XTB Full Review

XTB Full Review

XTB or X-trade Broker is one of the best forex and CFD brokers with more than 250,000 users around the world. It was founded in Poland, in 2002 and regulated by different financial authorities including the top-tier UK Financial Conduct Authority (FCA). Disclaimer: CFDs have a high risk of losing money rapidly. About 80% of retail investor accounts lose money due to leverage when trading CFDs with this provider. CFDs are not complying with the islamic religion. And if you want to trade in CFDs you should consider a swap-free account to follow islamic rules. Learn more about CFDs for muslims.

XTB Full Review - Key Statistics

Safety

Is XTB regulated?The XTB broker is regulated by many financial authorities in different countries like:

Is XTB a scam?XTB safety is divided into 2 parts: the safety of the broker itself and the safety of the client. Broker safetyXTB has a long track record since its foundation in 2002 and has survived from many financial crises up-till-now with more than 250,000 users worldwide. XTB is also listed in the Warsaw stock exchange in Poland and publishes its financial statements regularly. Also, XTB is regulated by top-tier financial authorities like the FCA which is trustworthy. Client protectionThe XTB client has protection according to his/ her country from different regulators. The table below shows the client protection amounts. XTB Legal Entities Table

XTB also provides a client negative balance protection for forex and CFD trading, but only for retail clients from the European Union. The non-EU clients are not covered by any negative balance protection. 2-step verificationUnfortunately, XTB lacks the two-step verification method while logging in. |

Offering of Investments

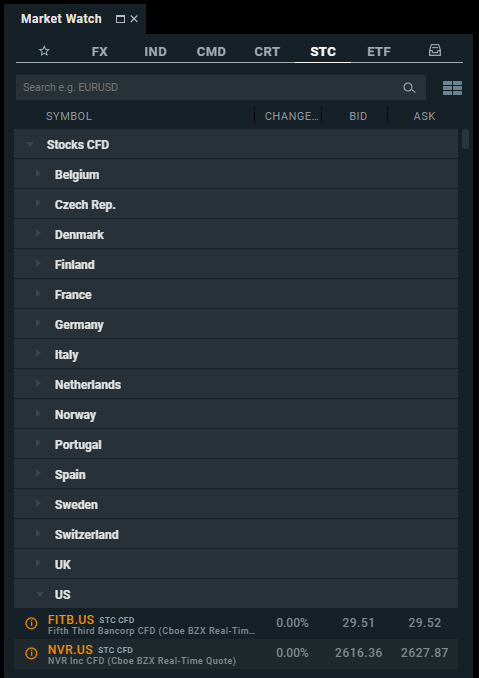

XTB is primarily a forex and CFD broker with the ability to trade in cryptocurrencies. It also provides a real stock and ETF trading for some European clients. Disclaimer: CFDs have a high risk of losing money rapidly. 79% of retail investor accounts lose money due to leverage when trading CFDs with this provider. CFDs are not complying with the islamic religion. And if you want to trade in CFDs you should consider a swap-free account to follow islamic rules. Learn more about CFDs for muslims. XTB Offering of Investments

Note: The FCA bans crypto trading for the UK retail customers from 6th of Jan 2021. The real stocks and ETF trading are also available for XTB traders in Europe except the UK, Cyprus, Hungary, and Italy. XTB real stocks and ETFs

|

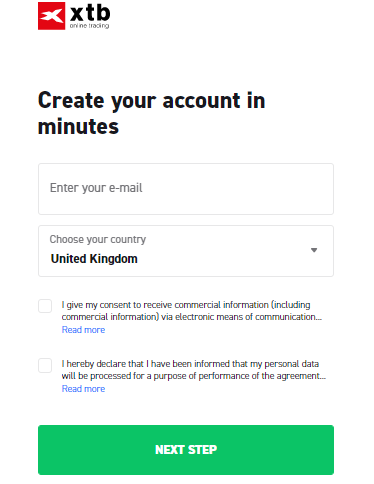

Account Opening

Countries availableXTB provides an account for European clients and from different countries all over the world. A special note here is that you cannot open an XTB account if you’re from the US. XTB countries list Min depositFor individuals, the min deposit is 0$ and you can deposit the amount you want,but the min deposit for corporates is relatively high of £15,000. Account typesXTB provides 2 types of accounts with different features:

In addition to the previous account types, you can open an islamic account that follows the islamic rules by providing an evidence that you line in a muslim country. XTB - Account comparison

XTB also provides a demo account with 0 fees if you want to experience the trading platform with no risk. There’s an option to join the XTB affiliate partner program if you want as well. How to open an accountYou can open an XTB account in minutes through these steps:

XTB - Account opening Notes: You can verify your identity through video or by uploading a scanned copy of your ID, passport, or driver license. For a residence proof, you can use utility bills or bank statements. |

Fees and Commissions

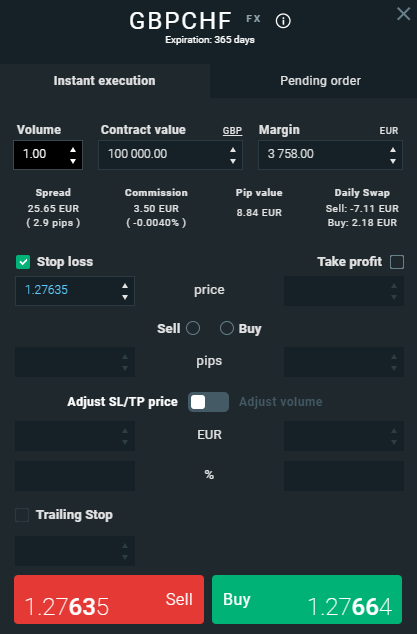

Before diving into the trading fees and commissions, you should know that they are different according to your account type.

For the islamic account there’s a commission as well. For simplicity, we divide this section into 3 parts: Commissions, trading fees, and non-trading fees. CommissionsThe commissions vary from account type to another. Commissions by Account Type

Trading FeesForex fees

Index feesFrom more than 40 indices all over the world, the spread is between 0.25 to117 pips, which is very competitive. Commodity feesFor more than 20 commodities, the spread is between 0.016 to 12 pips. Stock and ETF CFDsWith more than 1,800 instruments all over the world, the spreads start from 0.0012 pips. Disclaimer: CFDs have a high risk of losing money rapidly. 79% of retail investor accounts lose money due to leverage when trading CFDs with this provider. CFDs are not complying with the islamic religion. And if you want to trade in CFDs you should consider a swap-free account to follow islamic rules. Learn more about CFDs for muslims. CryptocurrenciesFor more than +20 cryptocurrencies, the fees range between 0.5%-2.5%. Please note that the availability and cost of these cryptocurrencies may vary according to your country. Non-trading feesFor the non-trading fees, XTB has the best options when compared with other brokers as the following:

(you can check the full withdrawal fees in withdrawal fees section)

|

Deposit and Withdrawal

Account CurrenciesThe XTB account has 5 base currency options for its users. Those currencies are USD, EUR, GBP, HUF, and PLN. Notes:

DepositOptions XTB allows several ways to deposit with a no minimum deposit. This includes credit cards, bank transferred, and electronic wallets. XTB deposit methods

XTB supports depositing using different electronic wallets such that:

Fees XTB charges nothing when depositing using bank transfers and credit cards, but on the other hand it charges 2% of the amount deposited when using an electronic wallet. Time Depositing using credit cards or electronic wallets is instant while depositing using a bank transfer may take several business days. WithdrawalOptions XTB charges nothing when you withdraw your money with a minimum of 100$. The way to withdraw your money is by a bank transfer only. XTB withdrawal methods and fees

Fees If your withdrawal amount is under a specified amount, XTB charges you with a fee according to your account base currency as shown in the table below. XTB min withdrawal fees

Time It takes 1 business day to withdraw your funds. |

Platforms and Languages

|

XTB works on different versions for platforms like mobile, web, and desktop. Web

The web version is available in 2 platforms:

Languages The xStation 5 is available in a variety of languages like English, Arabic, Chinese, and more. xStation 5 Languages

