- سبتمبر 12, 2021

- Posted by: ForexTradeOn

- Category: TMGM Full Review

Ranks (of 5):

- Safety: 3.5

- The offering of investment: 3.5

- Account opening: 4.5

- Fees: 4

- Deposit and withdrawal: 4.5

- Platforms and languages: 4

- Research: 5

- Customer service: 4.5

- Education: 2

- Overall: 3.9

Pros

Over 8 years of trading experience, regulated by top-tier financial authority, negative balance protection, a trading volume of 150 billion dollars, over 15,000 trading instrument, Forex and CFD trading, low minimum deposit, available in 150 countries, Islamic account option, demo account, Expert Advisors, low trading fees, free deposits and withdrawals, various base currencies, various deposit and withdrawal methods, available on MT4, and good research tools.

Cons

Not listed on the stock exchange, no client protection, no mutual funds trading, inactivity fees, no 24/7 support, and very limited educational materials.

Introduction

Trademax Global Markets or TMGM is an Australian Forex and CFD broker that’s founded in 2013. It has over 15,000 trading instruments and over 150 billion dollars as a trading volume. TMGM is also regulated by tier 1 authority, ASIC. TMGM is also available in over 150 countries around the world and offers competitive spreads and a variety of methods for depositing and withdrawal. TMGM is one of the best choices if you’re familiar with the MetaTrader platforms like the MetaTrader 4.

Disclaimer: CFDs have a high risk of losing money rapidly. About 80% of retail investor accounts lose money due to leverage when trading CFDs with this provider. Please note that CFDs are not complying with the Islamic religion. And if you want to trade in CFDs you should consider a swap-free account to follow Islamic rules. Learn more about CFDs for Muslims.

Safety

|

Pros |

Cons |

|---|---|

|

|

Is TMGM regulated?

The TMGM broker is regulated by many financial authorities like:

- ASIC: the Australian Securities and Investments Commission

- FMA: the Financial Markets Authority in New Zealand

- VFSC: Vanuatu Financial Services Commission

Is TMGM a scam?

TMGM safety is divided into 2 parts, the safety of the broker itself and the safety of the client.

Broker safety

TMGM has had a long tracking record since 2013. It also has over 130 billion USD of traded funds and passed through different financial crises up till now. On the other hand, it’s not listed on the stock exchange markets.

Client protection

Unfortunately, TMGM does not provide any client protection under its regulators.

TMGM Legal Entities Table

|

Country |

Protection amount |

Regulator |

Broker’s Legal Entity |

|---|---|---|---|

|

Australia |

No Protection |

ASIC |

Trademax Australia Limited, trading as TMGM, |

|

New Zealand |

No Protection |

FMA |

Trademax Global Markets (NZ) Limited |

|

Other Countries |

No Protection |

VFSC |

Trademax Global Limited, trading as TMGM, |

TMGM provides negative balance protection to prevent unusual events in your account and keep your balance never negative.

Offering of Investments

|

Pros |

Cons |

|---|---|

|

|

TMGM offers 5 classes of trading instruments; Forex, CFDs, shares, energies, and metals trading. You may not find trading instruments like mutual funds, bonds, or ETFs.

Disclaimer: CFDs have a high risk of losing money rapidly. About 80% of retail investor accounts lose money due to leverage when trading CFDs with this provider. Please note that CFDs are not complying with the Islamic religion. And if you want to trade in CFDs you should consider a swap-free account to follow Islamic rules.

Learn more about CFDs for Muslims.

TMGM Offering of Investments

|

Category |

Number of Products |

|---|---|

|

Forex |

50 |

|

CFD |

15 |

|

Stocks/ shares |

15,000 |

|

Metals |

3 |

|

Bonds |

No |

|

ETFs |

No |

|

Mutual Funds |

No |

|

Energies |

2 |

Note:

Please note that some of the trading options may depend on your account type and/or your country of residence according to governmental rules.

Account Opening

|

Pros |

Cons |

|---|---|

|

|

Countries available

TMGM is available in over 150 countries around the world including Australia, Germany, Italy, and more. There’s one restricted country which is the US because of governmental rules.

Account types

There are two main account types at TMGM:

- Classic (No Commission)

- Edge (Commission-based)

Each one of the two has its features and advantages as the table shows below.

TMGM – Account Comparison

|

Feature |

Classic Account |

Edge Account |

|---|---|---|

|

Spreads |

From 1.0 pips |

From 0.0 pips |

|

Commissions |

No Commissions |

$7 per round turn |

|

Demo Account |

Yes |

Yes |

|

Base Currencies |

USD, EUR, GBP, AUD, NZD, CAD |

USD, EUR, GBP, AUD, NZD, CAD |

|

Minimum Deposit |

$100 |

$100 |

|

Deposit Fee |

Free |

Free |

|

Withdrawal Fee |

Free |

Free |

|

Execution Type |

ECN |

ECN |

|

Expert Advisors (EAs) |

Yes |

Yes |

|

Available Platforms |

MT4 and MT5 |

MT4 and MT5 |

|

Islamic Account |

No |

Yes |

|

Hedging |

Yes |

Yes |

|

Scalping |

Yes |

Yes |

TMGM also provides a demo account with 0 fees if you want to experience the trading platform with no risk.

