- يونيو 27, 2021

- Posted by: ForexTradeOn

- Category: IG forex Broker review

Pros

Regulated by top-tier financial authorities, negative balance protection, over 45 years of trading experience, two factor authentication, segregated client funds, listed on London Stock Exchange, over 17,000 trading instruments, forex and CFD trading, bot trading, islamic account option, demo account, no minimum deposit, pro account option for professional traders, over 239,000 clients, low commissions, no deposit or withdrawal fees, no inactivity fees in the first 2 years, various base currencies, various deposit and withdrawal options, customized trading platform, available on MetaTrader 4, beautiful UI, price and notification alerts, reliable searching function, trading ideas, good charting tool, various customer support options, and good educational materials.

Cons

Limited trading products for some countries, high forex and CFD fees, not available on the MetaTrader 5 platform, no fundamental data available, and no 24/7 customer support.

Summary

Intro

IG is one of the biggest forex and CFD brokers in the industry with over 45 years of experience since 1974 and about 239,000 clients worldwide. It has a long tracking record and is regulated by top-tier financial authorities like FCA, the Financial Conduct Authority in the UK. It also has over 17,000 products for trading including forex, CFDs, ETFs, commodities, and more. With free withdrawals and deposits, IG becomes one of the best choices for you to start trading on.

Disclaimer: CFDs have a high risk of losing money rapidly. About 80% of retail investor accounts lose money due to leverage when trading CFDs with this provider. Please note that CFDs are not complying with the islamic religion. And if you want to trade in CFDs you should consider a swap-free account to follow islamic rules. Learn more about CFDs for Muslims.

Safety

|

Pros |

Cons |

|

|

Is IG regulated?

The IG broker is regulated by many financial authorities like:

- UK – Financial Conduct Authority (FCA)

- Germany – Federal Financial Supervisory Authority (BaFin)

- Switzerland – Swiss Financial Market Supervisory Authority (FINMA)

- US – Commodity Futures Trading Commission (CFTC) and National Futures Association (NFA)

- Australia – Australian Securities and Investment Commission (ASIC)

- New Zealand – Financial Markets Authority (FMA)

- Singapore – Monetary Authority of Singapore (MAS)

- Japan – Japanese Financial Services Authority (FSA)

- South Africa – Financial Sector Conduct Authority (FSCA)

- UAE – Dubai Financial Services Authority (DFSA)

- International – Bermuda Monetary Authority (BMA)

Is IG a scam?

IG safety is divided into 2 parts, the safety of the broker itself and the safety of the client.

Broker safety

IG Markets has a long tracking record of 47 years of trading experience. It’s originally located in London, UK., but it has offices around the world to help you. IG also has been regulated by a number of top-tier financial authorities and has been listed on the LSE (London Stock Exchange) and does its best to provide safety to its users.

Client protection

IG cares a lot about client’s safety and protection. That’s why it has client protection amounts for users in several countries as the table shows below.

IG Legal Entities Table

|

Country |

Protection amount |

Regulator |

Broker’s Legal Entity |

|

UK |

£85,000 |

FCA |

IG Markets Ltd |

|

Europe, excluding UK and Switzerland |

€20,000 |

BaFin |

IG Europe GmbH |

|

Switzerland |

CHF 100,000 |

FINMA |

IG Bank S.A. |

|

USA |

No protection |

CFTC and NFA |

IG US LLC |

|

Australia |

No protection |

ASIC |

IG Markets Ltd, Australia |

|

New Zealand |

No protection |

FMA |

IG Markets Ltd, Australia |

|

Singapore |

No protection |

MAS |

IG Asia Pte Ltd |

|

Japan |

No protection |

FSA |

IG Securities Ltd |

|

South Africa |

No protection |

FSCA |

IG Markets South Africa Limited |

|

United Arab Emirates |

No protection |

DFSA |

IG Limited |

|

International |

No protection |

BMA |

IG International Limited |

Clients also have additional asset protection through the Financial Services Compensation Scheme (FSCS), up to £85,000.

With IG. If your spread betting or CFD balance falls below zero, IG will bring it back to zero as soon as possible at no cost to you. Please note that this protection does not apply to professional traders who can still lose more than the balance on their account. This feature is also for the UK customers who apply for it.

Offering of Investments

|

Pros |

Cons |

|

|

IG Markets provides a variety of trading options with over 17,000 trading instruments including forex, CFDs, ETFs, bonds, commodities, cryptocurrencies, futures, metals, and energies.

IG Markets also supports Bot Trading which you can use in case you want a robot which can trade on your behalf.

Disclaimer: CFDs have a high risk of losing money rapidly. About 80% of retail investor accounts lose money due to leverage when trading CFDs with this provider. Please note that CFDs are not complying with the islamic religion. And if you want to trade in CFDs you should consider a swap-free account to follow islamic rules.

Learn more about CFDs for muslims.

IG Offering of Investments

|

Product |

Number of Products |

|

Currency Pairs |

205 |

|

Stock Index CFDs |

78 |

|

Metals |

6 |

|

Softs |

21 |

|

Commodities |

47 |

|

Bond CFDs |

13 |

|

Stock CFDs |

10,500 |

|

ETFs |

2,000 |

|

Energies |

7 |

On the negative side, IG does not offer all of the trading options for all users. As you see in the table below, for the USA clients, only forex is available for trading while other countries can trade on forex and CFDs.

IG – Countries VS Products

|

Countries |

Products |

|

All countries, except below |

Forex, CFD |

|

Austria, Denmark, France, Germany, Ireland, Italy, Netherlands, Norway, Portugal, Romania, Sweden |

Forex, CFD, Options |

|

UK*, Ireland, Malta, Cyprus, Australia + some smaller countries, like Gibraltar, the British Virgin Islands, etc. |

Forex, CFDs, Stocks |

|

USA |

Forex |

Note:

Please note that some of the trading options may depend on your account type as well whether it’s a mini or standard account.

Account Opening

|

Pros |

Cons |

|

|

Countries available

IG is available in over 70 countries around the world including the USA, UK, and Australia.

There are some limitations on some countries. For example, you can not open an IG account if you’re resident in North Korea.

See full IG Available countries list.

Account types

IG only provides one account option for all traders. This account has the following features as the table shows below.

IG CFD Account

|

CFD Account |

|

|

Demo Account |

Yes |

|

Spread |

Tight spreads |

|

Commissions |

For certain markets only |

|

Min deposit |

$0 |

|

Negative Balance Protection |

No |

|

Base Currencies |

GBP, EUR, AUD, CAD, CHF, USD, NZD, SGD, PLN, DKK, NOK, SEK, HKD, ZAR, JPY |

|

Islamic account option |

Yes |

|

Dormancy Fees |

Yes |

IG also provides a demo account with 0 fees if you want to experience the trading platform with no risk. You can also open an islamic account with no swap fees if you want as well.