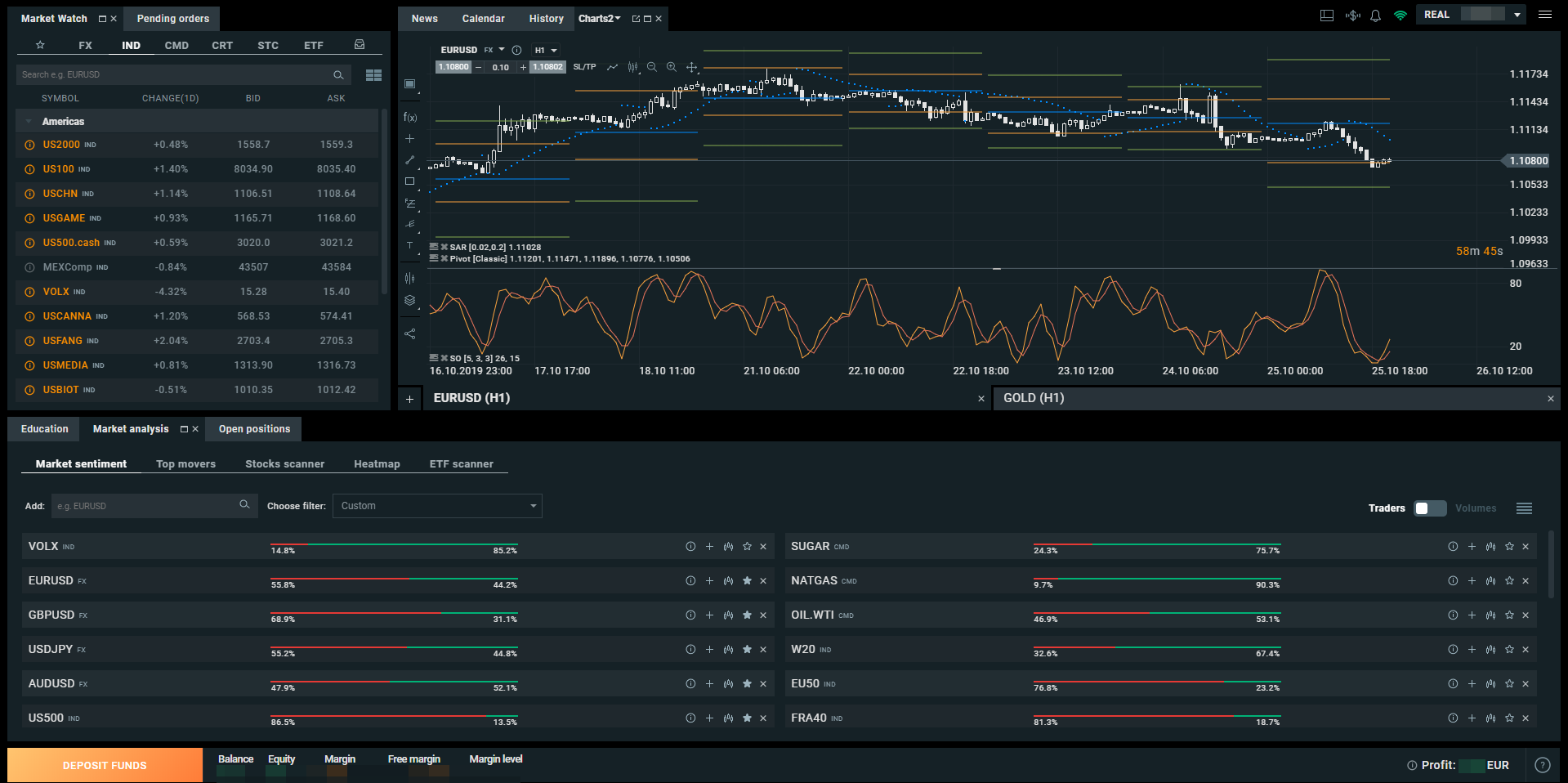

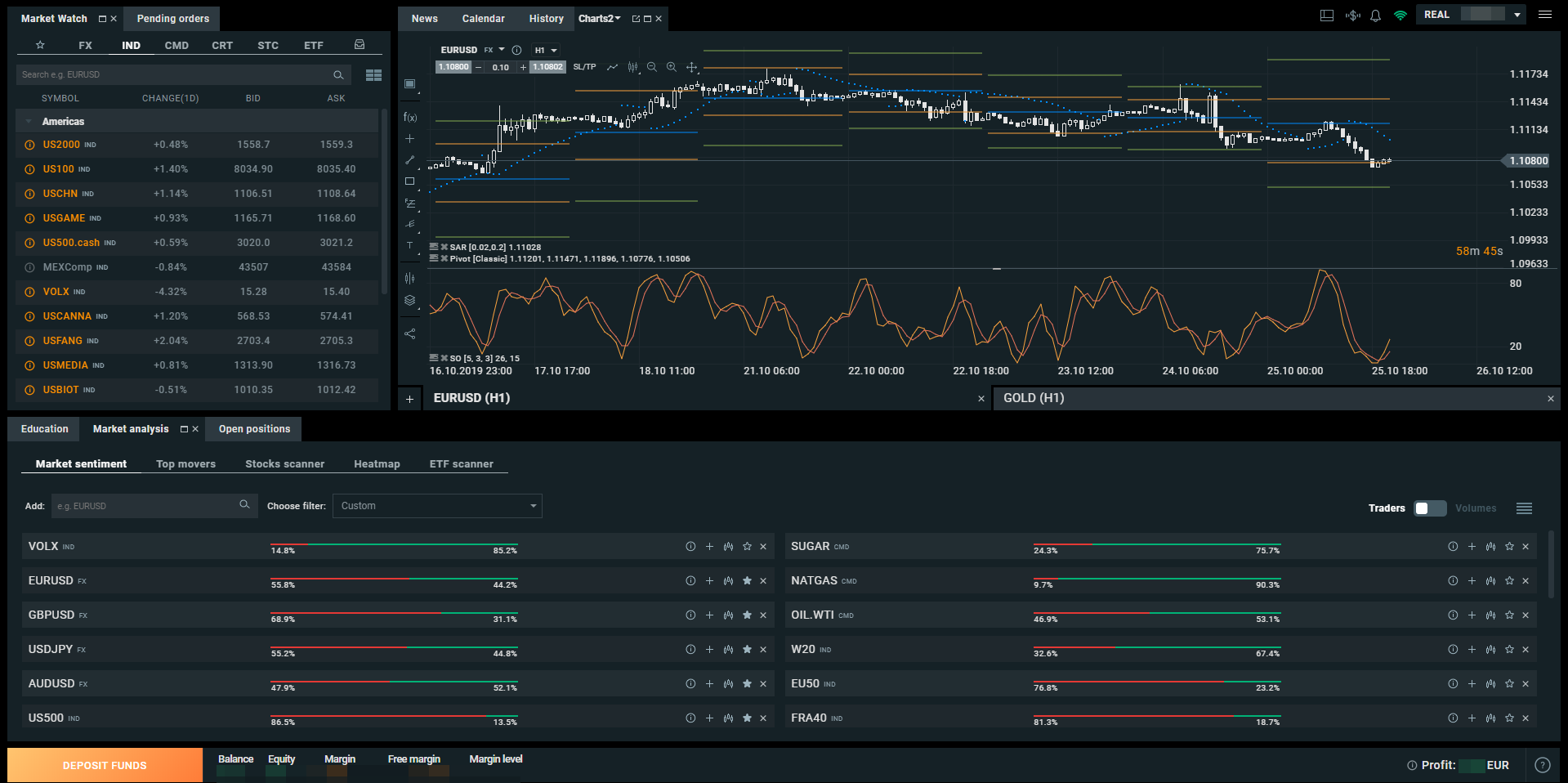

User interface (UI) The UI of the web trading platform looks complex when you first look at it, but it seems much easier when you start working with it. It has a user-friendly design that’s customizable and easy to use.