Min deposit

The minimum deposit of any account type is 100 of the account base currency.

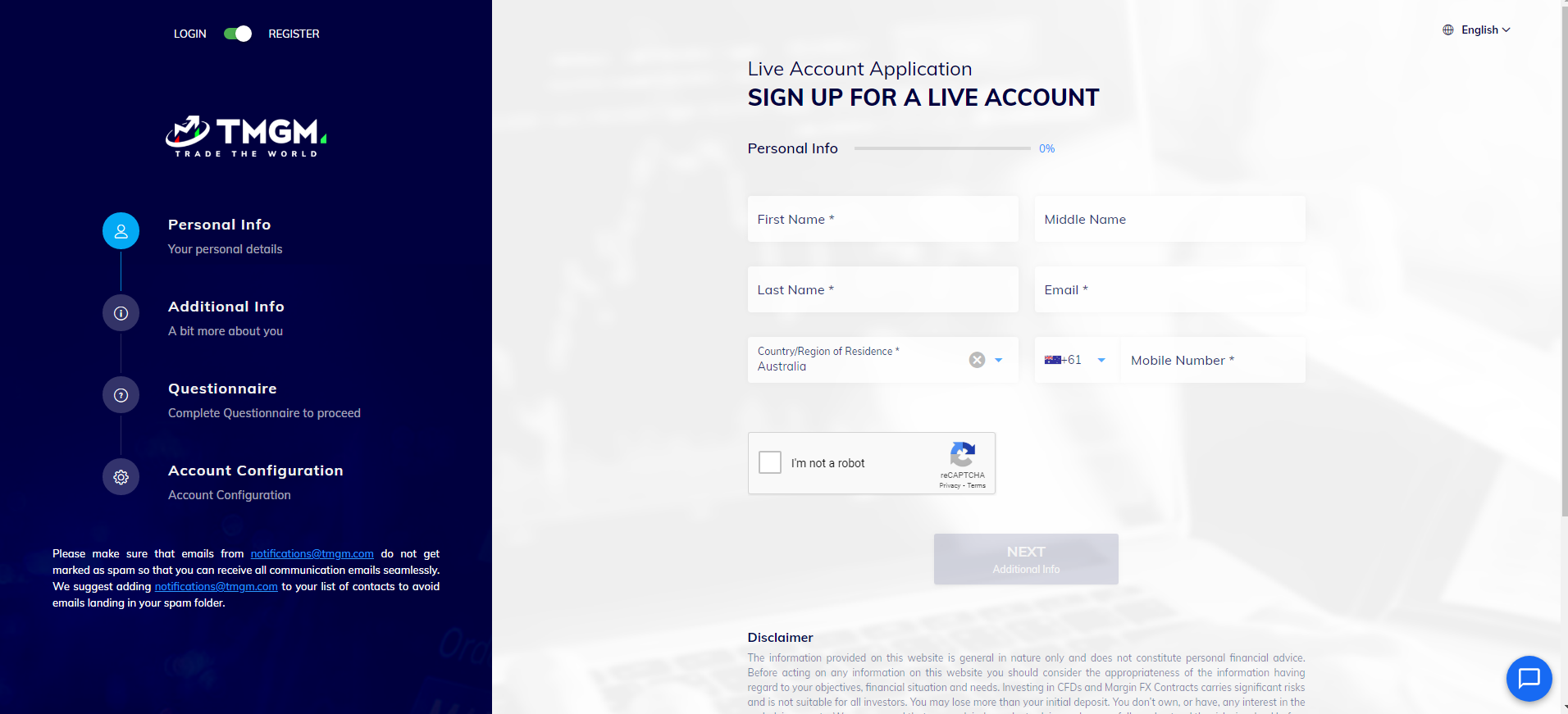

How to open an account

You can open a TMGM account in minutes through these steps:

- Enter your name, email, phone number, and country of residence.

- Enter some personal information like your city then set a password.

- Choose the account type and base currency.

- Provide proof of your identity and the country of residence.

- Fund your account and start trading.

TMGM – Account opening

Notes:

The verification process takes 1 business day to proceed.

Fees and Commissions

|

Pros |

Cons |

|---|---|

|

|

Commissions

TMGM charges commissions on the Edge account only. The commission value is $7 per round turn.

Trading Fees

Forex fees

The spread of trading EUR/ USD is 0.0 pips per lot.

Index fees

The spread of trading US500 index is 2.4 pips per lot.

Disclaimer: CFDs have a high risk of losing money rapidly. About 80% of retail investor accounts lose money due to leverage when trading CFDs with this provider. Please note that CFDs are not complying with the Islamic religion. And if you want to trade in CFDs you should consider a swap-free account to follow Islamic rules.

Learn more about CFDs for Muslims.

Metals

The spread of trading gold is 1 pip per lot.

Energies

The spread of trading crude oil is 0.0 pips per lot.