Min deposit

IG offers a minimum deposit of $0 for its accounts when using bank transfers. For credit/ debit cards and PayPal, the minimum deposit is $300/€300/£250 according to your account base currency.

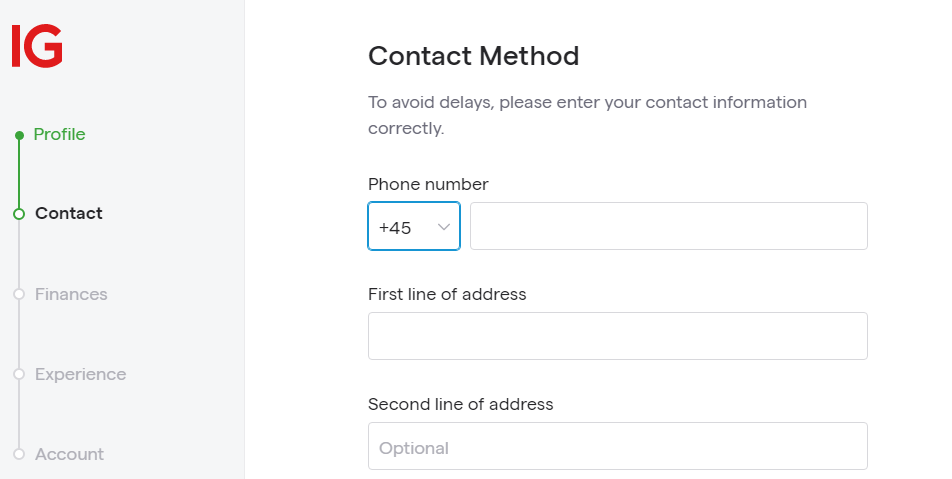

How to open an account

IG will confirm a time convenient for you and the whole process should not take more than 10 minutes.

Please note that this service is only available to clients who can provide a passport or an identity card which is machine-readable.

You can open an IG account in minutes through these steps:

- Enter your name, email, and country of residence.

- Add your phone number and other contact information like your address.

- Add you financial information (i.e., employment, income, savant, etc.)

- Answer some questions about your trading experience.

- Provide proof of your identity and the country of residence.

- Fund your account and start trading.

IG – Account opening

Fees and Commissions

|

Pros |

Cons |

|

|

Generally, IG has only commissions on certain markets only and relatively high forex and CFD fees on the other hand. Please, note that fees and commissions may differ according to countries, markets, and account types. So, read this section carefully in order to know all the information you need.

Commissions

IG applies commissions on trading shares as the table shows below.

IG Commissions

|

Share category |

Commission per side |

Minimum charge (online) |

Minimum charge (phone) |

|

Hong Kong SAR |

0.0018 |

HKD50 |

HKD50 |

|

US |

2 cents/share |

US$15 |

US$25 |

|

Australia |

0.0008 |

$7 |

$7 |

|

New Zealand |

0.001 |

$8 |

$8 |

|

UK (FTSE 350) |

0.001 |

10 |

15 |

|

UK (non-FTSE 350) |

0.0035 |

10 |

15 |

|

Euro1 |

0.001 |

10 |

25 |

|

Denmark |

0.001 |

DKK100 |

DKK250 |

|

Norway |

0.001 |

NOK100 |

NOK250 |

|

Sweden |

0.001 |

SEK99 |

SEK250 |

|

Switzerland |

0.001 |

CHF10 |

CHF25 |

|

Greece |

0.00475 |

25 |

40 |

|

Singapore |

0.001 |

SGD15 |

SGD15 |

|

Japan |

0.002 |

JPY1500 |

JPY2500 |

|

South Africa |

0.002 |

ZAR100 |

ZAR100 |

|

Canada |

3 cents/share |

CAD25 |

CAD25 |

|

International Order Book (IOB)2 |

0.0015 |

$15 |

$25 |

Trading Fees

Forex fees

The minimum spread for trading AUD/ USD is 0.6 pips per lot.

Index fees

The minimum spread for trading FTSE 100 index is points per contract, knowing that the value of one contract is £10 / £2 for Standard and Mini accounts respectively.

Disclaimer: CFDs have a high risk of losing money rapidly. About 80% of retail investor accounts lose money due to leverage when trading CFDs with this provider. Please note that CFDs are not complying with the islamic religion. And if you want to trade in CFDs you should consider a swap-free account to follow islamic rules.

Learn more about CFDs for muslims.

Futures

The minimum spread for trading Germany 30 is 6 points per contract, knowing that the value of one contract is €250 / €50 For Standard and Mini accounts respectively.

Metals

The spreads of trading Gold and Silver are 0.3 and 2 points per contract respectively, knowing that the values of contracts are $50 and $100 respectively.

Note:

- Gold’s contract size is 100 troy oz

- Silver’s contract size is 5,000 troy oz

Softs

The spread of trading Cocoa London is 3 points per contract, knowing that the contract size is £10.

Energies

The spread per contract of trading Oil – Brent Crude is 2.8, knowing that the contract size is $10.

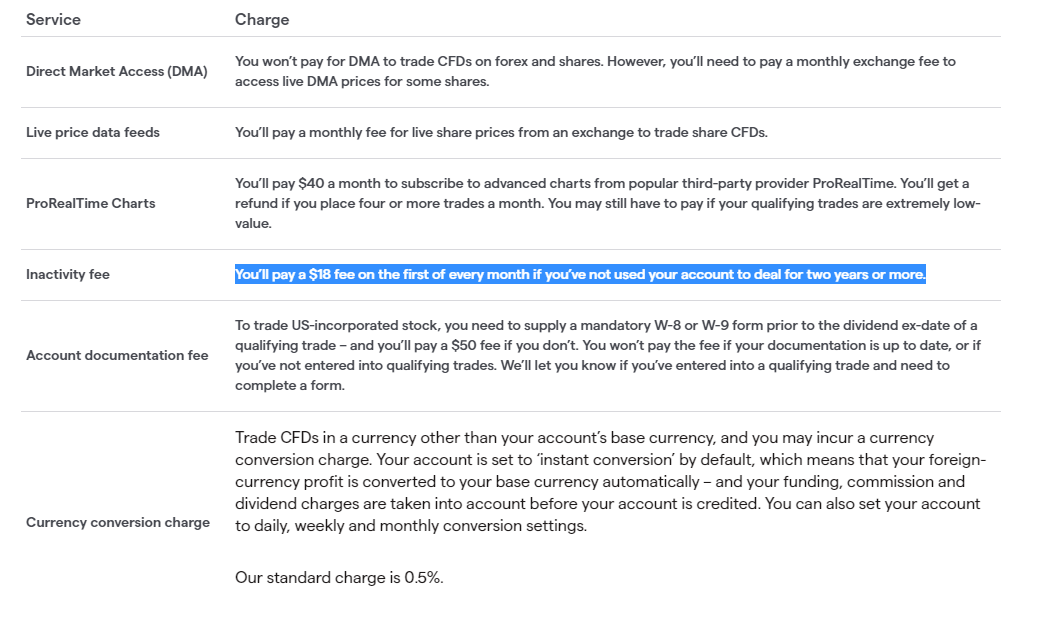

Non-trading fees

- Account fee: $0

- Deposit fee: $0 (for bank transfers)

- Withdrawal fees: $0

(you can check the full withdrawal fees in withdrawal fees section)

- Inactivity fee: You’ll pay a $18 fee on the first of every month if you’ve not used your account to deal for two years or more.

