Interactive Brokers Full Review

Interactive Brokers Full Review

Interactive Brokers is a US-based broker founded in 1978. It’s basically a forex and CFD broker and has a wide variety of other trading instruments. It’s also regulated by top-tier FCA.

Disclaimer: CFDs have a high risk of losing money rapidly. About 80% of retail investor accounts lose money due to leverage when trading CFDs with this provider. Please note that CFDs are not complying with the islamic religion. And if you want to trade in CFDs you should consider a swap-free account to follow islamic rules.

Learn more about CFDs for muslims.

Interactive Brokers Full Review - Key Statistics

Safety

Offering of Investments

Interactive Brokers offers different trading instruments like forex, CFDs, stocks, options, futures, metals, bonds, ETFs, mutual funds, and crypto trading. Disclaimer: CFDs have a high risk of losing money rapidly. About 80% of retail investor accounts lose money due to leverage when trading CFDs with this provider. Please note that CFDs are not complying with the islamic religion. And if you want to trade in CFDs you should consider a swap-free account to follow islamic rules. Learn more about CFDs for muslims. Interactive Brokers Offering of Investments

Interactive AdvisorsInteractive Brokers also provides many advisory programs for those who want to build their own portfolios by experts. The annual management fees ranging from 0.08% to 1.5% and minimums start at just $100. Notes:

|

Account Opening

Countries availableInteractive Brokers is available in over 200 countries including USA, Japan, Italy, and more. There are some countries that you can’t open an account from which have unstable political or economic backgrounds like North Korea.

Interactive Brokers countries list Account typesInteractive Brokers has different account categories available like:

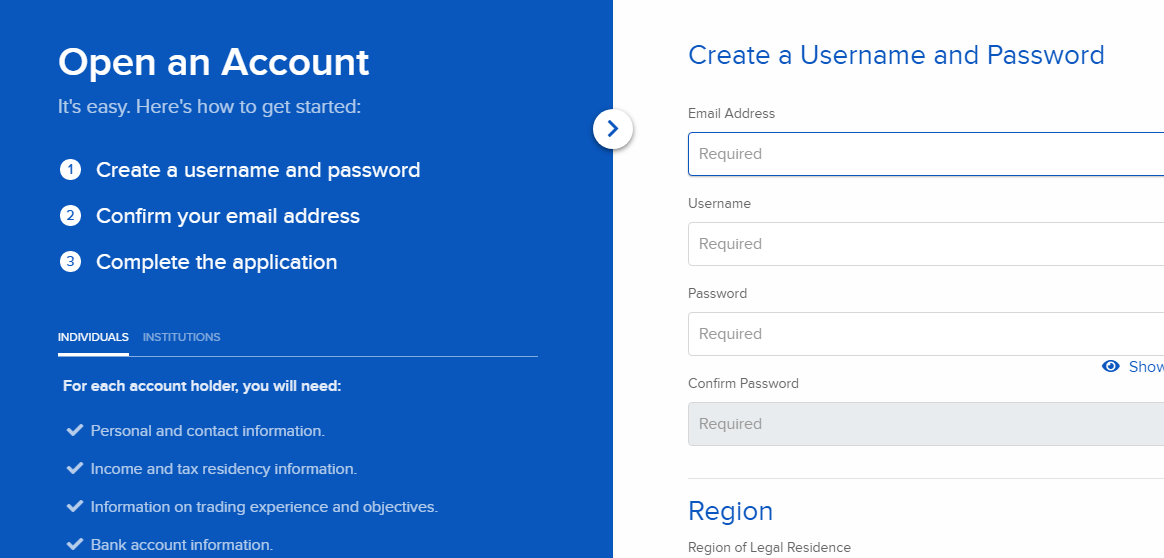

Each of the previous accounts has its own features and relative fees and commissions. Interactive Brokers also provides a demo account with 0 fees if you want to experience the trading platform with no risk. Min depositFor a lot of accounts, Interactive Brokers does offer a minimum deposit of $0. How to open an accountYou can open an Interactive Brokers account in minutes through these steps:

Interactive Brokers - Account opening |

Fees and Commissions

CommissionsThe commissions of Interactive Brokers differ from an account type to another and from trading instrument to another as the following:

There are three types of commissions:

Commissions are calculated based on volume and any external fees are added on. For example, in the USA, first USD 10,000 in face value have a commission of 0.1%, then it becomes 0.025% if greater than $10,000.

More than 40,000 Funds Available at the Lowest Cost Including 7,700 Commission-Free Funds. There’s also a fixed low commission of EUR 4.95 per trade for all other funds.

Disclaimer: CFDs have a high risk of losing money rapidly. About 80% of retail investor accounts lose money due to leverage when trading CFDs with this provider. Please note that CFDs are not complying with the islamic religion. And if you want to trade in CFDs you should consider a swap-free account to follow islamic rules. Learn more about CFDs for muslims. Non-trading fees

(you can check the full withdrawal fees in withdrawal fees section) |

Deposit and Withdrawal

Account CurrenciesThe Interactive Brokers account has different base currencies options like USD, EUR, HKD, GBP, AUD, SGD, CHF, CAD and JPY. Notes:

Deposit1. OptionsInteractive Brokers supports depositing using different options like:

In addition to the previous depositing options, Interactive Brokers also accepts transferring your money from another broker. On the other hand, there’s no option to deposit into your account using credit/ debit cards or electronic wallets. Interactive Brokers deposit methods

2. FeesInteractive Brokers offers a free-of-charge deposits 3. TimeIt takes from 1 - 2 days in order to complete your deposit into your account in Interactive Brokers. Withdrawal1. OptionsInteractive Brokers only provides withdrawal using bank transfers. Interactive Brokers withdrawal methods and fees

2. FeesInteractive Brokers offers a free withdrawal at the beginning of each month with $0 fees. The subsequent withdrawals have fees according to the base currency of your account and the method you use for withdrawals 3. TimeIt takes about 2 business days to withdraw your money from Interactive Brokers. |

Platforms and Languages

|

Interactive Brokers works on different platforms like Desktop / Mobile / Web. Each one of them has its own features and specifications. In the following section we will know more about them. Web Platform (Client Portal)

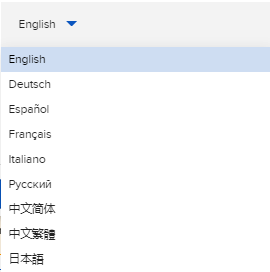

LanguagesThe web application of Interactive Brokers is available in a number of languages including some major languages like English, Spanish, Russian, and more.

