TD Ameritrade Full Review

TD Ameritrade Full Review

TD Ameritrade is one of the oldest online brokers in the US since 1975 with a long tracking record of +45 years and over 175 branches nationwide. It’s considered one of the safest brokers as it’s regulated by top-tier regulators like the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA).

TD Ameritrade Full Review - Key Statistics

Safety

Offering of Investments

TD Ameritrade offers a variety of trading instruments like forex, real stocks, ETFs, Futures, bonds, options, and IPOs. On the other hand, TD Ameritrade does provide all of these options for the US clients only, and for the international clients, there are some of them which are available only. There are no CFD trading in TD Ameritrade platform for all clients. TD Ameritrade Offering of Investments

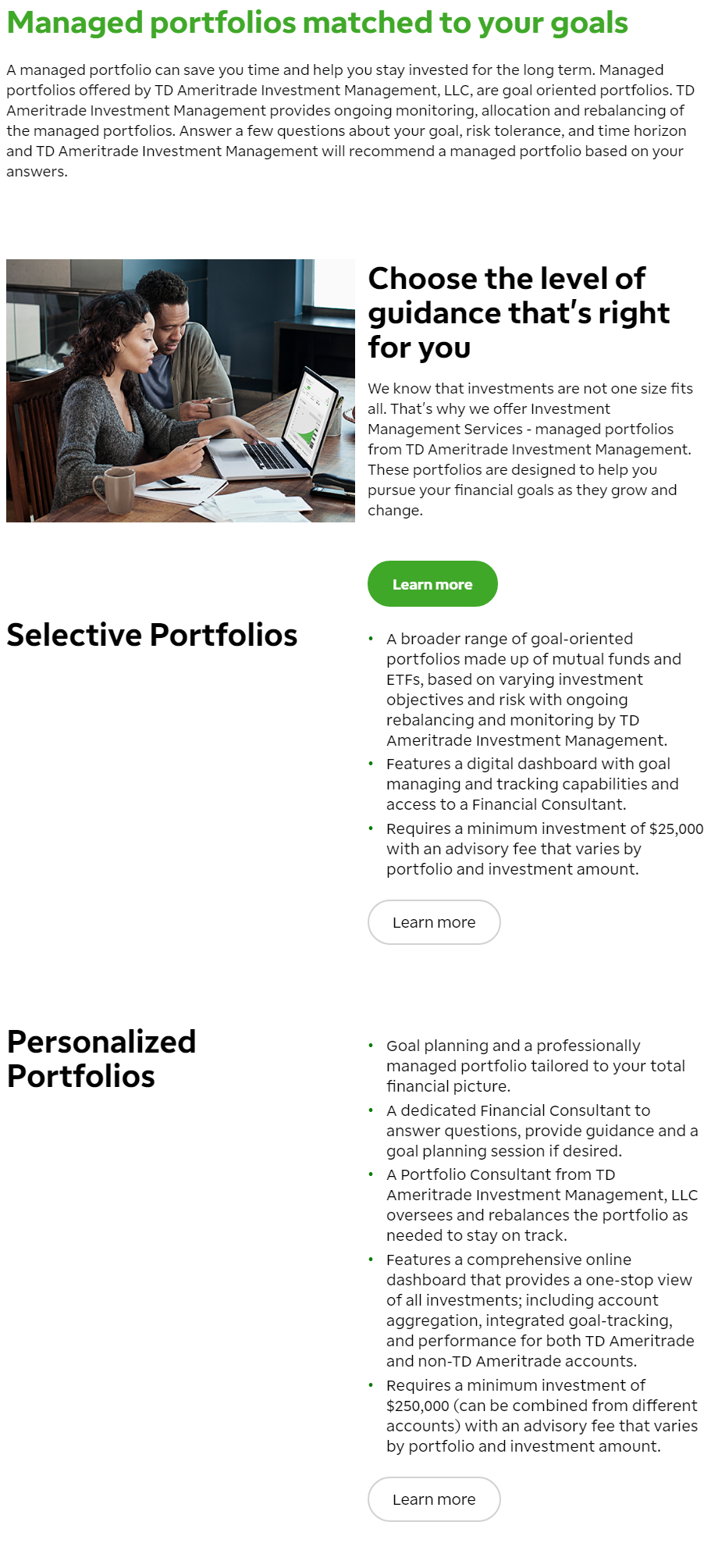

Social TradingTD Ameritrade does support social trading on its platform. So, you can copy trades from top investors as you want via Thinkorswim. You can also follow other traders, chat with them, as well as sharing your trading experience and results. PortfoliosTD Ameritrade does also provide two types of portfolio advisory systems:

This is more personalized advisory from an expert. Please note that the minimum required investment amount is $25,000 to activate this service.

This is a much more personalized advisory option from a professional with a starting point of $250,000.

TD Ameritrade - Managed Portfolios |

Account Opening

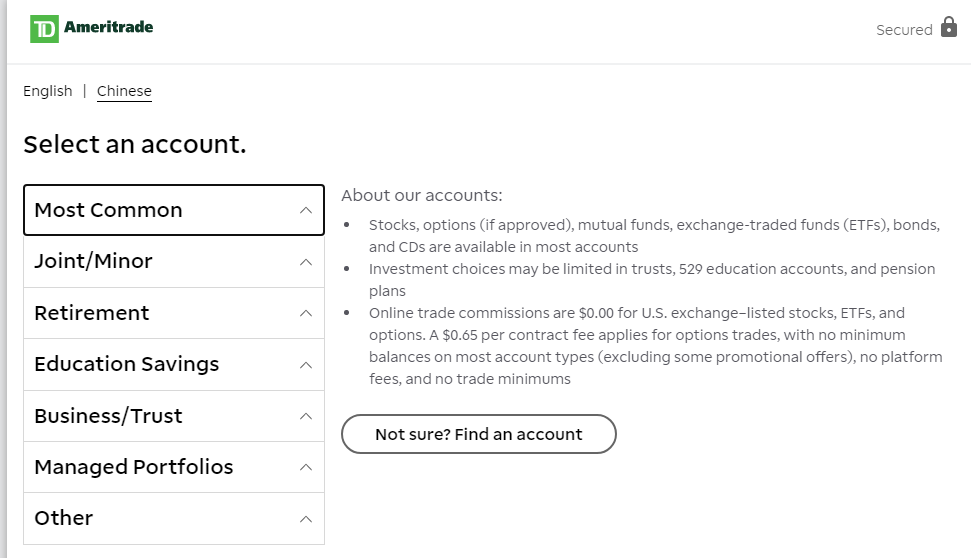

Countries availableTD Ameritrade is available in a lot of countries, except, but not limited to Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Account typesTD Ameritrade does provide a plenty of account types with different features and capabilities.