- Other fees

Please, note that IG charges you with other types of fees like the account documentation fees, currency conversion fees, and Pro Real Time charts. You can take a look at them in the image below.

IG Fees Explained

Deposit and withdrawal

|

Pros |

Cons |

|

|

Account Currencies

The IG account has 6 base currency options which are:

- GBP

- EUR

- AUD

- USD

- SGD

- HKD

Notes:

- You will not be charged with conversion fees if your account has the same currency with your bank account or when you trade assets with the same currency of your account.

- If you want to avoid being charged with conversion fees, you can open a multi-currency bank account at a digital bank.

Deposit

1. Options

IG supports depositing using different methods such that:

- Credit/ Debit Cards

- Bank Transfers

- HK FPS

- Paypal

IG deposit methods

|

IG |

|

|

Credit cards |

Yes |

|

Bank Transfers |

Yes |

|

Electronic wallet |

Yes |

2. Fees

IG does not charge any deposit fees, but at the same time there are minimum and maximum deposits allowed. So, please refer to the table shown below for more details.

IG Deposit Fees and Time

|

Method |

Fees |

Transfer Time |

Minimum Deposit Amount |

Maximum Deposit Amount |

|

Credit/ Debit Cards |

£0 |

Immediately |

£250 |

£99,999 for Debit / £50,000 for Credit |

|

FPS Hong Kong Dollars (HKD) |

£0 |

1 to 3 business days |

£0 |

No Maximum |

|

Bank Transfers |

£0 |

1 to 3 business days |

£0 |

No Maximum |

|

PayPal |

£0 |

Immediately |

£250 |

£25,000 |

Withdrawal

1. Options

IG provides several withdrawal options as the table shows below.

IG withdrawal methods and fees

|

IG |

|

|

Bank Transfers |

Yes |

|

Credit cards |

Yes |

|

Electronic wallet |

Yes |

|

Fee |

$0 |

2. Fees

IG does not charge withdrawal fees, but at the same time, there’s a minimum withdrawal applied of $150, unless you have less than $150 available on your account. In this situation, you can withdraw up to the amount available.

IG Withdrawal Options and Time

|

Method |

Fees |

Minimum Withdrawal Amount |

Time |

Maximum Withdrawal Amount |

|

Credit/ Debit Cards |

$0 |

$150 |

2 – 5 business days |

$25,000 per day |

|

FPS Hong Kong Dollars (HKD) |

$0 |

$150 |

1 – 3 business days |

No Maximum |

|

Bank Transfers |

$0 |

$150 |

1 – 3 business days |

No Maximum |

There’s also a minimum withdrawal amount applied according to the base currency you have as shown below.

Minimum Withdrawal

|

Currency |

Minimum withdrawal |

Maximum withdrawal (per day) |

|

GBP |

100 |

20,000 |

|

EUR |

150 |

25,000 |

|

AUD |

200 |

35,000 |

|

USD |

150 |

49,999 |

|

SGD |

200 |

35,000 |

|

HKD |

1,250 |

n/a |

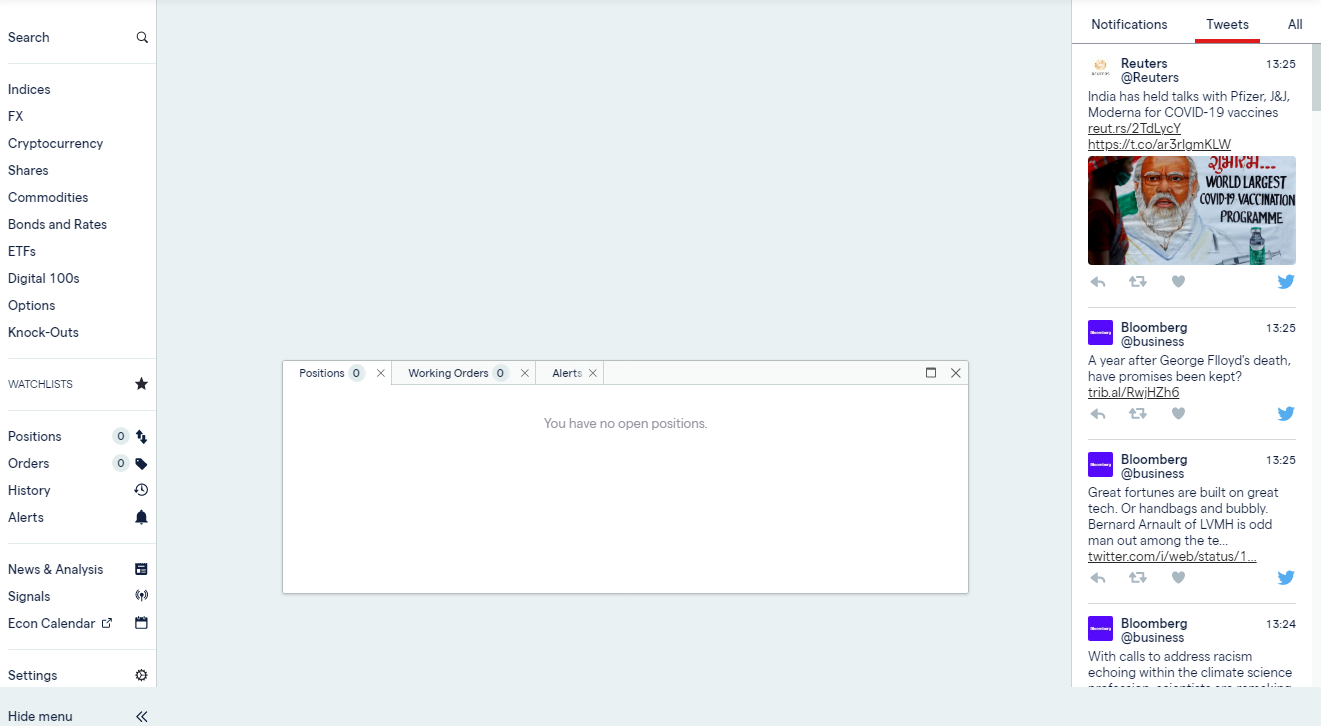

Platforms and Languages

IG works on its customized IG platform as well as the MetaTrader 4 platform. Unfortunately, IG does not work on its nearer version, the MetaTrader 5.

