HYCM Full Review

HYCM Full Review

HYCM, or Henyep Capital Markets is one of the oldest brokers out there with over 40 years of trading experience. HYCM is a forex and CFD broker with over 300 instruments and spreads starting from 0.2 pips. Its headquarters are in London, UK. and regulated by top-tier financial authorities like FCA, the Financial Conduct Authority and CySEC, the Cyprus Securities and Exchange Commissions. One of the biggest advantages of HYCM is that it has no deposit and withdrawal fees.

Disclaimer: CFDs have a high risk of losing money rapidly. About 80% of retail investor accounts lose money due to leverage when trading CFDs with this provider. Please note that CFDs are not complying with the islamic religion. And if you want to trade in CFDs you should consider a swap-free account to follow islamic rules.

Learn more about CFDs for muslims.

HYCM Full Review - Key Statistics

Safety

Offering of Investments

HYCM has over 300 trading instruments in different categories like forex, CFDs, cryptos, ETFs, and commodities. On the other hand there are no options, futures, bonds, or mutual funds trading at HYCM. Disclaimer: CFDs have a high risk of losing money rapidly. About 80% of retail investor accounts lose money due to leverage when trading CFDs with this provider. Please note that CFDs are not complying with the islamic religion. And if you want to trade in CFDs you should consider a swap-free account to follow islamic rules. Learn more about CFDs for muslims. HYCM Offering of Investments

Notes:

|

Account Opening

Countries availableHYCM is available in all countries except countries like the US, North Korea, and Japan. See all HYCM unavailable countries. Account typesHYCM provides 3 main account types which are:

Each one of the three has its features and specifications as the following table shows below. HYCM - Account comparison

HYCM also provides a demo account with 0 fees if you want to experience the trading platform with no risk. You can also use the tool provided by HYCM broker that helps you find the most suitable account type for you by answering some trading questions about your trading habits. VIP AccountIn addition to the previous account types, HYCM also provides a VIP account that has additional features like:

Min depositThe minimum deposit is based on the account type you have as the following:

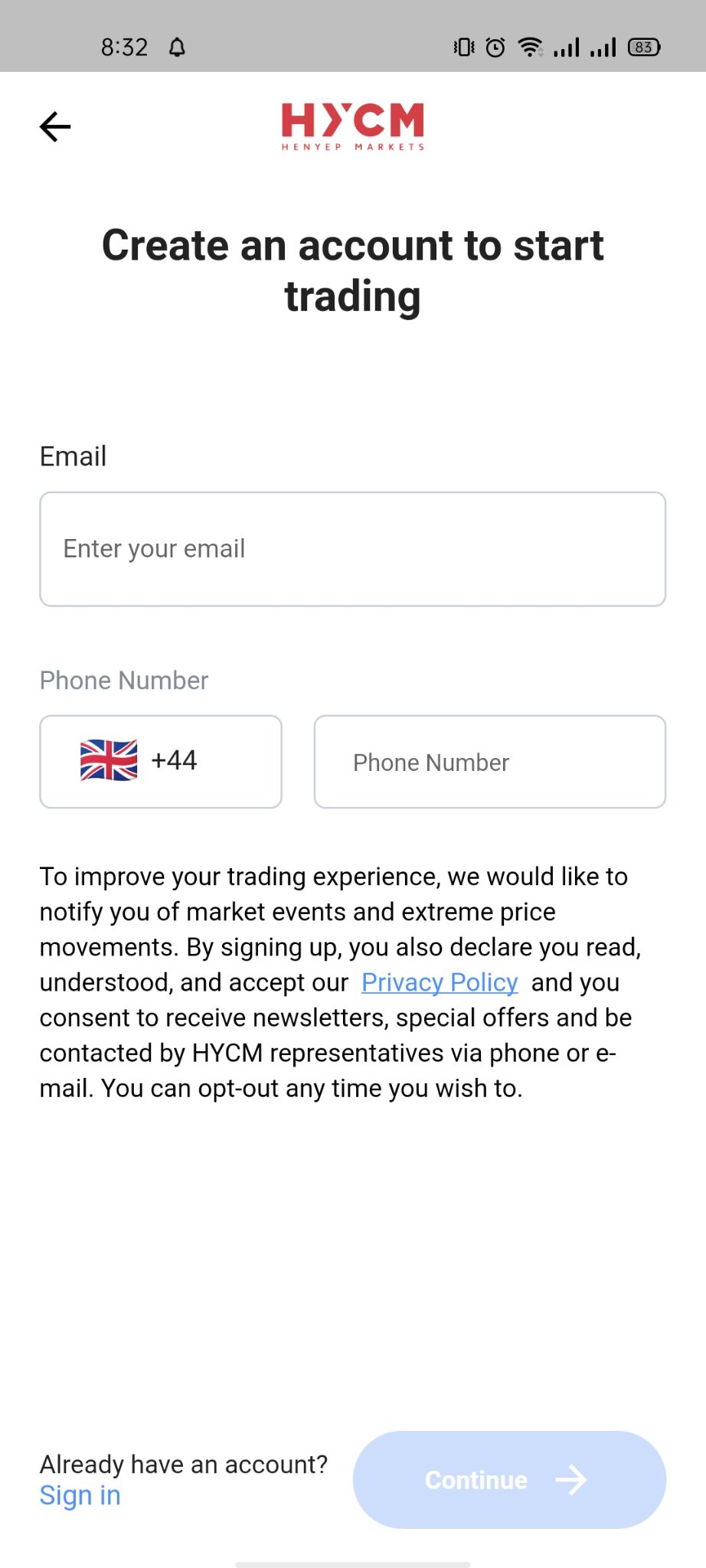

How to open an accountYou can open an HYCM account in minutes either from its website or the HYCM Mobile application. To open an account, follow these steps:

HYCM - Account opening Notes: The process of account verification takes from 1 to 2 business days to be done. |

Fees and Commissions

CommissionsFixed and classic accounts have no additional commissions and they are only charged with spreads for all products. For the Raw account, it’s charged with spreads + a commission of ($4 per round) when trading forex only. Other products like ETFs, CFDs, stocks, cryptos, and commodities have no commissions. Commissions by Account Type

Trading FeesPlease note that trading fees differ from an account to another. So, please check this section to get all the information you need. Forex feesThe minimum spreads for trading AUDCAD is:

SharesThe minimum spreads for trading Apple share is:

Index feesThe minimum spreads for trading US 500 is:

Disclaimer: CFDs have a high risk of losing money rapidly. About 80% of retail investor accounts lose money due to leverage when trading CFDs with this provider. Please note that CFDs are not complying with the islamic religion. And if you want to trade in CFDs you should consider a swap-free account to follow islamic rules. Learn more about CFDs for muslims. ETFsThe minimum spread for trading SPDR S&P 500 is 10 pips per lot for all account types. CommodityThe minimum spreads for trading COFFEE CFD is:

CryptocurrenciesThe minimum spreads for trading BTCUSD is:

Non-trading fees

(you can check the full withdrawal fees in withdrawal fees section)

|

Deposit and Withdrawal

Account CurrenciesThe HYCM account has 6 account currency options like:

Notes:

Deposit1. OptionsHYCM supports depositing using different methods such that:

HYCM deposit methods

2. Fees and TimeThe following table shows fees and processing time of each deposit method at HYCM. HYCM - Deposit Methods and Fees

Please note that HYCM does not charge on deposits, however there might be charges from the banks that are then deducted from the amount that you will receive.Withdrawal1. OptionsHYCM supports withdrawal using the same methods as deposit which are:

2. Fees and TimeHYCM Withdrawal Options and Fees

Notes:

|

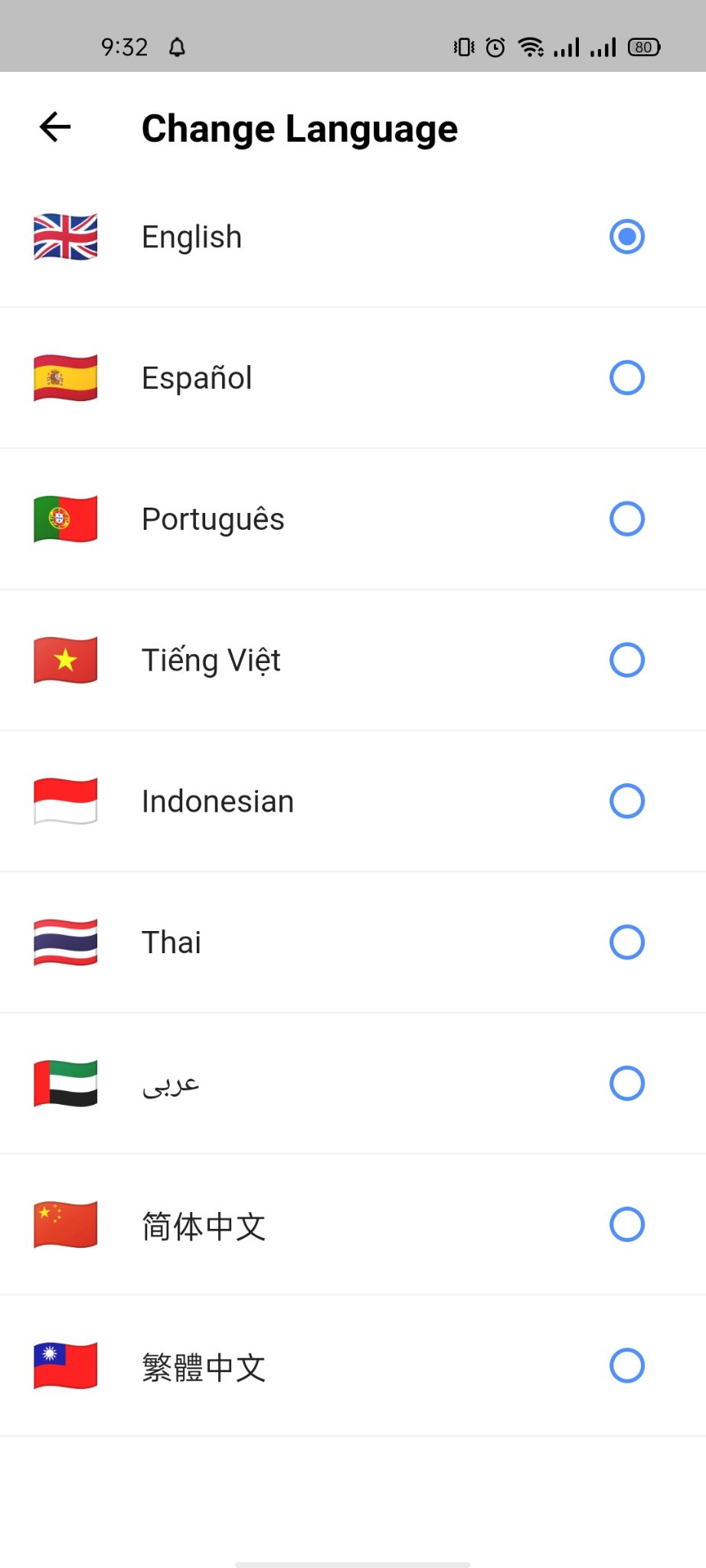

Platforms and Languages

|

HYCM works on two main platforms the MetaTrader 4 and MetaTrader 5. Each one of them has its own specifications and features. In this section, we will discuss each one of them in detail. MetaTrader 4

LanguagesMetaTrader 4 is available in a number of languages like: MT4 Languages

User interface (UI)MT4 has a very customizable UI that you can adjust according to your needs and preferences. On the other hand, it seems hard to find some of the features inside.