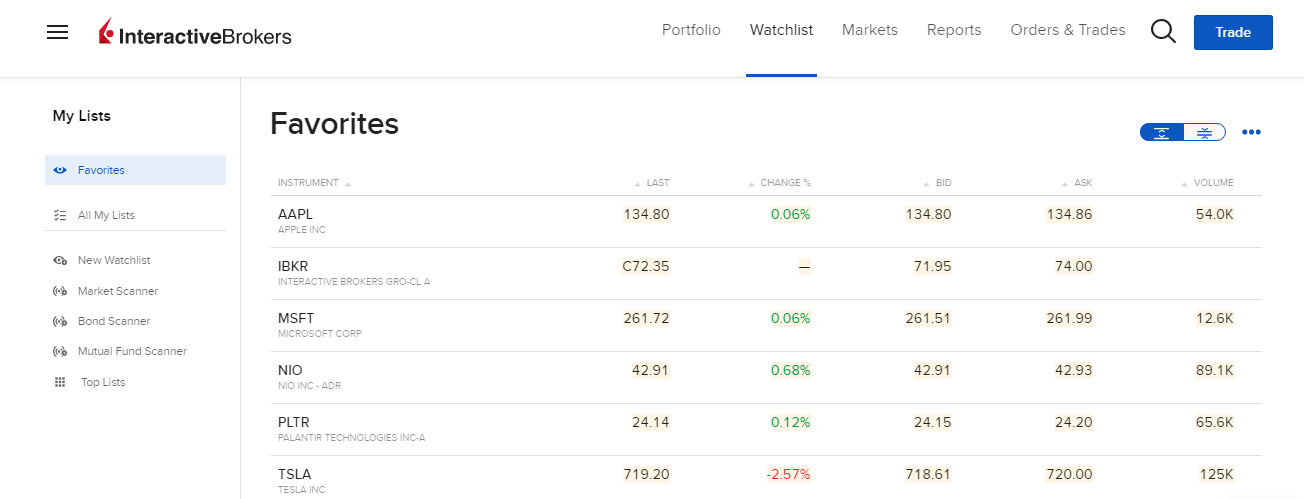

Interactive Brokers - Web - Languages User interface (UI)The UI of the web platform looks good and it’s user friendly with all functions in the right place.

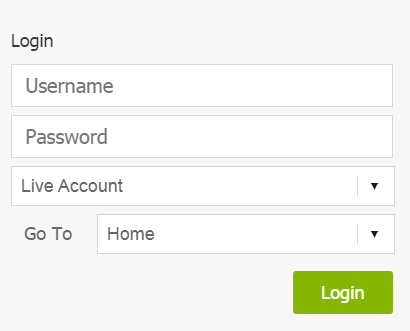

Interactive Brokers - Web - UI Login and SecurityThe web version of Interactive Brokers has a two-factor authentication method for login which is much safer than a lot of other broker platforms.

Interactive Brokers - Web - Login SearchingThe search function in the web platform works fine with the ability to find the product you’re searching for easily.

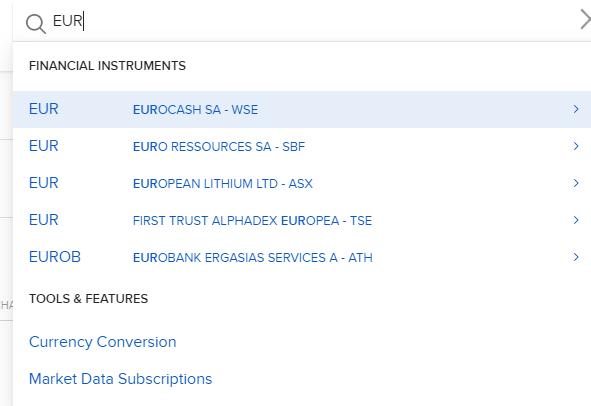

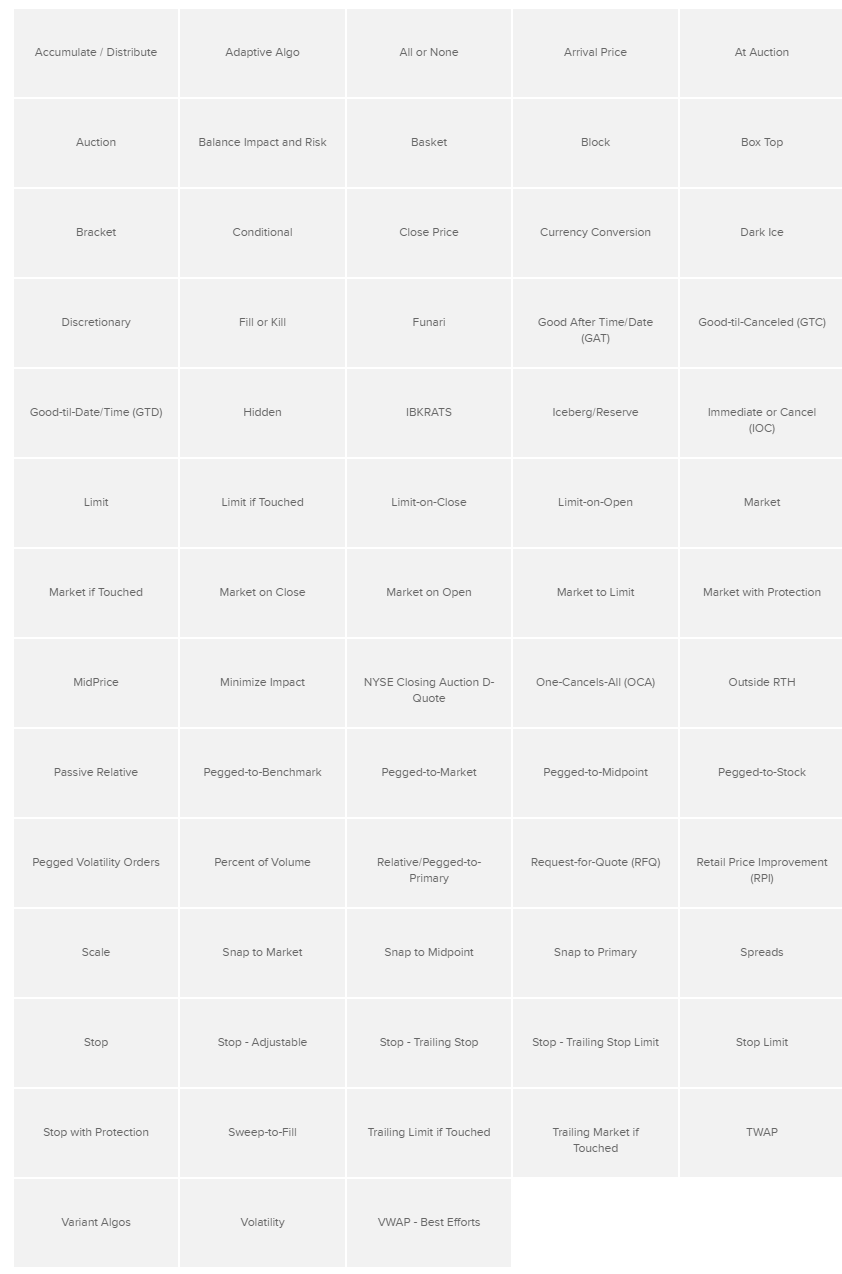

Interactive Brokers - Web - Search Placing ordersInteractive Brokers has a lot of order types and algos that you can use including:

Interactive Brokers - Web - Order Types and Algos Notifications and alertsThe web version has a notification and alerts option and you can find it in settings. Portfolio and reportsThe portfolio and reports are good with the fundamental data available within the platform including activity and custom statement. TWS (Desktop Version)