These are the most common account types between clients that have flexibility and access to comprehensive investment products, objective research, and have the following account options (Individuals, Joint Tenants, Tenants in common, community property, Tenants by the Entireties, and Guardianship)

These types of accounts were designed to help you reach your retirement goals faster and meet your income and lifestyle needs. There are a number of types in this category which are (Traditional IRA, Roth IRA, Rollover IRA, SEP IRA, Solo 401k, Simple IRA, and Profit Plan)

This category has a number of account types that help you save for education, at any level, choose from various state-qualified 529 Plans, tax-free Coverdell, or UGMA/UTMA accounts. It has a number of types like: (529 Plans, Coverdell Education Savings Account, and UGMA/ UTMA)

Specialty accounts make planning for the future easy. The following account types are available in this category: (Trust, Partnership, Limited Partnership, Investment Club, Limited Liability, Sole Proprietorship, Corporate, Non-incorporated, and Small Business Plans)

You can save your time and effort by subscribing to one of the managed portfolios plans that helps you trade with the minimum effort. This category includes the following types: (Selective and Personalized)

These types of accounts allow you to borrow money from TD Ameritrade and potentially increase your securities buying power by as much as 50%. TD Ameritrade also provides a demo account with 0 fees if you want to experience the trading platform with no risk. Min depositThe min deposit for the TD Ameritrade is $0. How to open an accountYou can open an TD Ameritrade account in minutes through these steps:

TD Ameritrade - Account opening |

Fees and Commissions

Trading FeesForex feesTD Ameritrades does not charge commissions on trading forex pairs, but the cost of the trade is reflected in the spread and TD Ameritrade is compensated by its liquidity provider based on the volume. OptionsFor online options, TD Ameritrade does charge a fee of $0.65 per contract. For the VIP clients, there are some discounts on the options based on trading volume. Mutual FundsTD Ameritrades has a fee of $49.99 for online no-load mutual funds. Stock, ETFs, and BondsTD Ameritrade does provide free stocks, ETFs, and Bonds options on its platform. Please note that if you decide to trade stocks in margin, you should consider that the annual margin rate for US is %9.5. FuturesTD Ameritrade charges a fee of $2.25 fee per contract (plus exchange & regulatory fees) Non-trading fees

(you can check the full withdrawal fees in withdrawal fees section)

|

Deposit and Withdrawal

Account CurrenciesThe TD Ameritrade account has only one account base currency which is USD and there’s no other option. Notes:

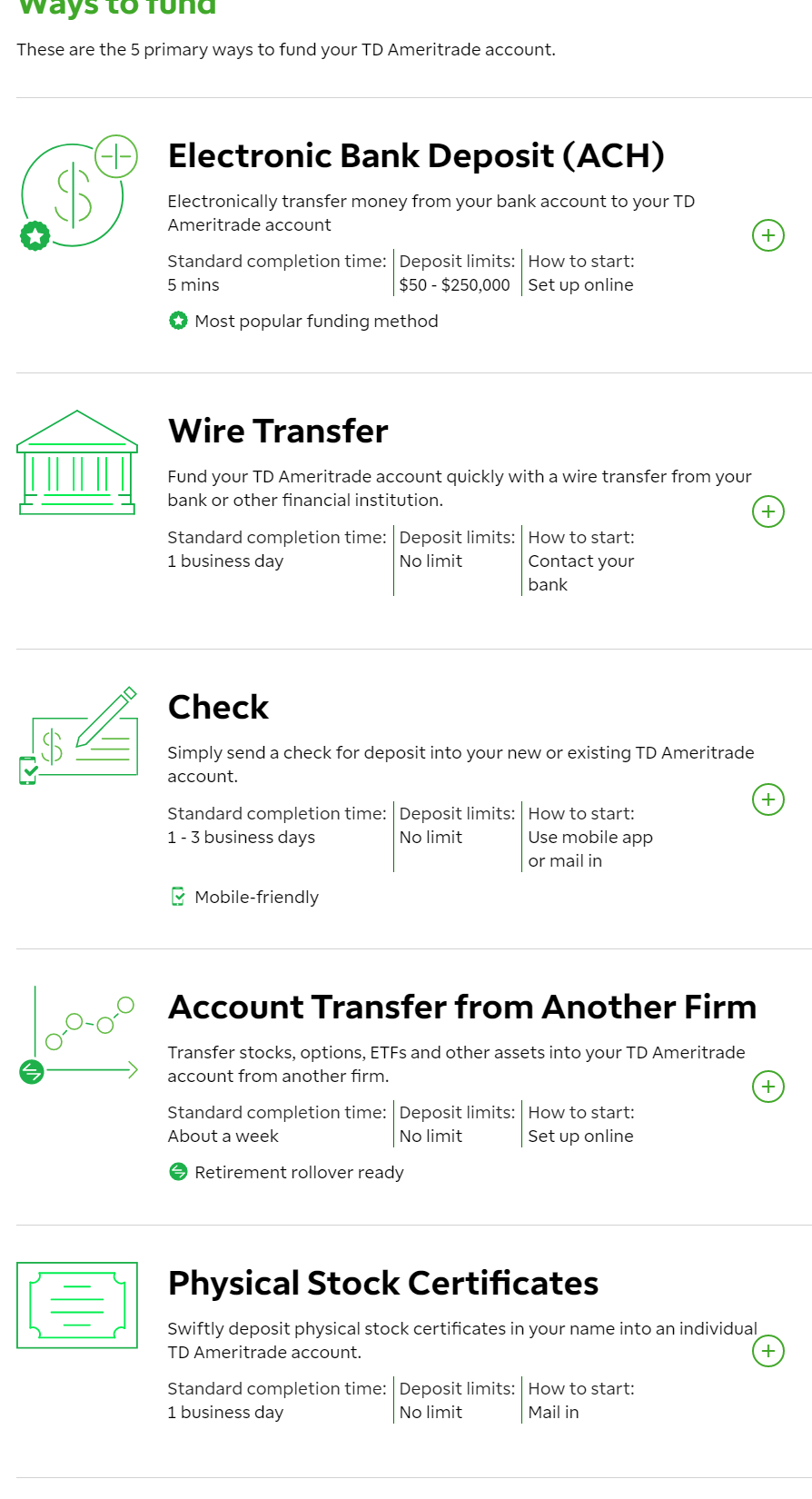

Deposit1. OptionsTD Ameritrade does provide a number of options for deposits like:

On the other hand, TD Ameritrade does not provide deposits using electronic wallets, credit cards, or cryptocurrencies. TD Ameritrade deposit methods

2. FeesTD Ameritrade does not charge fees on deposit unlike a lot of other brokers. 3. TimeIt takes no time funding your account as it happens immediately, but for the ACH transaction request, it might take about 2 days for transferring.

TD Ameritrade - Deposit Options Withdrawal1. OptionsTD Ameritrade has 2 options for withdrawals: ACH or bank transfer. Note: The only option available for non-US clients is by bank transfers anly. 2. FeesTD Ameritrade does not charge any fee except for withdrawals using bank transfers as they have a fee of $25. 3. TimeIt takes about 2 business days to withdraw your money from TD Ameritrades. |

Platforms and Languages

|

TD Ameritrade works on two main different platforms:

Both of these platforms are customized and mainly designed for trading in TD Ameritrade only but with different options and features for each. In this review, we will discuss the TD Ameritrade platform. TD Ameritrade Trading Platform

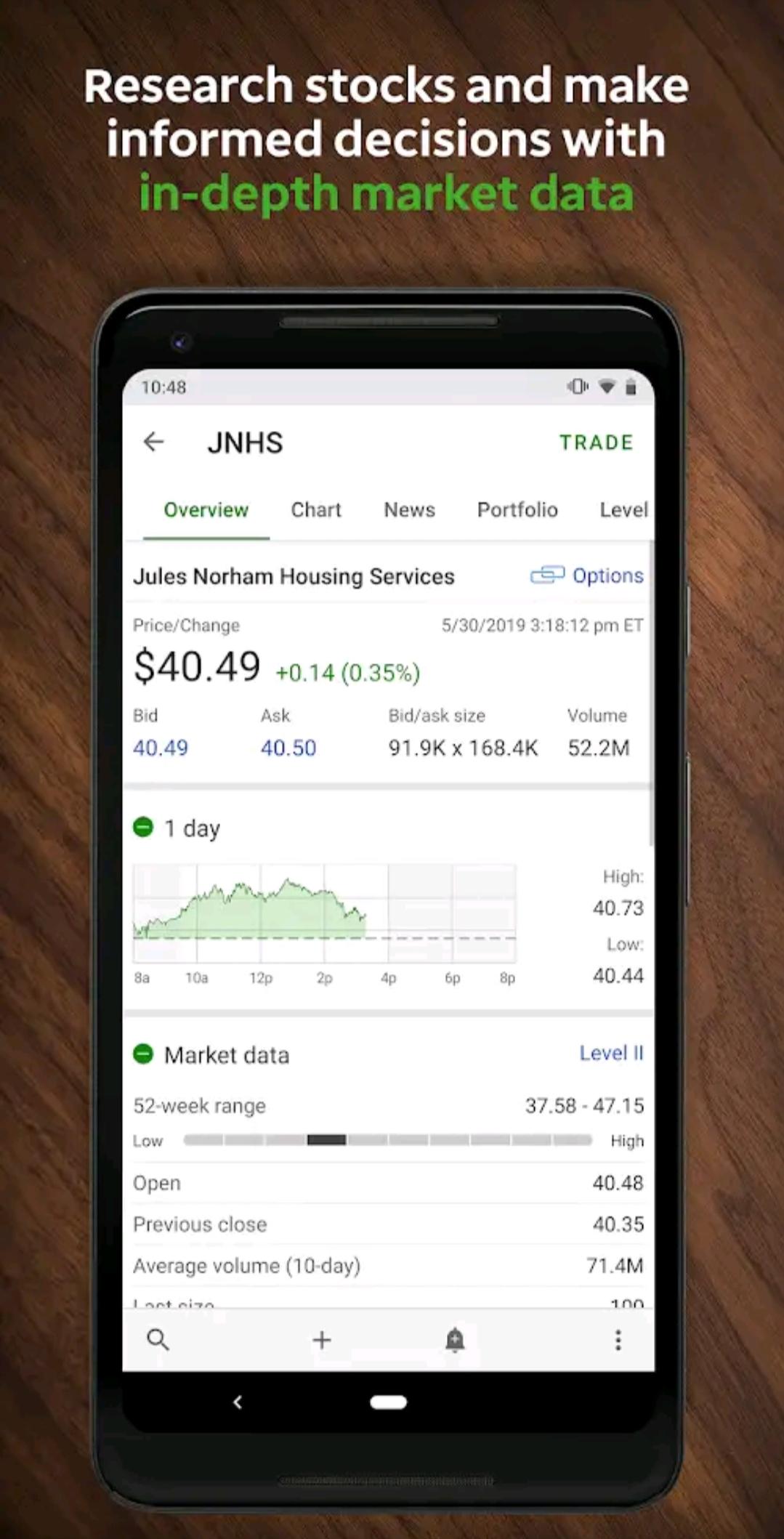

TD Ameritrade trading application works on web, desktop, and mobile platforms. It has a beautiful user interface UI as well as a safer login method (two-step verification) which is a very good point. LanguagesTD Ameritrade is available in two main languages: English, and Chinese. User interface (UI)The UI of both web and mobile versions are beautiful and have easy-to-access to all features and tools in the platform.

