GO Markets Full Review

GO Markets Full Review

GO Markets is one of the oldest and best brokers to trade forex and CFDs as well as metals and commodities. It has a long history since 2006 and has survived from a lot of financial disasters since then.

Disclaimer: CFDs have a high risk of losing money rapidly. About 80% of retail investor accounts lose money due to leverage when trading CFDs with this provider. Please note that CFDs are not complying with the islamic religion. And if you want to trade in CFDs you should consider a swap-free account to follow islamic rules.

Learn more about CFDs for muslims.

GO Markets Full Review - Key Statistics

Safety

Offering of Investments

GO Markets does offer a number of trading instruments like forex, CFDs, metals, and commodities. It also allows cryptocurrency trading as well. On the other hand, there’s no ETF, real stocks, or bonds trading. Disclaimer: CFDs have a high risk of losing money rapidly. About 80% of retail investor accounts lose money due to leverage when trading CFDs with this provider. Please note that CFDs are not complying with the islamic religion. And if you want to trade in CFDs you should consider a swap-free account to follow islamic rules. Learn more about CFDs for muslims. GO Markets Offering of Investments

Note: Please note that some of the trading options may depend on your account type and / or your country of residence according to the governmental rules. |

Account Opening

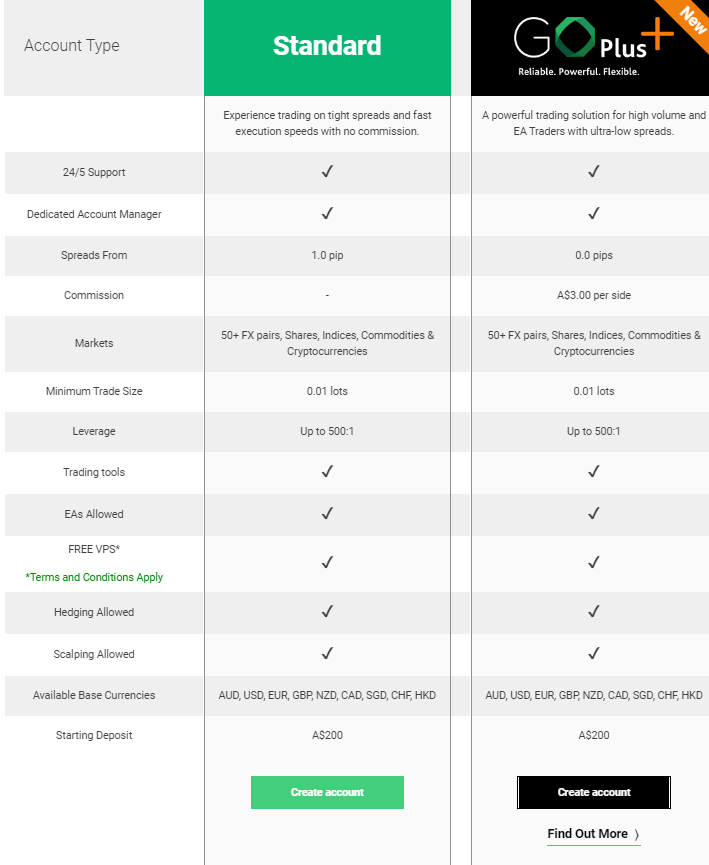

Countries availableGO Markets is available in a number of countries except some countries like the USA, Japan, Belgium, Canada, New Zealand, Turkey, and Vietnam. Account typesGO Markets offers 2 account types for its clients, the standard account and the GO Plus account. GO Markets - Account comparison

There’s another option to open a swap-free account to trade without any overnight fees. GO Markets also provides a demo account with 0 fees if you want to experience the trading platform with no risk. Min depositThe minimum deposit is $200 for both standard and GO Plus accounts.

