FBS Full Review

FBS Full Review

FBS is an online forex and CFD broker that’s founded in 2009. It’s operated by Tradestone Ltd and regulated by the Cyprus Securities and Exchange Commission (CySEC) and the International Financial Services Commission of Belize (IFSC).

Disclaimer: CFDs have a high risk of losing money rapidly. About 80% of retail investor accounts lose money due to leverage when trading CFDs with this provider. Please note that CFDs are not complying with the islamic religion. And if you want to trade in CFDs you should consider a swap-free account to follow islamic rules.

Learn more about CFDs for muslims.

FBS Full Review - Key Statistics

Safety

a. Is FBS regulated?The FBS broker is regulated by many financial authorities in different countries like:

b. Is FBS a scam?FBS safety is divided into 2 parts: the safety of the broker itself and the safety of the client. i. Broker safety FBS is considered safe as it has a long tracking record since 2009 with more than 12 years and +7000 traders daily on its platform. As well as it has survived from different economic disasters up-till-now. FBS has also received over 40 international awards that recognize them as a Transparent Broker with Best Customer Service. It has also over 16 million clients worldwide from over 190 countries. ii. Negative balance protection FBS is protecting his clients with a negative balance protection with stop orders to stop the loss and lower the risk. |

Offering of Investments

FBS provides a lot of trading instruments on its platform. These instruments include forex pairs, CFDs, metals, indices, crypto, commodities, shares, and energy trading. The main disadvantage here is that there is no ETF trading on its platform. Disclaimer: CFDs have a high risk of losing money rapidly. About 80% of retail investor accounts lose money due to leverage when trading CFDs with this provider. Please note that CFDs are not complying with the islamic religion. And if you want to trade in CFDs you should consider a swap-free account to follow islamic rules. Learn more about CFDs for muslims. FBS Offering of Investments

Social TradingAs well as the offering of investments above, there’s also an option to social trading in the FBS platform. This is done by browsing the list of top traders, checking their profit statistics, and picking the most successful ones to copy. The advantage here is that you can start and stop copying anytime as you want depending on your needs. |

Account Opening

a. Countries availableFBS has more than 16 million users worldwide in more than 190 countries. Although it’s not available in Belize, the USA, Brazil, Thailand, or Japan. b. Account typesFBS provides a variety of account types, each with some specifications and features that distinguish it from the others. In addition to these types you can open a demo account and trade with 0% risk for free. FBS - Account comparison

Note:

c. How to open an accountYou can open an FBS account in minutes through these steps:

FBS - Account opening |

Fees and Commissions

FBS has low commissions and CFD fees, and it offers a swap-free option on all of its accounts except for the ECN account. On the other hand, FBS does charge withdrawal fees on most of the options and there are charges as well for some of the deposit options. a. CommissionsFBS has competitive commissions available on its accounts that start from $0 for all the accounts except for the Zero Spread account that has a commission of $20 per lot. Note:

b. Trading Feesi. Forex fees The forex fees depend on your account and your country of residence as described in the ‘Account Opening’ section. The forex spreads according to the account type are as the following:

ii. Stock fees FBS has very low spreads for stocks as it starts from 1 pip, and the typical spread is around 3 pips. iii. Metals fees There are metal trading fees applied, and it ranges from 2 pips for the XAGUSD pair to 240 pips for palladium. iv. CFD fees FBS does offer competitive fees for contracts for differences (CFDs) that have a minimum of 2 pips to 25 pips. Disclaimer: CFDs have a high risk of losing money rapidly. About 80% of retail investor accounts lose money due to leverage when trading CFDs with this provider. Please note that CFDs are not complying with the islamic religion. And if you want to trade in CFDs you should consider a swap-free account to follow islamic rules. Learn more about CFDs for muslims. b. Non-trading fees

(you can check the full withdrawal fees in withdrawal fees section)

|

Deposit and Withdrawal

a. Account CurrenciesThe FBS account has 2 main account currencies which are EUR or USD. Notes:

