- يونيو 27, 2021

- Posted by: ForexTradeOn

- Category: Oanda Broker rewiew

|

Pros |

Cons |

|

None |

Introduction

Oanda is one of the oldest CFD and forex brokers since 1996. It’s originally founded in America, and regulated by top-tier regulators like FCA and CFTC.

Countries Available

You can open an account on Oanda from all over the world except, but not limited to North Korea, Iran, and Cuba.

Account Types

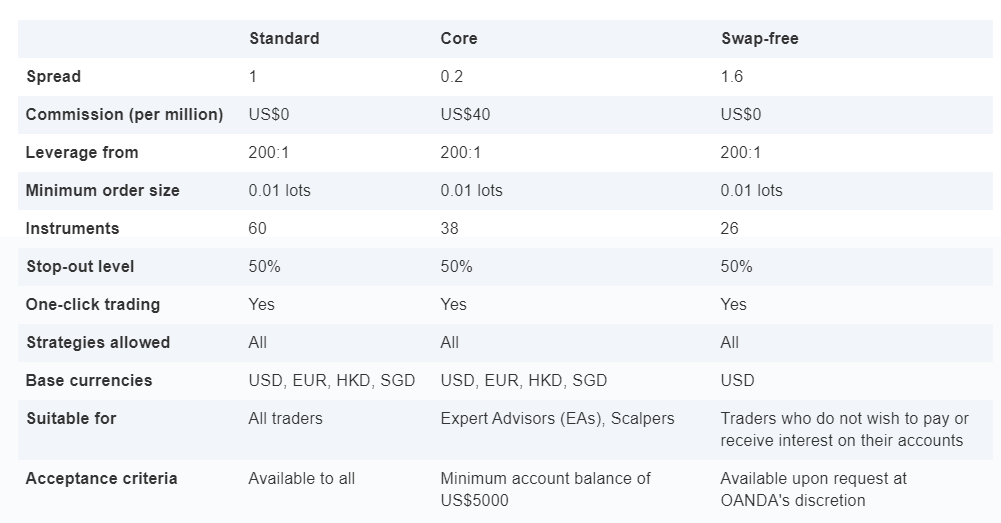

There’s only three trading account options that you can select one of them.

Oanda – Account comparison

|

Standard |

Core |

Swap-free |

|

|

Demo Account |

Yes |

Yes |

Yes |

|

Spread |

1 |

0.2 |

1.6 |

|

Commissions (per million) |

$0 |

$40 |

$0 |

|

Min deposit |

$0 |

$0 |

$0 |

|

Base Currencies |

USD, EUR, HKD, SGD |

USD, EUR, HKD, SGD |

USD |

|

Swap-Free |

No |

No |

Yes |

Oanda Account Types

Notes:

- In addition to the previous types, there’s a swap free account option for those who live in amuslim country.

- Oanda also provides a demo account with 0 fees if you want to experience the trading platform with no risk.

- There’s an option to join the Oanda affiliate partner program if you want as well.

Min Deposit

There’s no minimum deposit when you open an account at Oanda which is great.

How to Open Account

The process of opening an account is pretty simple. We will guide you through little steps to register and start using Oanda.

- Enter your country of residence.

- Provide a username and password.

- Provide some personal information like your employment.

- Verify your identity by providing a proof of residence.

- All done! You can start trading now.

Oanda – Account opening

Notes:

- Due also to the requirements of the regulatory bodies that supervise Oanda, it is necessary that in order to operate with your account you send them a proof that proves your identity and another proof that proves your current address :

- Identity document : You must send a copy of your ID, your passport or driving license . It has to be an official document that clearly shows your identity and that it is valid (the document you send cannot be expired). You can scan any of these documents and send it in PDF, JPG, GIF, or take a photo with your mobile if it is more comfortable for you. In any case, the image must have good quality and be completely readable, otherwise it may give you problems to verify it.

- Proof of address : This is to send a document that shows your current address . You will have to send a recent utility bill (not exceeding 3 months) for electricity, water, gas, landline or Internet (many brokers do not accept, for example, mobile phone bills). You can scan and send it in PDF, JPG, GIF, or take a photo with your mobile. Like the previous document, all the data must be legible and have sufficient quality.

FAQs

- How long does it take to verify my account?

- It takes from 1 to 3 days in order to verify your Oanda account.

- Can I open more than one trading account?

- Yes, Oanda offers you an option to open up-to 19 sub accounts under your main account in case you want to have more than one account with different currencies.

- Does Oanda allow bot trading?

- Yes, you can develop automated trading strategies with our API from the developer portal of Oanda.

- Does Oanda give a bonus?

- Unfortunately, you will not find any mention of any such promotion on the OANDA site.

- Does Oanda allow scalping?

- Yes, Oanda does allow scalping and hedging.

- How do I login using the MT4 mobile platform?

- Steps:

1. Go to ‘Settings’

2. Click on ‘Manage Accounts’ or ‘Settings’

3. Then click on the small plus sign or select ‘New Account’

4. Then select ‘Log in to an existing account’

5. Search for the broker name

6. Select the server your account was set up on

7. Enter your login credentials and password

8. Click on ‘Sign In’

- When trading forex, will you lose more than your initial deposit?

- Both our MetaTrader 4 and Oanda web trading platforms are set to automatically close your positions when your margin requirement reaches 100% (stop out level).

- Please note that this process is automated and is not a guarantee that your account will not enter into a negative equity situation and you should keep a balance amount in your account above your required margin.

- Can I login to the same account through different devices?

- Yes, you can login to the MetaTrader 4 platform using the same password and username through different devices.

- Does Oanda accept payments from third parties?

- No, as you can only deposit money from accounts that are in your name.

- Can I transfer funds between my OANDA sub-accounts?

- Ytes, you can transfer your money between your main account and any of your sub-accounts.