Fusion Markets Full Review

Fusion Markets Full Review

Fusion Markets is an Australian forex and CFD broker that was founded in 2010. Fusion Markets offers a variety of trading instruments like forex, CFD, metals, and commodities with low cost than other brokers. It’s also regulated by ASIC and VFSC.

Disclaimer: CFDs have a high risk of losing money rapidly. About 80% of retail investor accounts lose money due to leverage when trading CFDs with this provider. Please note that CFDs are not complying with the islamic religion. And if you want to trade in CFDs you should consider a swap-free account to follow islamic rules.

Learn more about CFDs for muslims.

Fusion Markets Full Review - Key Statistics

Safety

Offering of Investments

Fusion Markets provides a variety of trading products like forex, CFD, metals, commodities, equity indices, and cryptocurrency trading. On the other hand, there’s no ETF, options, futures, or bonds trading at Fusion Markets. Disclaimer: CFDs have a high risk of losing money rapidly. About 80% of retail investor accounts lose money due to leverage when trading CFDs with this provider. Please note that CFDs are not complying with the islamic religion. And if you want to trade in CFDs you should consider a swap-free account to follow islamic rules. Learn more about CFDs for muslims. Fusion Markets Offering of Investments

Social TradingFusion markets allows you to copy trades using two leading copy trading providers, Myfxbook and DupliTrade. Note:

|

Account Opening

Countries availableFusion Markets accepts clients from all over the world except some countries like Japan, New Zealand, North Korea and the United States. Account typesFusion Markets offers two types of accounts which are:

Both of the previous accounts have their own features and specifications. The following table shows differences between them. Fusion Markets - Account comparison

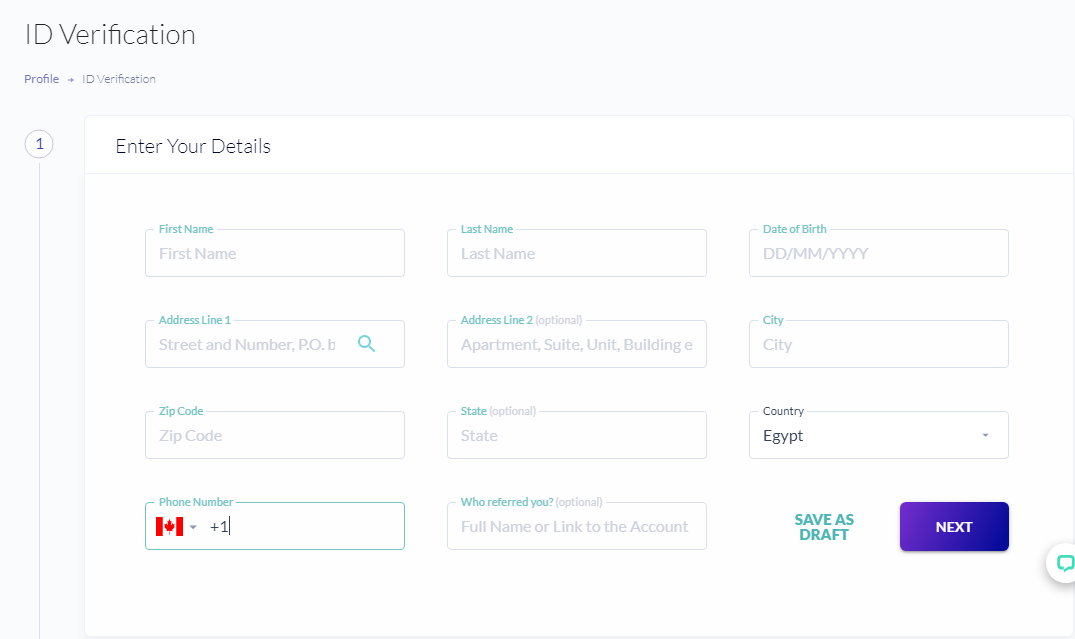

Fusion Markets also provides a demo account with 0 fees if you want to experience the trading platform with no risk. On the other hand, Fusion Markets does not provide a swap-free account option for clients who are following islamic rules. Min depositFusion Markets offers no minimum deposit when you create your account which is great. How to open an accountYou can open an Fusion Markets account in minutes through these steps:

Fusion Markets - Account opening |

Fees and Commissions

CommissionsFusion Markets provides low commissions on trading for the zero account. The commissions are as low as USD 2.25 per 1 standard lot or equivalent ($4.50 per round turn). The following table shows commissions by account currency. Commissions by Currency

