- يونيو 29, 2021

- Posted by: ForexTradeOn

- Category: GO Markets review

|

Pros |

Cons |

|

|

Introduction

GO Markets is one of the oldest and best brokers to trade forex and CFDs as well as metals and commodities. It has a long history since 2006. GO Markets also survived from a lot of financial disasters.

GO Markets fees may vary from account type to another. Please read the following sections for more information.

Commissions

The commissions differs from an account type to another as the following:

- Standard account: $0 per side

- GO Plus account: $3 per side

Trading Fees

Forex

The average EUR/USD spreads is 0.2 pips.

Share CFDs

GO Markets allow share CFDs trading in both the USA and Australia.

- For the USA shares, market fees is $0.0

- For Australia shares, market fees is $22

There are also commissions depending on the market you choose.

Indices

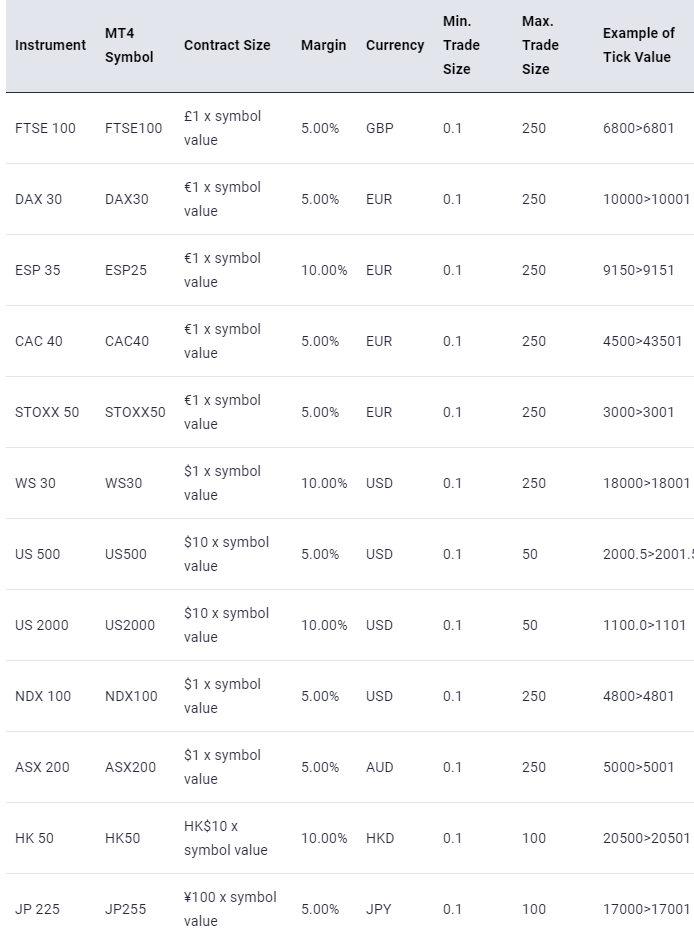

The margin rates of indices range between %5 and %10.

GO Markets – Indices

Disclaimer: CFDs have a high risk of losing money rapidly. About 80% of retail investor accounts lose money due to leverage when trading CFDs with this provider. Please note that CFDs are not complying with the islamic religion. And if you want to trade in CFDs you should consider a swap-free account to follow islamic rules.

Learn more about CFDs for muslims.

Cryptocurrencies

GO Markets has variable crypto currency spreads depending on the market prices and conditions.

Commodities

Commodities have no constant spreads as they have variable spreads according to the market prices, conditions, etc.

Non-Trading Fees

- Account fee: $0

- Deposit fees: $0

- Withdrawal fees: $0

- Inactivity fee: $0

FAQs

- Does GO Markets give a bonus?

- You can get up to 30% credit bonus by funding your GO MarketsTrading Account with any amount between $1,000 and $20,000.

- Does GO Markets allow scalping?

- Yes, GO Markets allow scalping and hedging.

- When trading forex, will you lose more than your initial deposit?

- MetaTrader 4 is set to automatically close your positions when your margin requirement reaches 100% (stop out level).

- Please note that this process is automated and is not a guarantee that your account will not enter into a negative equity situation and you should keep a balance amount in your account above your required margin.