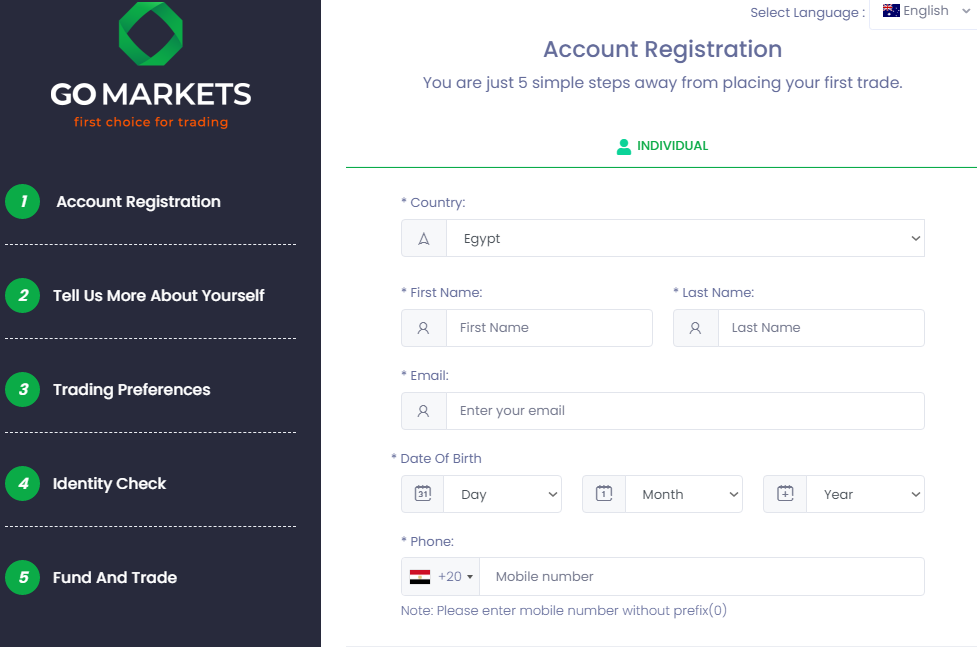

GO Markets Accounts How to open an accountYou can open a GO Markets account in minutes through these steps:

GO Markets - Account opening Note: If you face any problem while opening your account, you can send an email to newaccounts@gomarkets.com with your problem. |

Fees and Commissions

CommissionsThe commissions differs from an account type to another as the following:

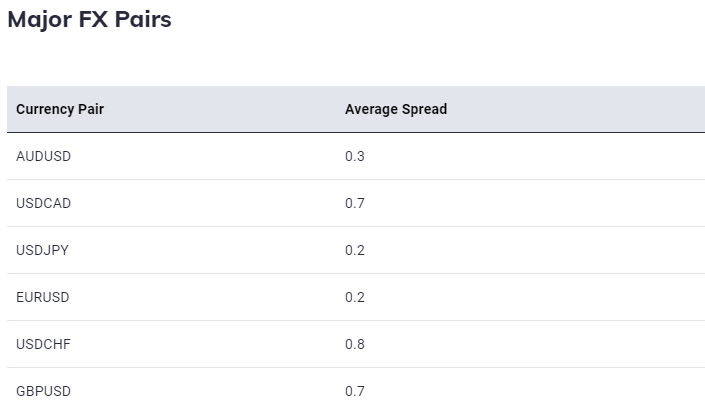

Trading FeesForex feesThe average EUR/USD spreads is 0.2 pips.

GO Markets - Major Forex Spreads Share CFDsGO Markets allow share CFDs trading in both the USA and Australia.

There are also commissions depending on the market you choose.