In this section we will discuss the IG and the MT4 trading platform in detail.

IG Web Application

|

Pros |

Cons |

|

|

Languages

The web trading platform is available in a number of languages including major languages like English, French, Japanese, Spanish, and more.

User interface (UI)

The UI of the web trading platform is easy to use and you can find the information you want in its right place without any effort. The navigation within the platform looks nice, especially that you can do anything on the same page without going to any other page.

IG – Web Platform – UI

Login and Security

Unfortunately, the web platform supports only a one-step verification with the username and password to login to your account dashboard.

IG – Web Platform – Login

Searching

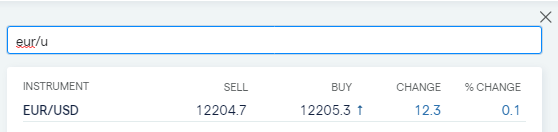

The searching function works fine. And even if you type the wrong asset name, it will show it for you for simplicity.

IG – Web Platform – Search

Placing orders

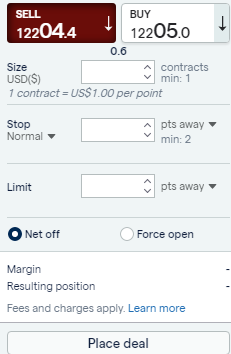

IG have 5 main types of orders on its web platform which are:

- Market order

- Limit order

- Stop-loss order

- Trailing stop order

- Guaranteed stop order

IG – Web Platform – Place Order

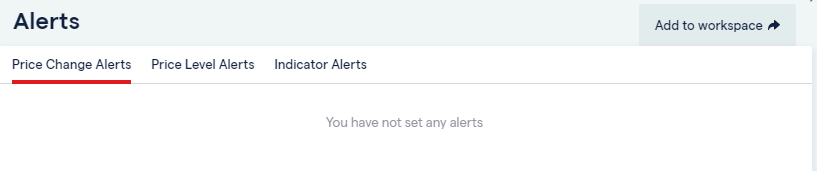

Notifications and alerts

With a variety of alerts and notification types, you can set price, automated, and much more alert types on the web platform.

IG – Web Platform – Alerts and Notifications

Portfolio and reports

You can have a clear look of your account and its performance through clear fee and portfolio reports by going to the ‘History’ tab in the bottom left corner of your dashboard.

IG Mobile Application

|

Pros |

Cons |

|

|

Languages

The IG Mobile Application is available in a number of languages like the web trading platform with the support of major languages like English, German, Spanish, and more.

The changing of language is a little bit tricky as you change it while you create your account and select the country of residence.

IG – Mobile Application – Languages

User interface (UI)

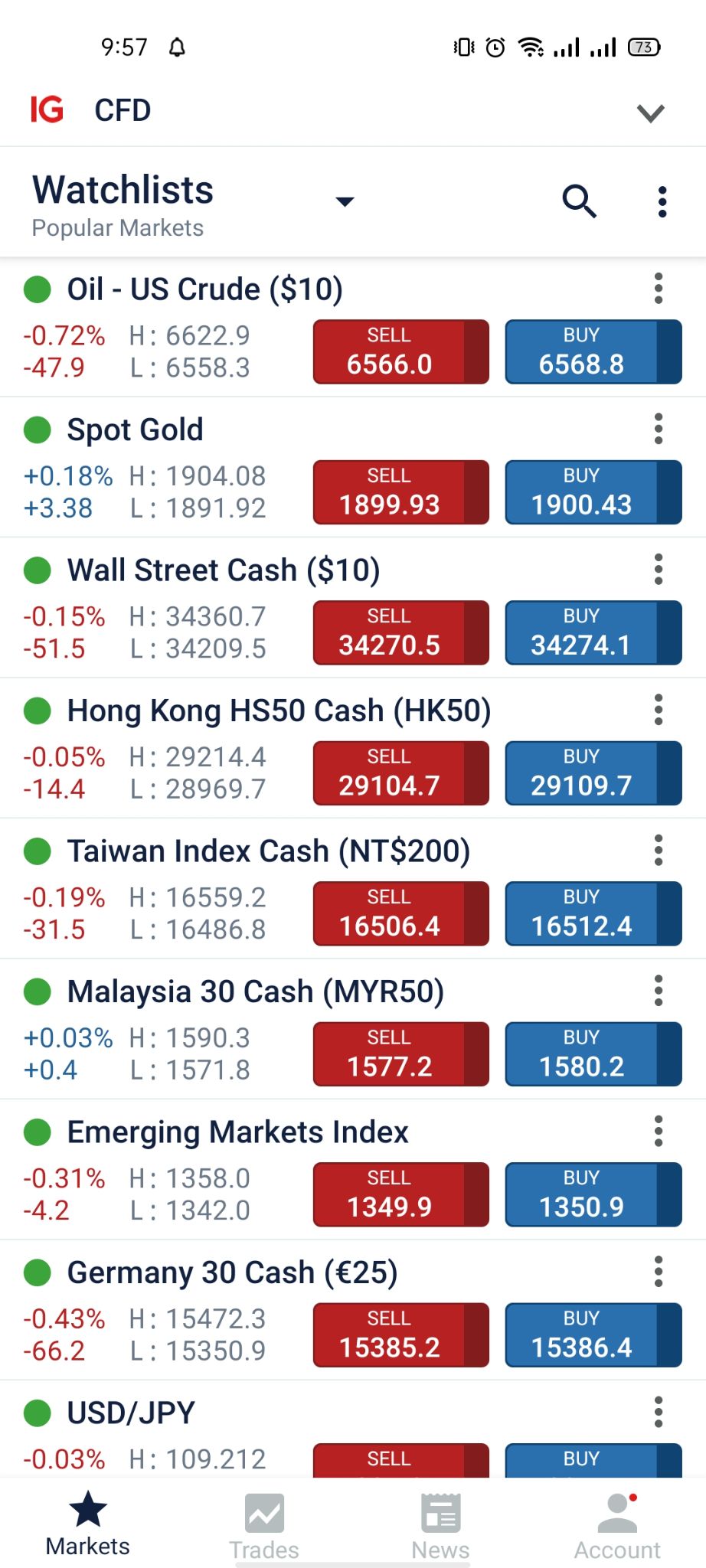

The UI of the mobile application looks nice and easy for beginners as well as the professional traders. You can find each function in its right place easily and use it perfectly without errors.

