FXTM Full Review

FXTM Full Review

ForexTime or FXTM broker is a forex and CFD broker which was founded in 2011, Cyprus. Both FXTM broker and Alpari broker are owned by Andrey Valerievich Dashin. The main advantage of FXTM is that it’s regulated by the top-tier FCA unlike the Alpari broker. FXTM has over 3 million clients from all over the world.

Disclaimer: CFDs have a high risk of losing money rapidly. About 80% of retail investor accounts lose money due to leverage when trading CFDs with this provider. Please note that CFDs are not complying with the islamic religion. And if you want to trade in CFDs you should consider a swap-free account to follow islamic rules.

Learn more about CFDs for muslims.

FXTM Full Review - Key Statistics

Safety

a. Is FXTM regulated?The FXTM broker is regulated by many financial authorities in different countries like:

b. Is FXTM a scam?FXTM safety is divided into 2 parts: the safety of the broker itself and the safety of the client. Broker safety FXTM is considered safe as it’s regulated by the top-tier financial authority FCA in the UK. Also, FXTM broker has a long track record from 2011 and has survived from different economic disasters until now. FXTM has also over 3 million clients all over the world. Client protection As FXTM is regulated by the FCA and other financial authorities, there are a number of client protection amounts in different countries as the table shows below: FXTM Legal Entities Table

Disclaimer: From March 2021, FXTM ends its retail operations in the EEA, and only the professional clients will be able to use FXTM. Also, FXTM has a negative balance protection on forex and CFD trading for the clients from the European Union only. |

Offering of Investments

FXTM allows forex, CFD, and cryptocurrencies trading as well as real stocks and metals, but it comes behind a lot of competitors in its offering. FXTM’s number of options for trading are low, especially in the stock CFDs and real stocks. While there are a number of trading options that are not available like ETFs, mutual funds, bonds, options, and futures. Disclaimer: CFDs have a high risk of losing money rapidly. 79% of retail investor accounts lose money due to leverage when trading CFDs with this provider. CFDs are not complying with the islamic religion. And if you want to trade in CFDs you should consider a swap-free account to follow islamic rules. Learn more about CFDs for muslims. FXTM Offering of Investments

Notes:

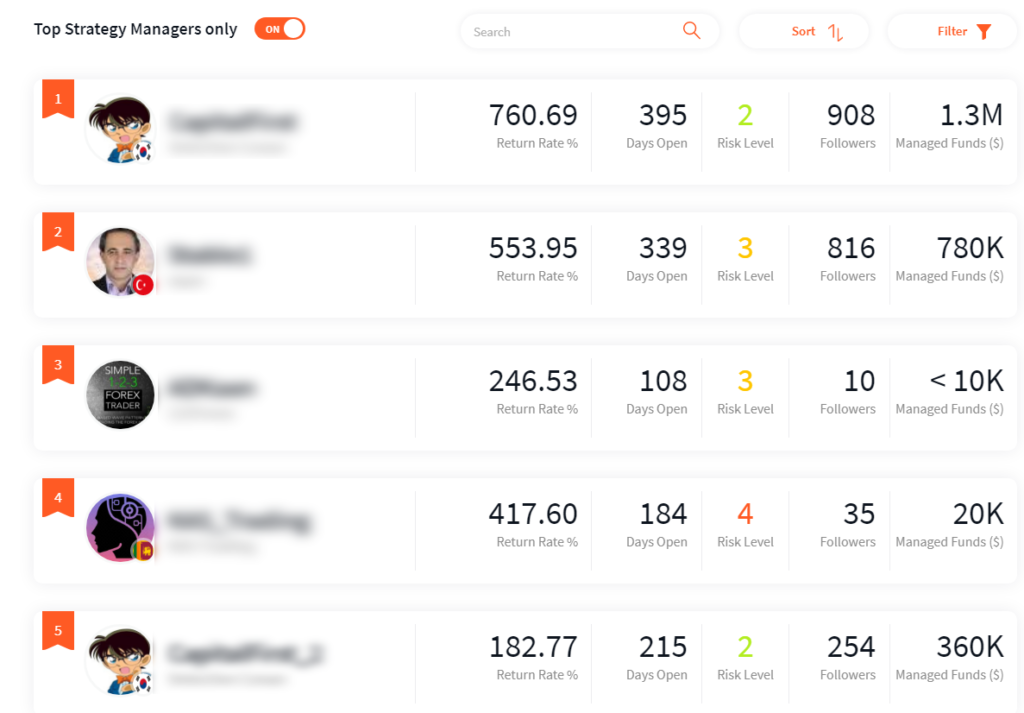

Social TradingUnlike a lot of brokers, FXTM offers a social trading option for the non-UK clients. This type of trading includes two parts: the investor and the strategy manager. You can decide to be any of them. If you’re an investor you can filter the strategy managers according to their success fees, all-time-profit, and more. For strategy managers, they can get commissions per each winning trade.