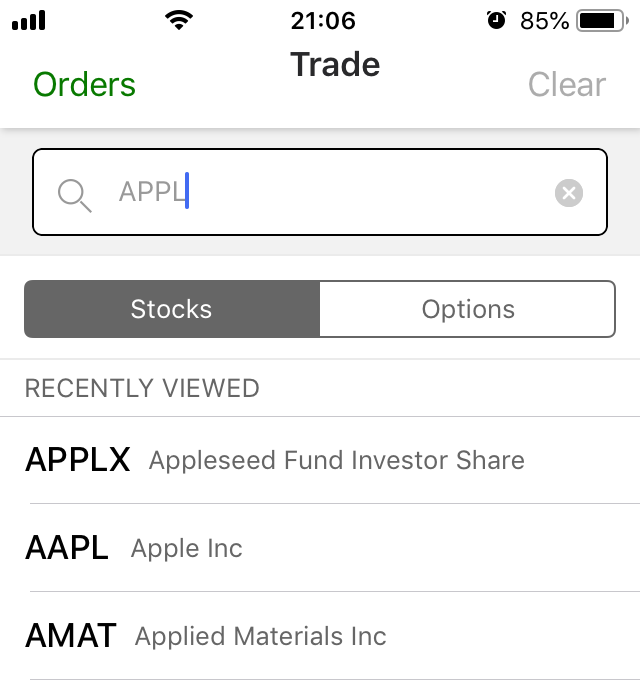

TD Ameritrade - Mobile Platform - UI Login and SecurityTD Ameritrade has a two-step verification method for login which is counted as a plus for TD Ameritrade. At the same time, this option is not available for the desktop version. SearchingThe searching function in the TD Ameritrade platform works fine, and you can search by the asset name.

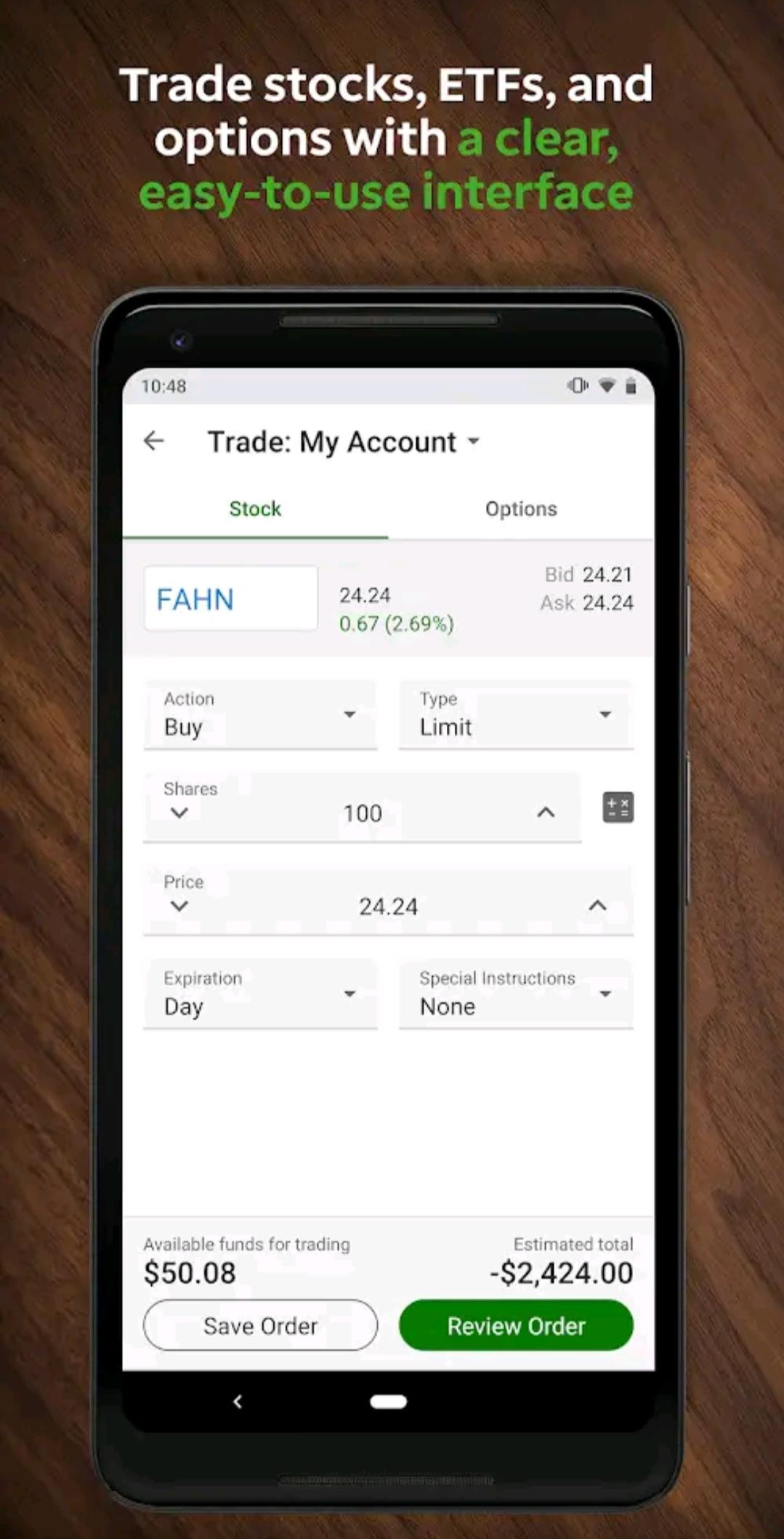

TD Ameritrade - Mobile Platform - Search Placing ordersThere are 6 main types of orders in TD Ameritrade Platform which are:

In addition to those 6 types, there’s other order types for the time limit.