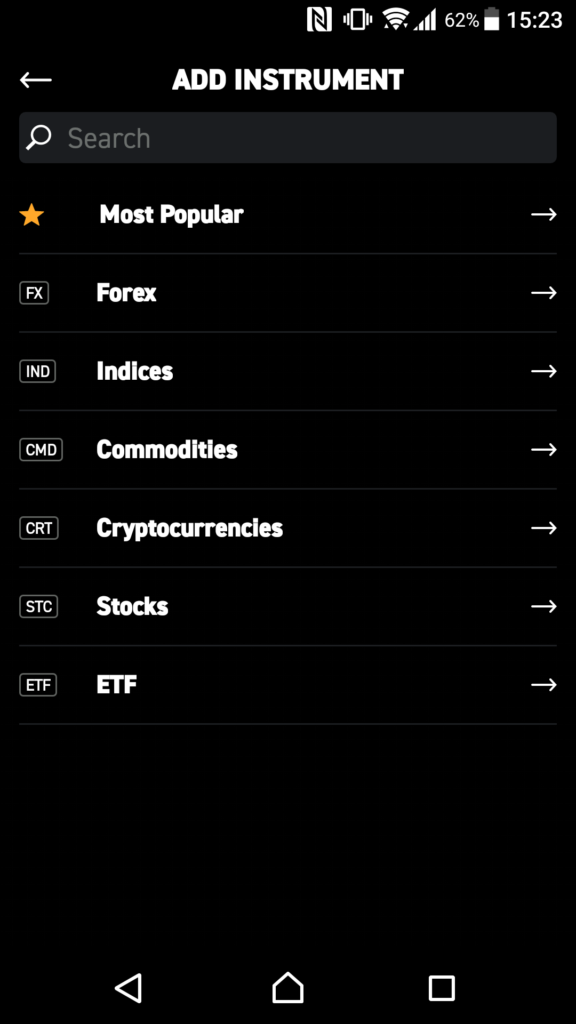

xStation 5 UI Login and Security Unfortunately, the web trading platform lacks the two-step verification method for much security. Searching You can search in the web trading platform by clicking on ‘Market Watch’ and enter the product, or you can browse by categories like the Forex Pair, CFDs, real stocks, and more.

xStation 5 - Search Placing orders There are 4 types of orders:

In addition to those 4 types, there’s another order which is the time limit ‘Good ‘til time’ or GTT. A useful tool in this platform is the trader calculator that helps you calculate different parameters in your trade.

xStation 5 - Place order Notifications and alerts You can customize the notification settings as you like for particular events and push SMS messages, email, etc. Portfolio and reports The web platform has a clear portfolio and fee reports with an ability to push daily reports via email.

DesktopThe xStation 5 also provides a desktop version with similar UI and functionalities as the web platform.

xStation 5 - Desktop Version

Mobile Platform

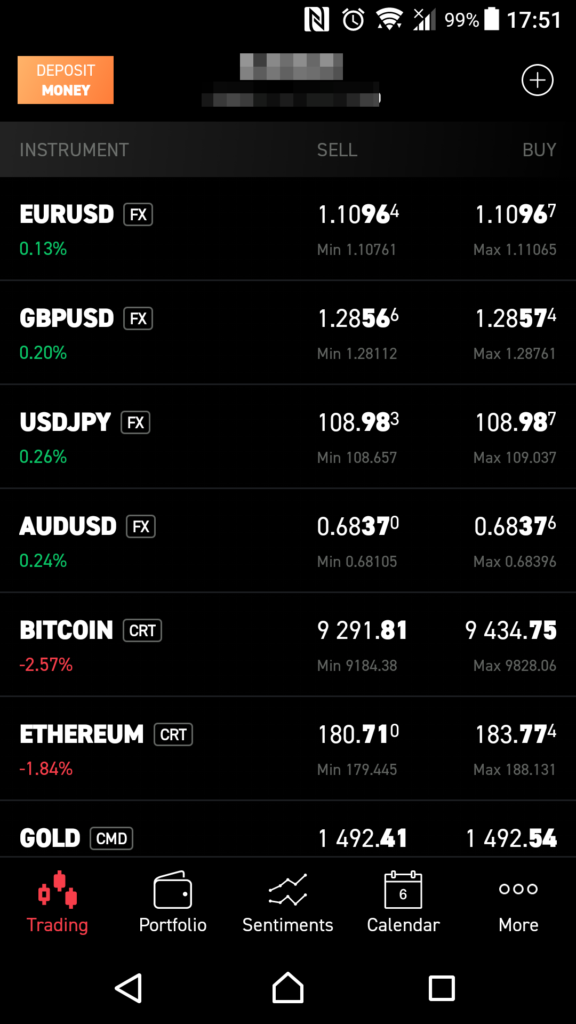

The xStation 5 as well as the MT4 have mobile applications for their platforms that are available for IOS and Android devices. And in this review we will consider the xStation 5 mobile application. Languages The mobile platform is available with the same languages like the web trading platform. User interface (UI) The interface of the mobile platform is very user-friendly with the most important tools for any trader.