Trading FeesForex feesThe average spread for EUR/USD is 0.09 pips per lot. Index feesFor the US500 of S&P500, the average spread is 0.39 pips per lot. Disclaimer: CFDs have a high risk of losing money rapidly. About 80% of retail investor accounts lose money due to leverage when trading CFDs with this provider. Please note that CFDs are not complying with the islamic religion. And if you want to trade in CFDs you should consider a swap-free account to follow islamic rules. Learn more about CFDs for muslims. Metals feesFor gold and silver, the average spreads are 0.14 and 0.007 pips per lot respectively. Commodity fees

Non-trading fees

(you can check the full withdrawal fees in withdrawal fees section)

|

Deposit and Withdrawal

Account CurrenciesThe Fusion Markets account has 8 currency options which are:

Notes:

Deposit1. OptionsFusion Markets supports depositing using different methods such that:

Fusion Markets deposit methods

2. FeesFusion Markets does not charge fees on funding your account if you fund with Visa or Mastercard. Also wire transfers from Australia to Australian accounts incur no fees. On the other hand, if you deposit your money from an international bank, there will be a fee of $20-$30. 3. TimeDepositing using credit/ debit cards or electronic wallets happens instantly while using bank transfers, it may take 2- 5 business days. Withdrawal1. OptionsFusion Markets has several withdrawal options as the following:

Fusion Markets withdrawal methods and fees

2. FeesFusion Markets does not charge any withdrawal fees on bank transfer and other withdrawal methods as well. On the other hand, but your bank may use an intermediary bank where fees are between $15-$25. Fusion Markets also apologies a minimum withdrawal amount of $30 for wire transfers which is free of charge for Australian clients. 3. TimeFusion markets will process your withdrawal on the same day if your withdrawal was received before 11 am AEDT. Otherwise, it will be processed the next day. Fusion Markets makes sure to make you receive your money within 1 - 5 business days for credit/ debit cards while the time of bank transfers may be 2 - 5 business days. Notes:

|

Platforms and Languages

|

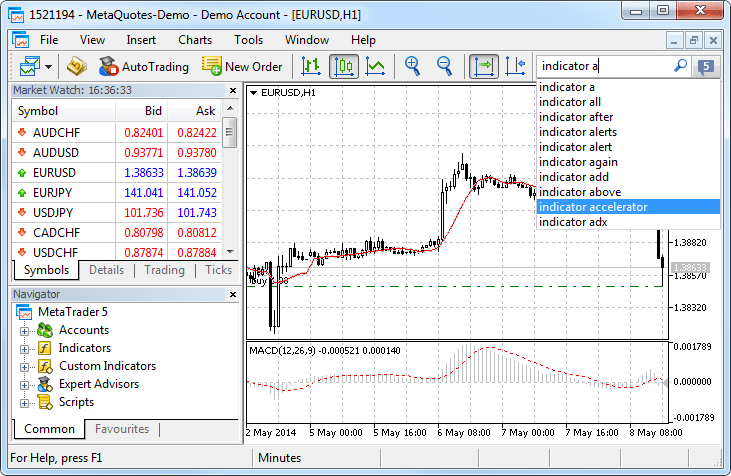

Fusion Markets works on two main platforms which are the MT4 and MT5 trading platforms. In this section, we will discuss each aspect of them ion detail. MT4 Platform

LanguagesMetaTrader 4 is available in a number of languages like: MT4 Languages

User interface (UI)MT4 has a very customizable UI that you can adjust according to your needs and preferences. On the other hand, it seems hard to find some of the features inside.