Non-trading fees

- Account fee: $0

- Deposit fee: $0

- Withdrawal fees: $0

(you can check the full withdrawal fees in the withdrawal fees section)

- Inactivity fee: $30 inactivity fee if your account balance falls below $500 or if it remains inactive for over 180 days

Deposit and withdrawal

|

Pros |

Cons |

|---|---|

|

|

Account Currencies

The TMGM account has 6 base currencies:

- EUR

- USD

- GBP

- NZD

- AUD

- CAD

Notes:

- You will not be charged with conversion fees if your account has the same currency as your bank account or when you trade assets with the same currency of your account.

- If you want to avoid being charged with conversion fees, you can open a multi-currency bank account at a digital bank.

Deposit

1. Options

TMGM supports depositing using different methods such that:

- Visa

- Master Card

- Revolut

- Wise

- Bank Transfer

- Neteller

- Skrill

- UnionPay

- RMB Instant

- FasaPay

- SticPay

- Broker to Broker

- SEA Instant Pay

TMGM deposit methods

|

TMGM |

|

|---|---|

|

Credit cards |

Yes |

|

Bank Transfers |

Yes |

|

Electronic wallet |

Yes |

2. Fees

TMGM charges no fees for deposits above $100.

3. Time

The processing time is within 1 business day except for the bank transfers that take 1 to 3 business days to proceed.

Withdrawal

1. Options

TMGM withdrawal options are:

- Revolut

- Wise

- Bank Transfer

- Neteller

- Skrill

- RMB Instant

- SEA Instant Pay

TMGM withdrawal methods

|

TMGM |

|

|---|---|

|

Bank Transfers |

Yes |

|

Credit cards |

No |

|

Electronic wallet |

Yes |

|

Fee |

$0 |

2. Fees

TMGM charges no withdrawal fees on withdrawals above $100. Note that your bank may charge you additional transfer fees. So, contact your bank for more information.

3. Time

All withdrawals proceed within 1 business day for all methods except for the bank transfer that may take from 3 – 5 business days.

Platforms and Languages

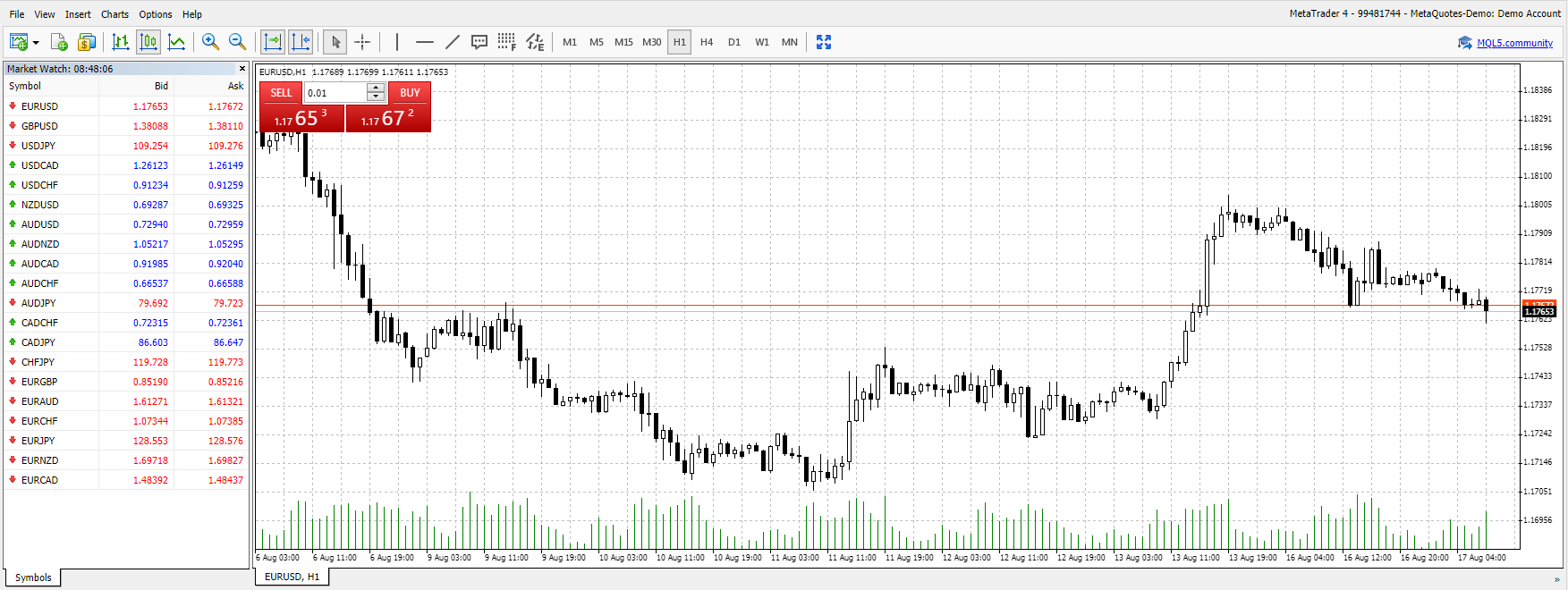

TMGM works on the MetaTrader 4 platform which is a famous platform and is known by a lot of traders. In this section, we will dig deeper into this platform in detail.