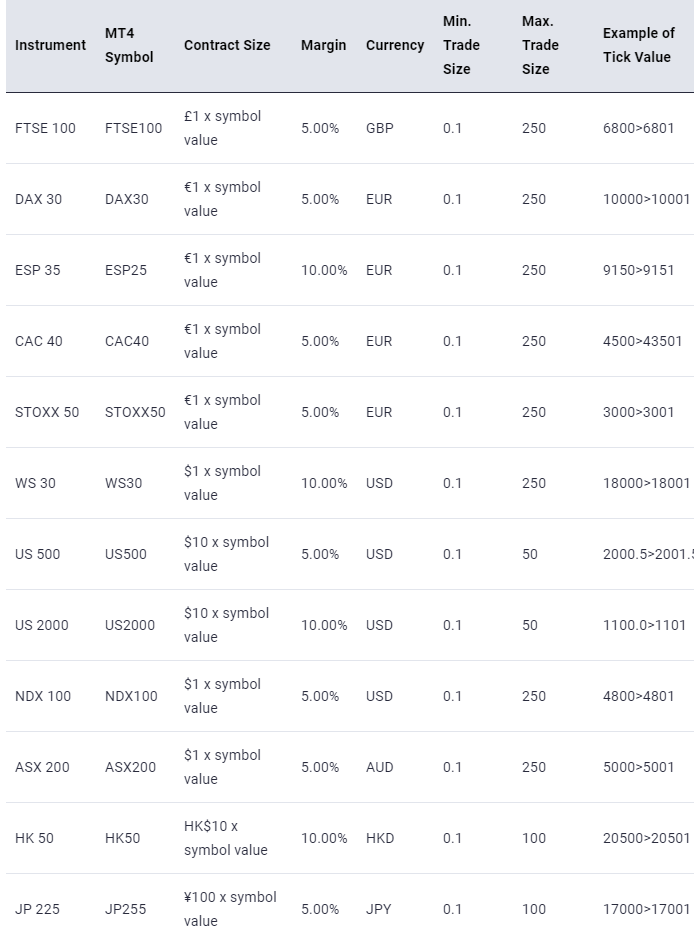

GO Markets - Share CFDs IndicesThe margin rates of indices range between %5 and %10.

GO Markets - Indices Disclaimer: CFDs have a high risk of losing money rapidly. About 80% of retail investor accounts lose money due to leverage when trading CFDs with this provider. Please note that CFDs are not complying with the islamic religion. And if you want to trade in CFDs you should consider a swap-free account to follow islamic rules. Learn more about CFDs for muslims. CryptocurrenciesGO Markets has a variable crypto currency spreads depending on the market prices and conditions. Commodity feesCommodities have no constant spreads as they have variable spreads according to the market prices, conditions, etc.

GO Markets - Commodities Non-trading fees

(you can check the full withdrawal fees in withdrawal fees section)

|

Deposit and Withdrawal

Account CurrenciesThe GO Markets account has a number of base currencies like AUD, USD, EUR, GBP, NZD, CAD, SGD, CHF, and HKD. Notes:

Deposit1. OptionsGO Markets has a number of deposit options:

GO Markets deposit methods

2. FeesGO Markets do not charge any internal deposit fees using Visa/Mastercard, Skrill, Neteller and Bank Transfer. 3. TimeThe transfer is instant except for the bank transfers that may take several business days. Withdrawal1. OptionsGO Markets has an option to withdraw your money using credit cards or bank transfers. GO Markets withdrawal methods and fees

2. FeesGo markets does not charge withdrawal fees. Note: Please note that funding withdrawals to non-Australian banking institutions may be subject to bank fees from any intermediary bank involved in the transaction and may attract a receiving fee from your bank/institution. Please account for these fees when making withdrawals of a small amount. 3. TimeThe withdrawals using credit cards happen within 1 business day, but for the bank transfers, it may take several business days. Notes:

|

Platforms and Languages

|

GO Markets works on two main platforms which are the MT4 and MT5. So, whatever the platform you use, you can trade with GO Markets. Let’s dig deeper into each one. MT4 Platform

