP Markets’ for simplicity is an Australian forex and CFD Broker that has a long tracking record from 2005 with the largest trading options and lowest fees.

Commissions

FP Markets does charge no commission when trading forex whether you have a standard or islamic account which is very competitive.

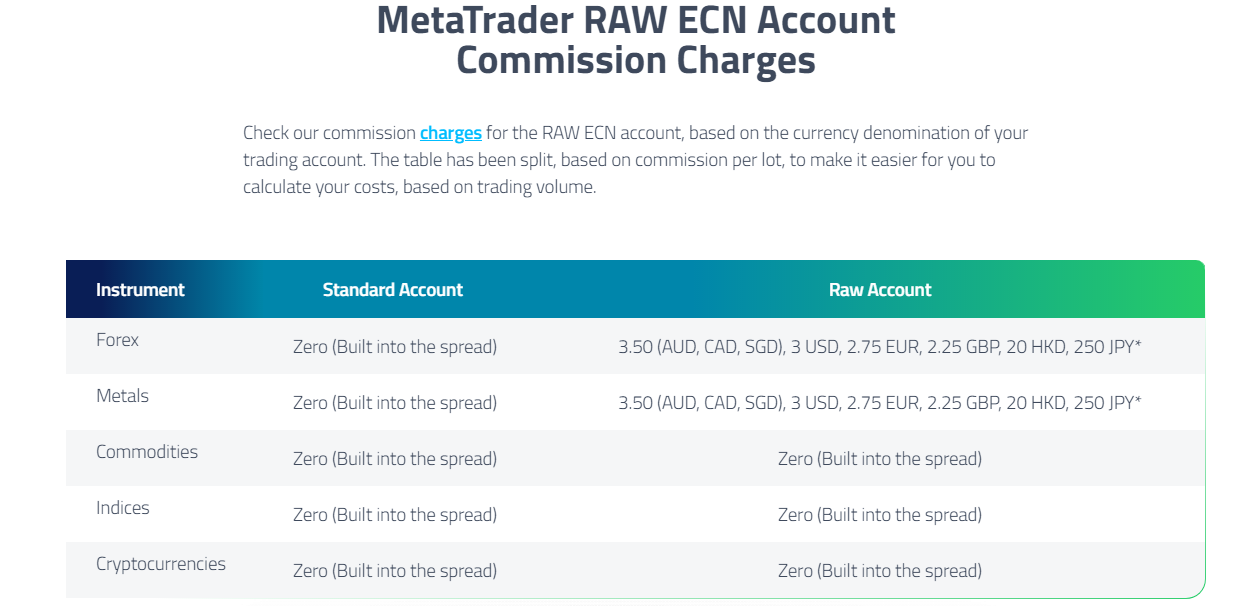

On the other hand, FP Markets charges a commission on Raw accounts as the following image shows.

FP Markets – Commissions

Trading Fees

The trading fees of FP Markets differ from one account type to another as the following:

Forex

- For standard accounts, the spreads start at 1.1 pips for the EUR/USD.

- For Raw (ECN) accounts, the spreads start at 0 pips for the EUR/USD, but there’s a commission of $3 per lot.

Metals

- For standard accounts, the spreads range between 0.012 and 0.16 pips for silver and gold respectively.

- For the Raw (ECN) accounts, the spreads range between 0.01 and 0 pips for silver and gold respectively. There’s also a commission of $3 per lot.

Indices

- For standard accounts, the minimum spread is 0.6 pips.

- For the Raw (ECN) accounts, the minimum spread is 0.1 pips.

Disclaimer: CFDs have a high risk of losing money rapidly. 79% of retail investor accounts lose money due to leverage when trading CFDs with this provider. CFDs are not complying with the islamic religion. And if you want to trade in CFDs you should consider a swap-free account to follow islamic rules. Learn more about CFDs for muslims.

Commodities

- For standard accounts, the minimum spread is 0.04 pips.

- For the Raw (ECN) accounts, the minimum spread is 0.02 pips.

Cryptocurrencies

- For standard accounts, the Average spread is 0 pips.

- For the Raw (ECN) accounts, the minimum spread is 0.0005 pips.

Non-Trading Fees

- Account fee: $0

- Deposit fees: $0

- Withdrawal fees: $0 (for credit/ debit cards)

- Inactivity fee: $0

FAQs

- Does FP Markets allow bot trading?

- Yes, it does.

- Does FP Markets give a bonus?

- Unfortunately, FP Markets does not offer bonuses on trading accounts.

- Does FP Markets allow scalping?

- Yes, FP Markets does allow scalping and hedging.

- Where is my money held?

- Client funds are held with a AAA rated bank such as National Australia Bank or Commonwealth Bank of Australia. All client funds are held in segregated accounts.

- Is the swap-free account option available?

- The swap-free account option is available on both our Raw and Standard account types on the MT4 and MT5 trading platforms.

- Does FP Markets accept payments from third parties?

- FP Markets does not accept payments from third parties and will only accept funds that we receive directly from the named trading account holder.