MetaTrader 4 Platform (MT4)

|

Pros |

Cons |

|---|---|

|

|

Languages

MetaTrader 4 is available in several languages like:

MT4 Languages

|

Arabic |

Bulgarian |

Chinese |

Croatian |

Czech |

Danish |

|---|---|---|---|---|---|

|

Dutch |

English |

Estonian |

Finnish |

French |

German |

|

Greek |

Hebrew |

Hindi |

Hungarian |

Indonesian |

Italian |

|

Japanese |

Korean |

Latvian |

Lithuanian |

Malay |

Mongolian |

|

Persian |

Polish |

Portuguese |

Romanian |

Russian |

Serbian |

|

Slovak |

Slovenian |

Spanish |

Swedish |

Tajik |

Thai |

|

Traditional Chinese |

Turkish |

Ukrainian |

Uzbek |

Vietnamese |

User interface (UI)

MT4 has a very customizable UI that you can adjust according to your needs and preferences. On the other hand, it seems hard to find some of the features inside.

MT4 – Mobile Version – UI

Login and Security

Unfortunately, the MT4 does not provide a two-step verification method for logging in, and it does only support a one-step login.

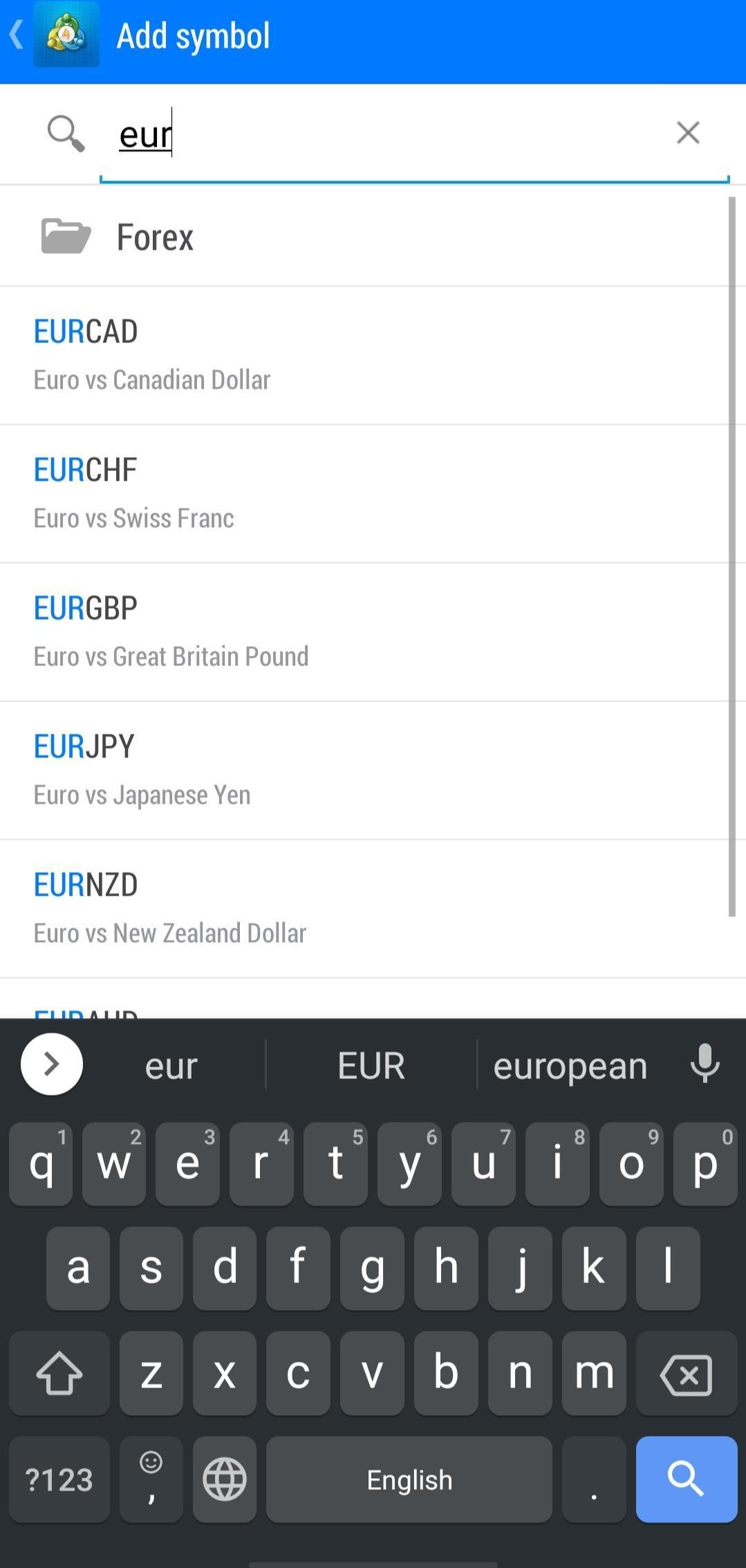

Searching

Searching using the MT4 platform has two different options:

- You can search by category and find assets.

- You can also type the name of the asset and search for it manually.

