FP Markets Full Review

FP Markets Full Review

‘First Prudential Markets’ or ‘FP Markets’ for simplicity is an Australian forex and CFD Broker that has a long tracking record from 2005 with the largest trading options and lowest fees.

Disclaimer: CFDs have a high risk of losing money rapidly. About 80% of retail investor accounts lose money due to leverage when trading CFDs with this provider. Please note that CFDs are not complying with the islamic religion. And if you want to trade in CFDs you should consider a swap-free account to follow islamic rules.

Learn more about CFDs for muslims.

FP Markets Full Review - Key Statistics

Safety

Offering of Investments

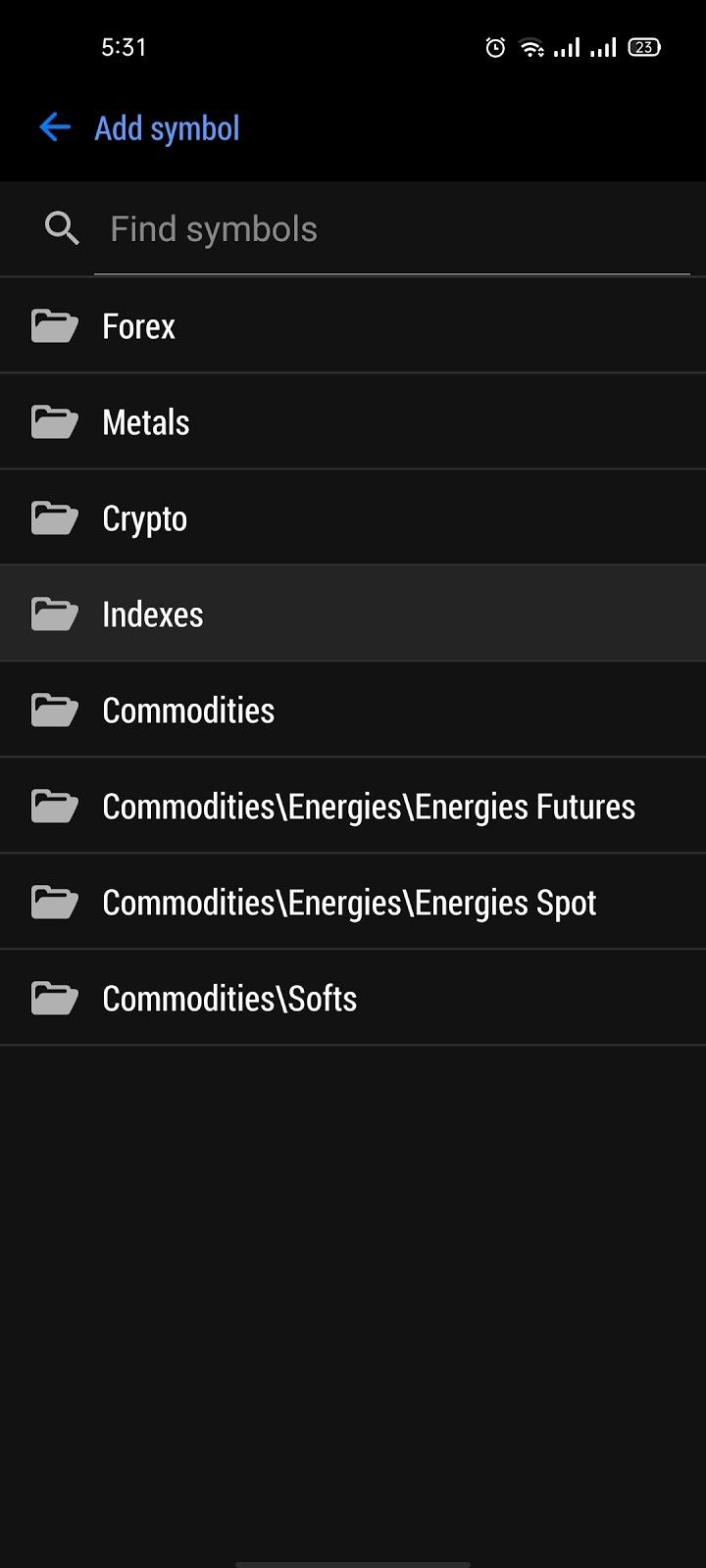

FP Markets provides a variety of trading instruments like forex and CFDs. There are also options to trade with commodities and cryptocurrencies. Disclaimer: CFDs have a high risk of losing money rapidly. About 80% of retail investor accounts lose money due to leverage when trading CFDs with this provider. Please note that CFDs are not complying with the islamic religion. And if you want to trade in CFDs you should consider a swap-free account to follow islamic rules. Learn more about CFDs for muslims. FP Markets Offering of Investments

