Oanda Full Review

Oanda Full Review

Oanda is one of the oldest CFD and forex brokers since 1996. It’s originally founded in America, and regulated by top-tier regulators like FCA and CFTC.

Disclaimer: CFDs have a high risk of losing money rapidly. About 80% of retail investor accounts lose money due to leverage when trading CFDs with this provider. Please note that CFDs are not complying with the islamic religion. And if you want to trade in CFDs you should consider a swap-free account to follow islamic rules.

Learn more about CFDs for muslims

Oanda Full Review - Key Statistics

Safety

Offering of Investments

Oanda does provide a variety of trading instruments like forex and CFDs, metals, commodities, and cryptocurrencies. Some of these options depend on the type of your trading account and the country of residence. Unfortunately, there’s no ETF trading, bonds, or futures. Disclaimer: CFDs have a high risk of losing money rapidly. About 80% of retail investor accounts lose money due to leverage when trading CFDs with this provider. Please note that CFDs are not complying with the islamic religion. And if you want to trade in CFDs you should consider a swap-free account to follow islamic rules. Learn more about CFDs for muslims. Oanda Offering of Investments

Note:

|

Account Opening

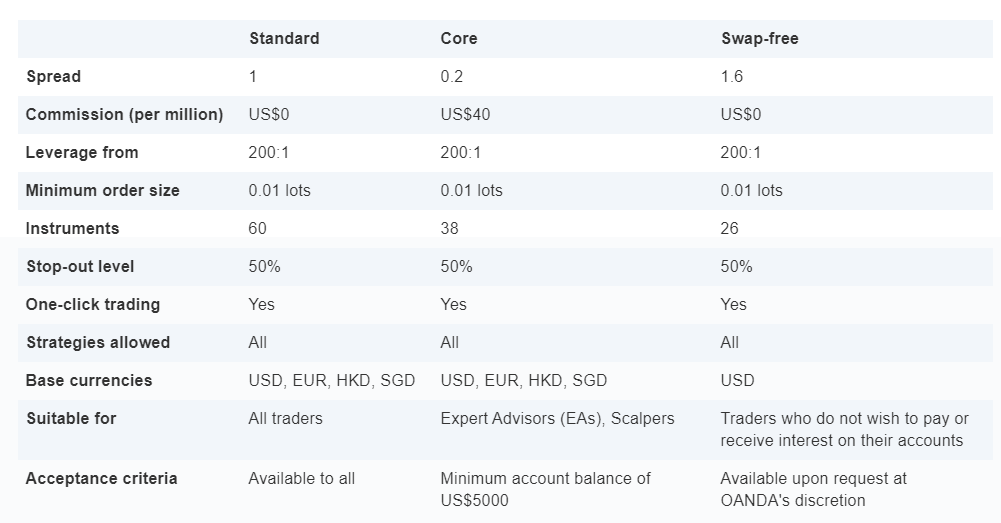

Countries availableYou can open an account on Oanda from all over the world except, but not limited to North Korea, Iran, and Cuba. Account typesThere’s only three trading account options that you can select one of them. Oanda - Account comparison

Oanda also provides a demo account with 0 fees if you want to experience the trading platform with no risk.