MT4 – Mobile Platform – Search

Placing orders

MT4 has simple order types which are:

- Market

- Limit

- Stop

- Trailing stop

In addition to those 4 types, there are other orders: the time limit ‘Good ‘til time’ (GTT) and Good ’til canceled (GTC).

There’s also an order confirmation feature in MT4.

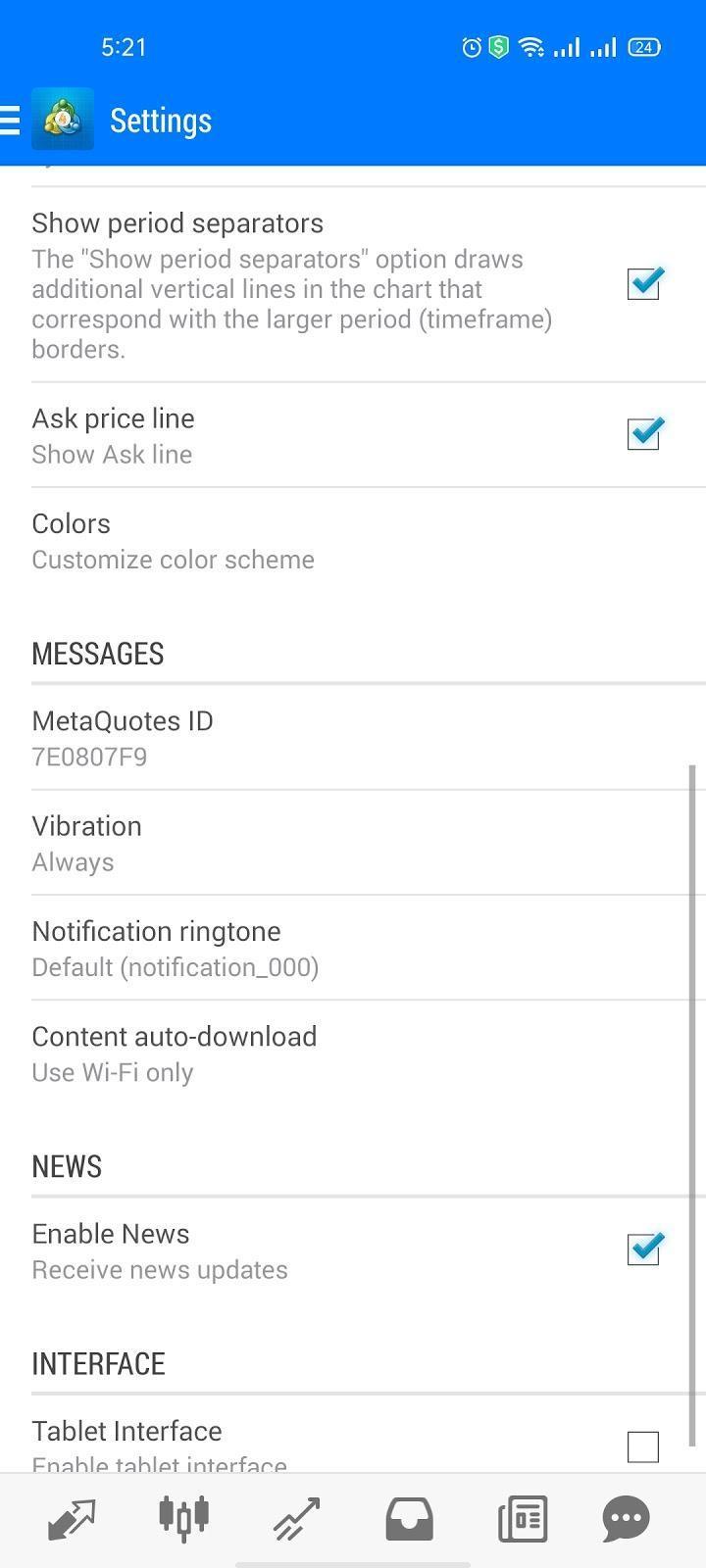

Notifications and alerts

Unfortunately, the MT4 web trading platform does not have an option to set price alerts and notifications unlike the desktop and mobile versions.

MT4 – Mobile Version – Notifications Settings

Portfolio and reports

Under the ‘History’ tab, you can find your portfolio reports with a clear fee description.

MT4 – Mobile Version – Portfolio

Research Tools

|

Pros |

Cons |

|---|---|

|

|

Sources

The research tools comes from 3 places:

- TMGM website

- MT4 trading platform

- Third-party provider (Trading Central)