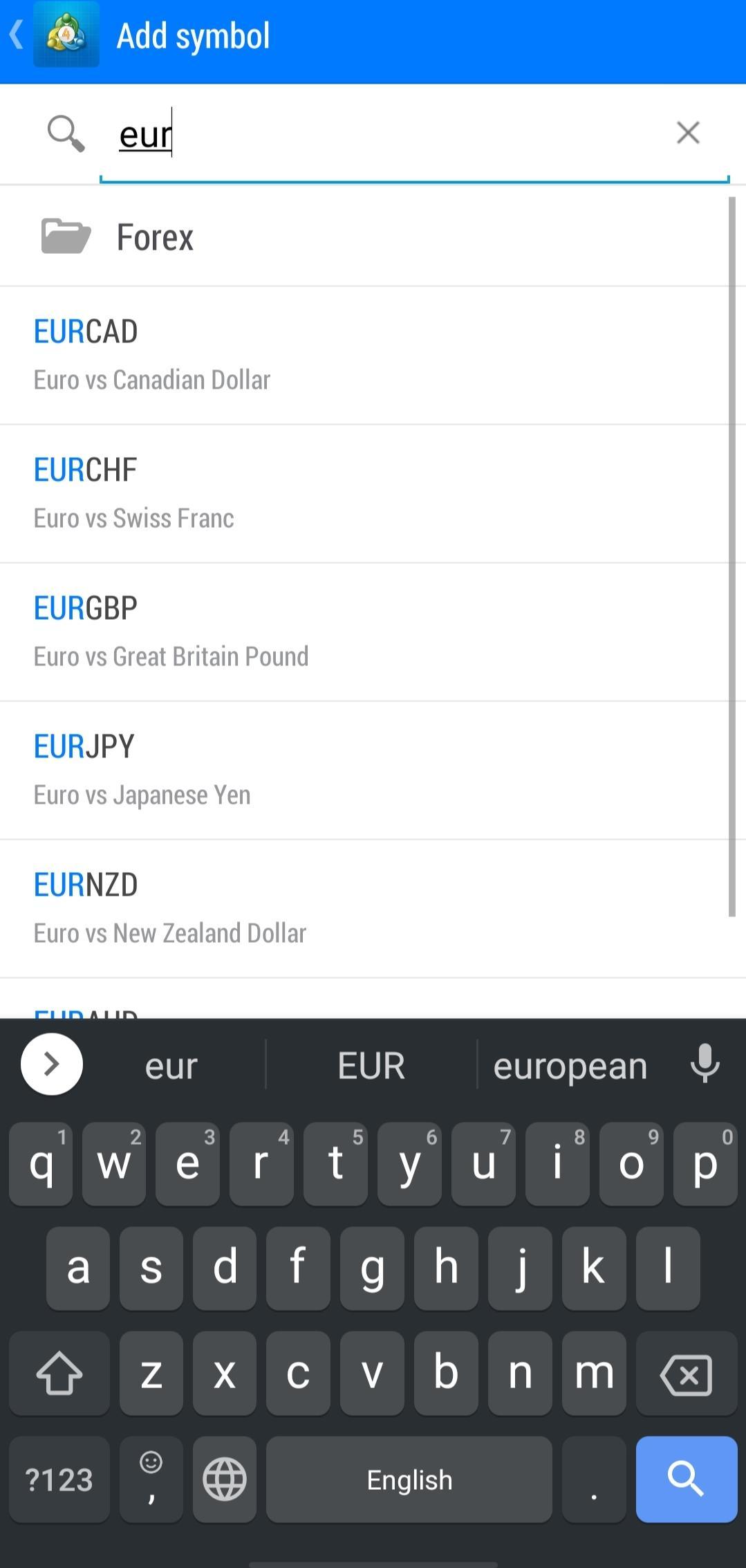

MT4 - Mobile Version - UI Login and SecurityUnfortunately, the MT4 does not provide a two-step verification method for logging in, and it does only support a one-step login. SearchingSearching using the MT4 platform has two different options:

MT4 - Mobile Platform - Search Placing ordersMT4 has a simple order types which are:

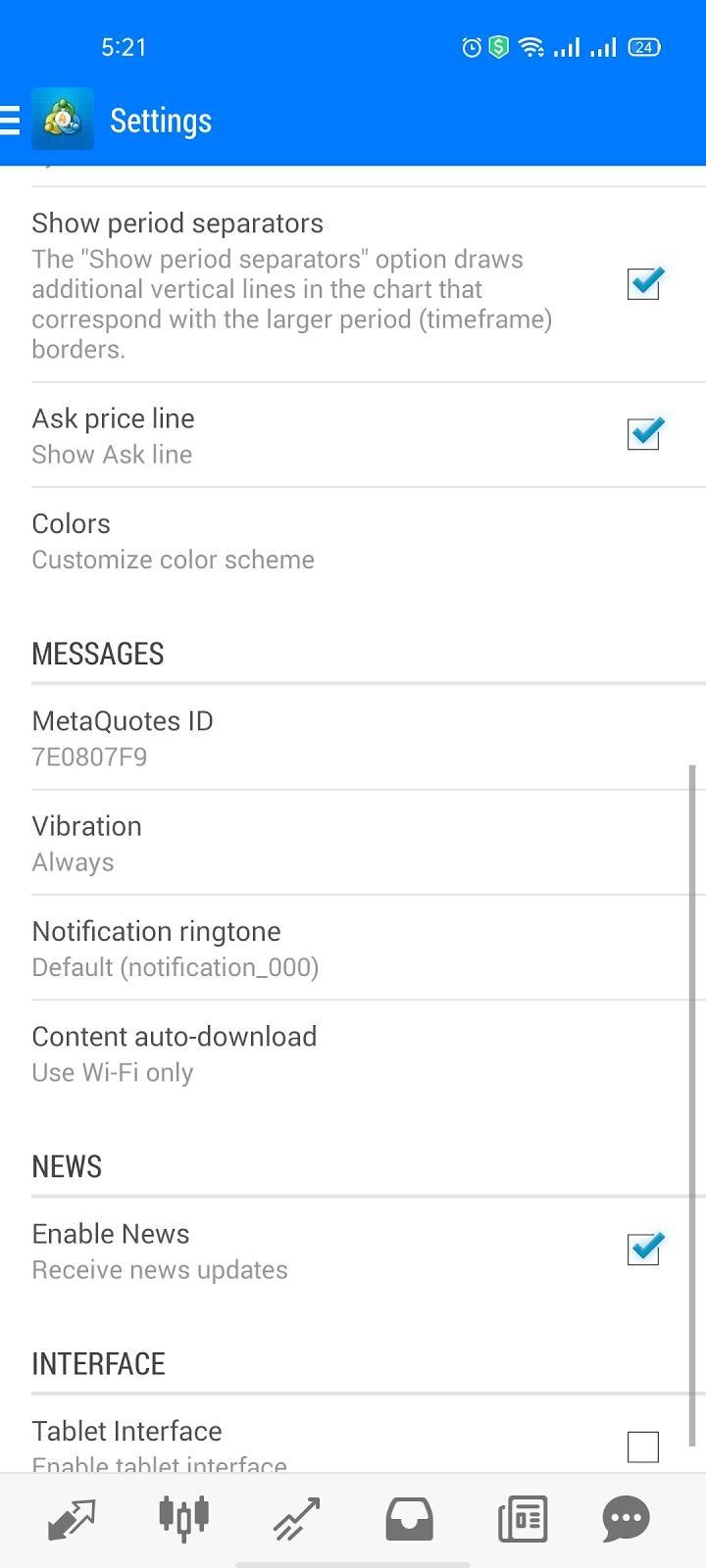

In addition to those 4 types, there are other orders which are the time limit ‘Good ‘til time’ (GTT) and ‘Good 'til canceled’ (GTC). There’s also an order confirmation feature in MT4. Notifications and alertsUnfortunately, the MT4 web trading platform does not have an option to set price alerts and notifications unlike the desktop and mobile versions.

MT4 - Mobile Version - Notifications Settings Portfolio and reportsUnder the ‘History’ tab, you can find your portfolio reports with a clear fee description.