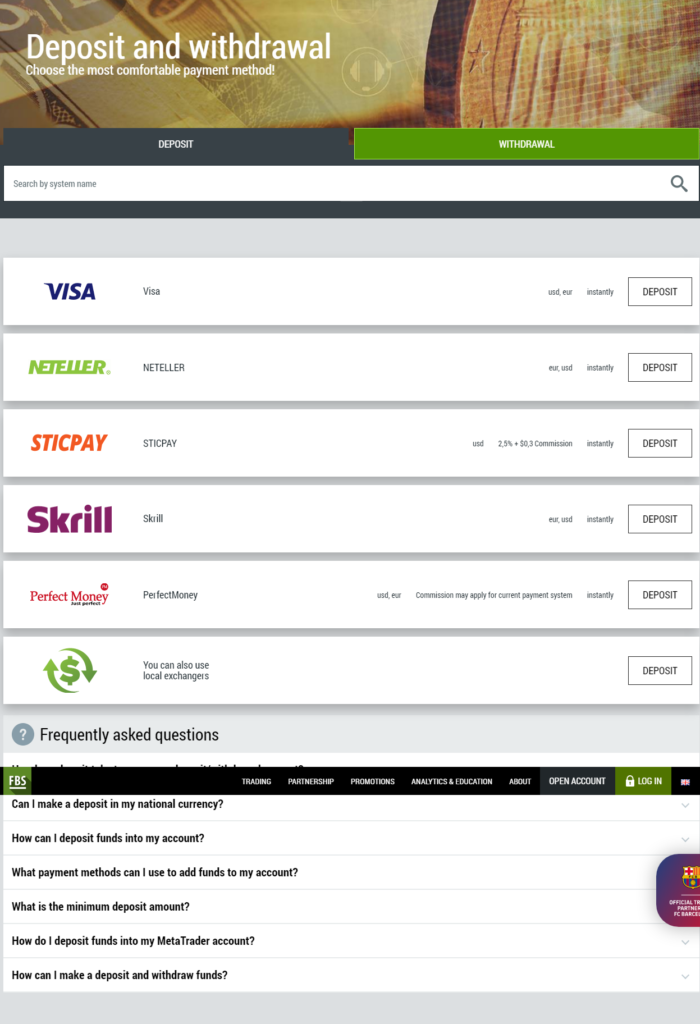

b. Deposit1. Options FBS supports a number of deposit options which are:

Along with the previous deposit options you can also use local exchangers. 2. Fees FBS does not charge any deposit fees except for the Stic Pay option that has a $0.3 commission + 2.5% from the deposit amount. 3. Time The transfer time is instant on all the options as it takes no time.