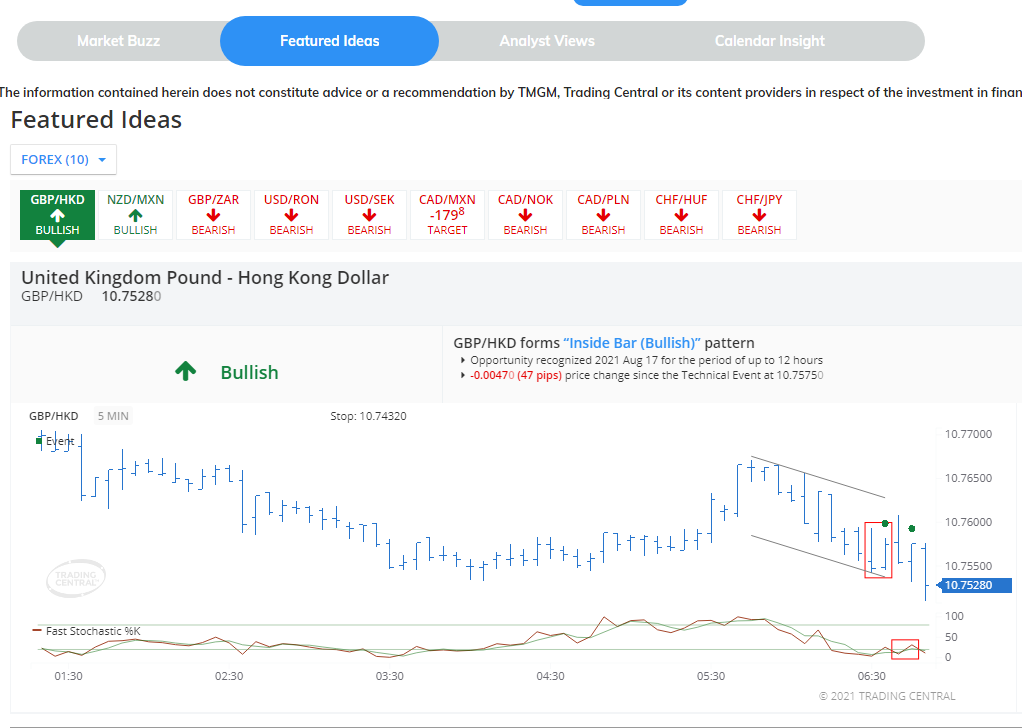

Trading ideas

The trading Ideas tool is provided by Trading Central and you can find it in Trading Tools > Featured Ideas.

This tool gives you a great look at the market with expected losses and wins currently. You can take advantage of it by trading in the suggested assets whether by buy/ sell according to the predictions.

TMGM – Research – Trading Ideas

Charting

The charting tool is provided by the MT4 platform and you can use from over 30 technical indicators while plotting the chart to discover patterns. This will help you in constructing your trading strategy a lot.

TMGM – Research – Charting

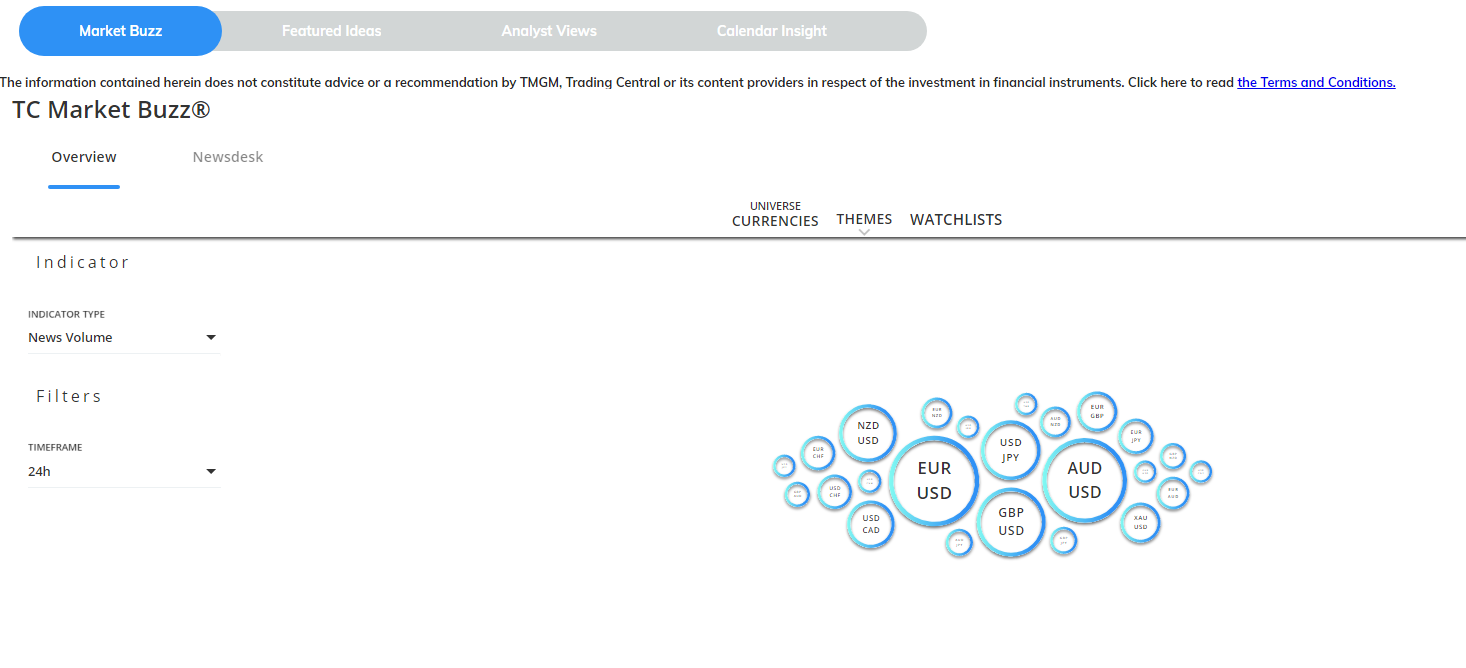

Newsfeed

You can find relevant news to the assets in the Newsfeed tool provided by Trading Central. This tool is available in Trading Tools > Market Buzz. The UI of the tool lets you pick the trading asset you want to view information about from a variety of assets.