LanguagesMetaTrader 4 is available in a number of languages like: MT4 Languages

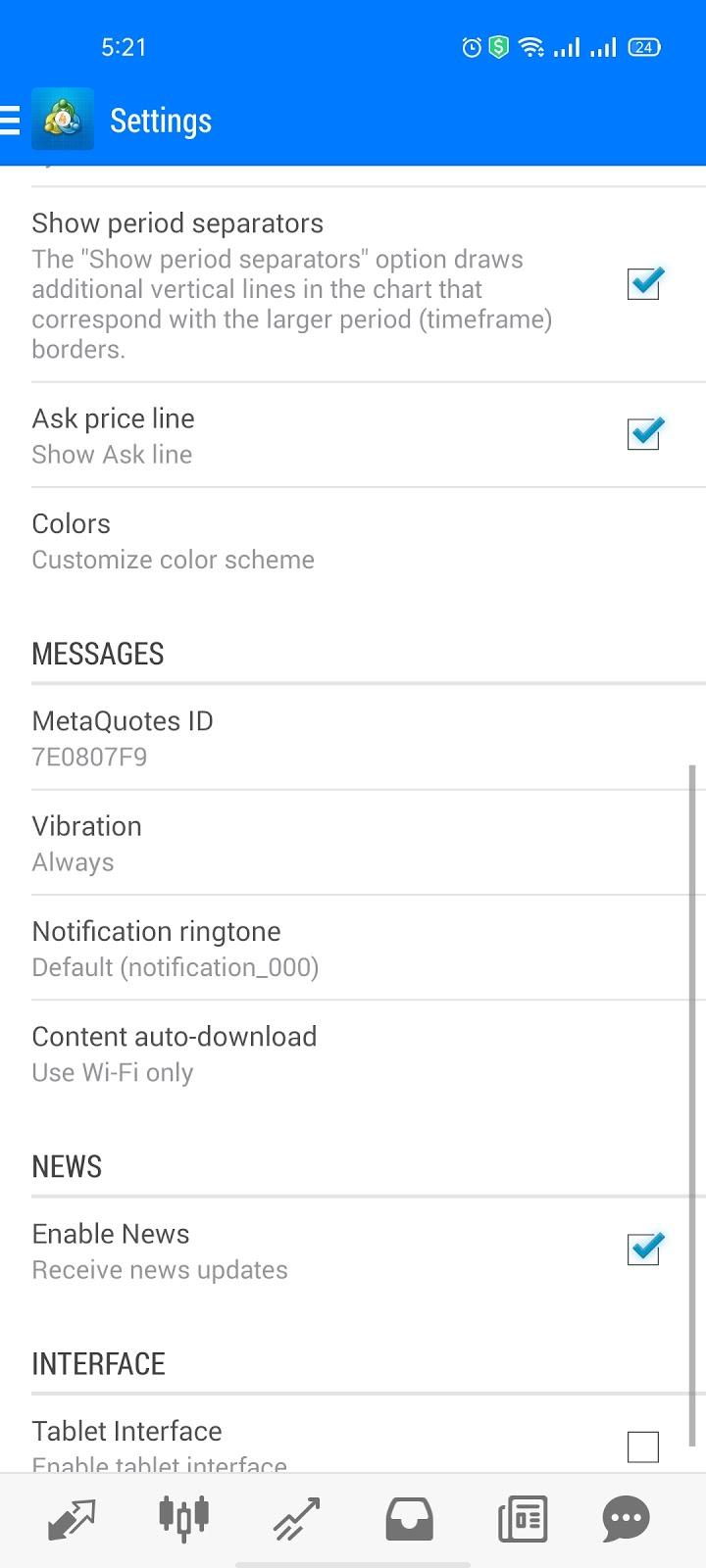

User interface (UI)MT4 has a very customizable UI that you can adjust according to your needs and preferences. On the other hand, it seems hard to find some of the features inside.

MT4 - Mobile Version - UI Login and SecurityUnfortunately, the MT4 does not provide a two-step verification method for logging in, and it does only support a one-step login. SearchingSearching using the MT4 platform has its pros and cons.

Placing ordersMT4 has a simple order types which are:

In addition to those 4 types, there are other orders which are the time limit ‘Good ‘til time’ (GTT) and ‘Good 'til canceled’ (GTC). There’s also an order confirmation feature in MT4. Notifications and alertsUnfortunately, the MT4 web trading platform does not have an option to set price alerts and notifications unlike the desktop and mobile versions.