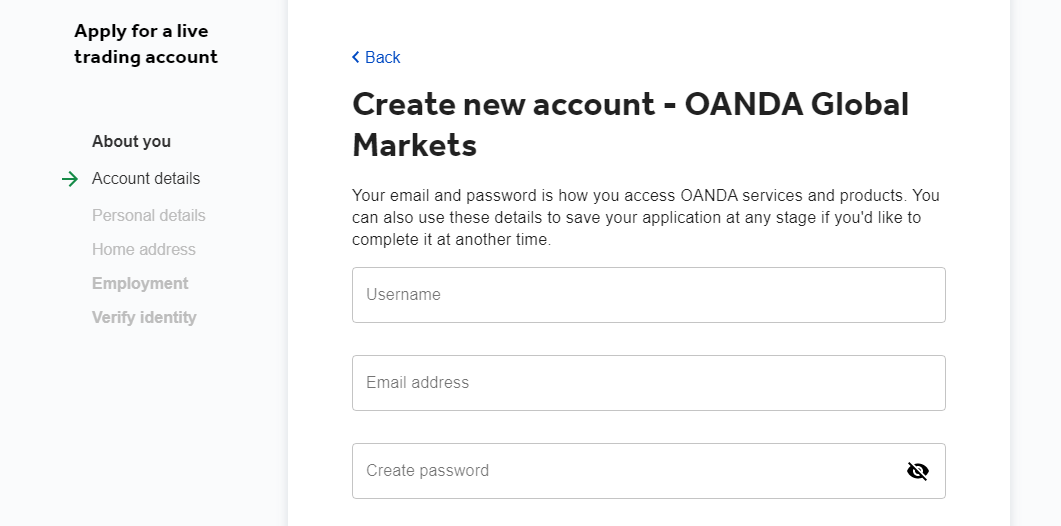

Oanda Account Types Min depositThere’s no minimum deposit when you open an account at Oanda which is great. How to open an accountYou can open an Oanda account in minutes through these steps:

Oanda - Account opening |

Fees and Commissions

CommissionsYou only pay a fixed commission per trade. The total cost for each trade will be the sum of the applicable core spread plus commission. Our core pricing spreads start from 0.1, with $40 commission per million USD traded. Trading FeesForex feesThe minimum forex spread is 0.2 pips per lot. Index feesFor indices, the spread ranges between 3.7 and 11 pips. Commodity feesFor commodities, Oanda’s spread ranges between 1.6 and 40 pips for natural gas and copper respectively. MetalsThe spread ranges between 0 and 367 pips for silver and gold respectively. Disclaimer: CFDs have a high risk of losing money rapidly. About 80% of retail investor accounts lose money due to leverage when trading CFDs with this provider. Please note that CFDs are not complying with the islamic religion. And if you want to trade in CFDs you should consider a swap-free account to follow islamic rules. Learn more about CFDs for muslims. Non-trading fees

(you can check the full withdrawal fees in withdrawal fees section)

|

Deposit and Withdrawal

Account CurrenciesThe Oanda account has 4 main account currencies which are: USD, EUR, HKD, and SGD. Notes:

Deposit1. OptionsOanda deposit methods

Oanda supports depositing using different methods such that:

2. FeesOanda does not charge any deposit fees from you. 3. TimeBank Transfers can take several business days while depositing using other methods is instant. Withdrawal1. OptionsOanda supports withdrawal using the same methods like deposit as the following:

Oanda withdrawal methods and fees

2. FeesOanda does charge $0 fees for withdrawals using debit cards. The first credit card withdrawal each month is also free of charge. For withdrawals using bank transfers, Oanda does charge a fee of $25. 3. TimeIt takes 2 - 3 business days to transfer your money in the best case. |

Platforms and Languages

|

Oanda works on different platforms like :

Each of the previous platforms has its pros and cons. So, let’s dig deeper into each one of them. fxTrade

LanguagesfxTrade is available in the following languages:

User interface (UI)The UI of fxTrade looks beautiful with the ability to navigate seamlessly within the application.

fxTrade - Mobile Platform - UI Login and Security

SearchingSearching through the platform for assets is fine. You can search for the asset you want and find it easily without any problem. Placing ordersThere are 5 types of orders:

Notifications and alertsOn the web and desktop platforms, there’s no option to set alerts. On the other hand, you can set alerts on the mobile application platform. Portfolio and reportsfxTrade provides a good portfolio report with clear fees and spreads as well.