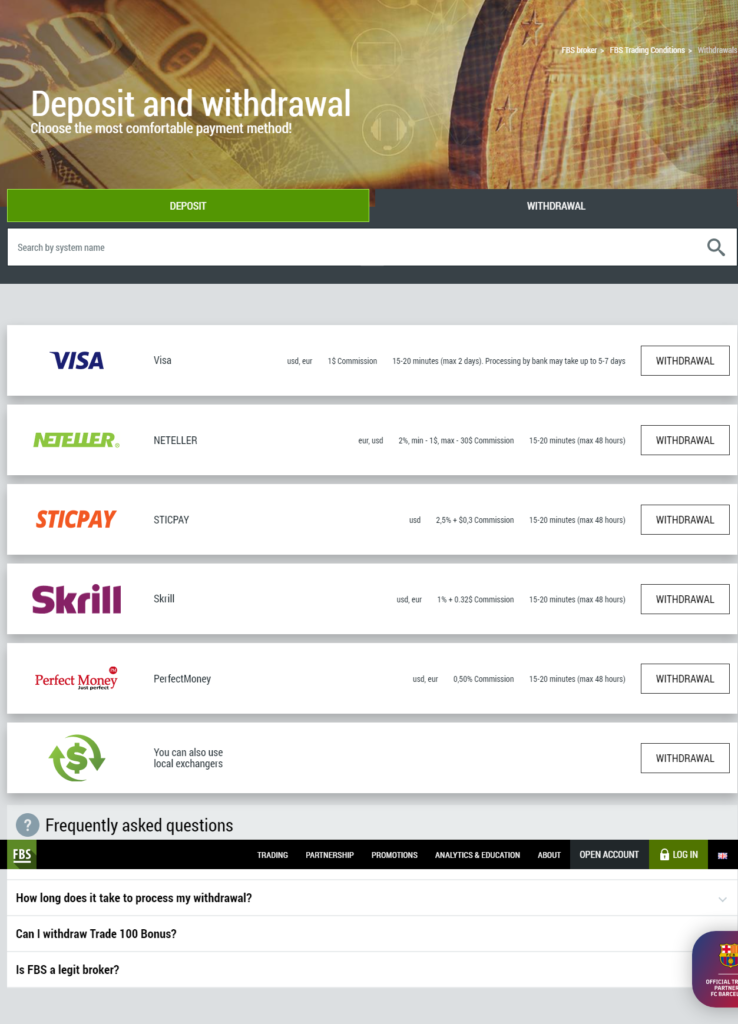

FBS Deposit Methods and Fees c. Withdrawal1. Options FBS provides the same methods of the deposit options for withdrawals as the following:

Along with the previous deposit options you can also use local exchangers. 2. Fees FBS does charge fees on withdrawals with a minimum of $1 as the following table shows: FBS withdrawal fees

3. Time All withdrawals are done within 15 mins minimum or 48 hours maximum except for the Visa option that might take up to 7 business days to be done. |

Platforms and Languages

|

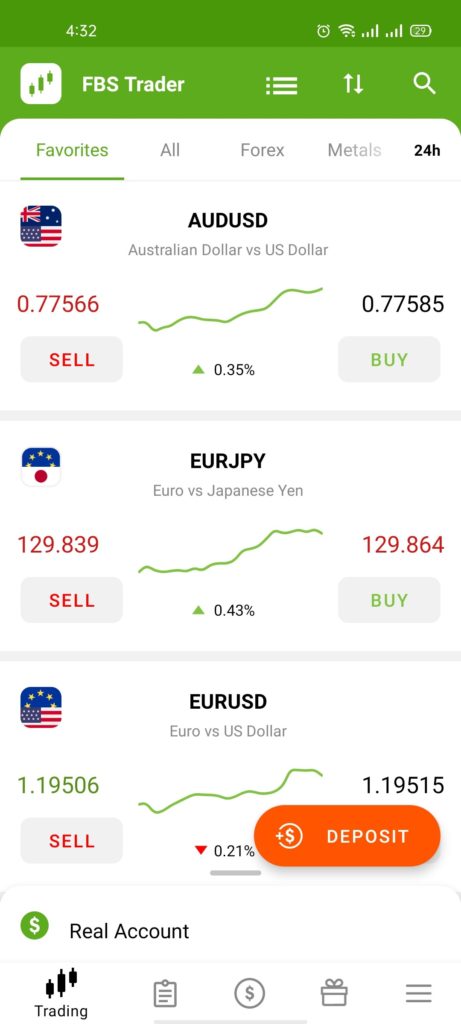

FBS supports two popular platforms which are MT4 and MT5 as well as the customized platform FBS Trader. The MT4 and MT5 platforms have Web / Windows / Mac versions. The FBS trader has Web / Windows / Mac versions in addition to the mobile trading platform for Android and IOS. 1. FBS Trader

This is a customized platform for FBS broker that has a beautiful UI with easy navigation and Professional support 24/7. It also provides a two-step verification for financial transactions for more security. The main cons is that it does not have a two-step verification method for logging in. a. Languages FBS is an international broker with clients in more than 190 countries and available in a variety of languages. b. User interface (UI) The UI of the FBS Trader platform is simple, attractive, and beautiful. With the main information about trading shown in the home page.