xStation 5 Mobile App - UI Login and security Unfortunately, the web trading platform lacks the two-step verification method for much security, but at the same time you can set a fingerprint verification in your mobile device to provide more security. Searching Like the web trading platform, you can type the product name in the search bar or browse in different categories smoothly.

xStation 5 Mobile App - Search Placing orders Same as the web platform, there are 4 types of orders:

In addition to those types, there’s another order which is the time limit ‘Good ‘til time’ or GTT.

xStation 5 Mobile App - Place Orders Notifications and alerts You can set your preferred notification alerts in your mobile such that the market alerts or market news. |

Research Tools

When it comes to research and tools, XTB provides very useful charting in a user-friendly manner with the main fundamental data. SourcesThere are 2 sources for the information in the research part:

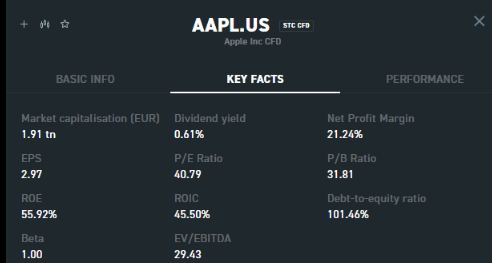

The research tools are available in a number of languages like English and Arabic with the ability to show news commentary in our language if we set the language to English. Trading ideasYou can find short-term trading ideas in the news flow, but when you try to search for a specific term, you will spend more time to find your term as the trading ideas are not well-structured. Fundamental dataWhen you try to view the fundamental data, you’ll find it very limited and you can not access neither the financial statements nor the operational metrics.

XTB - Fundamental data ChartingXTB provides great charting tools that allow you to use 35 technical indicators with the ability to save charts.

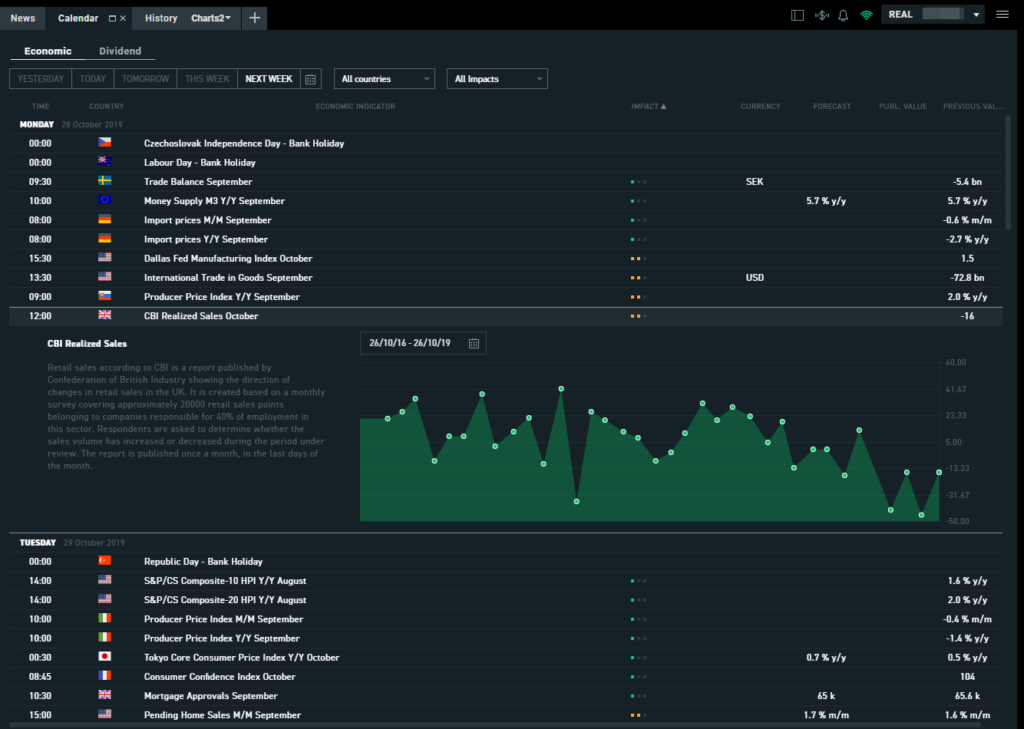

XTB - Charting NewsfeedThe news feed here is a mix of recommendations, market, and data releases from the economic calendar. In the economic calendar, you can see upcoming events with a short summary per each along with its historical data.