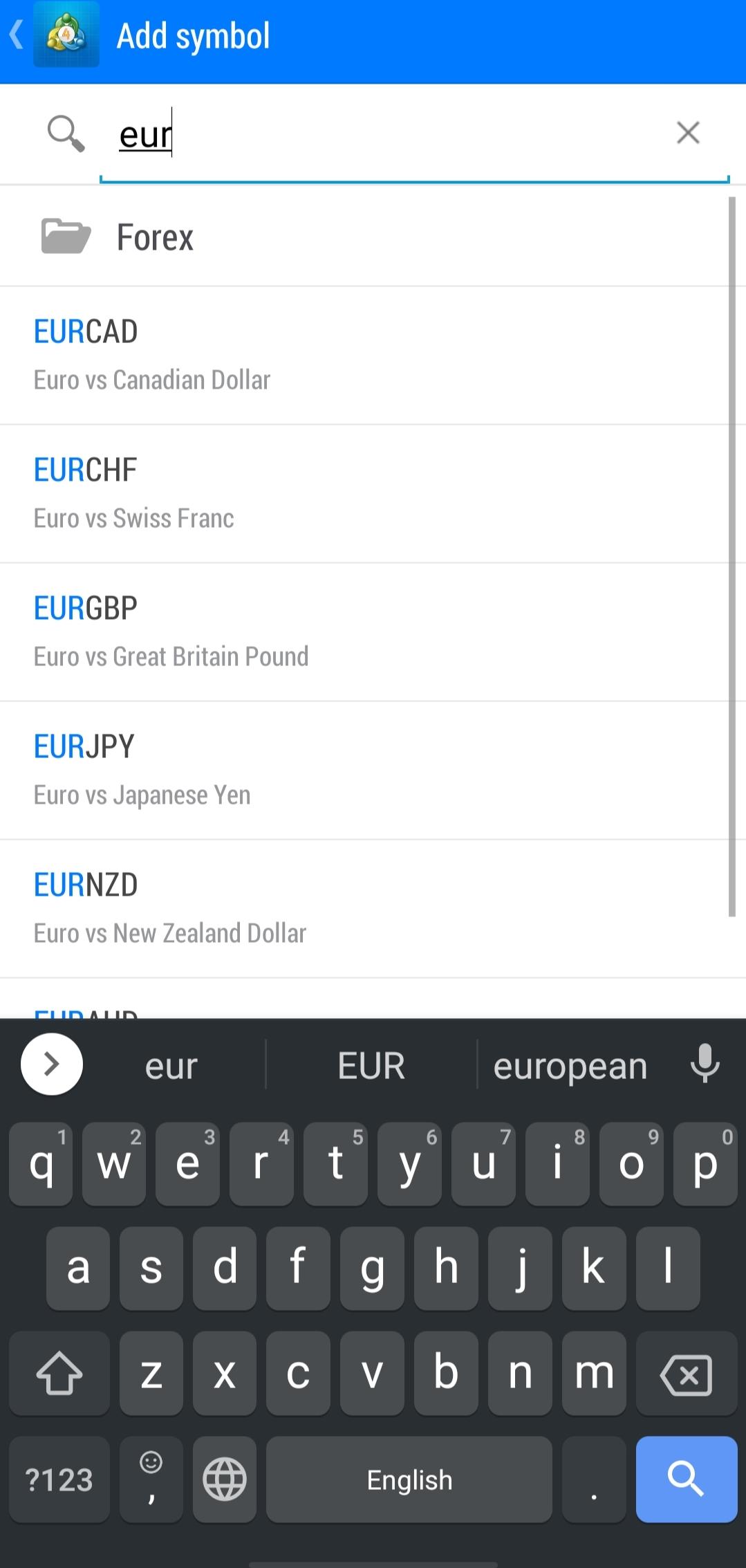

MT4 - Mobile Version - UI Login and SecurityUnfortunately, the MT4 does not provide a two-step verification method for logging in, and it does only support a one-step login. SearchingSearching using the MT4 platform has two different options:

MT4 - Mobile Platform - Search Placing ordersMT4 has a simple order types which are:

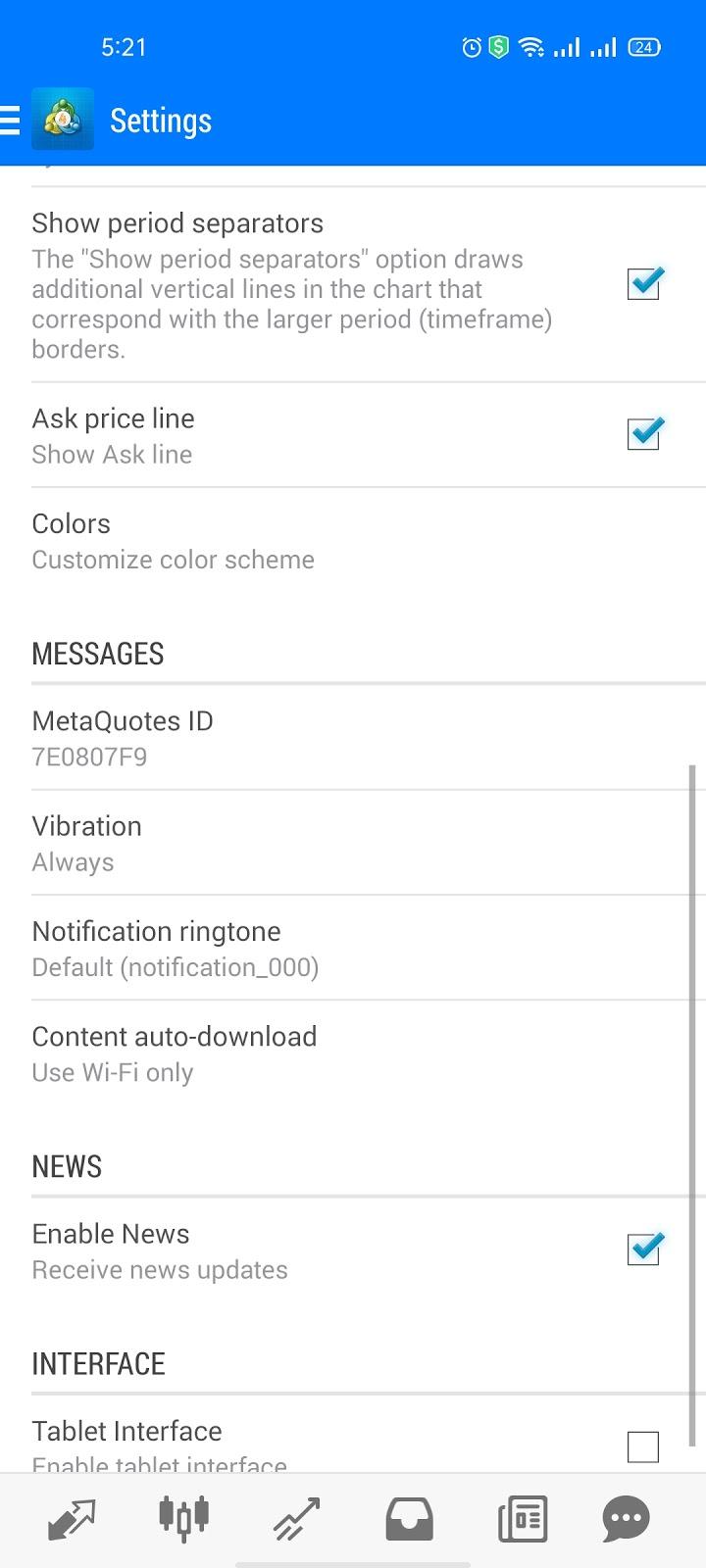

In addition to those 4 types, there are other orders which are the time limit ‘Good ‘til time’ (GTT) and ‘Good 'til canceled’ (GTC). There’s also an order confirmation feature in MT4. Notifications and alertsUnfortunately, the MT4 web trading platform does not have an option to set price alerts and notifications unlike the desktop and mobile versions.

MT4 - Mobile Version - Notifications Settings Portfolio and reportsUnder the ‘History’ tab, you can find your portfolio reports with a clear fee description.

MT4 - Mobile Version - Portfolio MT5

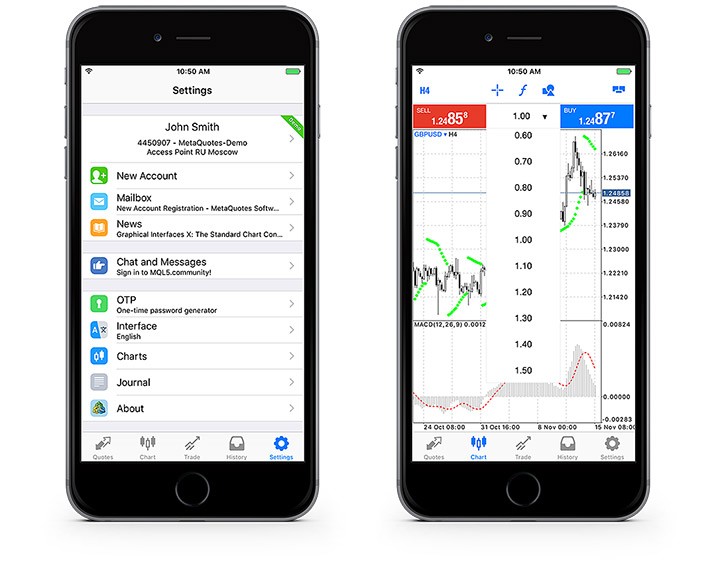

MT5 is a free application for traders allowing them to perform technical analysis and trading operations in the Forex and exchange markets. LanguagesMT4 does support over 20 languages including English, French, Spanish, Italian, Japanese, and Chinese. User interface (UI)MT5 was launched in June, 2010. It has about 1 million users worldwide. It also has a good interface which is similar to MT4 with the main functionalities available. MT5 is more suitable for advanced traders.