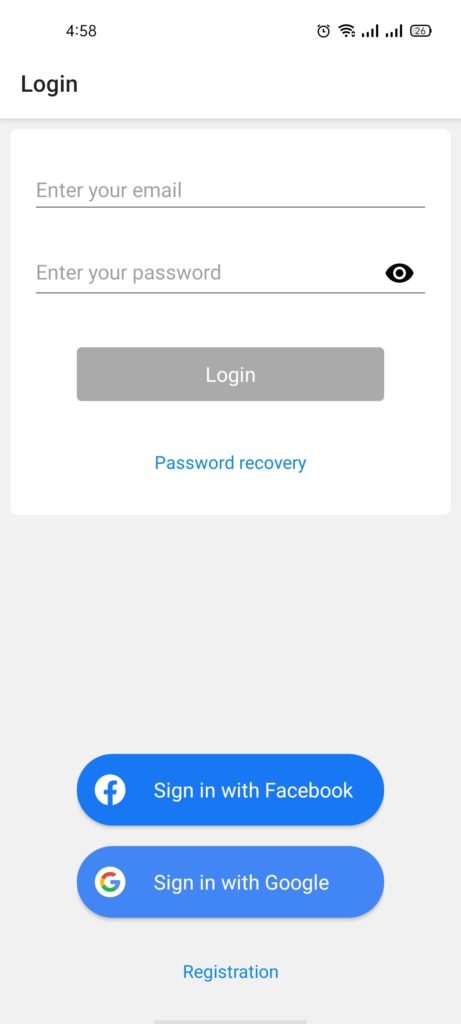

FBS Trader - UI c. Login and Security Unfortunately, there’s no option of two-step verification for logging in using the FBS Trader, but there’s a fingerprint authentication.

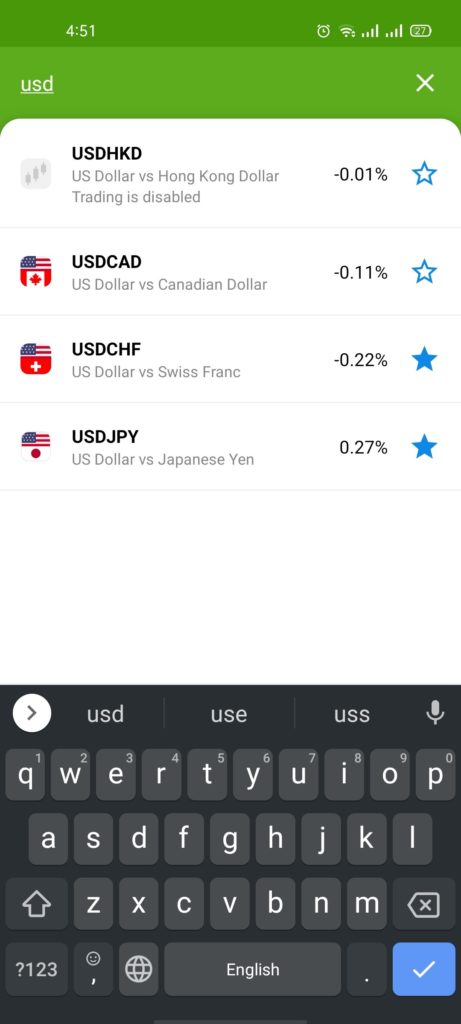

FBS Trader - Login d. Searching The searching functionality in the FBS Trader is very fine and you can find the trading asset you want just by typing the name of it.

