- يونيو 27, 2021

- Posted by: ForexTradeOn

- Category: saxo Broker review

|

Pros |

Cons |

|

|

Introduction

Saxo Bank is one of the most popular investment banks all vr the world. It’s originally founded in 1992 in Denmark. It’s also regulated by top-tier financial authorities like the FCA, the Financial Conduct Authority in the UK. Saxo Bank has over 40,000 trading products in several categories like forex, CFDs, commodities, ETFs, and more. It also has low trading fees, with a good trading experience through its customized trading platforms. Saxo Bank also has several third party research tools that help you trade smart with the least effort and create your own trading strategies.

Countries Available

Saxo Bank is available in countries all over the world, except the US, Iran, Cuba, Sudan, Syria, and North Korea.

Account Types

Saxo bank has 3 different account types. Each one of them has its own specifications and features as the table shows below. Saxo Bank also has an islamic account account option for traders who want to follow islamic rules.

Saxo Bank – Account comparison

|

Classic |

Platinum |

VIP |

|

|

Minimum Deposit |

$2,000 |

$200,000 |

$1,000,000 |

|

Prices |

Low |

%30 Lower Prices |

Best Prices |

|

Support |

Yes |

Yes |

Yes |

|

Local Language Support |

No |

Yes |

Yes |

|

Contact With Trading Experts |

No |

No |

Yes |

|

Exclusive Event Invitations |

No |

No |

Yes |

Saxo Bank also provides a demo account with 0 fees if you want to experience the trading platform with no risk.

Notes:

- In addition to the previous types, there’s an islamic account option for those who live in amuslim country.

- Saxo Bank also provides a demo account with 0 fees if you want to experience the trading platform with no risk.

- There’s an option to join the Saxo Bank affiliate partner program if you want as well.

Min Deposit

The minimum deposit differs according to the account type as well as the country of residence. For Denmark residents. For more information about other countries, check the table below.

Saxo Bank – Minimum Deposit

|

Countries |

Minimum Deposit |

|

UK |

£500 |

|

Denmark |

No minimum deposit |

|

Norway |

NOK 10,000 |

|

Switzerland |

CHF 2,000 |

|

France |

EUR 2,000 |

|

Netherlands |

EUR 2,000 |

|

Australia |

AUD 3,000 |

|

China Hong Kong |

$2,000 |

|

Singapore |

SGD 3,000 |

|

Other countries |

$10,000 |

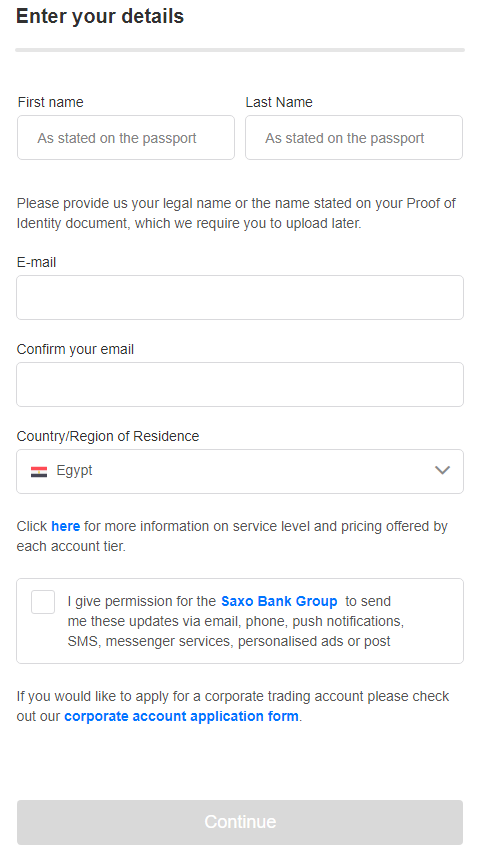

How to Open Account

You can open an Saxo Bank account in minutes through these steps:

- Enter your name, email, and country of residence.

- Provide some personal information like your address, gender, date of birth, phone number and nationality.

- Enter some information about your profession and work.

- Provide some information about your financial status and savings.

- Select your account base currency.

- Answer some questions about your trading experience.

- Set a password then click ‘Confirm’.

- Provide proof of your identity and the country of residence.

- Fund your account and start trading.