Notes: For the UK-clients, FCA bans trading in cryptocurrencies from Jan. 2021. Social TradingFP Markets allows social trading on its platform. That means that you can follow top traders and copy trades from them at any time. |

Account Opening

Countries availableFB Markets accepts clients from all over the world except from U.S, Japan or New Zealand residents or residents from any other country or jurisdiction where such distribution or use would be contrary to those local laws or regulations. Account typesFP Markets does provide a variety of account types based on the type of investment you want to do. According to each category of accounts, you can choose the category that suits you the most. The categories are:

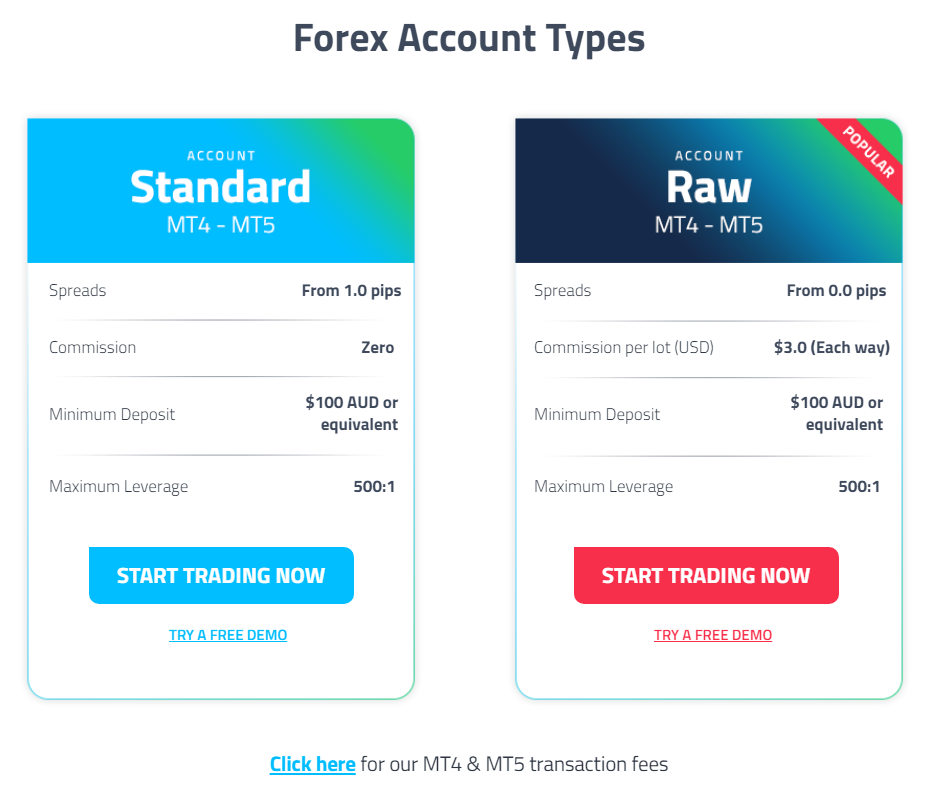

Let’s dive into each category of these in detail. 1- Forex Accounts This category contains 2 main account types: standard and raw accounts. This category is mainly for trading forex. FP Markets - Forex Account comparison