MT4 - Mobile Version - Portfolio MetaTrader 5

LanguagesMT5 supports over 20 languages including English, French, Spanish, Italian, Japanese, and Chinese. User interface (UI)MT5 was launched in June, 2010. It has about 1 million users worldwide. It also has a good interface which is similar to MT4 with the main functionalities available. MT5 is more suitable for advanced traders.

MT5 desktop version

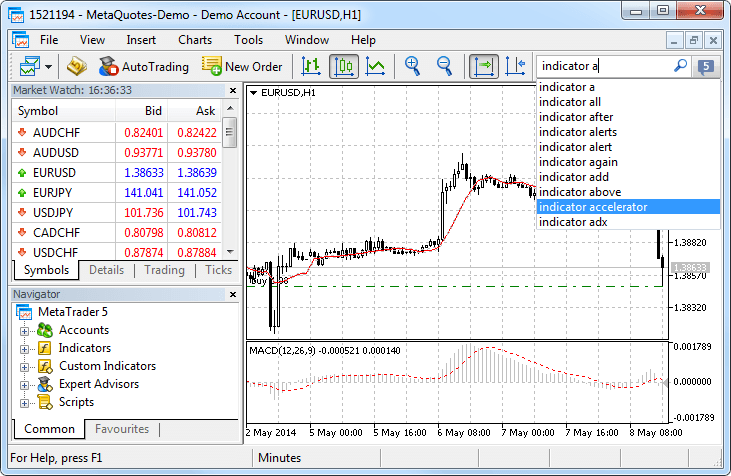

MT5 - Mobile Version SecurityMT4 encrypts your trading data with all of your information from cyber attacks as well as not revealing your IP address while trading using the platform. From a login perspective, MT4 has a two-step verification method as well to protect your account from hacks. ResearchMT5 offers financial and forex news from international agencies and provides a daily broadcast of dozens of newsletters from global events. MT5 also provides you with powerful and clear searching tools.

MT5 search Placing ordersMT5 has the same order types as the MT4 platform which are:

In addition to these 5 order types, the MetaTrader 5 platform has two more order options which are:

Like the MT4, MT5 has ‘stop loss’ and ‘take profit’ options while trading as well. Notifications and alertsMT5 has instant notifications and alerts in its system to never miss an opportunity in the market. ReportsThe MT5 platform carries news reports from international news agencies and also sports an economic calendar. |

Research Tools

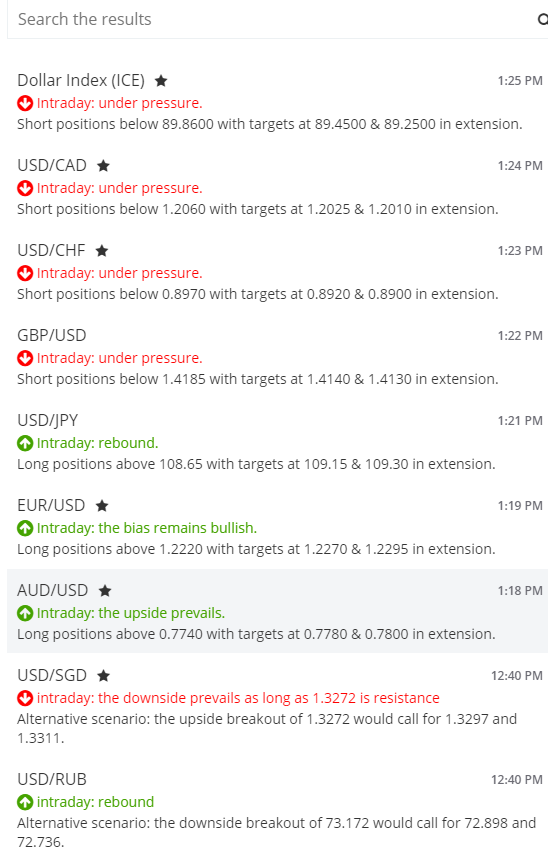

SourcesThe research tools of HYCM can be found in the client portal of HYCM website, or from the MT4 trading platform. Trading ideasHYCM provides a good trading ideas tool to give you more opportunities with the latest movements in the financial industry.