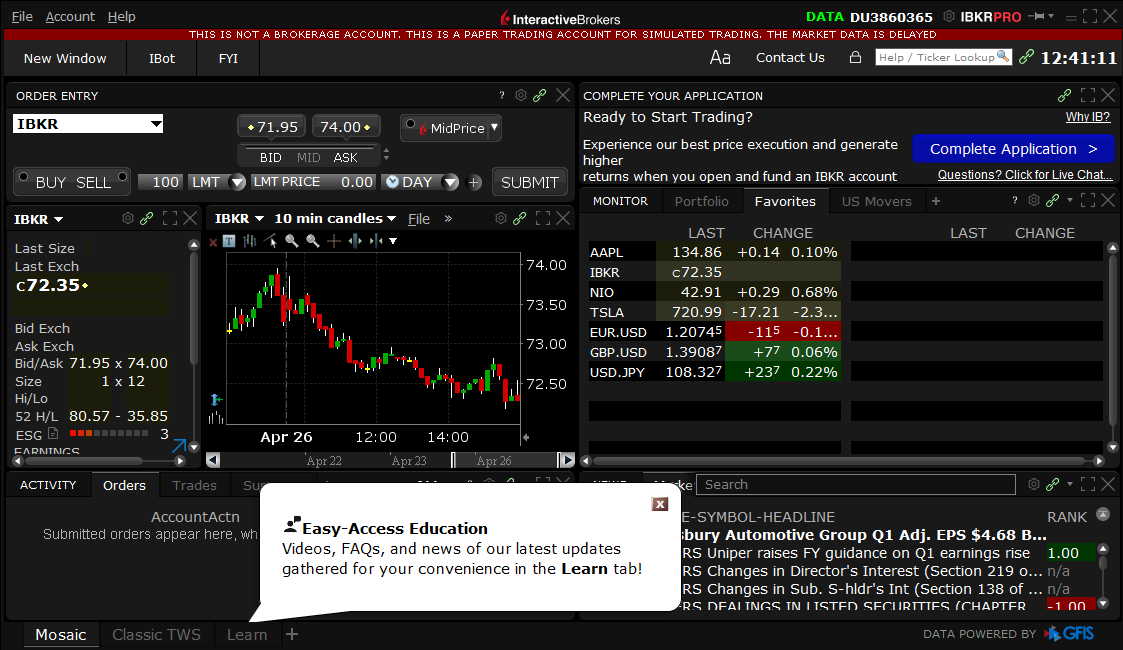

LanguagesThe TWS is available in the same languages of the web trading platform. User interface (UI)The UI of the TWS platform looks complicated and it’s very hard for beginner traders to use it.

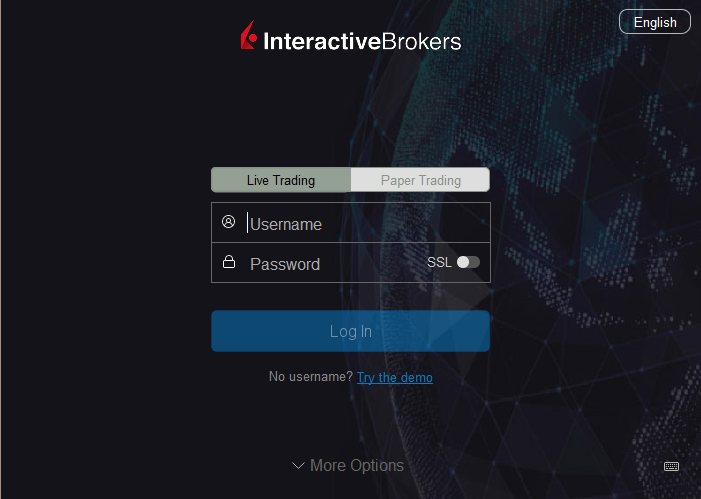

Interactive Brokers - Desktop - UI Login and securityAs the web trading platform, TWS has two-factor authentication for login which is safe.

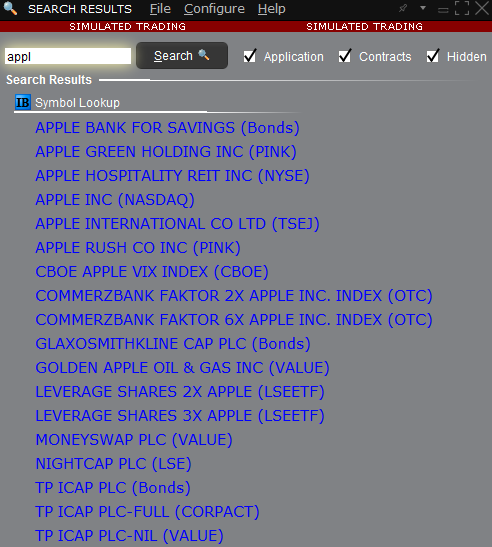

Interactive Brokers - Desktop - Login SearchingThe search function within the TWS platform is not very user-friendly and it takes too much time to load results.

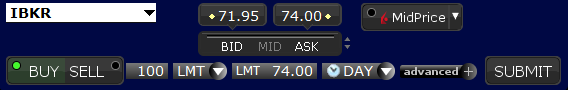

Interactive Brokers - Desktop - Search Placing ordersSame as the web platform, there is a number of order types including, but not limited to:

Interactive Brokers - Desktop - Place Orders Notifications and alertsThe reports in the TWS platforms have the same data like the wenb trading platform. IBKR (Mobile Platform)