FXTM - Investment managers |

Account Opening

a. Countries availableFXTM is available in a number of countries and has customers in Europe, Africa, and Asia. It has also over 3million clients from more than 180 countries. b. Account typesFXTM has two types of accounts:

FXTM also offers a swap-free option that you can enable on all of its accounts except on the MetaTrader 5 platform or the exotic currencies. Standard Accounts FXTM - Standard accounts’ comparison

ECN Accounts FXTM - ECN accounts’ comparison

Notes:

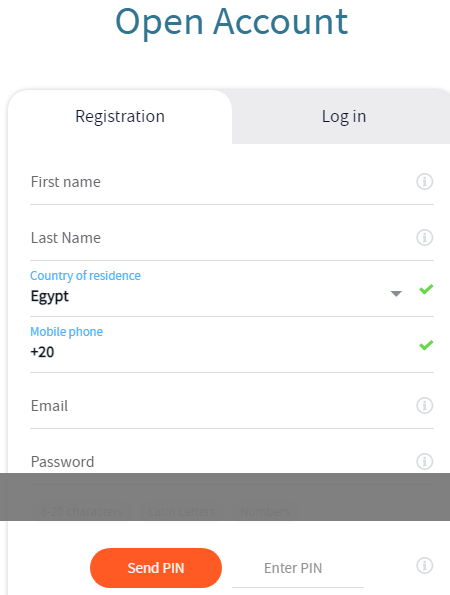

c. How to open an accountYou can open an FXTM account in minutes and get approval within 1 business day. Steps:

FXTM - Account opening Note:

|

Fees and Commissions

a. CommissionsFXTM gets no commissions except for the ECN account as the following: b. Trading FeesSpreads differ from account to another according to its type as the following: FXTM - Account Spreads

Forex fees: EUR/USD from 0.1, GBP/USD from 0.3, AUD/CAD from 2.5, EUR/HKD from 2.9 Stock CFD fees: Apple from 17, BP from 2, Google from 130 Stock Trading: Apple from 2, Amazon from 21 Real Stocks: From 2020, FXTM charges no commissions, and if you’re a non-EU you can trade in real stocks with $0 commissions. Spot Metals: XAGEUR from 7.0, XAGUSD from 0.4, XAUUSD from 9.0 European Stock CFDs: Adidas from 19, Bayer from 4, Deutsche Post AG from 2 Disclaimer: CFDs have a high risk of losing money rapidly. 80% of retail investor accounts lose money due to leverage when trading CFDs with this provider. CFDs are not complying with the islamic religion. And if you want to trade in CFDs you should consider a swap-free account to follow islamic rules. Learn more about CFDs for muslims. c. Non-trading fees

(you can check the full withdrawal fees in withdrawal fees section)

|

Deposit and Withdrawal

a. Account CurrenciesThe FXTM account has 4 base currencies which are EUR, GBP, USD, NGN. Notes:

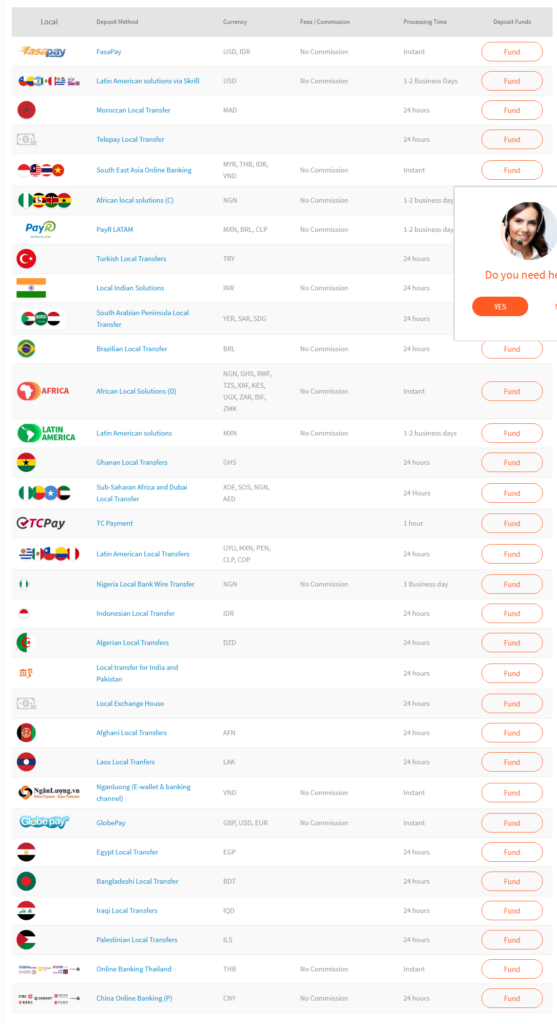

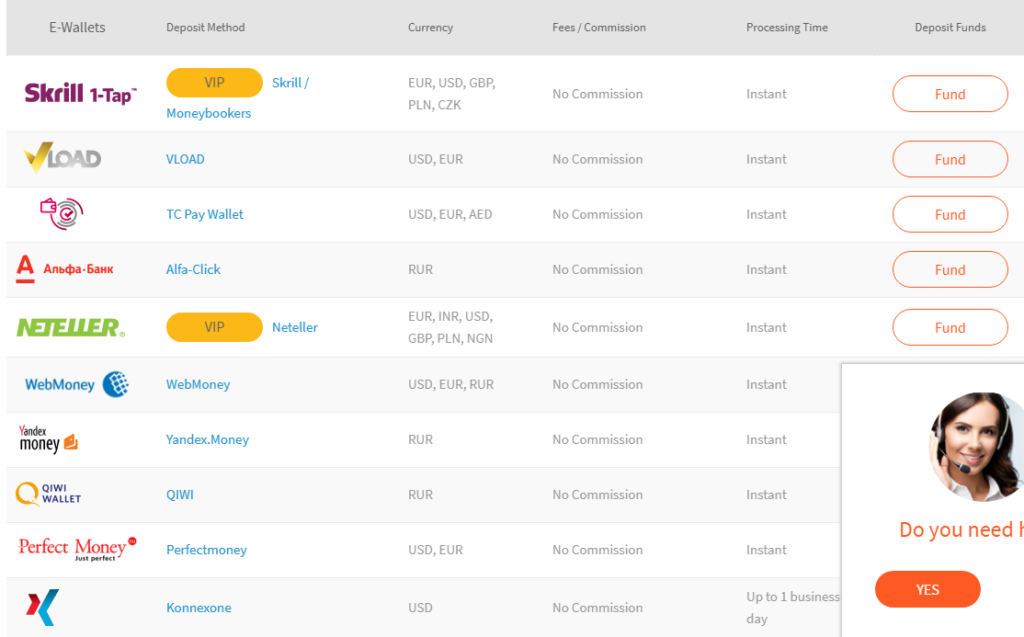

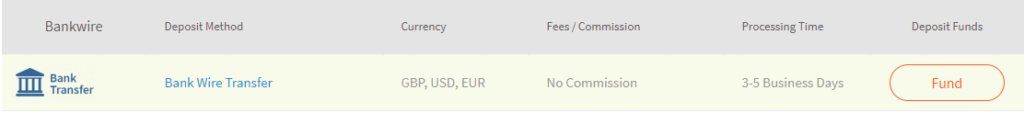

b. Deposit1. Options FXTM supports depositing with bank transfers, credit cards, and bank transfers. FXTM deposit methods

FXTM supports depositing using different electronic wallets and options like:

Notes:

2. Fees FXTM charges no deposit fees using any of the depositing methods. 3. Time

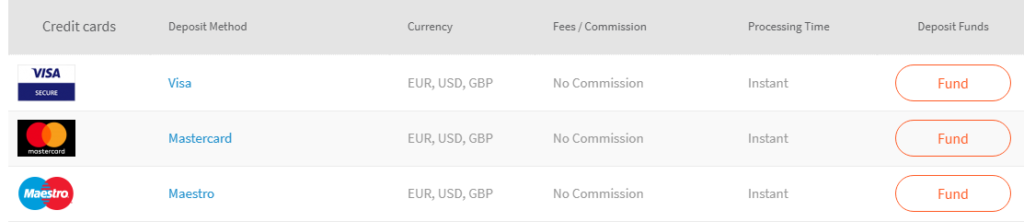

Deposit options and methods Deposit using credit cards

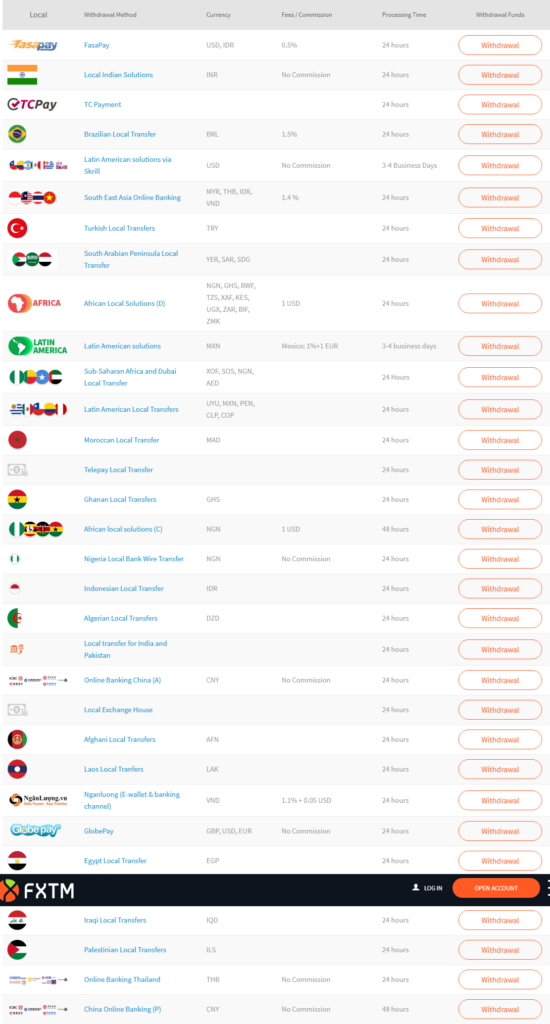

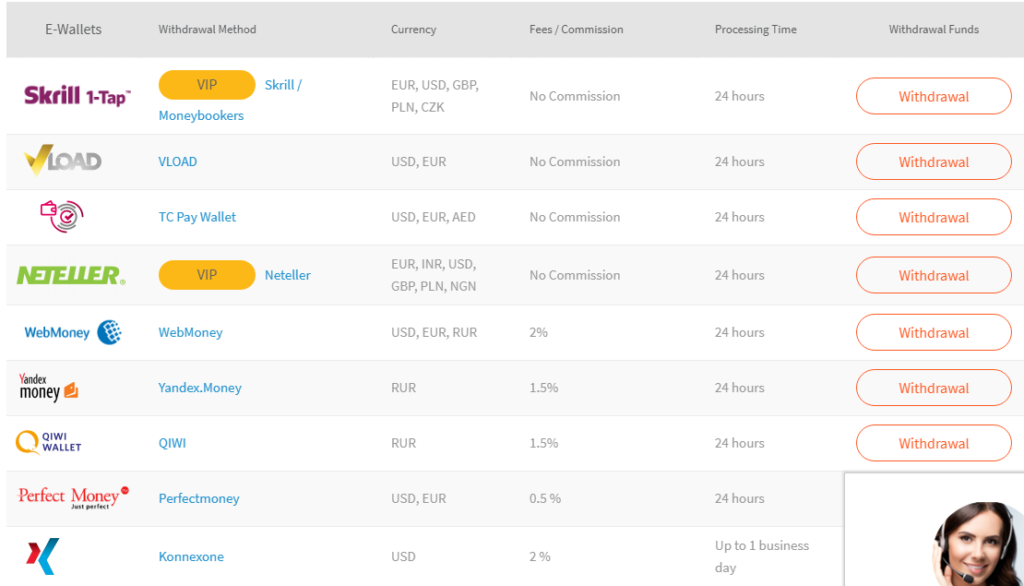

Deposit using electronic wallets Deposit using bank transfers c. Withdrawal1. OptionsLike the deposit, withdrawal options are through credit cards, electronic wallets, and bank transfers. FXTM withdrawal methods

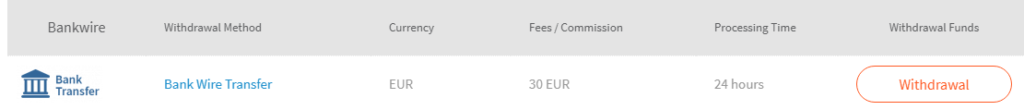

2. Fees FXTM charges fees on most of the withdrawal options as the following images show. 3. Time Withdrawal using credit cards and electronic wallets is done within a day, but for the bank transfers, it takes several business days.