IG – Mobile Platform – UI

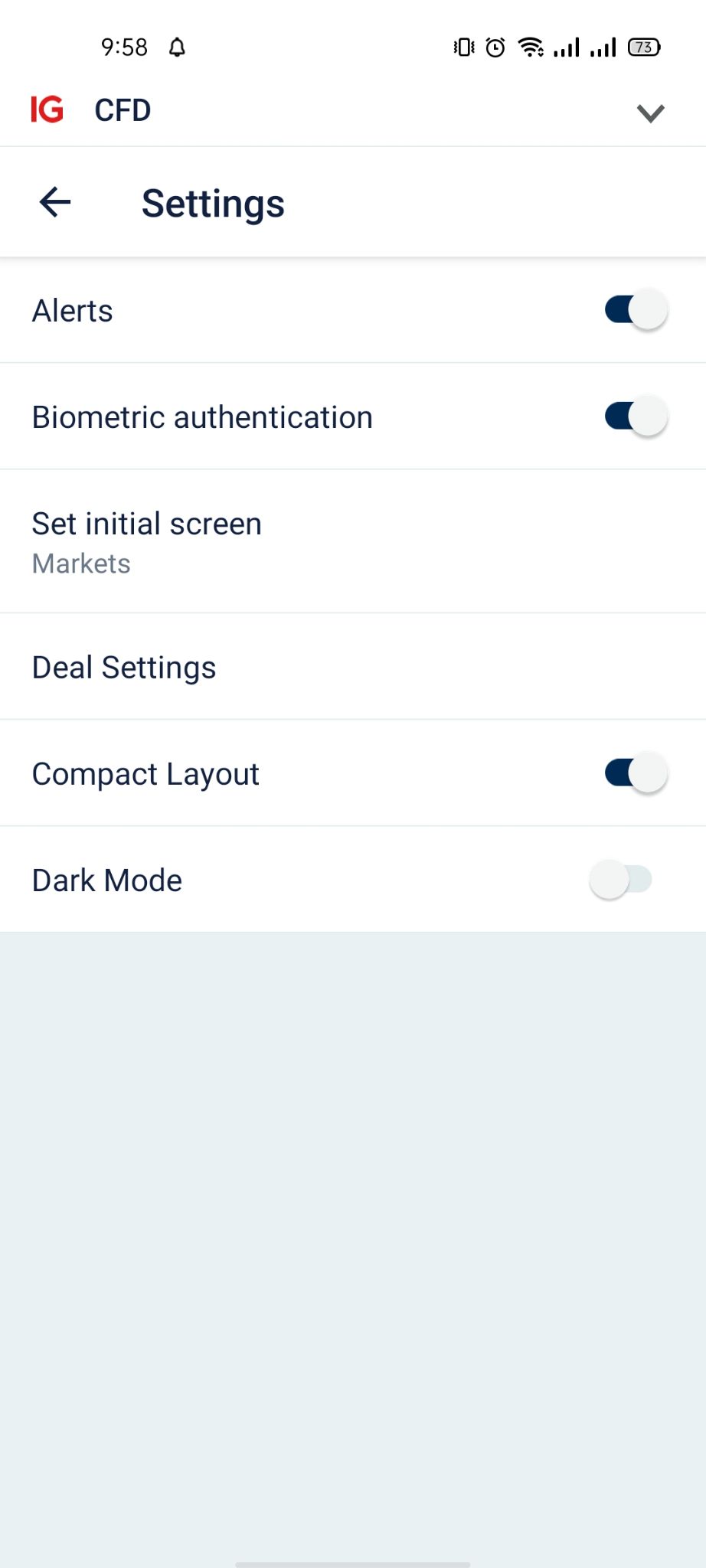

Login and security

IG has a great and safe login using the two-step verification method using both email and password along with the biometric verification using your Touch/ Face ID.

IG – Mobile Platform – Biometric Authentication

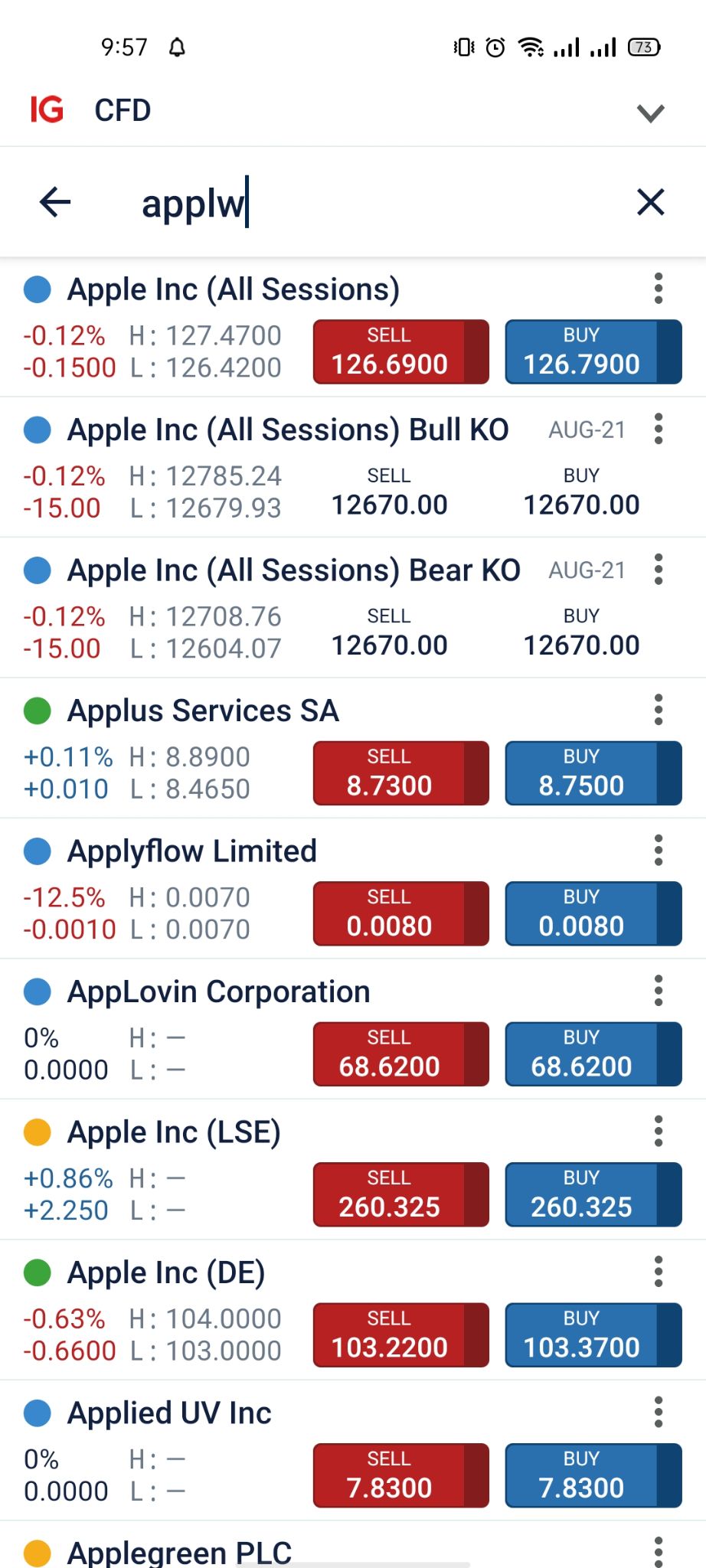

Searching

Like the web application platform, it has a very good searching function with the ability to search for categories as well as the asset name and find them easily.