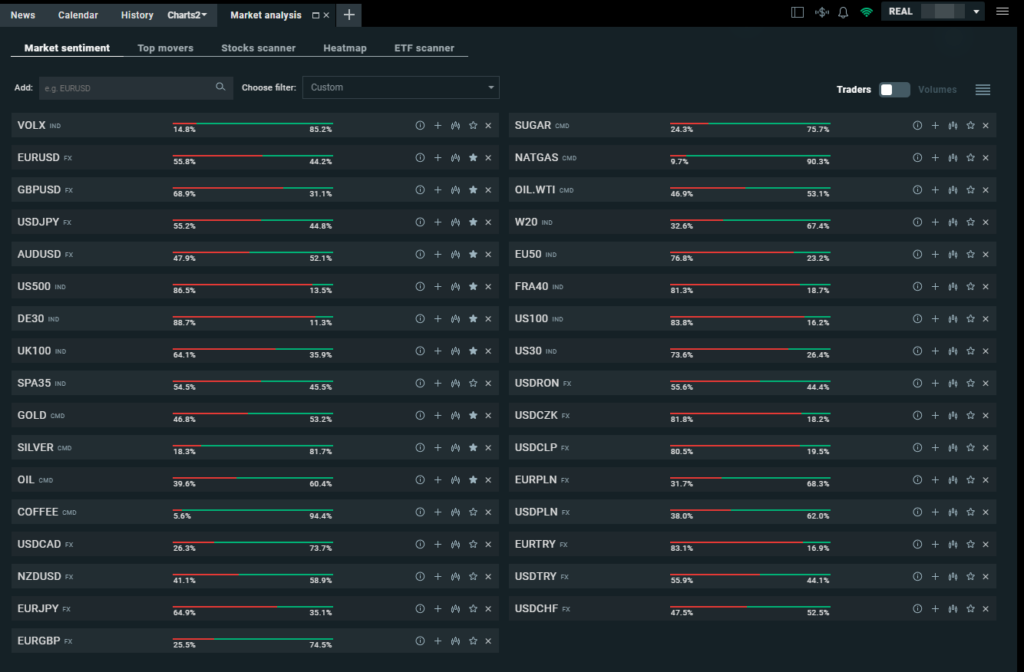

XTB - Newsfeed Other toolsMarket sentiment analysis This shows the percentage of long and short positions among clients for each asset Heatmap This tool shows a visualization of winners and losers.