Saxo Bank – Account opening

Notes:

- Due also to the requirements of the regulatory bodies that supervise Saxo Bank, it is necessary that in order to operate with your account you send them a proof that proves your identity and another proof that proves your current address :

- Identity document : You must send a copy of your ID, your passport or driving license . It has to be an official document that clearly shows your identity and that it is valid (the document you send cannot be expired). You can scan any of these documents and send it in PDF, JPG, GIF, or take a photo with your mobile if it is more comfortable for you. In any case, the image must have good quality and be completely readable, otherwise it may give you problems to verify it.

- Proof of address : This is to send a document that shows your current address . You will have to send a recent utility bill (not exceeding 3 months) for electricity, water, gas, landline or Internet (many brokers do not accept, for example, mobile phone bills). You can scan and send it in PDF, JPG, GIF, or take a photo with your mobile. Like the previous document, all the data must be legible and have sufficient quality.

FAQs

- How long does it take to verify my account?

- It takes about 1 to 3 business days to verify your Saxo Bank account.

- Can I open more than one trading account?

- You may open several different types of accounts with Saxo (e.g. an individual, joint, corporate), but not more than one of each account (i.e. you may not open multiple individual accounts in the same name).

- Does Saxo Bank allow bot trading?

- Yes, Saxo Bank allows bot trading through API trading options.

- Does Saxo Bank give a bonus?

- Yes, Saxo Bank does offer a loyalty program in which you earn points each time you make a trade on Saxo Bank platform. Also, these points help you upgrade your account level as well as have better pricing. The points required to join each program are:

- Classic: 0 points

- Platinum: 120,000 points

- VIP: 500,000 points

As said above, the points you earn depend on the trade volume you have. The following table will help you know more information about how much you should trade in order to get points.

Saxo Bank – Reward Points

|

Product |

Volume |

Points |

|

FX spot trade |

EUR 10,000 |

30 |

|

FX option trade |

EUR 10,000 |

40 |

|

CFD index trade |

EUR 10,000 |

20 |

|

CFD equity trade |

EUR 10,000 |

180 |

|

CFD all trade |

EUR 10,000 |

30 |

|

CFD exp. trade |

EUR 10,000 |

20 |

|

Stock trade |

EUR 10,000 |

160 |

|

Stock option trade |

1 |

50 |

|

Non-stock option trade |

1 |

110 |

|

Contract future trade |

1 |

110 |

|

Contract options trade |

1 |

110 |

|

Bonds investment |

EUR 10,000 |

320 |

- Does Saxo Bank allow scalping and hedging?

- Saxo Bank does allow scalping, but it does not allow hedging on its platform.

- When will my demo account expire?

- After 20 days.

- Do I retain access to my Demo account after opening a live account?

- Yes, clients retain access to their Demo accounts after opening live accounts. Clients are also able to extend their Demo access by contacting their account representative.

- How many individuals can open a joint account?

- Saxo Bank accepts joint accounts between two persons only and only between first line family members defined as: spouse, siblings, parents and children.

- How do I transfer money between sub-accounts?

- Go to Menu > Deposits and Transfers > Sub-account transfer.

- Then select:

- The account you wish to transfer funds from

- The receiving account

- The amount

- Click Transfer

Please note that Saxo Bank does not charge any fees on transferring money between sub-accounts, but there is a conversion fee that’s deducted from the deposited amount for currency conversion.

- How do I open a sub-account?

- You can open a sub account from Saxo Bank trading platforms as the following:

- SaxoTraderGo/ Pro:

> Contact support > Create a support request > Sub-account request

> Contact support > Create a support request > Sub-account request - SaxoInvestor:

> Contact Support > Submit ticket > Sub-account request

> Contact Support > Submit ticket > Sub-account request - SaxoTraderGo (Mobile): Menu > Support > Contact Support > Submit ticket > Sub-account request

- Can I fund my account in a different currency other than the account base currency?

- Yes, you can. But there will be a conversion fee deducted from the deposited amount.

- Can I be logged into my account on more than one platform simultaneously?

- Unfortunately, no.

- Does Saxo Bank offer an islamic (swap-free) account?

- Yes, it does.

- Can I use two different accounts simultaneously on the same PC?

- If you have two accounts (i.e., individual and joint account) you can login simultaneously from the both, one of them on the SaxoTraderGo, and the other on SaxoTrader Pro.