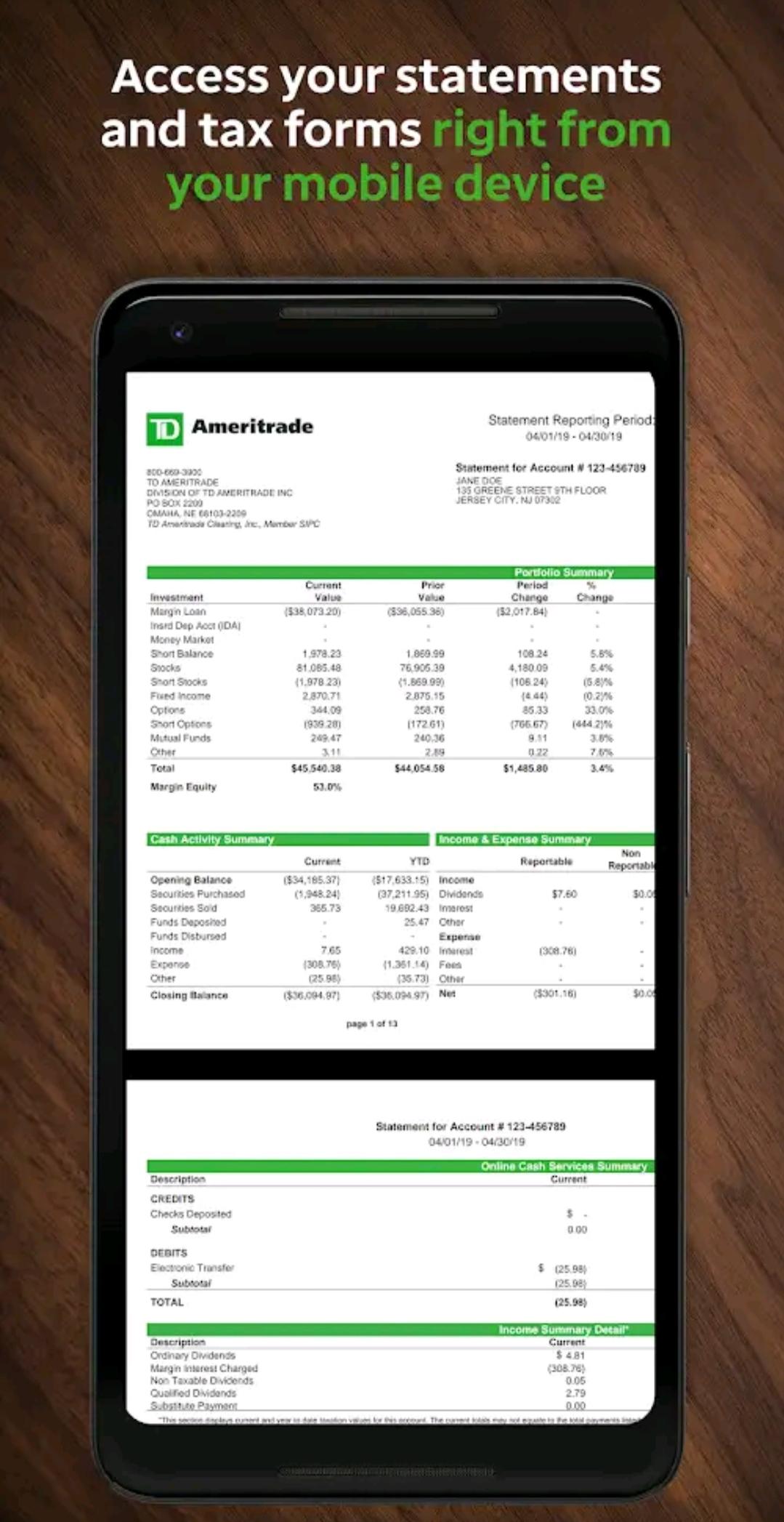

TD Ameritrade - Mobile Platform - Place Order Notifications and alertsYou can set notifications whatever the platform you choose. Portfolio and ReportsTD Ameritrade has good reports and account statements in its platform with the availability to see transactions and more fundamental data.