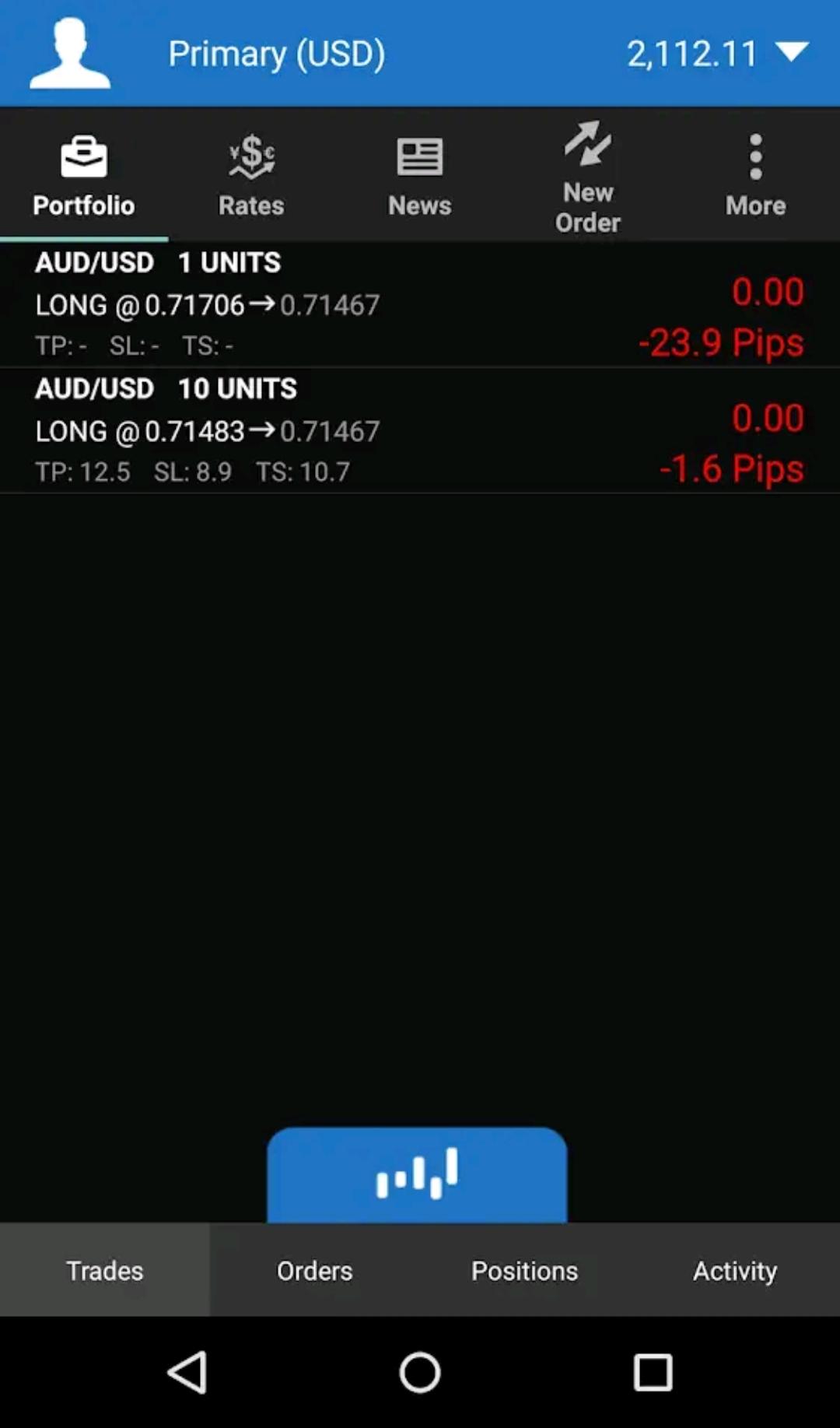

fxTrade - Mobile Platform - Portfolio MT4 Platform

LanguagesMetaTrader 4 is available in a number of languages like: MT4 Languages

User interface (UI)MT4 has a very customizable UI that you can adjust according to your needs and preferences. On the other hand, it seems hard to find some of the features inside.

MT4 - Mobile Version - UI Login and SecurityUnfortunately, the MT4 does not provide a two-step verification method for logging in, and it does only support a one-step login. SearchingSearching using the MT4 platform has its pros and cons.