FBS Trader - Search e. Placing orders There are 4 main types of orders:

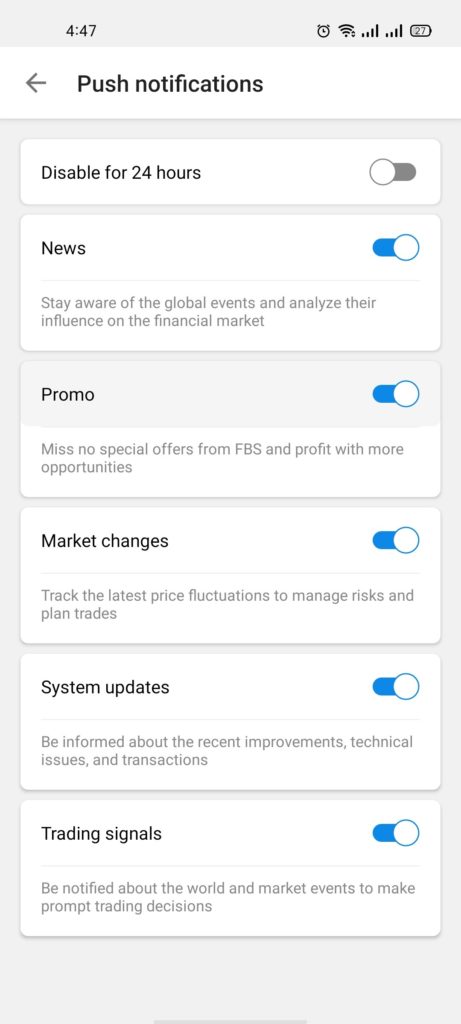

f. Notifications and alerts You can set notifications and alerts on the mobile version of FBS to notify you with market changes, news, and trading signals.

FBS Trader - Notifications 2. MT4

a. Languages MetaTrader 4 is available in a number of languages like: MT4 Languages

b. User interface (UI) MT4 has a very customizable UI that you can adjust according to your needs and preferences. On the other hand, it seems hard to find some of the features inside.

MT4 - UI c. Login and Security Unfortunately, the MT4 does not provide a two-step verification method for logging in, and it does only support a one-step login. d. Searching Searching using the MT4 platform has its pros and cons.

e. Placing orders MT4 has a simple order types which are:

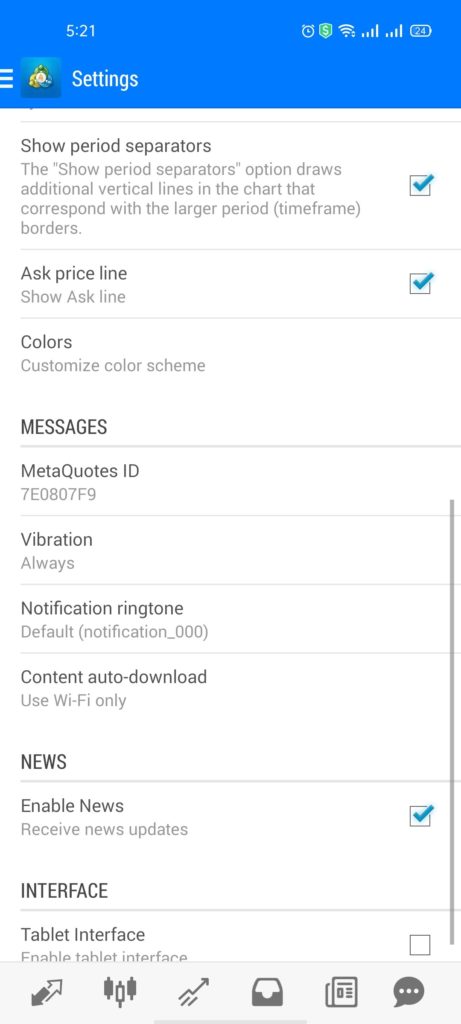

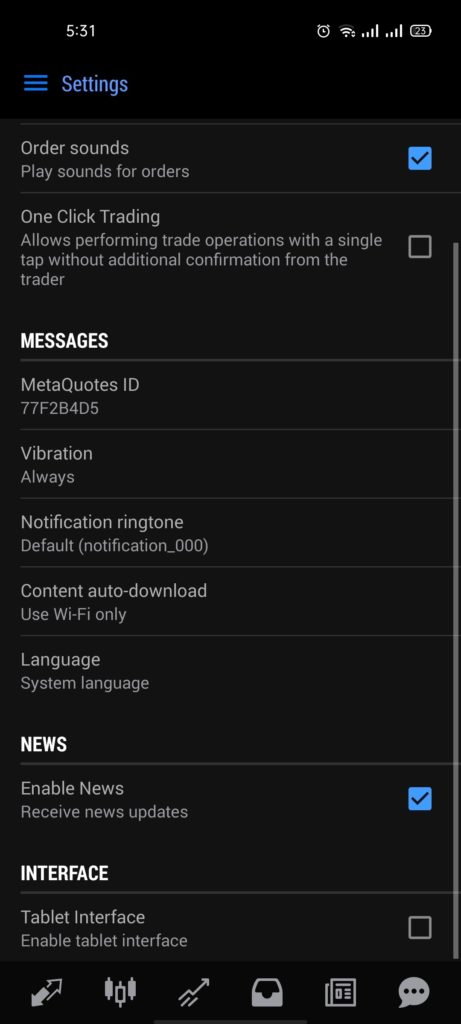

In addition to those 4 types, there are other orders which are the time limit ‘Good ‘til time’ (GTT) and ‘Good 'til canceled’ (GTC). There’s also an order confirmation feature in MT4. f. Notifications and alerts Unfortunately, the MT4 web trading platform does not have an option to set price alerts and notifications unlike the desktop and mobile versions.

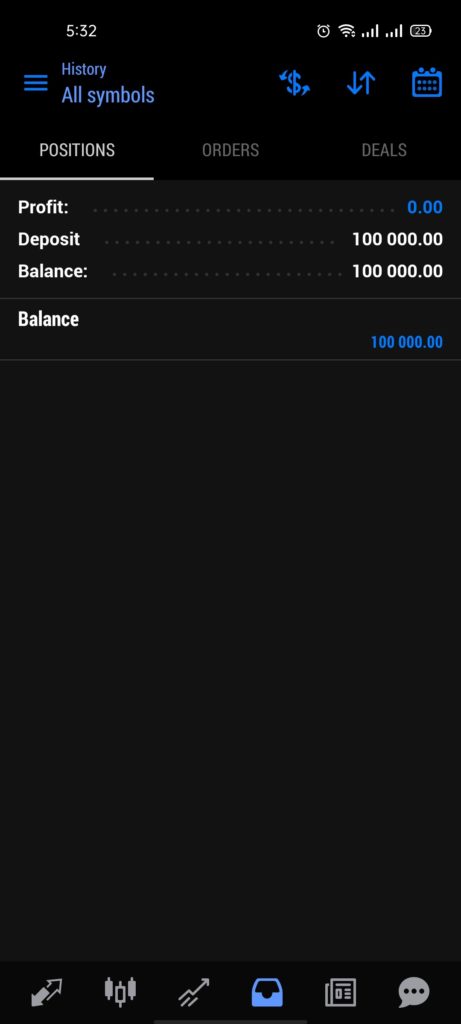

MT4 - Notifications Settings g. Portfolio and reports Under the ‘History’ tab, you can find your portfolio reports with a clear fee description.

MT4 - Portfolio 3. MT5 Platform

a. Languages MT5 is available in 7 main languages: English, Russian, Spanish, Portuguese, Bulgarian, Chinese and Italian. b. User interface (UI) MT5 has a very customizable UI that you can adjust according to your needs and preferences with the dark theme option. On the other hand, it seems hard to find some of the features inside.