Withdrawal options and methods Withdrawal using credit cards

Withdrawal using electronic wallets Withdrawal using bank transfers |

Platforms and Languages

|

FXTM uses a third-party platform for trading using the MT4 and MT5 platforms. 1. Web

The web platform of the FXTM is provided by the MetaTrader with a highly customizable design that;s available in a number of languages. We will go through the MT4 platform as it’s supported by all of the account types described above. a. Languages MetaTrader 4 is available in a number of languages like: MT4 Languages

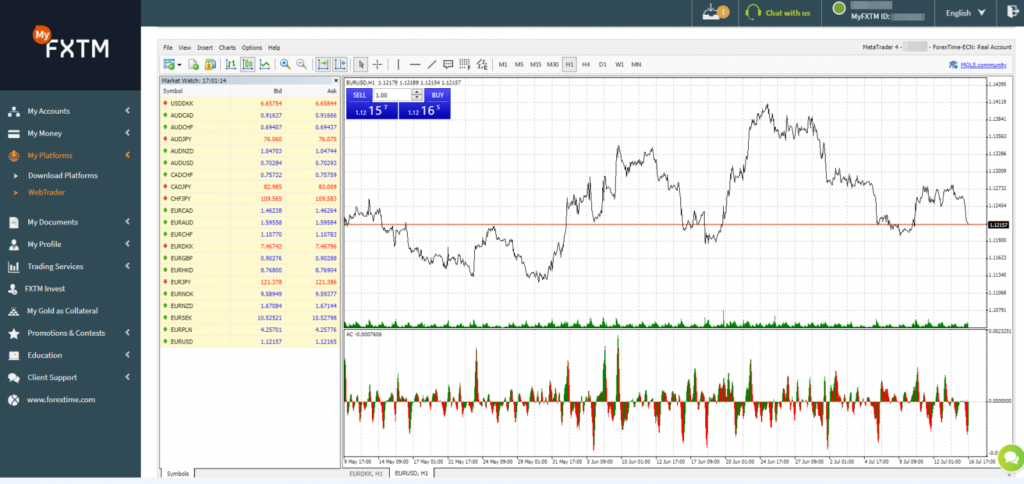

b. User interface (UI) FXTB has a very customizable UI that you can adjust according to your needs and preferences. On the other hand, it seems hard to find some of the features inside.

FXTM - web trading platform UI c. Login and Security Unfortunately, the web platform does not provide a two-step verification method for logging in, and it does only support a one-step login. d. Searching Searching using the MT4 platform has its pros and cons.

e. Placing orders MT4 has a simple order types which are:

In addition to those 4 types, there are other orders which are the time limit ‘Good ‘til time’ (GTT) and ‘Good 'til canceled’ (GTC). There’s also an order confirmation feature in the web trading platform of MT4. f. Notifications and alerts Unfortunately, the MT4 web trading platform does not have an option to set price alerts and notifications unlike the desktop version. g. Portfolio and reports Under the ‘History’ tab, you can find your portfolio reports with a clear fee description. 2. Desktop

The desktop version of the MT4 has the same UI as the web platform, but the main difference here is that you can set price alerts and notifications. The desktop version of MT4 is available in the same languages, order types, searching, and reports like the web trading platform