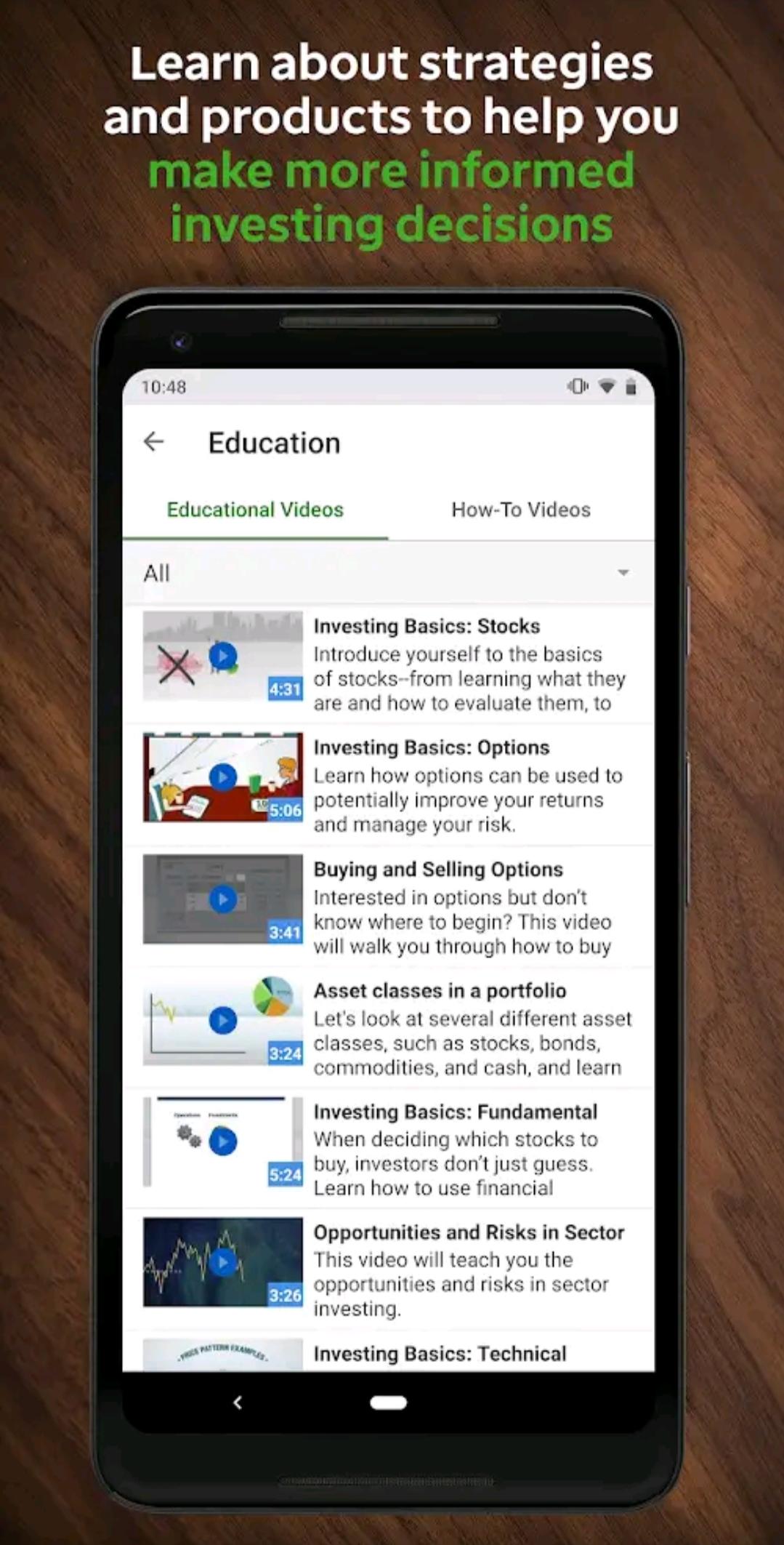

TD Ameritrade - Mobile Platform - Account Statement EducationYou can access the educational materials on all platforms of TD Ameritrade like videos.

TD Ameritrade - Mobile Platform - Education Platforms Comparison Table

|

Research Tools

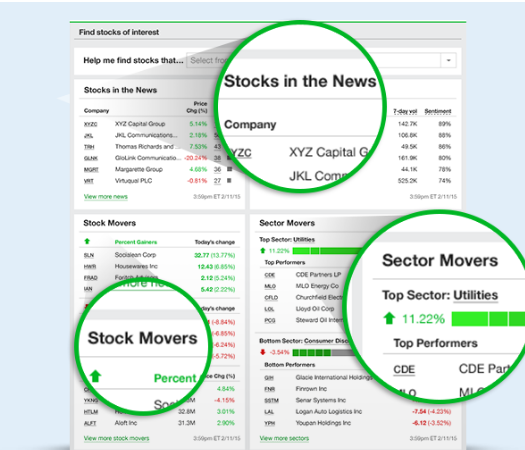

SourcesTD Ameritrade does provide a number of searching tools from third-party providers that broaden your financial experience and helps you trade in the best possible way. Those third-party providers are Morningstar, DowJones, CFRA, and Thomson Reuters. Trading ideasThe trading ideas provided by TD Ameritrade are about stocks, ETFs, mutual funds, and fixed income instruments. From the stocks ideas section, you can get a full overview that helps you monitor your volume and see the sectors that are on the move.

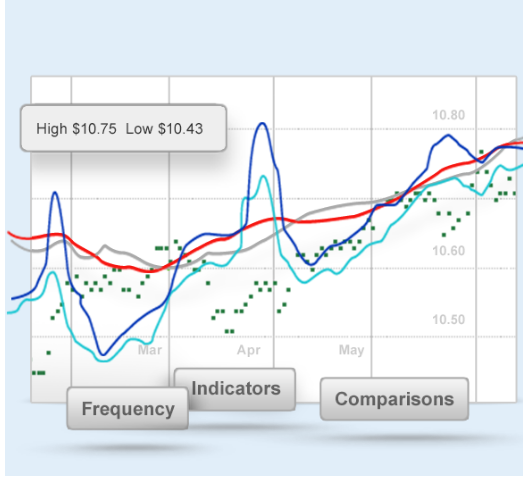

TD Ameritrade - Stocks Overview ChartingUsing the Stocks Charts, you can get Spot trends and potential opportunities that may fit your investment strategy with our customizable charts. You can also use a number of indicators to help you as well.

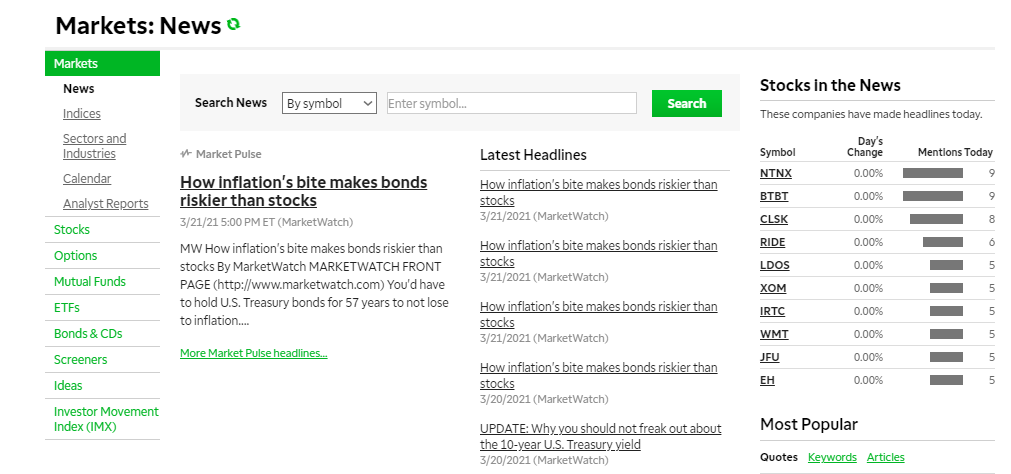

TD Ameritrade - Stocks Chart NewsfeedNews comes from the ‘Market Edge’ tool in which you can follow the market news and conditions to be up-to-date. Market Edge does also provide a timely information and technical analysis of the markets with reports. Unfortunately, the news feed lacks visual elements like pictures and videos.