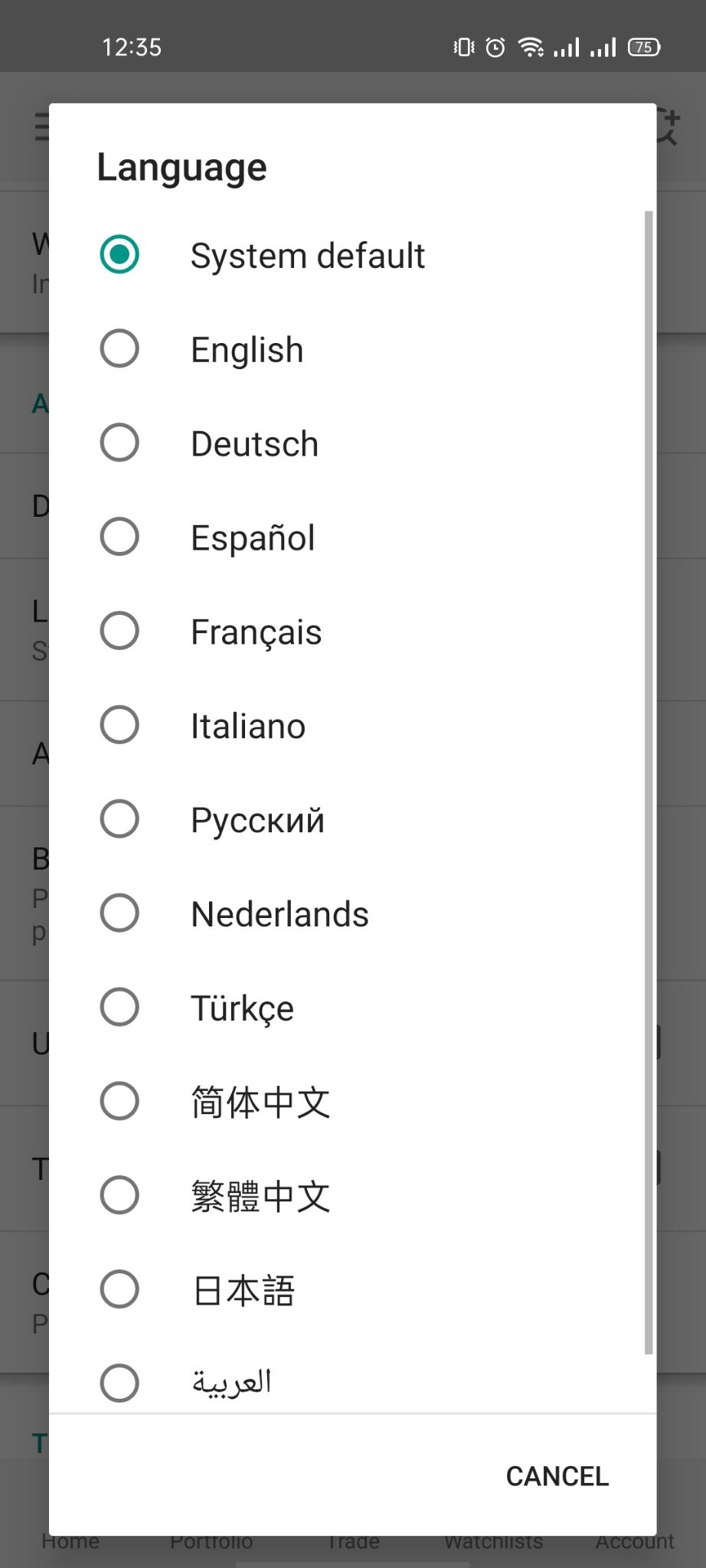

LanguagesThe IBKR application is available in a variety of languages including Arabic, English, Japanese, and more.

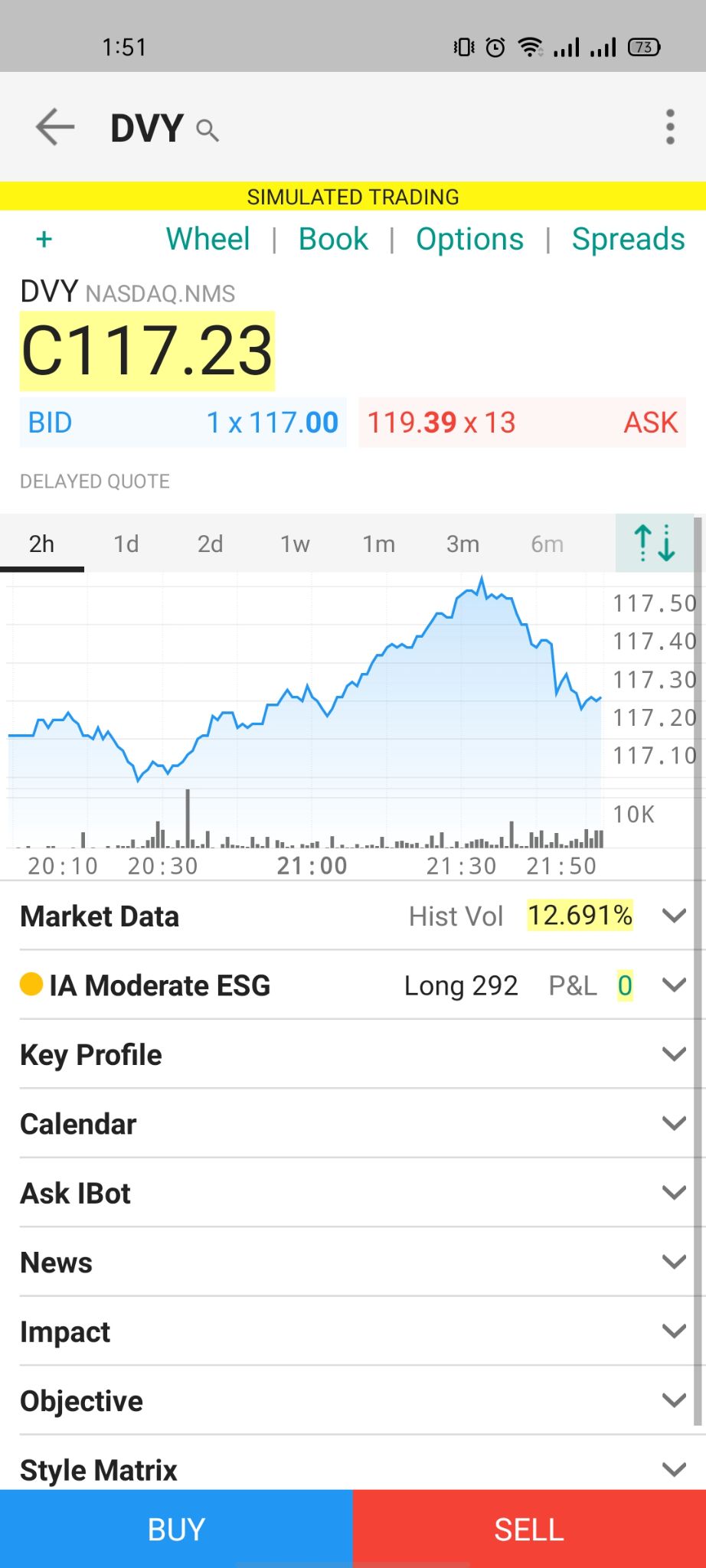

Interactive Brokers - Mobile - Languages User interface (UI)The IBKR application has a very user friendly UI with the ability to navigate easily and find the right information in the right place.

Interactive Brokers - Mobile - UI Login and securityLike the web and desktop trading platforms, the mobile trading app has a two-factor authentication method for login.