MT5 desktop version

MT5 - Mobile Version SecurityMT4 encrypts your trading data with all of your information from cyber attacks as well as not revealing your IP address while trading using the platform. From a login perspective, MT4 has a two-step verification method as well to protect your account from hacks. ResearchMT5 offers financial and forex news from international agencies and provides a daily broadcast of dozens of newsletters from global events. MT5 also provides you with powerful and clear searching tools.

MT5 search Placing ordersMT5 has the same order types as the MT4 platform which are:

In addition to these 5 order types, the MetaTrader 5 platform has two more order options which are:

Like the MT4, MT5 has ‘stop loss’ and ‘take profit’ options while trading as well. Notifications and alertsMT5 has instant notifications and alerts in its system to never miss an opportunity in the market. ReportsThe MT5 platform carries news reports from international news agencies and also sports an economic calendar. |

Research Tools

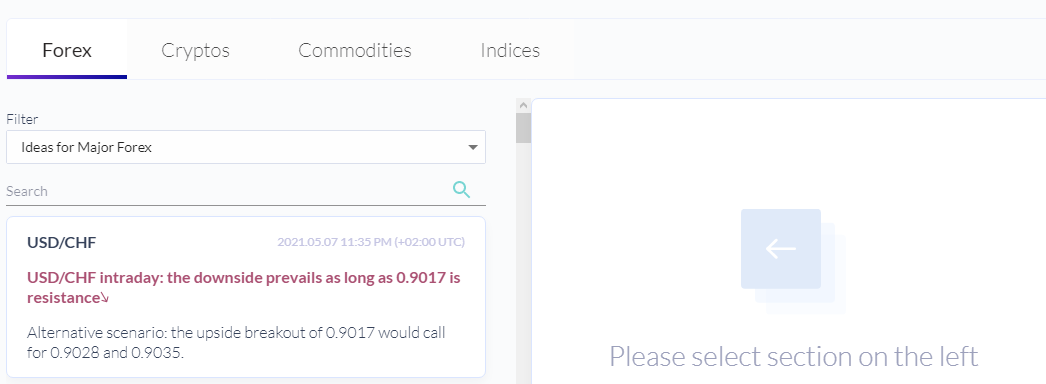

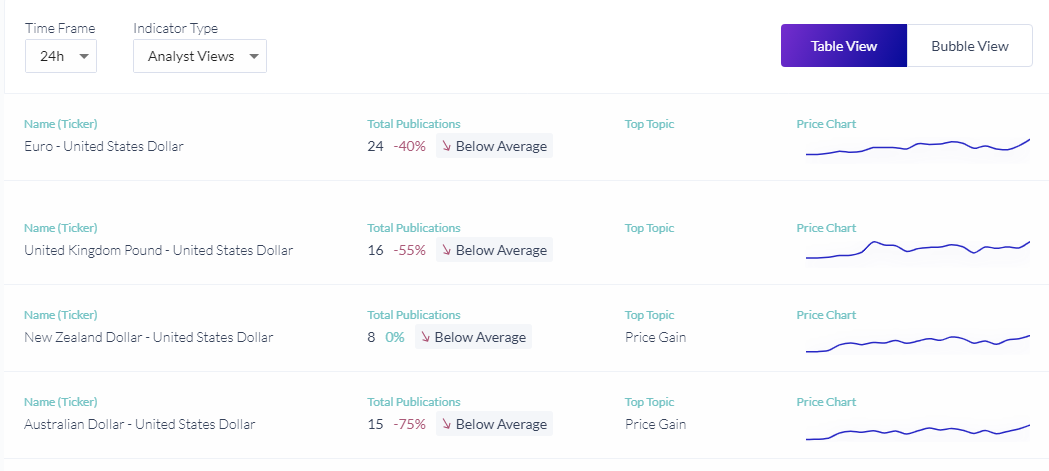

SourcesThe research tools come from the Fusion Markets’ website. Trading ideasFusion Markets provides a trading ideas section with wi=hich you can decide what product to trade.