FXTM - desktop trading platform UI 3. Mobile Platform

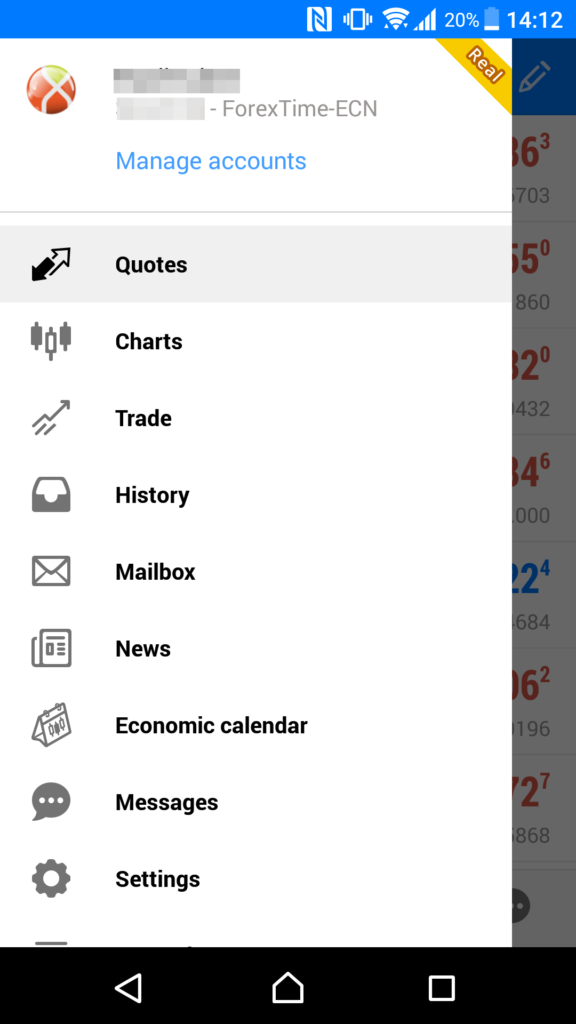

The mobile trading platform of FXTM is provided as well from MetaTrader and has a user-friendly design with great search options and notifications. On the other hand, it does not come with a two-step verification login option nor touch face ID. a. Languages There are a number of languages available in the mobile trading platform, but you can only change the language by setting it as a default in your device. The languages available are: FXTM - Mobile trading platform languages

b. User interface (UI) The user interface of the mobile trading platform is user-friendly and has a number of useful features.

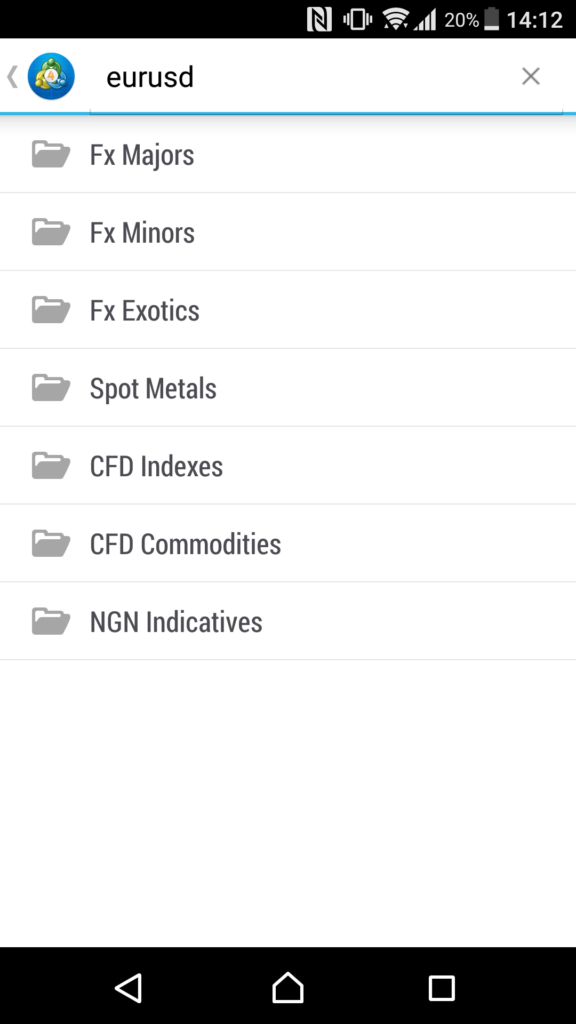

FXTM - Mobile trading platform UI c. Login and security Like the web and desktop version, there’s no two-step verification method in the mobile trading platform nor touch/ face ID. d. Searching Unlike the web and desktop trading platforms, there is a good searching option in the mobile platform and you can search by typing the name of the asset you want to find.

FXTM Mobile trading platform - Search function e. Placing orders The mobile trading platform has the same order types as the web and desktop platforms which are:

In addition to those 4 types, there are other orders which are the time limit ‘Good ‘til time’ (GTT) and ‘Good 'til canceled’ (GTC). Note: Unlike the web trading platform, there’s no order confirmation in the mobile trading platform. f. Notifications and alerts Like the desktop version, the mobile trading platform has an option to set price alerts and notifications. |

Research Tools

FXTM has a lot of research tools like news flow, trading ideas, and technica analysis. On the other hand, it lacks the fundamental data needed for the user. a. Sources The research tools are available on:

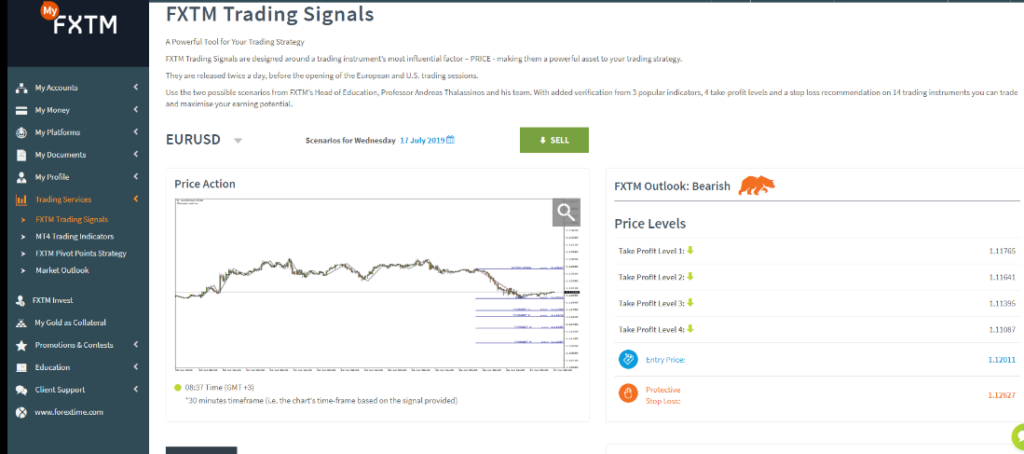

b. Trading ideas Under the ‘trading services’ section in the MyFXTM, you can find your trading ideas based on some technical tools.

FXTM trading ideas c. Fundamental data Unfortunately, FXTM lacks the fundamental data research tools in any platform. d. Charting You can view charts and filter them using 35+ indicators across the MetaTrader platforms. These indicators might be trendlines, Fibonacci retracement, and more. On the other hand, it’s hard sometimes to do little tasks in the charts as the UI is not up to date.

FXTM charting tool e. Newsfeed FXTM provides a newsfeed option to find market updates, research tools, forex news, and more. There’s also an economic calendar to be up-to-date with the latest information in the trading industry.

FXTM newsfeed f. Other tools In addition to the research tools mentioned previously, FXTM provides another tool which is the Pivot Points Strategy that helps you analyze the price direction well. |

Customer Service

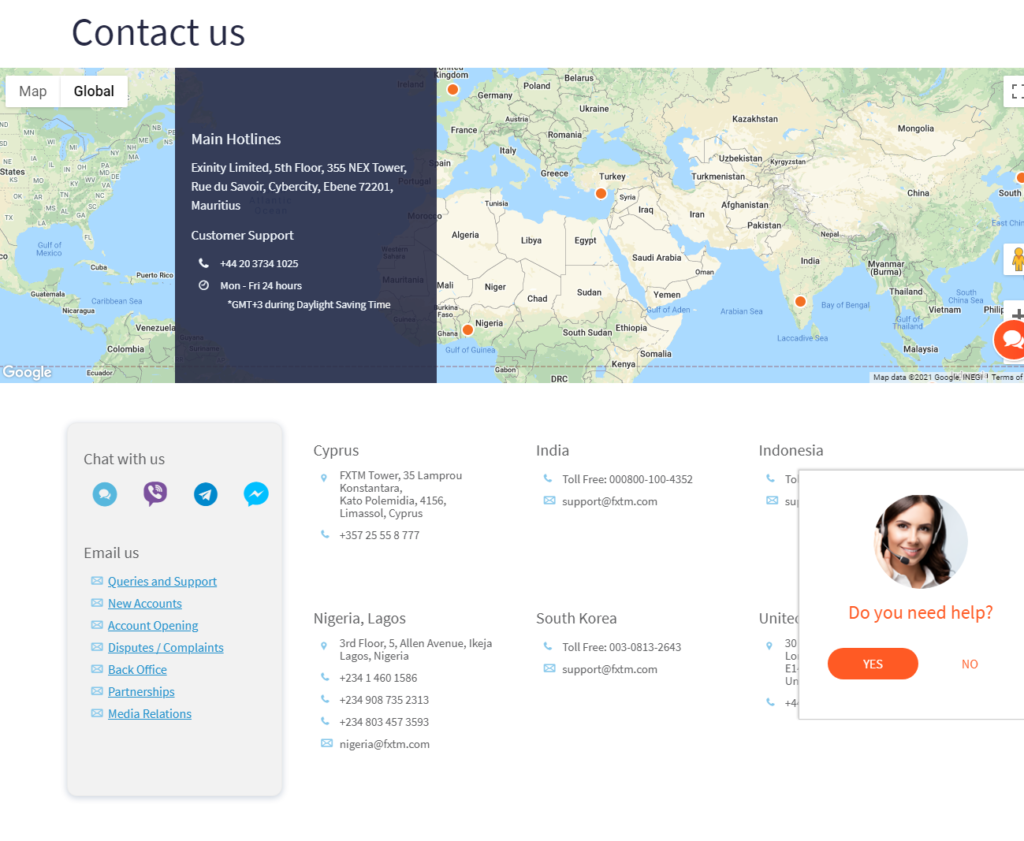

a. OptionsFXTM supports different customer service channels like the live chat, phone, and email. FXTM also has a fast response time across all of these channels. Beside these channels, you can also chat with FXTM through WhatsApp, Viber, Telegram and Facebook Messenger. The customer service option is available only within days Monday to Friday.