IG – Mobile Platform – Search

Placing orders

Same as the web platform, there are 5 types of orders which are:

- Market order

- Limit order

- Stop-loss order

- Trailing stop order

- Guaranteed stop order

IG – Mobile Platform – Place Orders

Notifications and alerts

IG mobile application platform has the notification and alerts feature that helps you set alerts for a variety of things like prices and other kinds of signals as well.

IG – Mobile Platform – Signals

MetaTrader 4 Platform

|

Pros |

Cons |

|

|

Languages

MetaTrader 4 is available in a number of languages like:

MT4 Languages

|

Arabic |

Bulgarian |

Chinese |

Croatian |

Czech |

Danish |

|

Dutch |

English |

Estonian |

Finnish |

French |

German |

|

Greek |

Hebrew |

Hindi |

Hungarian |

Indonesian |

Italian |

|

Japanese |

Korean |

Latvian |

Lithuanian |

Malay |

Mongolian |

|

Persian |

Polish |

Portuguese |

Romanian |

Russian |

Serbian |

|

Slovak |

Slovenian |

Spanish |

Swedish |

Tajik |

Thai |

|

Traditional Chinese |

Turkish |

Ukrainian |

Uzbek |

Vietnamese |

User interface (UI)

MT4 has a very customizable UI that you can adjust according to your needs and preferences. On the other hand, it seems hard to find some of the features inside.

MT4 – Mobile Version – UI

Login and Security

Unfortunately, the MT4 does not provide a two-step verification method for logging in, and it does only support a one-step login.

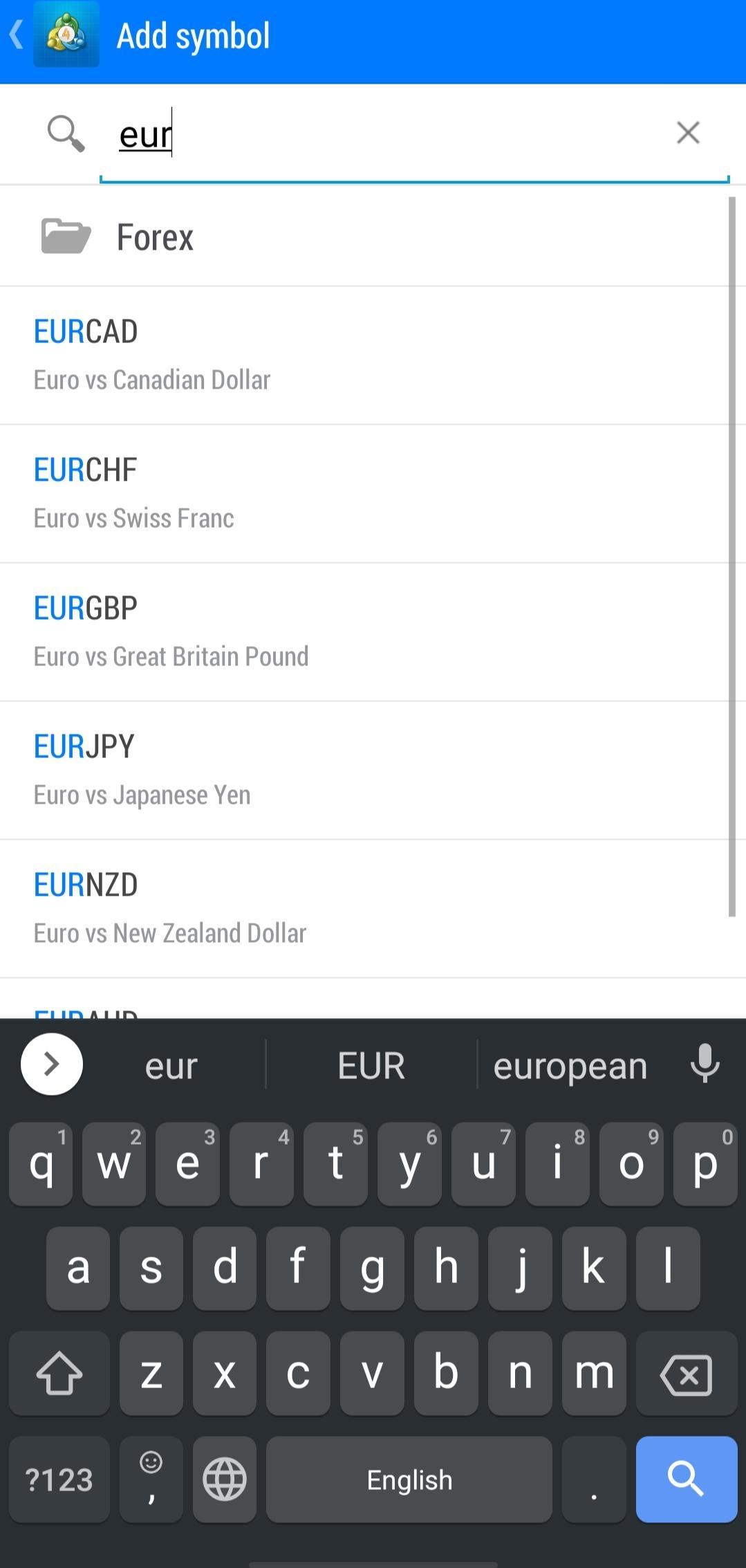

Searching

Searching using the MT4 platform has two different options:

- You can search by categories and find assets.

- You can also type the name of the asset and search for it manually.

MT4 – Mobile Platform – Search

Placing orders

MT4 has a simple order types which are:

- Market

- Limit

- Stop

- Trailing stop

In addition to those 4 types, there are other orders which are the time limit ‘Good ‘til time’ (GTT) and ‘Good ’til canceled’ (GTC).

There’s also an order confirmation feature in MT4.