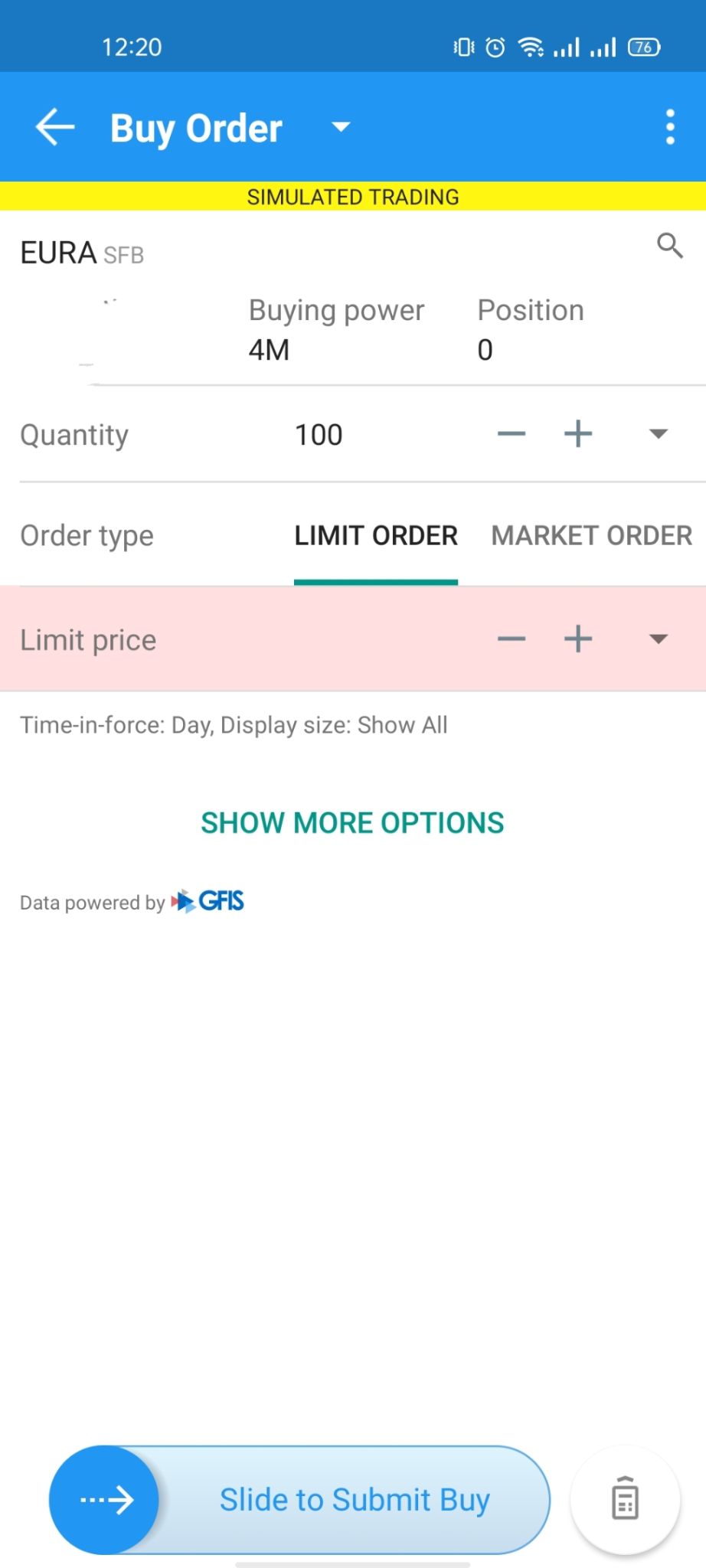

Interactive Brokers - Mobile - UI SearchingThe searching function in the IBKR app is very good and you can find the instrument you’re looking for just by typing the first letters of it. Placing ordersSame as the web platform, there are a lot of order types like:

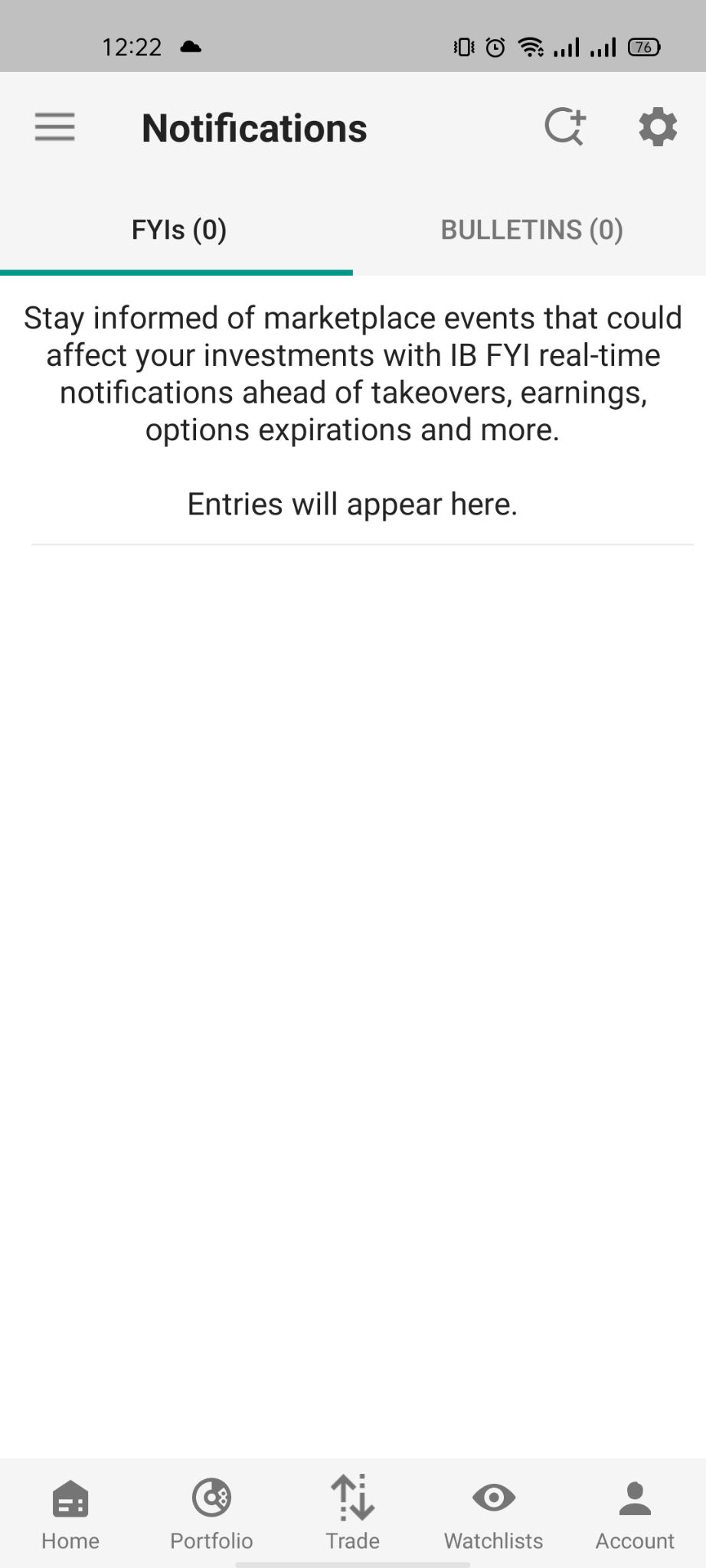

Interactive Brokers - Mobile - Place Orders Notifications and alertsIn the IBKR app, you can set notifications and alerts from a separate tab within the application.