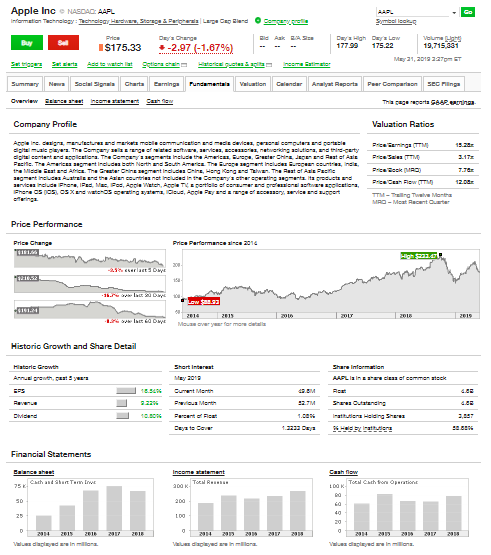

TD Ameritrade - Market Edge - News Fundamental dataTD Ameritrade provides also a separate fundamental data tap in which you can check the fundamental data of each asset from different sources. TD Ameritrade - Fundamental Data Other toolsThere are a number of other useful research tools in TD Ameritrade like:

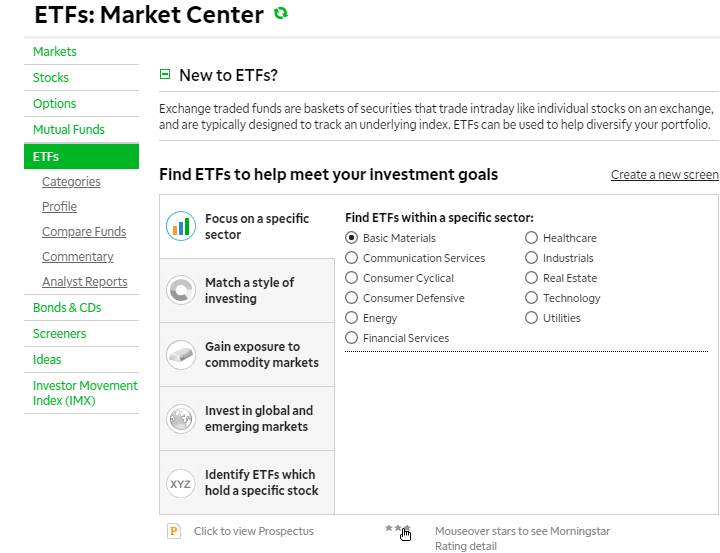

You can use this tool to research and monitor ETFs with extensive information.

TD Ameritrade - ETF Market Center

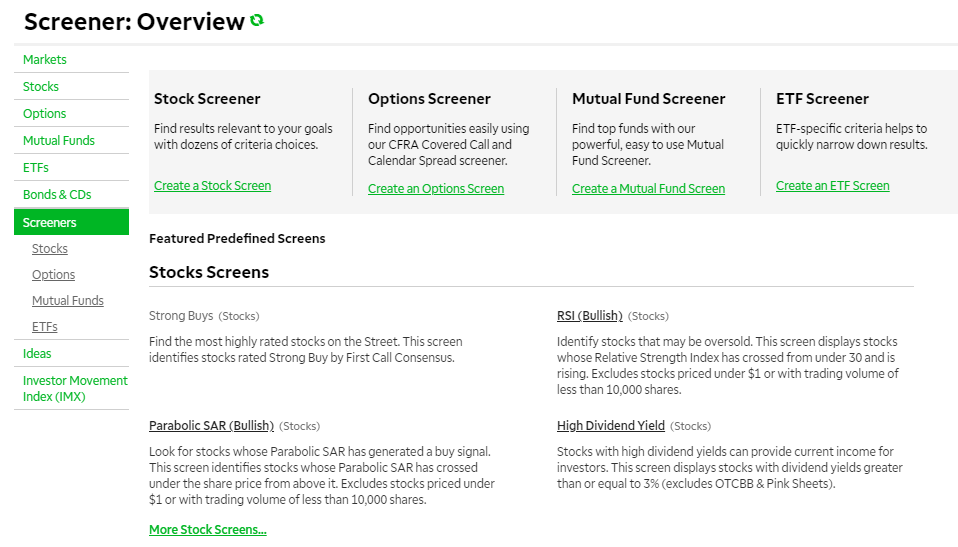

This tool helps you find the right instruments for you according to predetermined screeners based on strong buys, lifecycle, highest alpha, lowest expense ratio, and more – or create your own custom screens. Whether you are searching for stocks, options, mutual funds, or even ETFs, this tool will help you a lot.

TD Ameritrade - Screeners

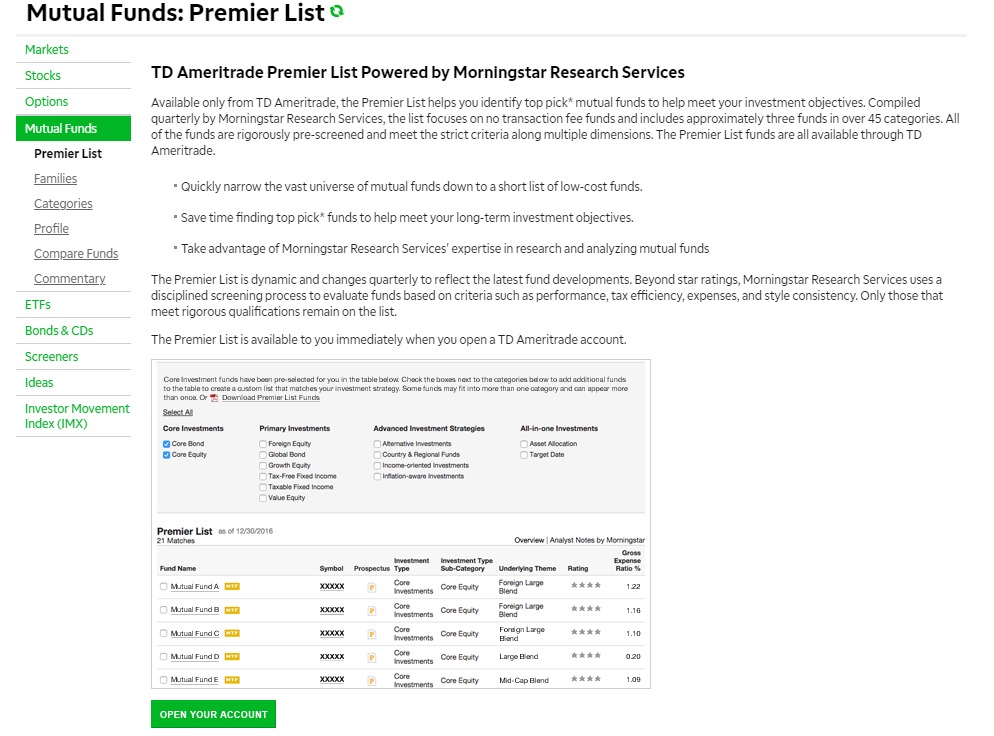

It allows you Identify top-pick mutual funds provided by Morningstar only for the TD Ameritrade clients.