Placing ordersMT4 has a simple order types which are:

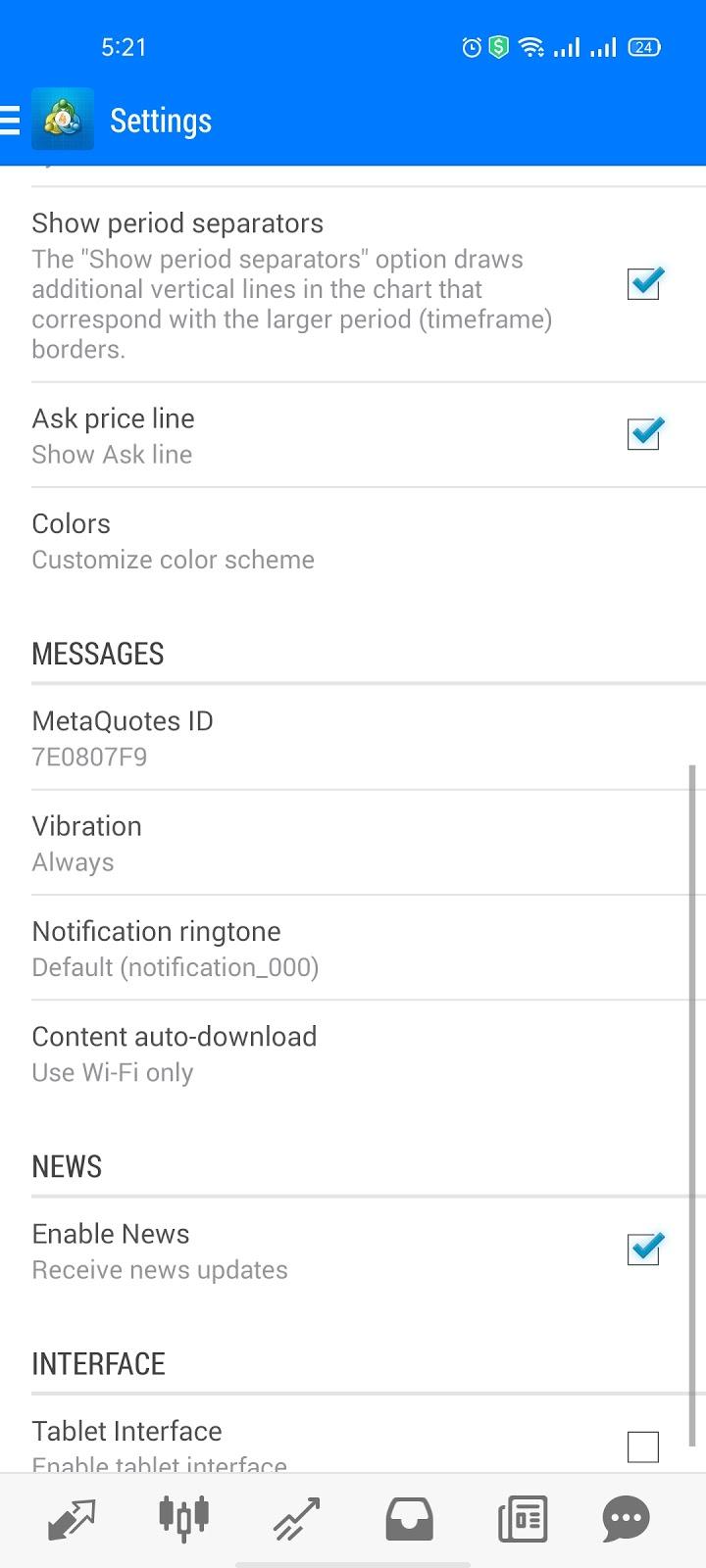

In addition to those 4 types, there are other orders which are the time limit ‘Good ‘til time’ (GTT) and ‘Good 'til canceled’ (GTC). There’s also an order confirmation feature in MT4. Notifications and alertsUnfortunately, the MT4 web trading platform does not have an option to set price alerts and notifications unlike the desktop and mobile versions.

MT4 - Mobile Version - Notifications Settings Portfolio and reportsUnder the ‘History’ tab, you can find your portfolio reports with a clear fee description.

MT4 - Mobile Version - Portfolio |

Research Tools

Oanda offers a number of research tools in order to help you trade with the best possible experience. SourcesOanda does provide its research tools through its platform as well as the MT4 trading platform. Fundamental dataOanda provides some fundamental data within the ‘Economic Analysis’ section. ChartingOanda has a great charting feature with the ability to choose from a variety of indicators and visualize the data smoothly.