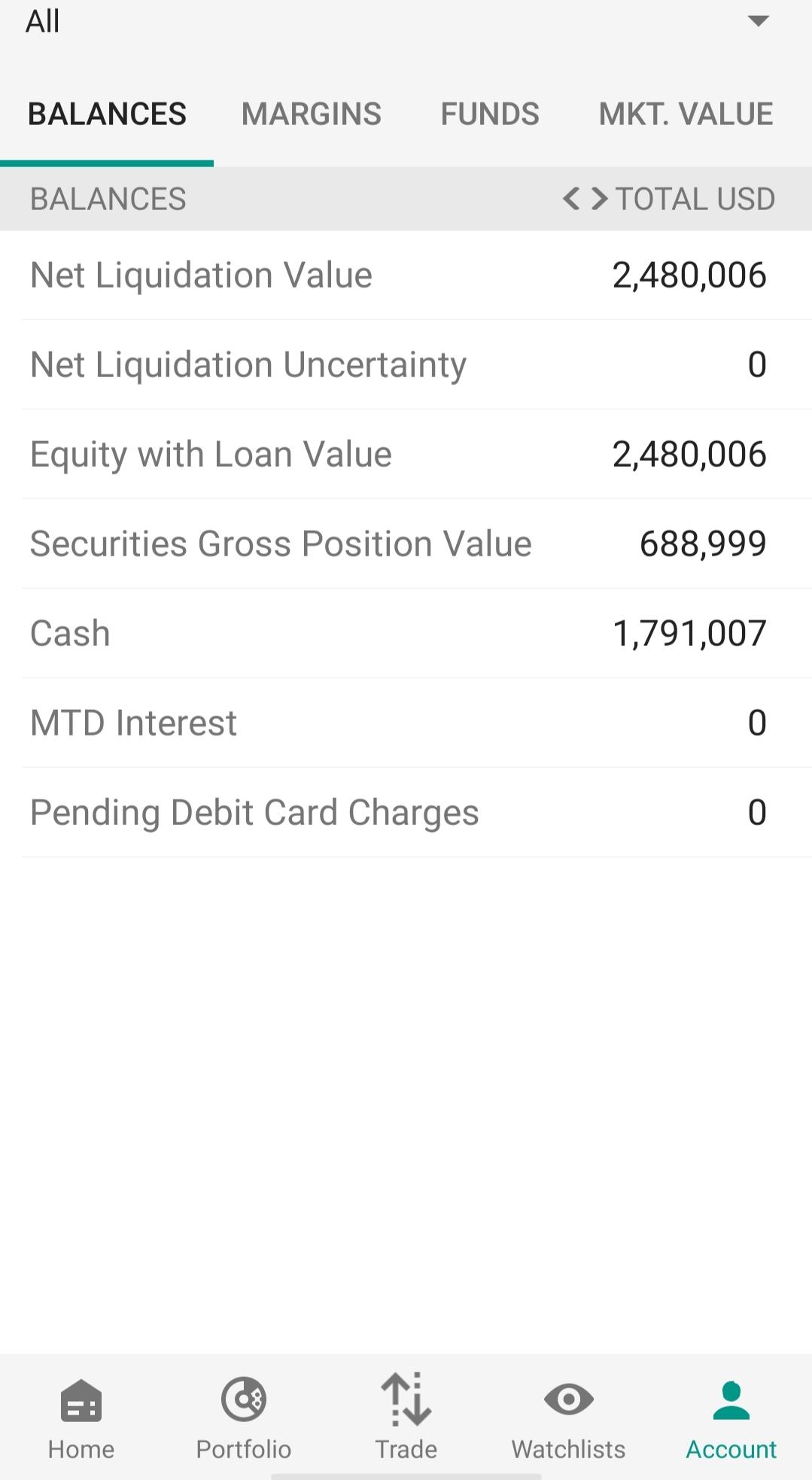

Interactive Brokers - Mobile - Notifications Portfolio and ReportsThe IBKR app has a clear fee and portfolio reports with the ability to view earnings and all other fundamental data. |

Research Tools

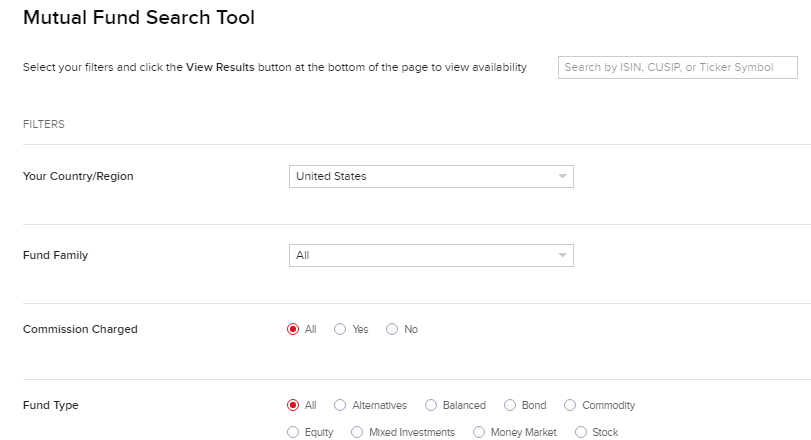

SourcesInteractive brokers has good research tools as well as other third party tools that you can use. Mutual Funds Search ToolThis tool allows you to search mutual funds by country, family, commission, and fund type.

Interactive Brokers - Research - Mutual Funds Search Tool Fundamental dataInteractive Brokers provides fundamental data like income statements on all its platforms. ChartingThe charting too of Interactive Brokers is very useful with over 120 indicators to choose from.