TD Ameritrade - Premier List |

Customer Service

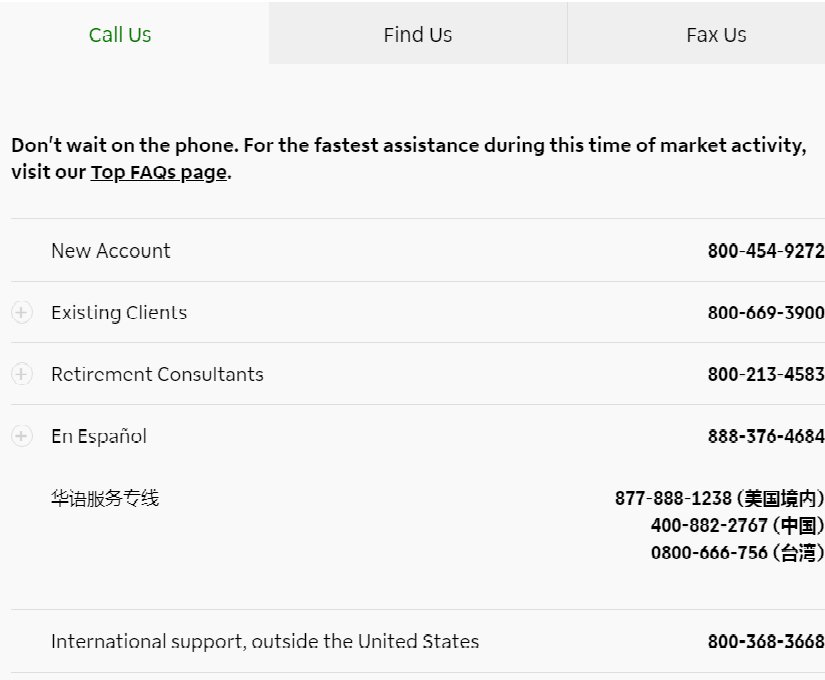

OptionsTD Ameritrade supports customer service via phone calls for its new and existing clients as well. LanguagesTD Ameritrade supports customer service in three main languages: English, Chinese, and Spanish. ExperienceTD Ameritrade provides a webpage of top asked FAQs for fast and helpful answers as well as providing an option of phone calls for clients all over the world. The phone support is very fast and the support team gives relevant answers with low response time.

TD Ameritrade - Customer support |

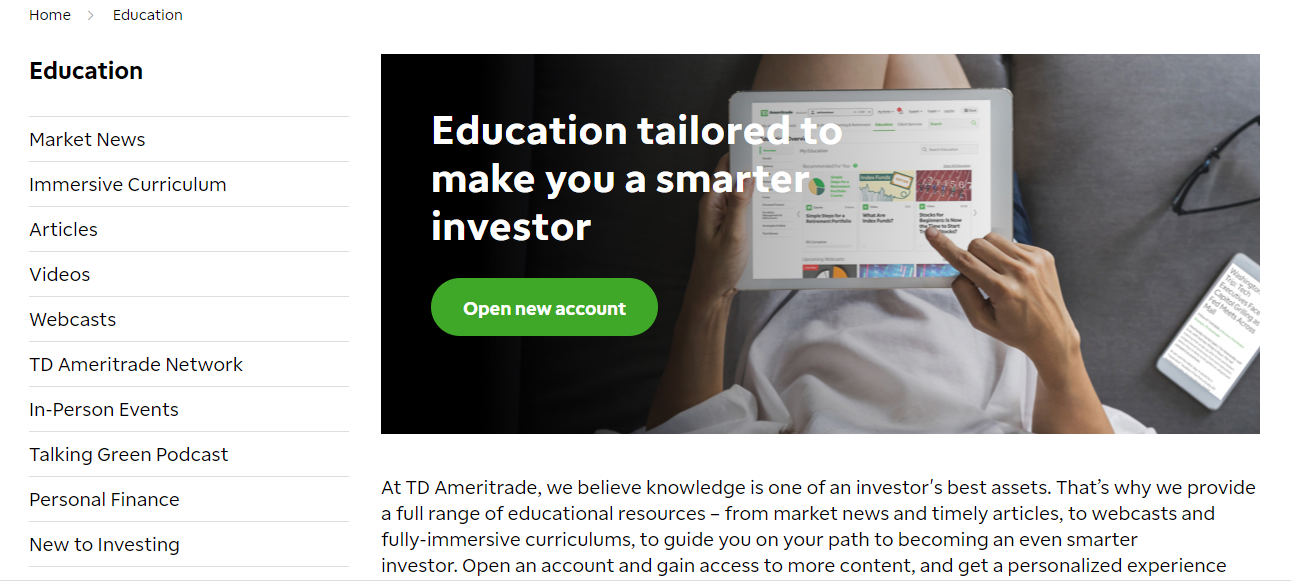

Education

TD Ameritrade provides a collection of helpful educational materials like:

In addition to these materials, TD Ameritrade also offers a demo account in order to let its clients trade with 0% risk. If you’ve opened an TD Ameritrade account, you are already registered at paperMoney which is an account provided by Thinkorswim and offers a number of charting and professional tools with the ability to access complex instruments like futures.

TD Ameritrade - Education |

FAQs

Conclusion :

|