TMGM – Research – Newsfeed

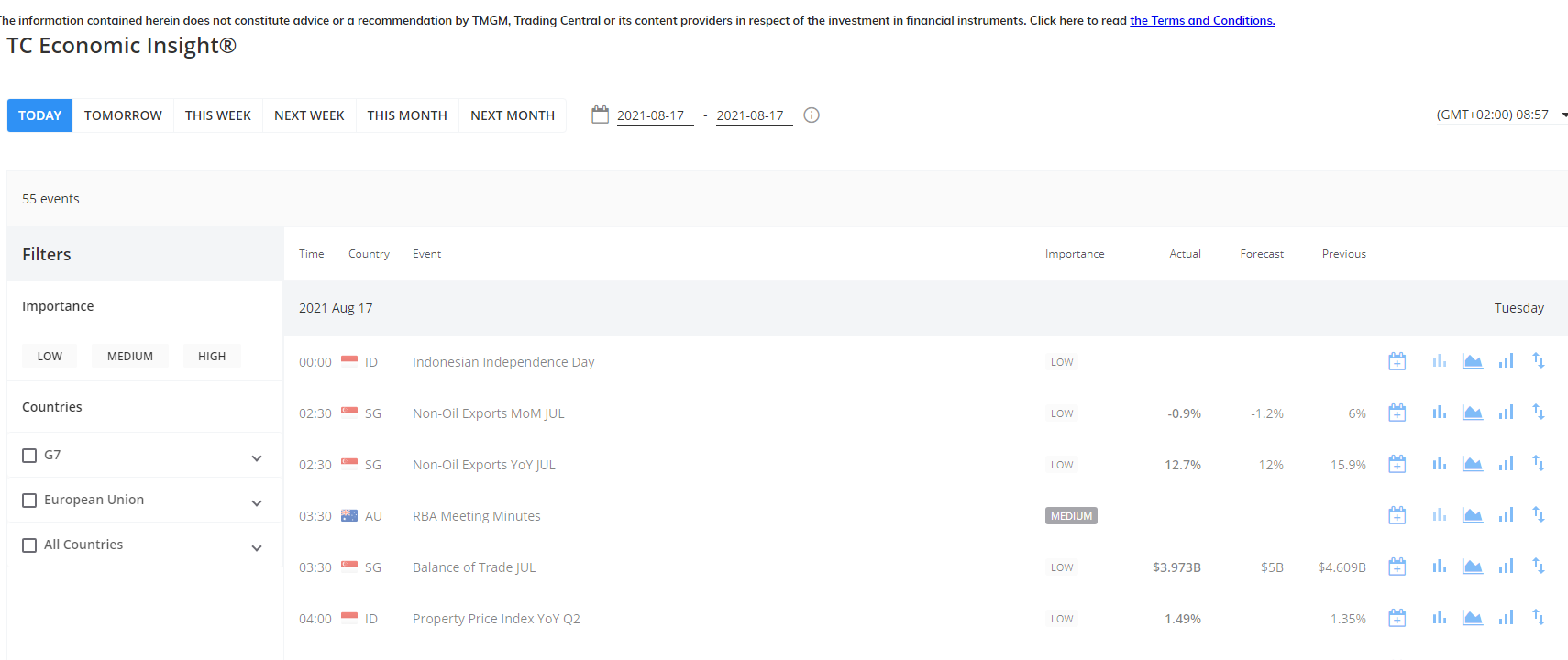

Economic Calendar

The economic calendar tool at TMGM lets you know about upcoming important events in the financial market. It also provides some fundamental data at a glance.