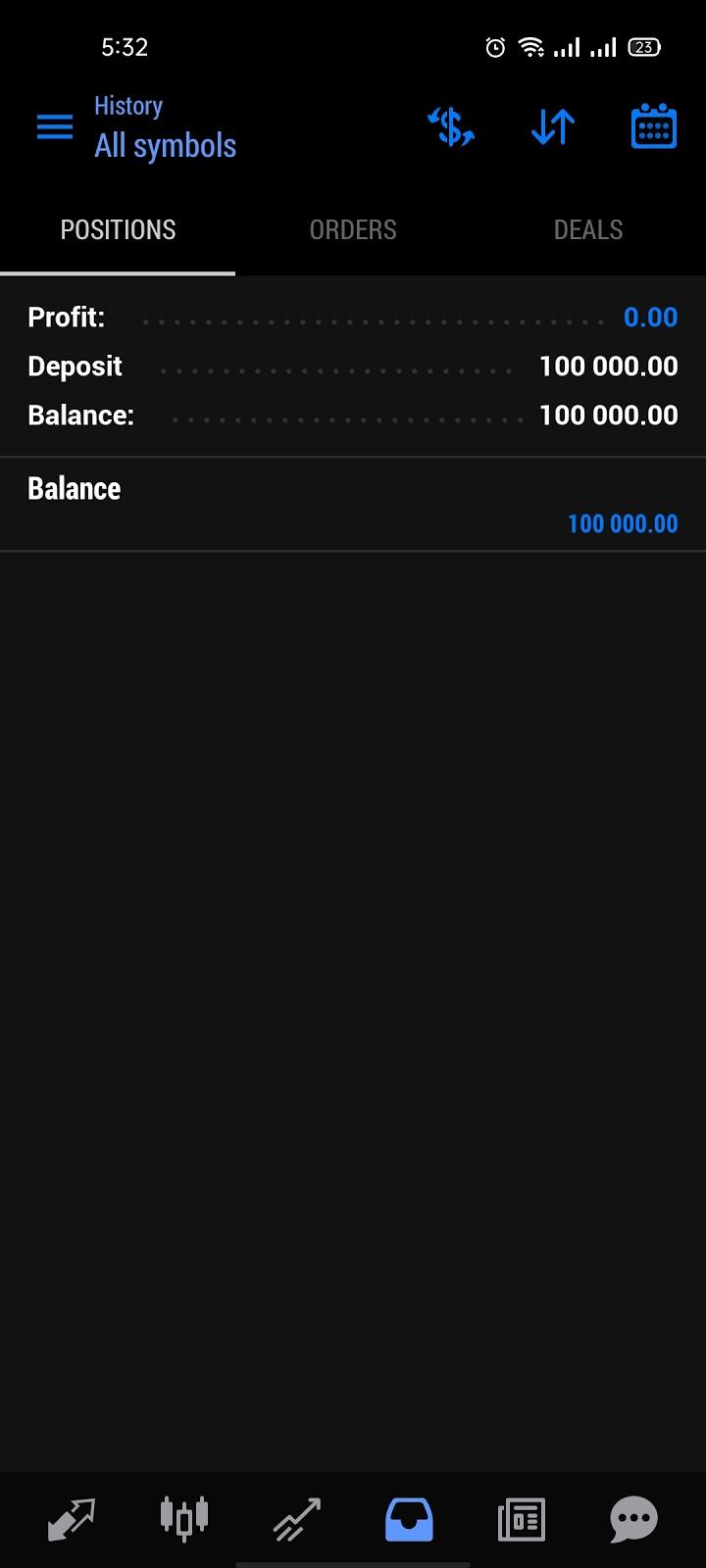

MT4 - Mobile Version - Notifications Settings Portfolio and reportsUnder the ‘History’ tab, you can find your portfolio reports with a clear fee description.

MT4 - Mobile Version - Portfolio MT5 Platform

LanguagesMT5 is available in 7 main languages: English, Russian, Spanish, Portuguese, Bulgarian, Chinese and Italian. User interface (UI)MT5 has a very customizable UI that you can adjust according to your needs and preferences with the dark theme option. On the other hand, it seems hard to find some of the features inside.