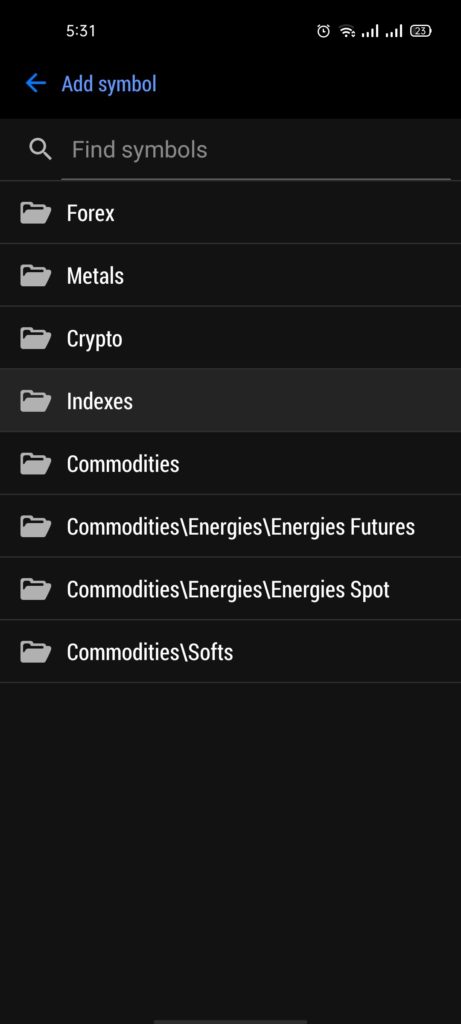

MT5 - UI c. Login and Security Unfortunately, the MT5 does not provide a two-step verification method for logging in, and it does only support a one-step login. d. Searching Searching using the MT5 platform has its pros and cons.

MT5 - Search e. Placing orders MT5 has a simple order types which are:

There’s also an order confirmation feature in MT5. f. Notifications and alerts Unfortunately, the MT5 web trading platform does not have an option to set price alerts and notifications unlike the desktop and mobile versions.

MT5 - Notifications Settings g. Portfolio and reports Under the ‘History’ tab, you can find your portfolio reports with a clear fee description.

MT5 - Portfolio FBS Platforms Comparison Table

|

Research Tools

a. SourcesThe main source of research tools is the FBS Trader platform. b. Trading ideasFBS does provide trading ideas and options to trade as well as an option to copy trades from top rated traders. c. ChartingUnfortunately, FBS lacks autochartist tools and customization. d. Other toolsEconomic calendar This is a tool in which you can see upcoming events in the economic and forex industry in order not to miss them. Expert Analysis This is an option for traders to ask broker experts about anything in the field although FBS does not specify which expert offers this service. |

Customer Service

FBS offers a variety of customer support options through different channels with the ability to chat using social platforms. a. OptionsFBS supports different customer service channels like:

b. LanguagesThe languages available for customer service are many with the support of major languages like English, Arabic, Chinese, Indonesian, Malay, Korean, Thai, Lao, Vietnamese, Spanish, Portuguese, French, Japanese, Urdu, Turkish, Burmese, German, French, and Italian. c. ExperienceThe channels of the customer service have different experience from each other as the following:

|

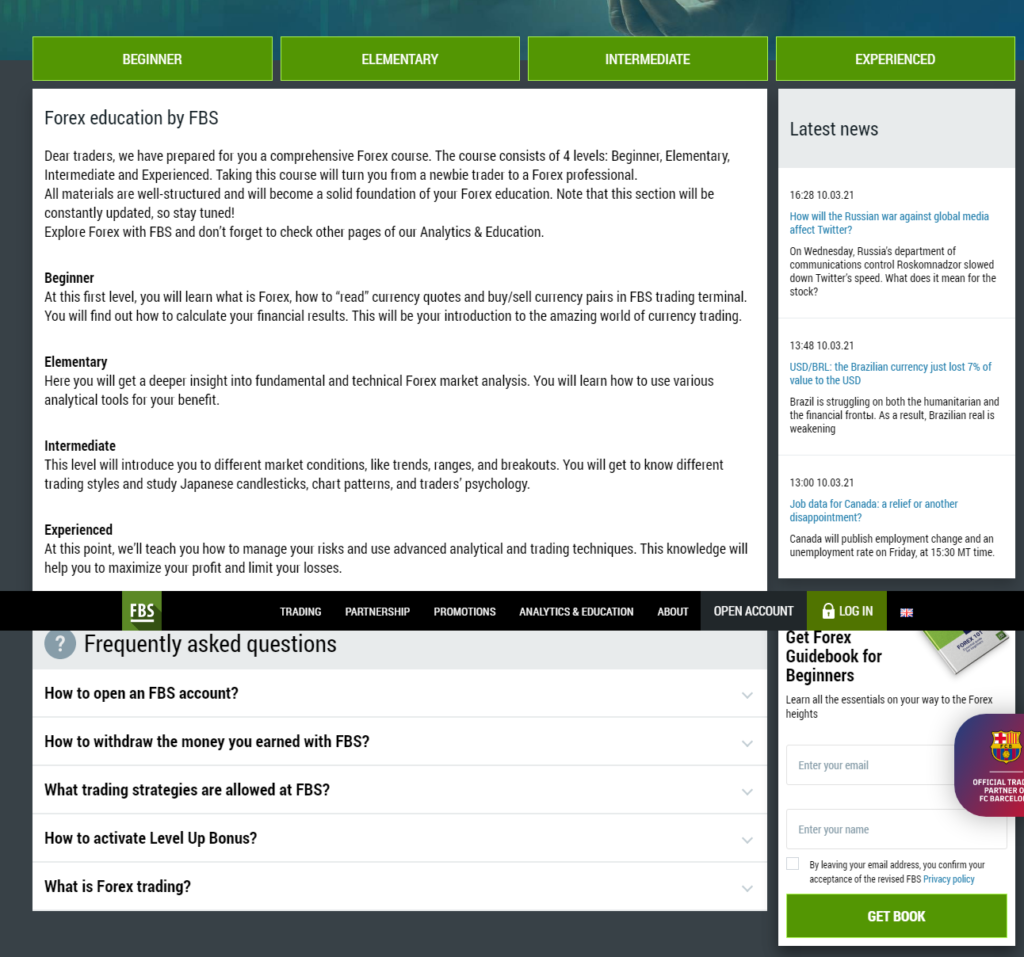

Education

FBS does provide great educational materials about trading for different segments. Whether you are a beginner, elementary, intermediate, or experienced, you will find the materials that suit your level. FBS also provides videos and articles on its platforms in order to help you understand trading. There’s also a glossary of the main terms on trading that you should familiarize yourself with. FBS is also providing future seminars in some countries that you can attend as well. And in case if you want to trade without any risk, you can use a demo account to trade with 0% risk and familiarize yourself with the platform.

FBS Education |

FAQs

|

Does FBS allow bot trading? Yes, it does allow bot trading. Does FBS provide an islamic account? You can choose any of the swap free accounts like the Cent, Micro, Standard, or Zero spread accounts. All of the previous accounts have an option of swap-fee. Does FBS give a bonus? Yes, it has up to $140 as a welcome bonus. Does FBS allow scalping? Yes, FBS does allow trade with scalping. What is an FBS Trader? It’s a mobile trading platform for FBS broker that’s available on both Android and IOS. Can I open more than one trading account? Yes, you can open up to 10 accounts of each type within one Personal area if 2 conditions are accomplished:

How to enable the swap-free option in my account? Steps:

|

FBS Full Review - Reviews

FBS Full Review - Review Conclusion

-

- Overall & individual ranks

- Pros: social trading, negative balance protection, swap-free accounts, low commissions

- Cons: deposit and withdrawal fees, no client protection amount, no two-step verification for login.

- Best for: swap-free account options and low commssions

- Regulated by: CySEC and IFSC

- Headquarters: Belize

- Foundation year: 2009

- Min Deposit : $1

- Deposit and Withdrawal methods: credit/ debit cards, electronic wallets, and bank transfers

- Deposit and withdrawal fees: high

- Base currencies: EUR and USD

- Offering of investments: forex, CFDs, metals, CFDs, real stocks, and exotics.

- Number of users: 16 million