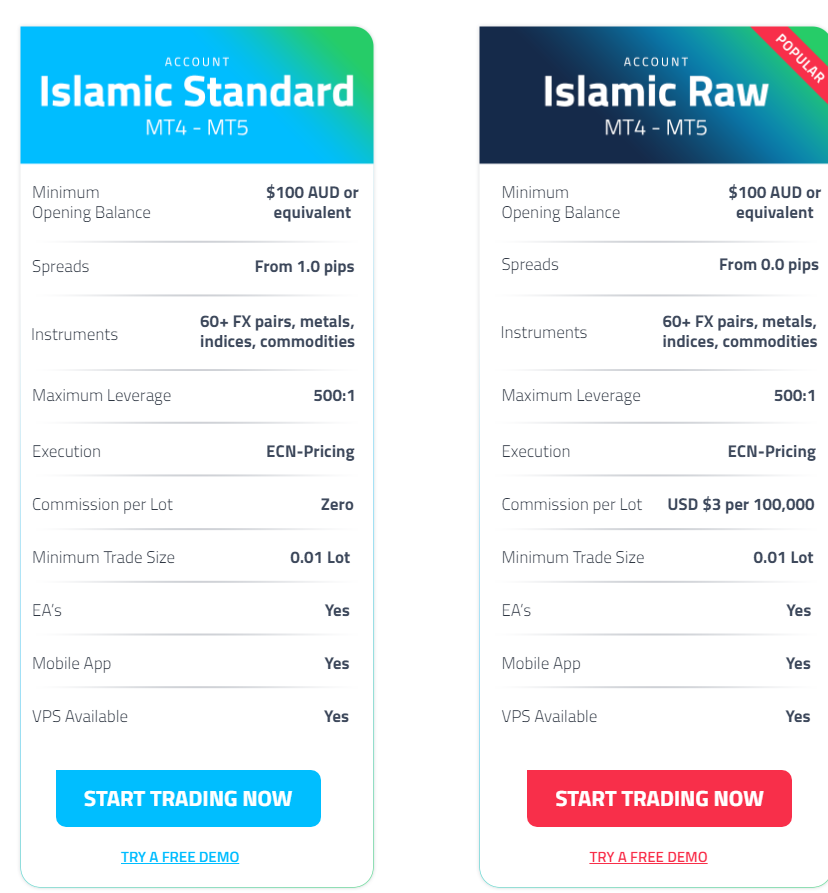

FP Markets - Forex Accounts In addition to the previous account types, there is an islamic account option with no swap fees for people who follow islamic rules.