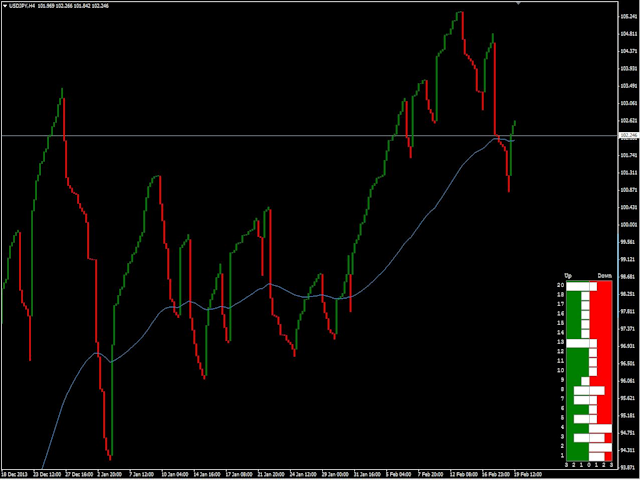

HYCM - Research - Trading Ideas ChartingHYCM provides a charting tool through the MT4 platform that can be customized according needs with over 30 indicators. The negative part is that the charting tool is outdated and needs to look more user-friendly.

HYCM - Research - MT4 Charting NewsfeedHYCM has a good tool that shows the latest news in the market to keep you updated with the latest information.

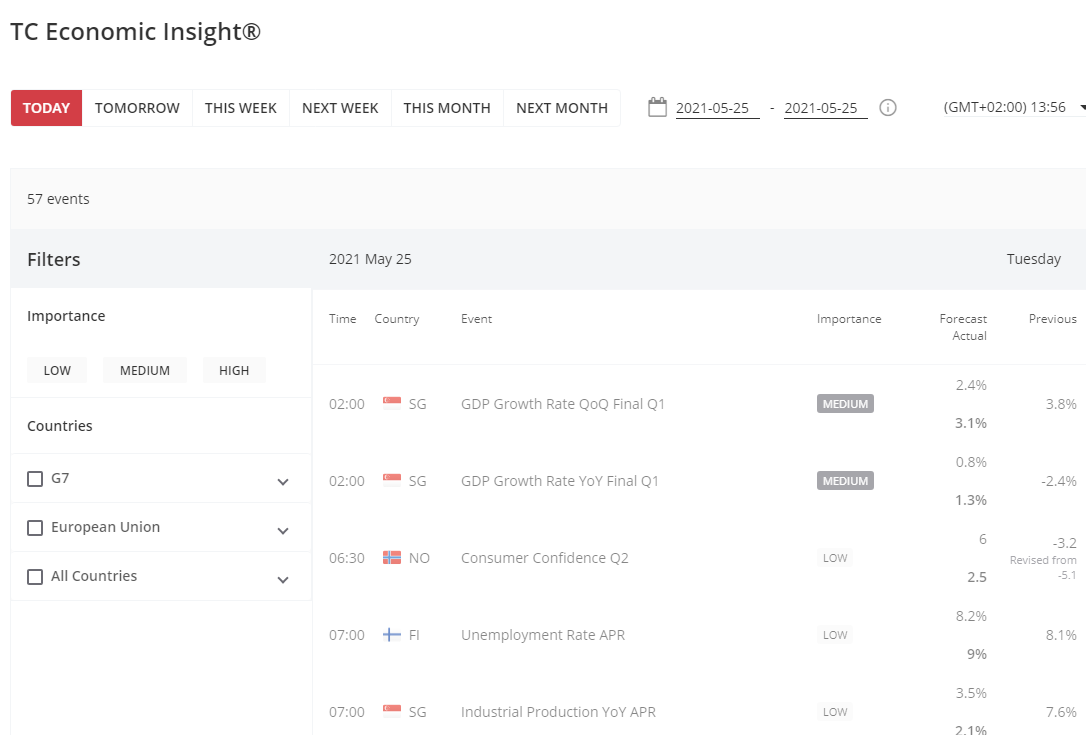

HYCM - Research - Newsfeed Other toolsThere are some other tools provided by the HYCM broker which are:

This tool helps you track the important upcoming events in the financial industry in case you want to prepare yourself for them.