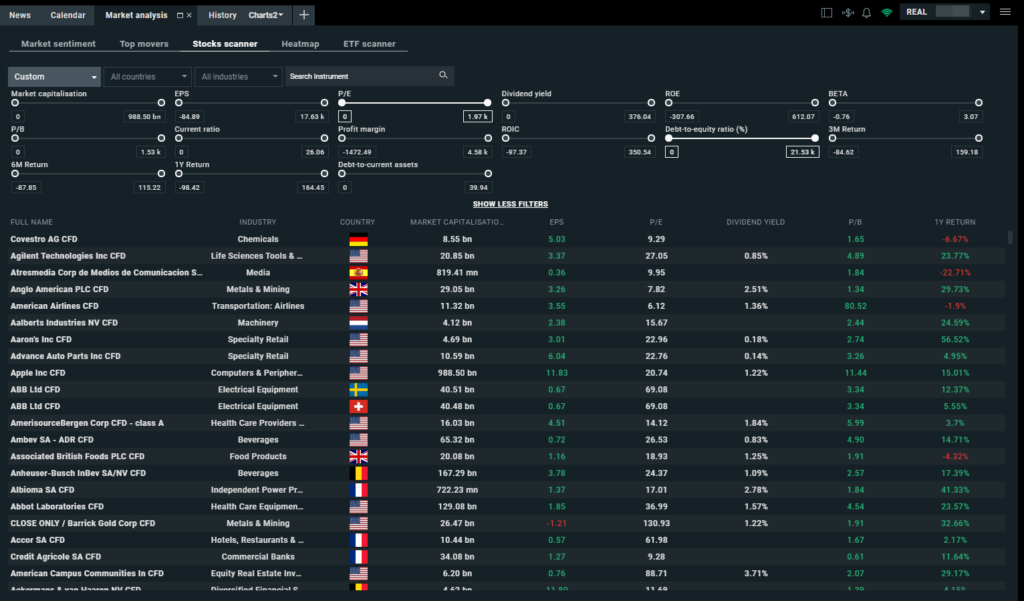

XTB - Heatmap and Market sentiment analysis Stock scanner This filters the stocks you may trade on using 15 different factors like market capitalization, P/E, beta, and debt-to-equity ratio.

XTB - Stock scanner ETF Scanner This tool is like the stock scanner and provides 10 different factors to filter the ETFs like cumulative return and the total value of assets. |

Customer Service

OptionsXTB supports different customer service channels like live chats, phone calls, and emails with a fast response time. LanguagesThe languages available for customer service are many with the support of major languages like English, German, Arabic, and more.

XTB - Customer service ExperienceFor the live chat, it works very fine with faster responses and relevant answers. Phone calls also work fine with the support of many languages and countries. For the emails, the customer service team replies within a day without any problem. |

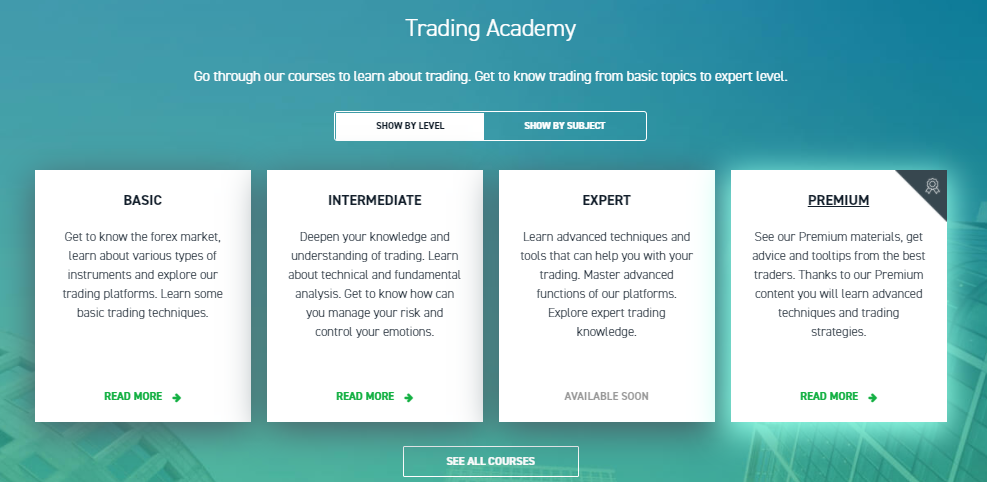

Education

Options XTB supports different customer service channels like live chats, phone calls, and emails with a fast response time. Languages The languages available for customer service are many with the support of major languages like English, German, Arabic, and more.

XTB - Customer service Experience For the live chat, it works very fine with faster responses and relevant answers. Phone calls also work fine with the support of many languages and countries. For the emails, the customer service team replies within a day without any problem. |

FAQs

|

Does XTB allow bot trading?

Does XTB give a bonus?

Does XTB provide active trader discounts?

Does XTB allow scalping?

|

XTB Full Review - Reviews

XTB Full Review - Review Conclusion

-

- Overall & individual ranks

- Pros: min deposit and withdrawal fees, user friendly, excellent education services

- Cons: high CFD fees, limited fundamental data, lacks 2 step verification

- Best for: CFD and forex trading

- Regulated by: FCA, CySEC, KNF, CNMV, IFSC

- Headquarters: London and Warsaw

- Foundation year: 2002

- Min Deposit : 0$

- Deposit methods: bank transfer, credit cards, and electronic wallets

- Withdrawal method: bank transfer

- Deposit and withdrawal fees: $0

- Base currencies: 5

- Offering of investments: forex, CFDs, crypto currencies, stock, and ETFs

- Number of users: +250,000