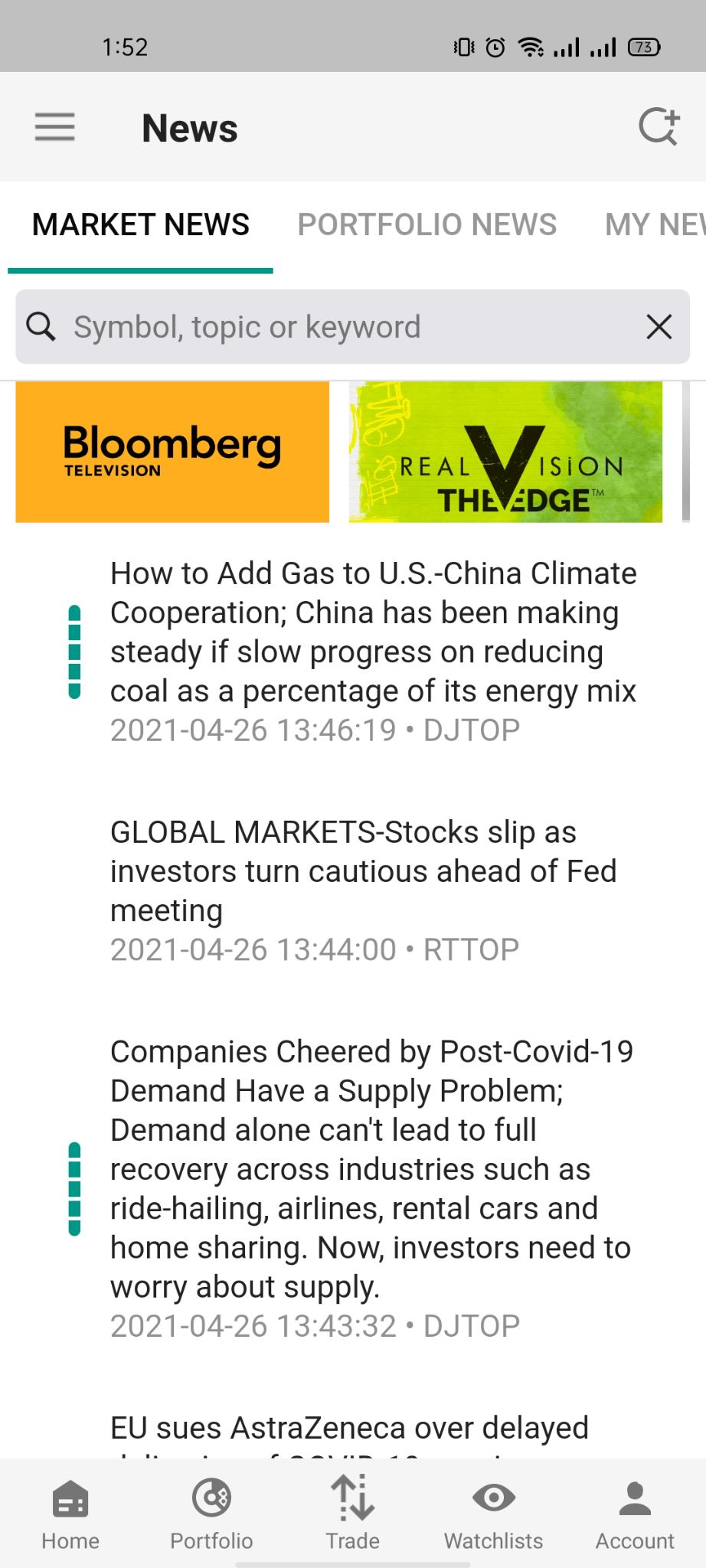

Interactive Brokers - Research - Charting NewsfeedIf you like to keep up with the financial news, Interactive Brokers provides a news section to do so. It’s available on the web and the mobile application platform.