TMGM – Research – Economic Calendar

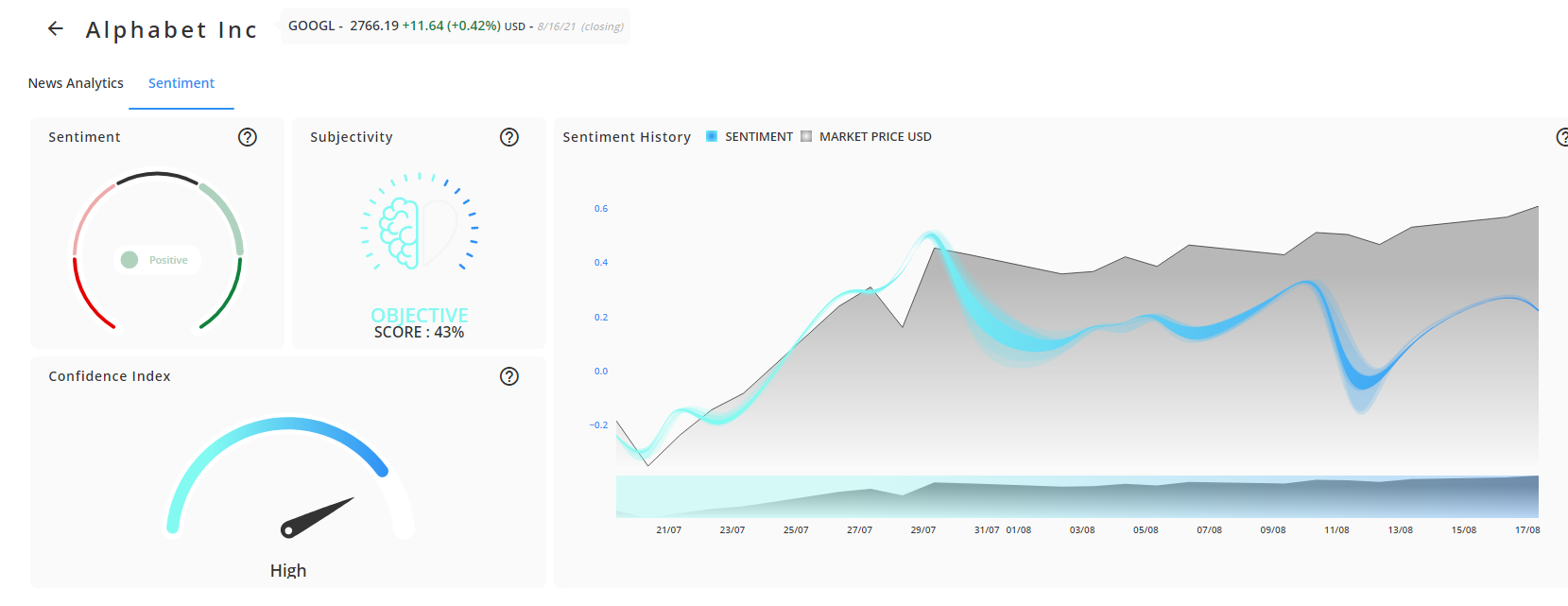

Sentiment Analysis

TMGM also has a sentiment analysis tool that lets you view some data about the asset including subjectivity and confidence level.

TMGM – Research – Sentiment Analysis

Customer Support

|

Pros |

Cons |

|---|---|

|

|

Options

TMGM supports different customer service channels like:

- Live chat

- Phone call

TMGM – Customer Support

Education

|

Pros |

Cons |

|---|---|

|

|

TMGM has very few educational materials of an educational blog and a demo account only. There are no tutorials, videos, webinars, etc.

TMGM – Education

FAQs

-

- How long does it take to verify my account?

- It takes about 1 to 2 business days to verify your TMGM account.

- Can I open more than one trading account?

- Yes, you can do such a thing from the client portal. The maximum number of accounts you can have is 5.

- Does TMGM allow bot trading?

- Yes, through Expert Advisors (EAs).

- Does TMGM give a bonus?

- Yes, it does. You can contact the customer support team after you open a new account if you’re a new client to get your No Deposit Bonus.

- Does TMGM allow scalping and hedging?

- Yes, it does allow both scalping and hedging.

- Where is my money held?

- Your funds are held securely in the Tier 1 bank, National Australia Bank. your money is kept in segregated accounts separate from the company’s own funds.

- Does TMGM offer a swap-free account option?

- Yes, it does provide it through the edge account type only.

- How do I log in using the MT4 mobile platform?

- Steps:

1. Go to ‘Settings’

2. Click on ‘Manage Accounts’ or ‘Settings’

3. Then click on the small plus sign or select ‘New Account’

4. Then select ‘Log in to an existing account

5. Search for the broker name

6. Select the server your account was set up on

7. Enter your login credentials and password

8. Click on ‘Sign In’

-

- When trading forex, will you lose more than your initial deposit?

- The MetaTrader 4 platform is set to automatically close your positions when your margin requirement reaches 100% (stop out level).

- Please note that this process is automated and does not guarantee that your account will not enter into a negative equity situation. You should keep a balanced amount in your account above your required margin.

- Can I log in to more than one account from the same computer?

- Yes, you can do such a thing by using the MT4 Multi Terminal.

- Can I log in to the same account through different devices?

- Yes, you can log in to the MetaTrader 4 platform using the same password and username through different devices.

- Does TMGM accept payments from third parties?

- Payments should be from an account that holds the same name as yours.

Conclusion:

- Pros: negative balance protection, over 150 billion of trading volume, over 15,000 trading instruments, Islamic account

- Cons: not listed on the stock exchange, no client protection, very limited educational materials

- Best for: MT4 traders

- Regulated by: ASIC, FMA, VFSC

- Headquarters: Australia

- Foundation year: 2013

- Min Deposit: $100

- Deposit methods: credit/ debit cards, electronic wallets, bank transfers

- Withdrawal method: electronic wallets, bank transfers

- Deposit and withdrawal fees: $0

- Base currencies: EUR, USD, GBP, NZD, AUD, CAD

- The offering of investments: Forex, CFDs, metals, energies, shares