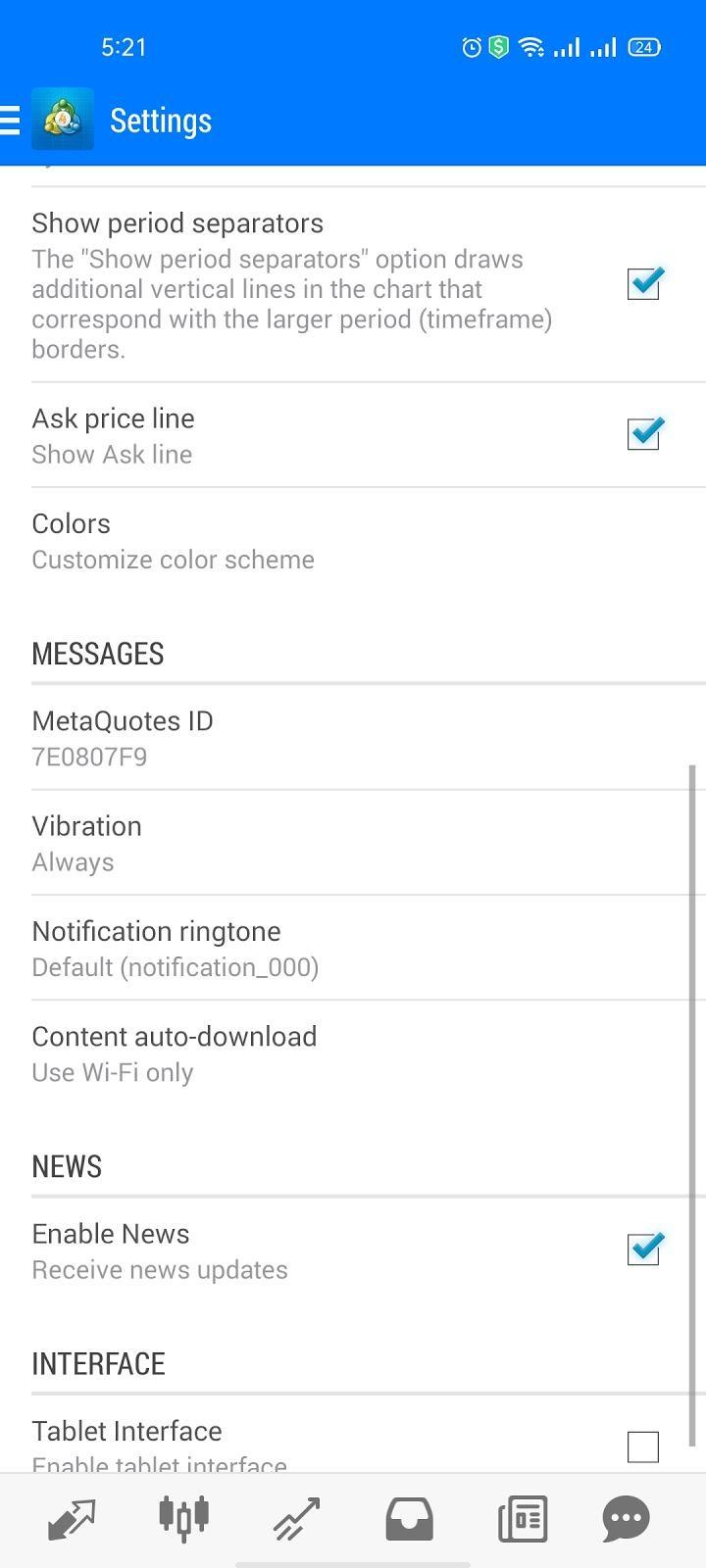

Notifications and alerts

Unfortunately, the MT4 web trading platform does not have an option to set price alerts and notifications unlike the desktop and mobile versions.

MT4 – Mobile Version – Notifications Settings

Portfolio and reports

Under the ‘History’ tab, you can find your portfolio reports with a clear fee description.

MT4 – Mobile Version – Portfolio

Research Tools

|

Pros |

Cons |

|

|

Sources

The research tools come from two places, the IG platform, or the MT4 trading platform. Both of them have great and helpful tools that make your trading easier than before with trading ideas, charting options, economic calendar, and a Newsfeed.

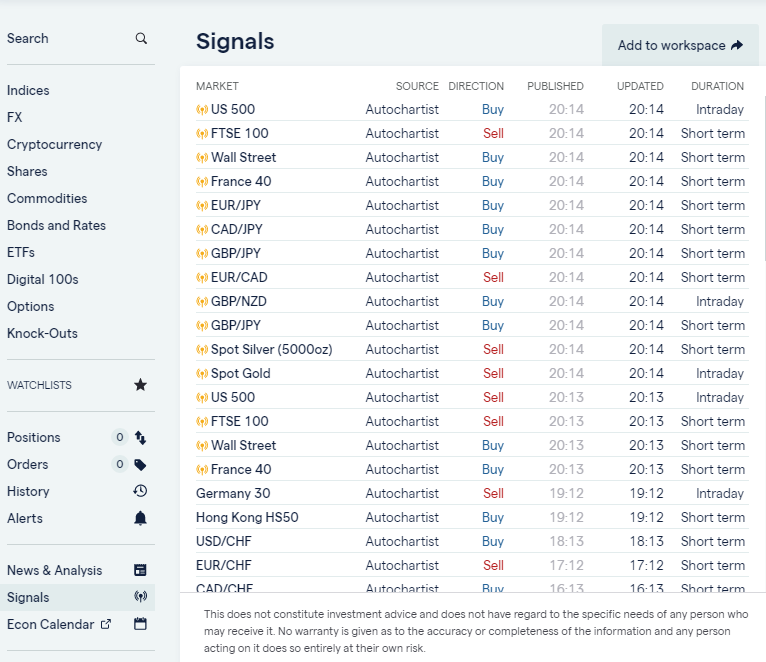

Trading ideas

IG has a great trading ideas tool that provides you with a number of trading instruments along with their relative forecasting (buy or sell). This tool helps you avoid risks and losses by following the market trends.

IG – Research – Signals

Fundamental data

Surprisingly, there’s no fundamental data available on your IG account.

Charting

With over 30 indicators, IG has a great charting tool that helps you discover patterns and have a close look at the market movements in seconds.