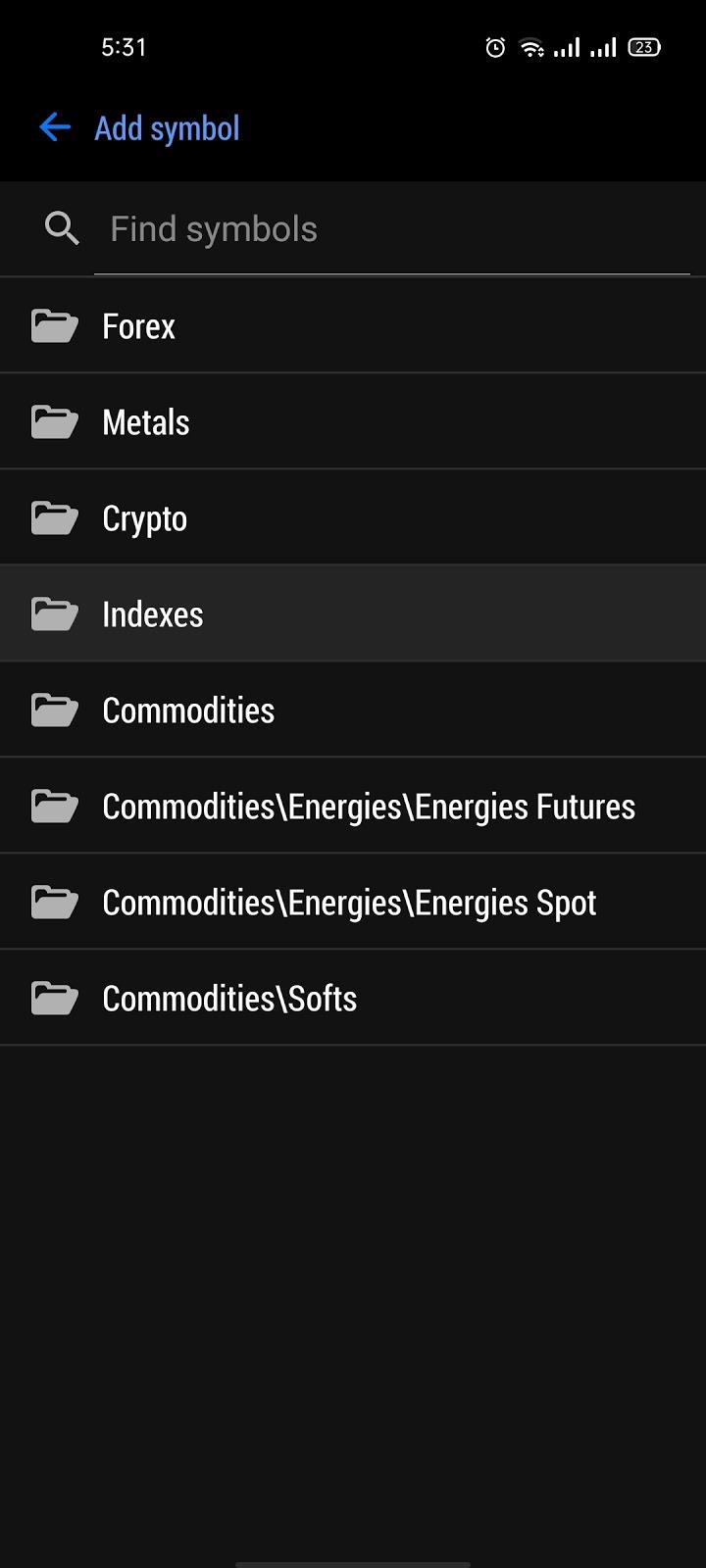

MT5 - Mobile Version - UI Login and SecurityUnfortunately, the MT5 does not provide a two-step verification method for logging in, and it does only support a one-step login. SearchingSearching using the MT5 platform has its pros and cons.

MT5 - Mobile Version - Search Placing ordersMT5 has a simple order types which are:

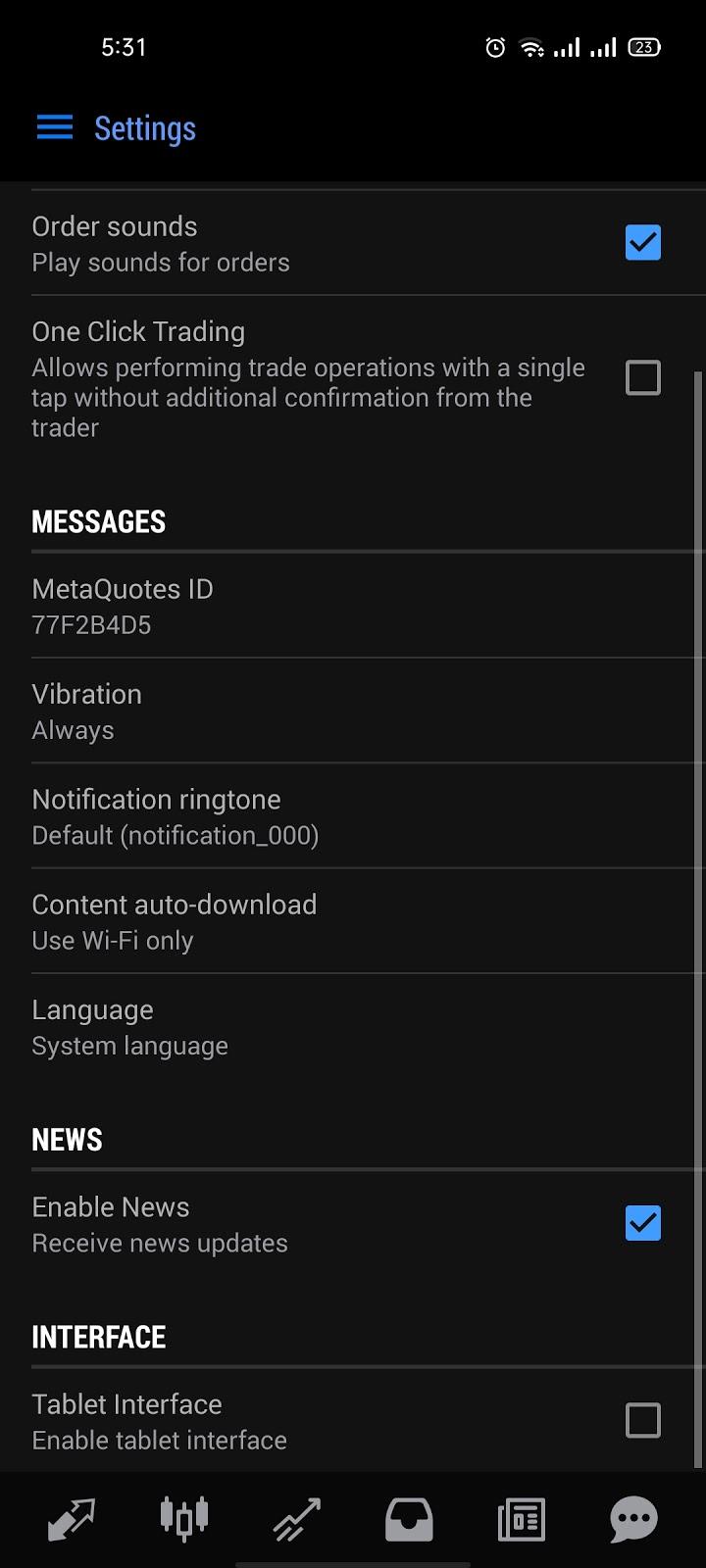

There’s also an order confirmation feature in MT5. Notifications and alertsUnfortunately, the MT5 web trading platform does not have an option to set price alerts and notifications unlike the desktop and mobile versions.

MT5 - Mobile Version - Notifications Settings Portfolio and reportsUnder the ‘History’ tab, you can find your portfolio reports with a clear fee description.

MT5 - Mobile Version - Portfolio MT4 and MT5 Platforms Comparison Table

|

Research Tools

Go Markets offers a variety of tools to its traders in order to have the best Trading experience. SourcesYou can access the research tools through the MT4 and MT5 platforms. They’re both having great research tools that can be very helpful for any trader. Also, you can use a variety of tools on MyfxBook application. AutochartistThis tool is provided by the MT4 platform with the ability to better discover patterns within charts without any effort. Autochartist also scans and monitors the markets on your behalf for trends and patterns to help inform your trading decisions.

Autochartist tool MT4 GenesisIt is a comprehensive suite of MetaTrader trading tools to enhance the power of your standard MetaTrader platform and works on Forex, Indices & Commodities. MT4 Genesis allows you to better manage your account with the ability to set alerts to never miss an opportunity. Please note that MT4 Genesis is a paid suite, but you can get it for free if you have a GO Plus account. Trading CentralYou can access some other tools from the ‘Trading Central’ section at the GO Markets website. Those tools are:

You can get here technical analysis on every type of trading instruments and help you optimize your strategy

This tool combines the invaluable experience of senior analysts in one place and monitors the market with global 24/7 coverage on over 8,000 financial instruments.

This is a newsletter that helps you be updated with the latest news right from your inbox.

This tool helps you find patterns in charts by offering three innovative indicators that represent market psychology and assist with identifying new trade opportunities and potential entry/exit points.

This tool combines the award-winning methodologies of Trading Central’s research desks with powerful pattern recognition. Other toolsThere are a punch of other tools that may help you as well like:

|

Customer Service

OptionsGO Markets supports different customer service options like :

LanguagesThe languages available for customer service are many with the support of major languages like English, Bahasa, Malay, Vietnamese, Filipino, Thai, Arabic, Spanish, Portuguese, French and Chinese. ExperienceYou can get relevant answers as well as fast responses from the customer support from GO Markets experienced team. |

Education

GO Markets has a very organized educational materials with enhanced trading content in a variety of formats like:

GO Markets - Education |

FAQs

1. Go to ‘Settings’ 2. Click on 'Manage Accounts' or 'Settings' 3. Then click on the small plus sign or select 'New Account' 4. Then select 'Log in to an existing account' 5. Search for the broker name 6. Select the server your account was set up on 7. Enter your login credentials and password 8. Click on 'Sign In'

Conclusion:

|