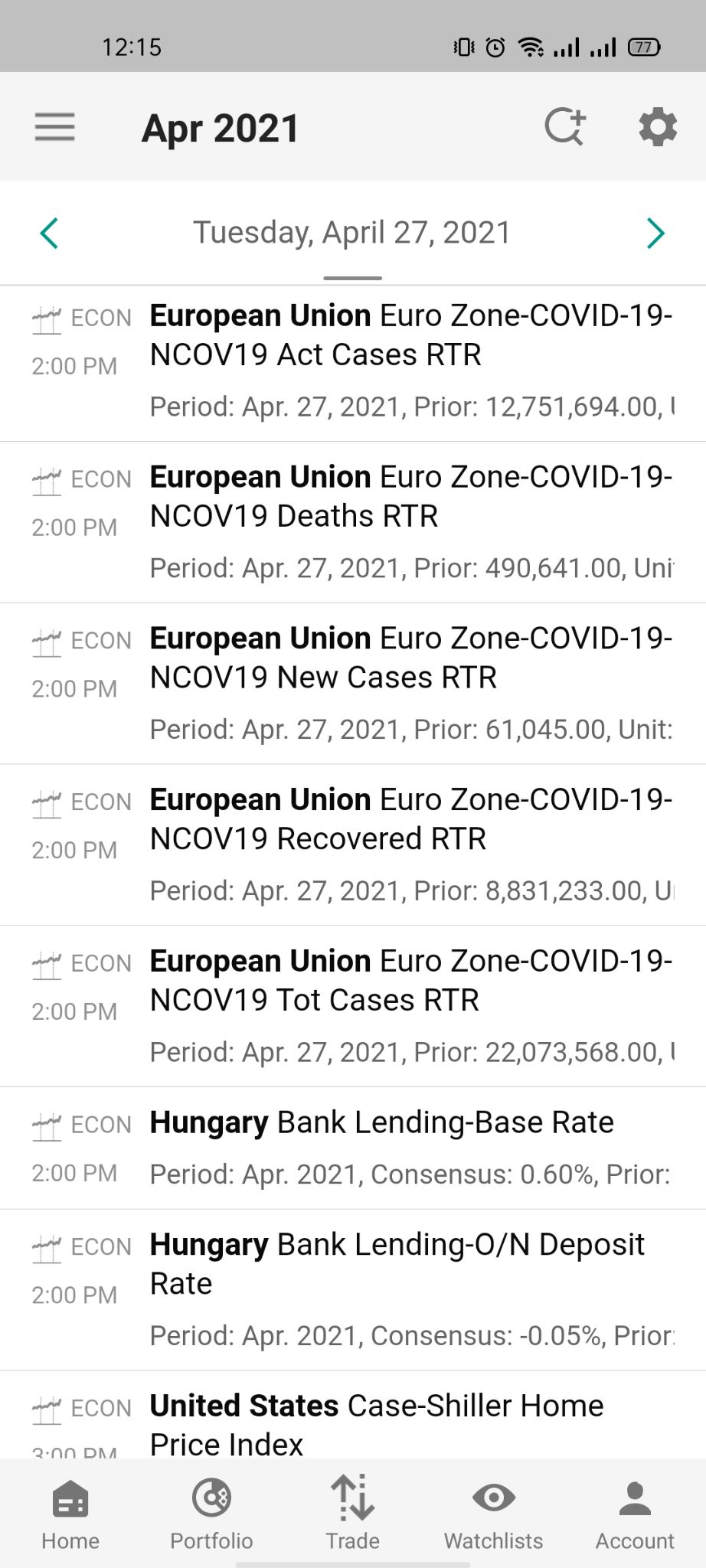

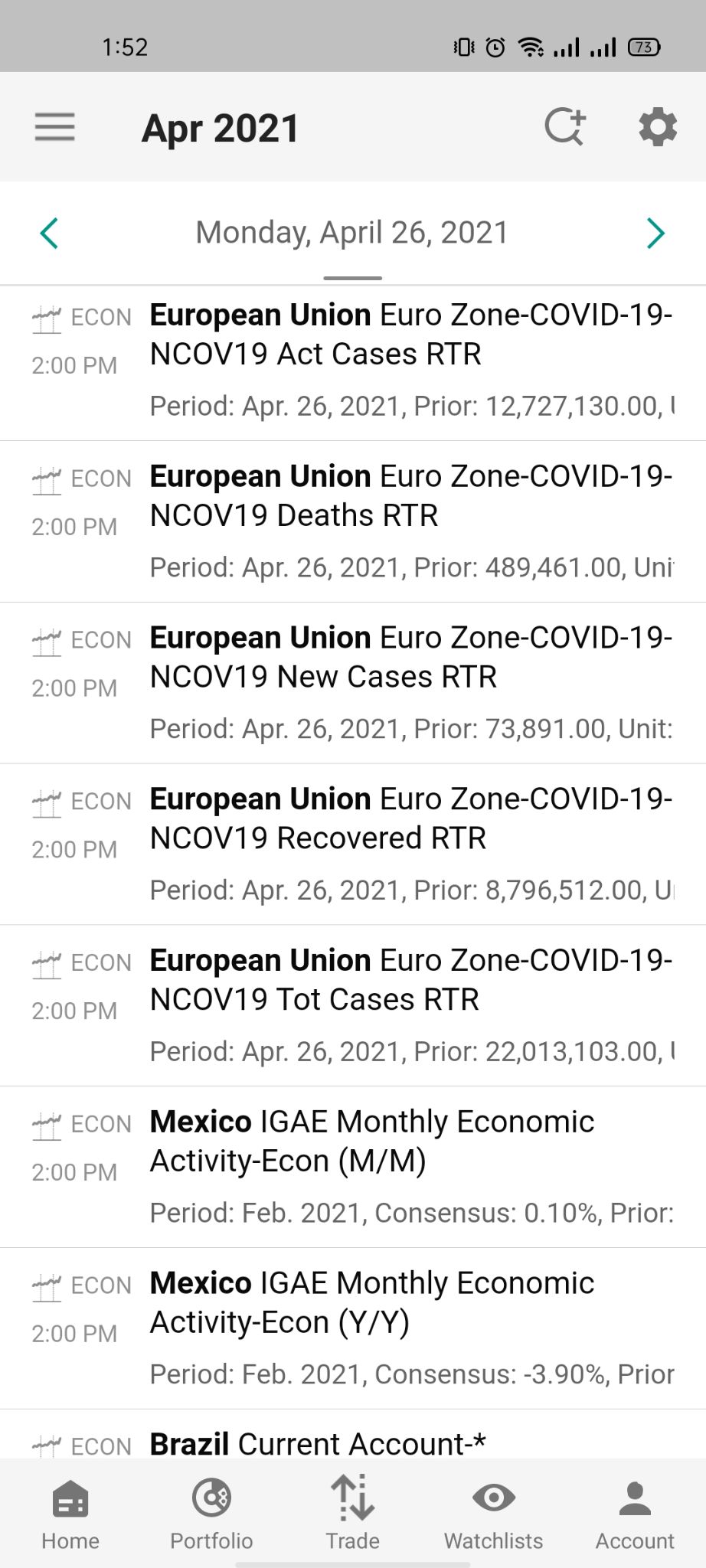

Interactive Brokers - Research - Newsfeed Economic CalendarIn order not to miss any important financial event. Interactive Brokers provides an economic calendar for the upcoming financial events.

Interactive Brokers - Research - Economic Calendar |

Customer Service

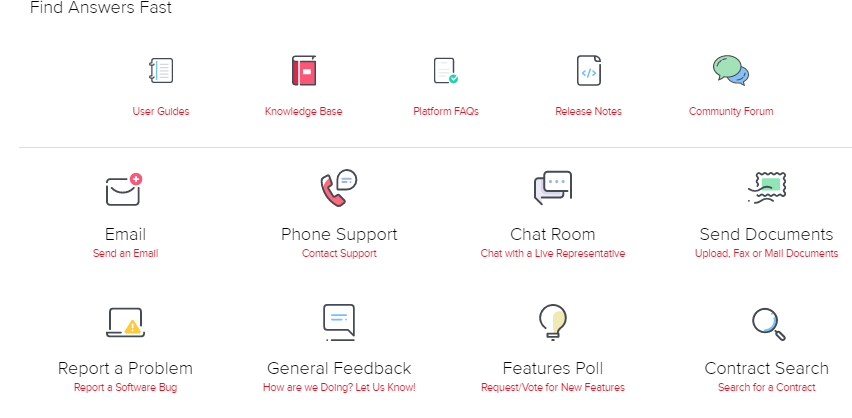

OptionsInteractive Brokers supports different customer service channels like:

LanguagesThe languages available for customer service are many with the support of major languages like English, Russian, Chinese, and more.

Interactive Brokers - Customer Support |

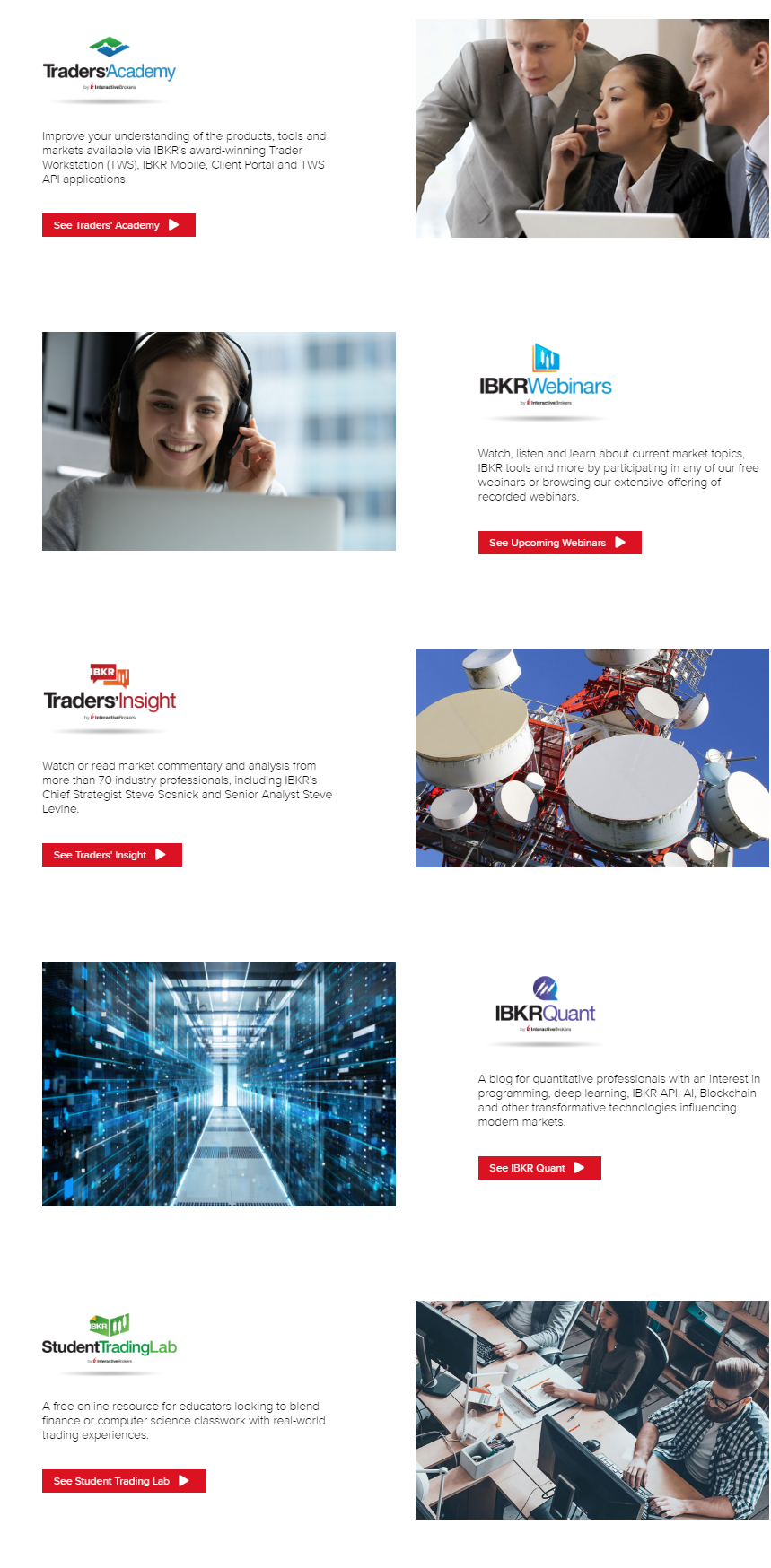

Education

Interactive Brokers provides some great educational materials for both beginners and advanced traders. Those educational materials are:

Interactive Brokers - Education |

FAQs

FAQs

Conclusion:

|