FXTM - Customer support b. LanguagesThe languages available for customer service are many with the support of major languages like Arabic, Czech, Chinese, English, Farsi, French, Hindi, Indonesian, Italian, Korean, Malaysian, Polish, Russian, Spanish, Urdu and Vietnamese. c. Experience

|

Education

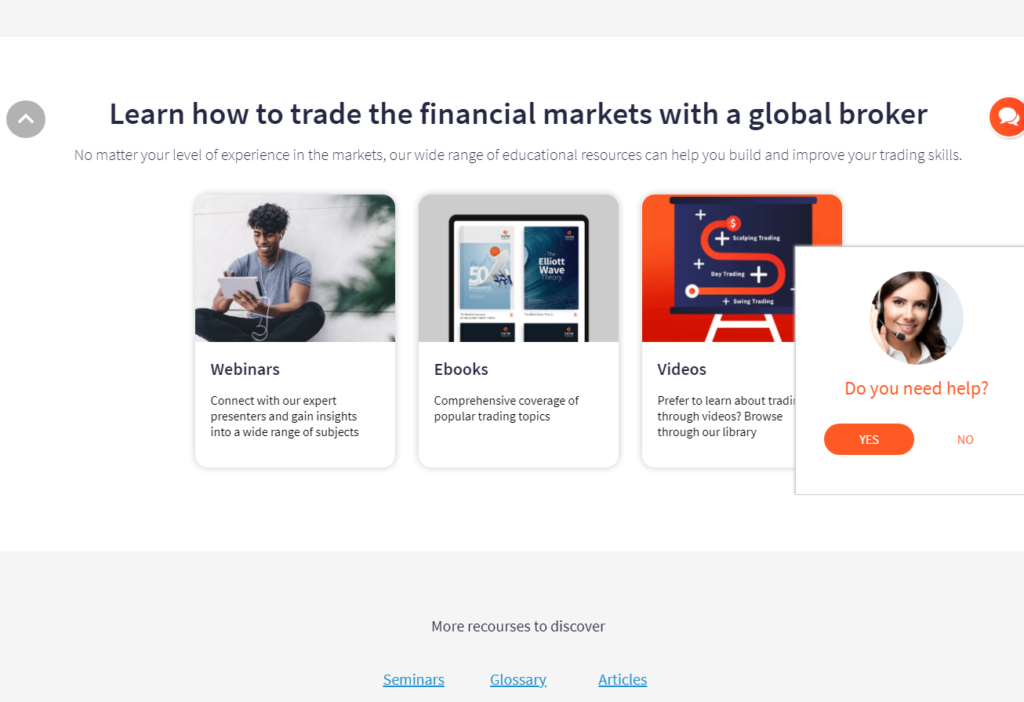

FXTM provides great educational materials and options that you will like. These options are through:

Beside these options, FXTM provides seminars in some countries that you can attend. This option is very useful and not popular with other brokers.

FXTM Educational materials |

FAQs

What is MyFXTM?

How long does it take to verify my account?

Can I open more than one trading account?

Does FXTM allow bot trading?

Does FXTM give a bonus?

Does FXTM allow scalping?

How to enable the swap-free option in my account?

|

FXTM Full Review - Reviews

FXTM Full Review - Review Conclusion

-

- Overall & individual ranks

- Pros: regulated by FCA, and negative balance protection

- Cons: withdrawal fees, outdated UI, no fundamental data available

- Best for: forex traders on the MetaTrader platforms

- Regulated by: FCA, CySEC.and FSCA

- Headquarters: Cyprus

- Foundation year: 2011

- Min Deposit : starts from $10 to $100, $500, and $25,000

- Deposit and withdrawal methods: credit cards, electronic wallets, and bank transfers

- Deposit fees: $0

- Withdrawal fees: high

- Base currencies: USD / EUR / GBP / NGN

- Offering of investments: forex, CFD, metals, real stocks, cryptocurrencies

- Number of users: over 3 million clients