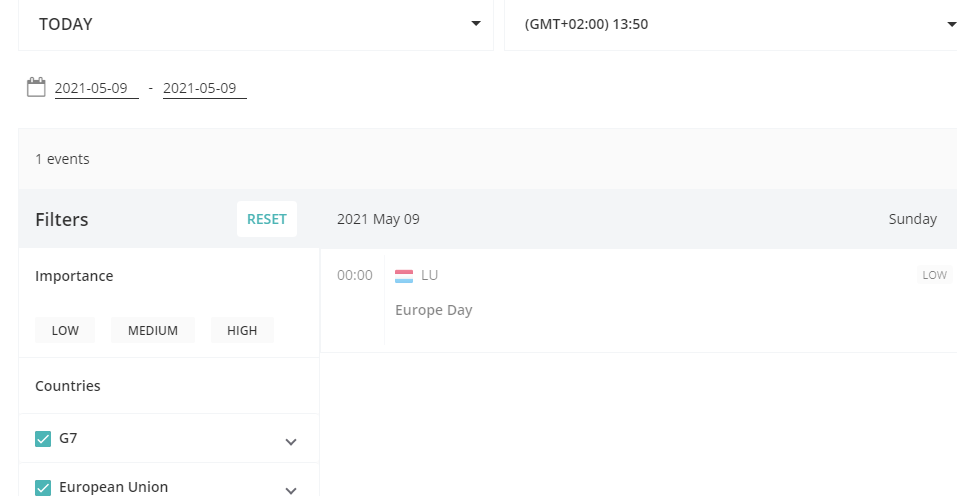

Fusion Markets - Research - Trading Ideas Economic CalendarThe economic calendar of Fusion Markets is very helpful in order to know the important upcoming financial events and never miss a one.

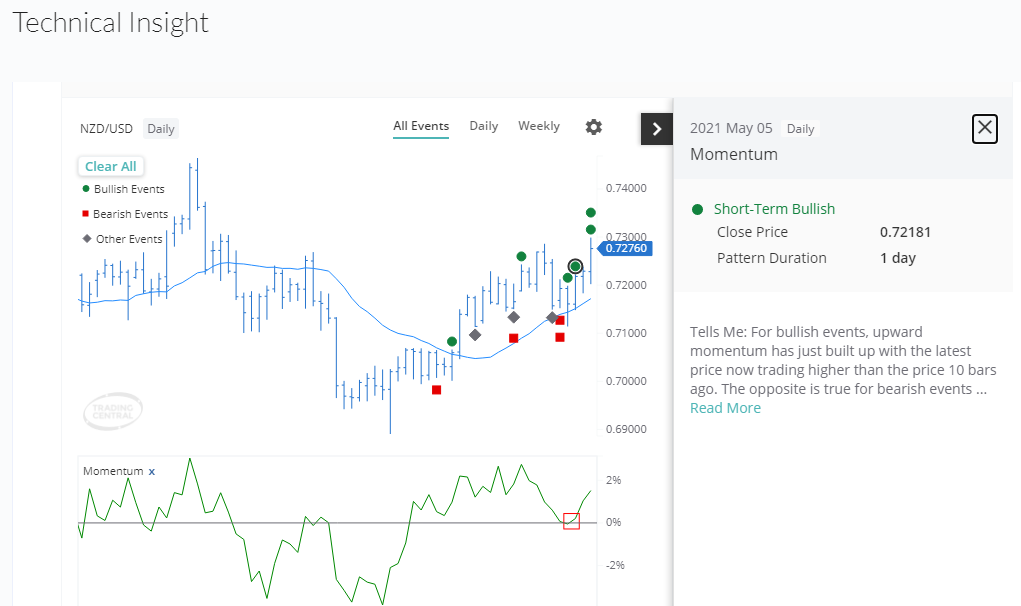

Fusion Markets - Research - Economic Calendar ChartingFusion Markets has a good charting tool where you can choose from a variety of indicators and recognize patterns.

Fusion Markets - Research - Charting NewsfeedFusion Markets gives you a good newsfeed feature to know the latest news and be updated.

Fusion Markets - Research - Newsfeed Other toolsFusion Markets also provides other research tools like:

|

Customer Service

OptionsFusion Markets supports different customer service channels like:

LanguagesThe languages available for customer service are many with the support of major languages like English and Thai.

Fusion Markets - Customer Support |

Education

Fusion Markets provides a demo account in order to trade with %0 risk. On the other hand, there’s no educational materials like videos, tutorials, or webinars. |

FAQs

1. Go to ‘Settings’ 2. Click on 'Manage Accounts' or 'Settings' 3. Then click on the small plus sign or select 'New Account' 4. Then select 'Log in to an existing account' 5. Search for the broker name 6. Select the server your account was set up on 7. Enter your login credentials and password 8. Click on 'Sign In'

Conclusion:

|