Oanda - Research Tools - Charting NewsfeedOanda does give an option to view recent news through its research tool ‘Market Pulse’ which gives you a glance of the financial market at the moment within the platform. Other toolsOanda has also some other features that you may like:

|

Customer Service

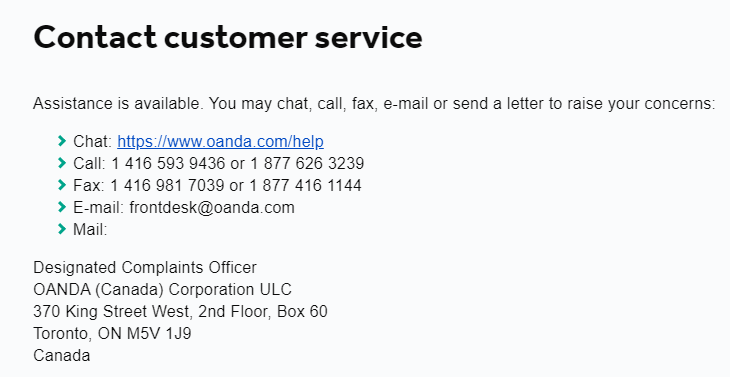

OptionsOanda supports different customer service channels like:

In addition to the previous contact options you can send a mail directly to Oanda, telling them your problem and asking for help. Unfortunately, there’s no 24/7 customer support at Oanda.

Oanda Customer Support Options LanguagesThe languages available for customer service are many with the support of major languages like English, Spanish, German, and Japanese. |

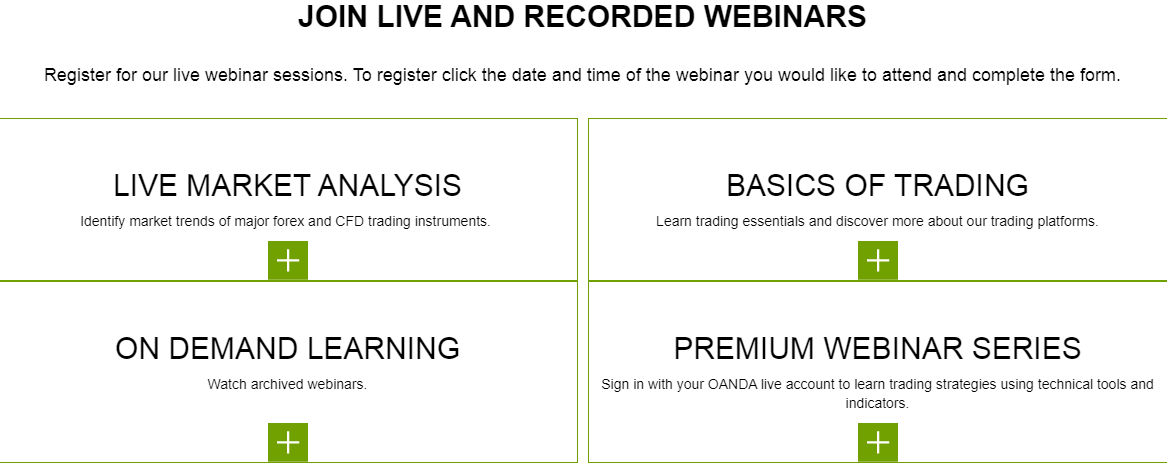

Education

Oanda does provide a good educational materials like:

In addition to the previous educational materials, Oanda does provide a demo account as well on the MT4 platform in order to learn with %0 risk. On the other hand, the materials could be more organized than what it looks like now to be more user-friendly.

Oanda Educational Materials |

FAQs

1. Go to ‘Settings’ 2. Click on 'Manage Accounts' or 'Settings' 3. Then click on the small plus sign or select 'New Account' 4. Then select 'Log in to an existing account' 5. Search for the broker name 6. Select the server your account was set up on 7. Enter your login credentials and password 8. Click on 'Sign In'

Conclusion:

|