IG – Web Platform – Charting

Newsfeed

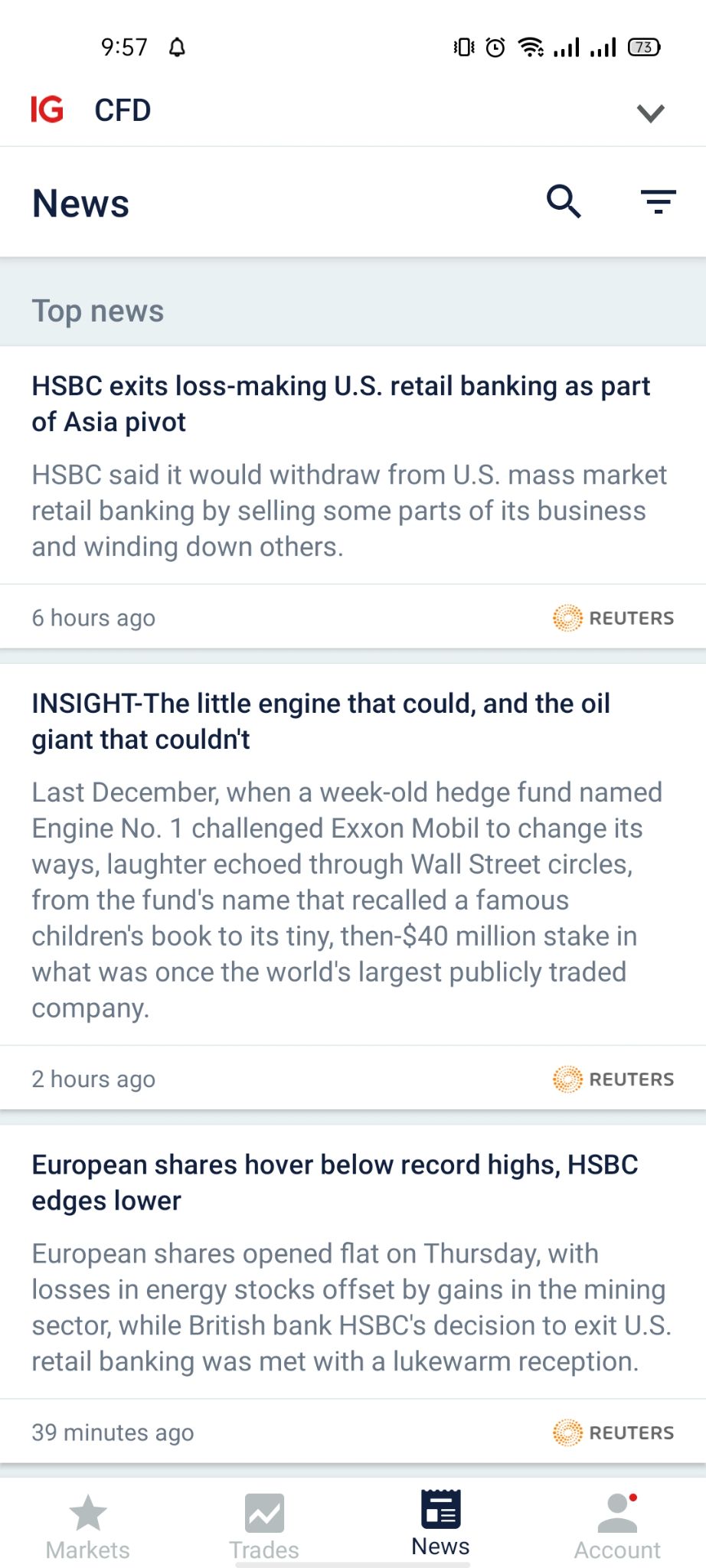

If you like checking market news everyday, then you may like the Newsfeed provided by IG as it helps you see important news at a glance in one place easily.

IG – Mobile Platform – Newsfeed

Other tools

IG also has an ‘Economic Calendar’ that helps you get an overview of the upcoming events in the financial industry and never miss anyone.

IG – Mobile Platform – Economic Calendar

Customer Support

|

Pros |

Cons |

|

|

Options

IG supports different customer service channels like:

- Live chat

- Phone call

Languages

The languages available for customer service are many with the support of major languages like English and Chinese.

Education

|

Pros |

Cons |

|

|

IG broker has good educational materials for trading, trading orders, and other trading topics. Those educational materials are:

- Seminars

- Webinars

- Events

- Articles

- Glossaries

In addition to the previous educational materials, IG also provides a demo account for free in case you want to trade with %0 risk.

IG Education

FAQs

-

- How long does it take to verify my account?

- It takes about 2 to 3 business days to verify your IG account.

- Does IG give cash rebates?

- Yes. For pro traders only.

- Can I open more than one trading account?

- Yes. You can open another account by Simply logging in to My IG. Click one of the ‘add an account’ links on the dashboard and then choose the account you want from the pop-up.

- Does IG allow bot trading?

- Yes, IG allows you to use trading bots in order to trade on behalf of you.

- Does IG provide a mini account?

- Yes, it does provide a mini account with lower values for trading.

- Does IG give a bonus?

- Unfortunately, IG does not provide any bonuses or promotions.

- Does IG allow scalping and hedging?

- IG does allow scalping, but on the other hand it does not allow hedging.

- Can someone else trade on my behalf on IG?

- Yes. You can allow someone else to trade on your CFD account by granting them power of attorney (POA).

- The person you nominate must also hold an account with us. If they don’t already, they can apply online.

- You can email the completed form to helpdesk.en@ig.com. IG aims to have the POA set up on the same day as received it, however it can take longer. Ensure all information has been filled out on the form, as this will help prevent delays.

- Where is my money held?

- In segregate bank accounts

- What happens to my money if IG goes into liquidation?

- In the unlikely event of this happening, all the clients would have their share of the segregated money returned, minus the administrators’ costs in handling and distributing these funds.

- What happens to my funds if the bank which holds my funds goes insolvent?

- As all deposits lodged with us are held on trust for you in a regulated trust account, in such circumstances those deposits would attract all the legal protections afforded to trust money.

- How to enable the swap-free option in my account?

- By emailing IG at helpdesk.ae@ig.com with instructions to do so. IG will email you back once this has been done.

- How do I login using the MT4 mobile platform?

- Steps:

1. Go to ‘Settings’

2. Click on ‘Manage Accounts’ or ‘Settings’

3. Then click on the small plus sign or select ‘New Account’

4. Then select ‘Log in to an existing account’

5. Search for the broker name

6. Select the server your account was set up on

7. Enter your login credentials and password

8. Click on ‘Sign In’

-

- Why can’t I see all IG markets on MT4?

- MT4 is limited as to how many markets it can show. Currently, IG shows forex, indices and some commodities, with a view to expand on these soon. To make sure you have the most up to date product offering, all you need to do is right click in the ‘marketwatch’ window and then select ‘show all.’

- When will my demo account expire?

- After 2 months.

- When trading forex, will you lose more than your initial deposit?

- Yes. All trading involves risk. Losses can exceed deposits.

- Can I login to more than one account from the same computer?

- Yes, you can do such a thing by using the MT4 Multi Terminal.

- Can I login to the same account through different devices?

- Yes, you can login to the MetaTrader 4 platform using the same password and username through different devices.

- Does IG accept payments from third parties?

- No. Payments should be under your name.

Conclusion:

- Pros: negative balance protection, islamic account option, 17,000 trading products, segregated client funds

- Cons: limited trading options for some countries, high forex and CFD fees, no fundamental data available

- Best for: beginners and professionals

- Regulated by: FCA, BaFin, FINMA, CFTC, NFA, ASIC, FMA, MAS, FSA, FSCA, DFSA, BMA

- Headquarters: London, UK.

- Foundation year: 1974

- Min Deposit : $0 (using bank transfers)

- Deposit and withdrawal methods:credit/ debit cards, bank transfers, electronic wallet

- Deposit and withdrawal fees: $0

- Base currencies: EUR, USD, GBP, AUD, SGD, HKD

- Offering of investments: forex, CFDs, ETFs, commodities, real stocks, options, futures, metals, bonds, cryptocurrencies

- Number of users: 239,000