HYCM - Research - Economic Calendar

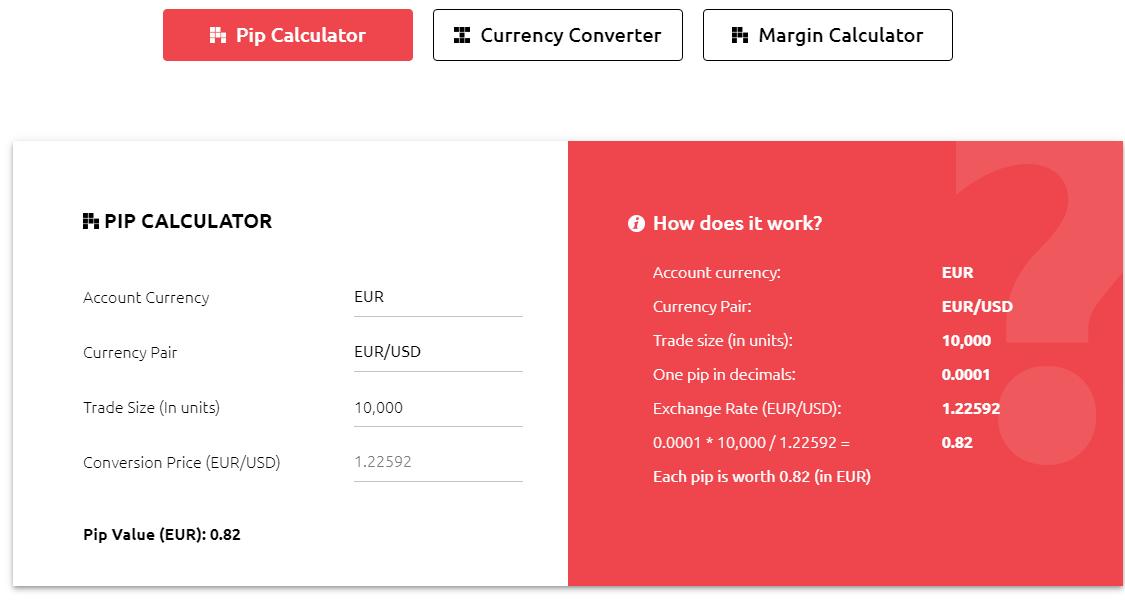

If you struggle calculating trading money by yourself, this tool will help you with 3 main calculators that makes it easier for you to think of other important things. Those calculators are pip calculator, currency converter, and margin calculator.

HYCM - Research - Calculators |

Customer Service

OptionsHYCM supports different customer service channels like:

LanguagesThe languages available for customer service are many with the support of major languages like English, Arabic, and Spanish.

HYCM - Languages |

Education

HYCM provides a lot of helpful educational materials that help you start trading and know more about it. Those materials are:

In addition to the above educational materials, HYCM Provides a demo account that you can use in trading with %0 risk. |

FAQs

1. Go to ‘Settings’ 2. Click on 'Manage Accounts' or 'Settings' 3. Then click on the small plus sign or select 'New Account' 4. Then select 'Log in to an existing account' 5. Search for the broker name 6. Select the server your account was set up on 7. Enter your login credentials and password 8. Click on 'Sign In'

|

HYCM Full Review - Reviews

HYCM Full Review - Review Conclusion

- Pros: negative balance protection, islamic account option, no deposit or withdrawal fees

- Cons: not listed on stock exchange, $100 minimum deposit, inactivity fee

- Best for: Beginners

- Regulated by: FCA, CySEC, CIMA, DIFC

- Headquarters: London, UK

- Foundation year: 1977

- Min Deposit : $100

- Deposit and withdrawal methods:credit/ debit card, electronic wallet, bank transfer

- Deposit and withdrawal fees: $0

- Base currencies: USD, EUR, GBP, AED, CAD

- Offering of investments: forex CFDs, stocks, ETFs, commodities, crypto