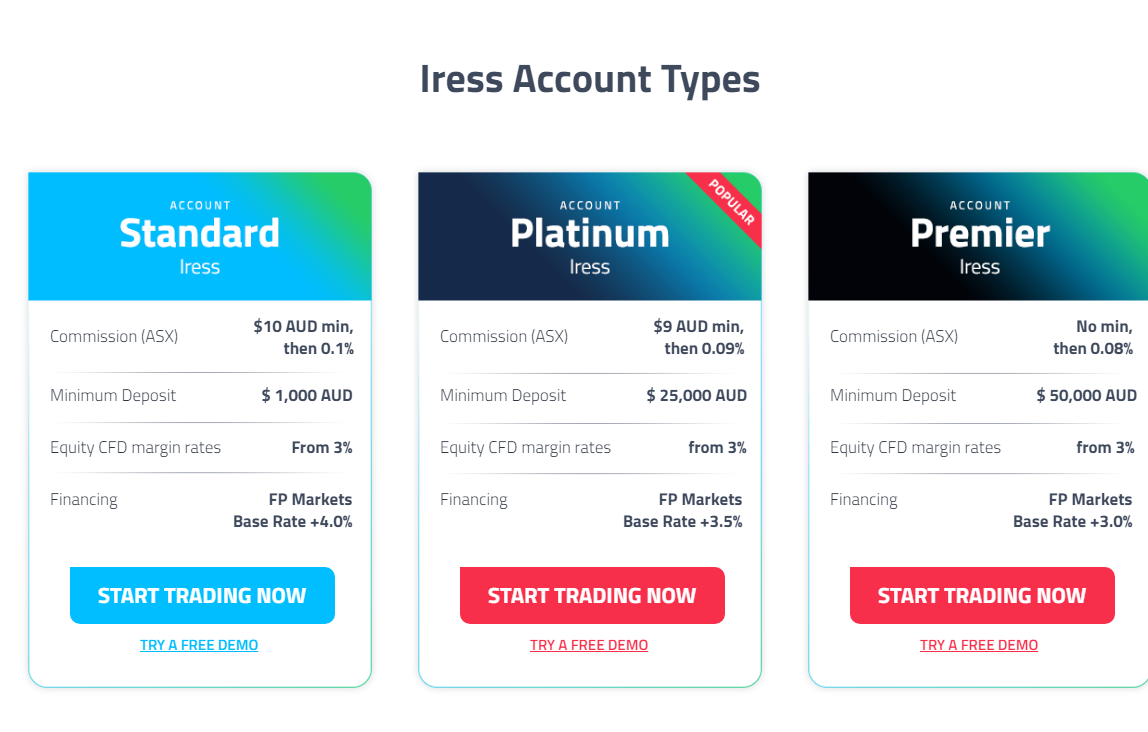

FP Markets - Islamic Accounts 2- IRESS Accounts This category contains 3 main account types:standard, platinum, premier. This category is mainly for trading forex, futures, and CFDs. FP Markets - IRESS Account comparison

FP Markets also has a great option for clients who want to open multiple accounts as they can open sub-accounts, each one of them can have its own base currency. (i.e., UDS, EUR, etc.)

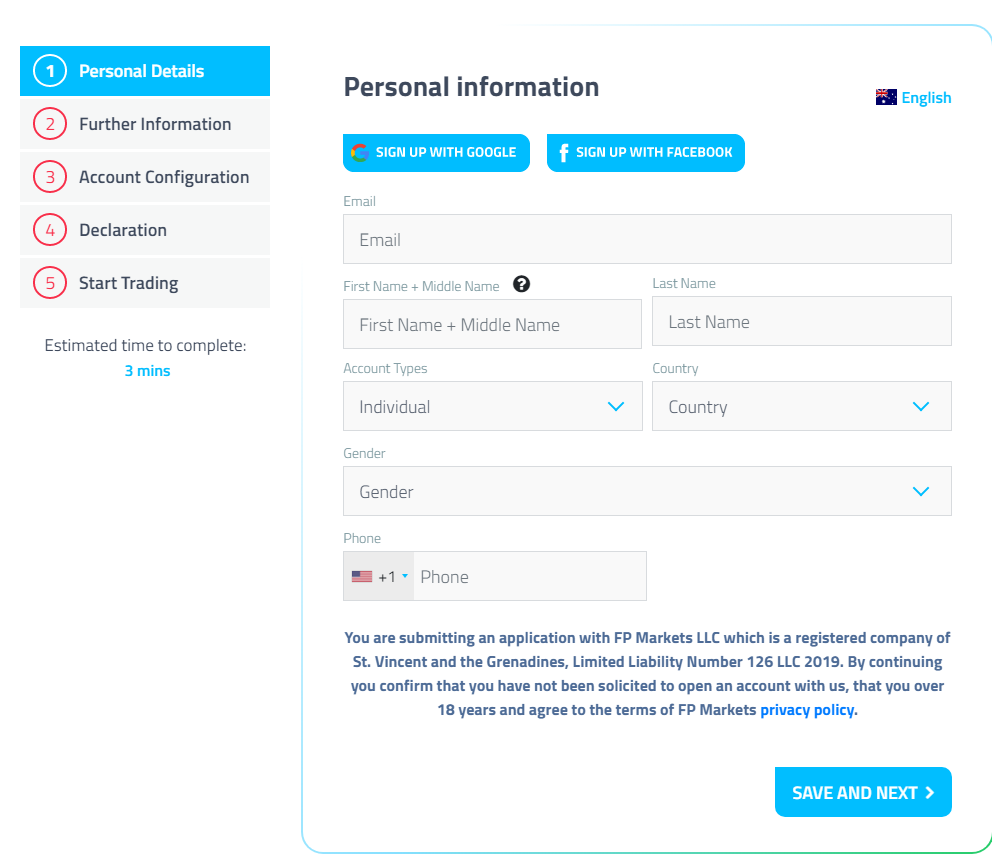

FP Markets - IRESS Accounts Min depositThe minimum deposit for MetaTrader accounts is $100, but at the same time, the minimum deposit for CFD reading accounts is high starting at $1,000. How to open an accountThe process of opening an FP Markets account is very easy and straightforward within minutes.

You can open an FP Markets account in minutes through these steps:

FP Markets - Account opening Notes: There is a thing we noticed after creating an account which is interesting as we received a call from the customer support team of FP Markets to help us start trading on the platform. They also provide us with a tutorial video to know more about the MetaTrader Platform. |

Fees and Commissions

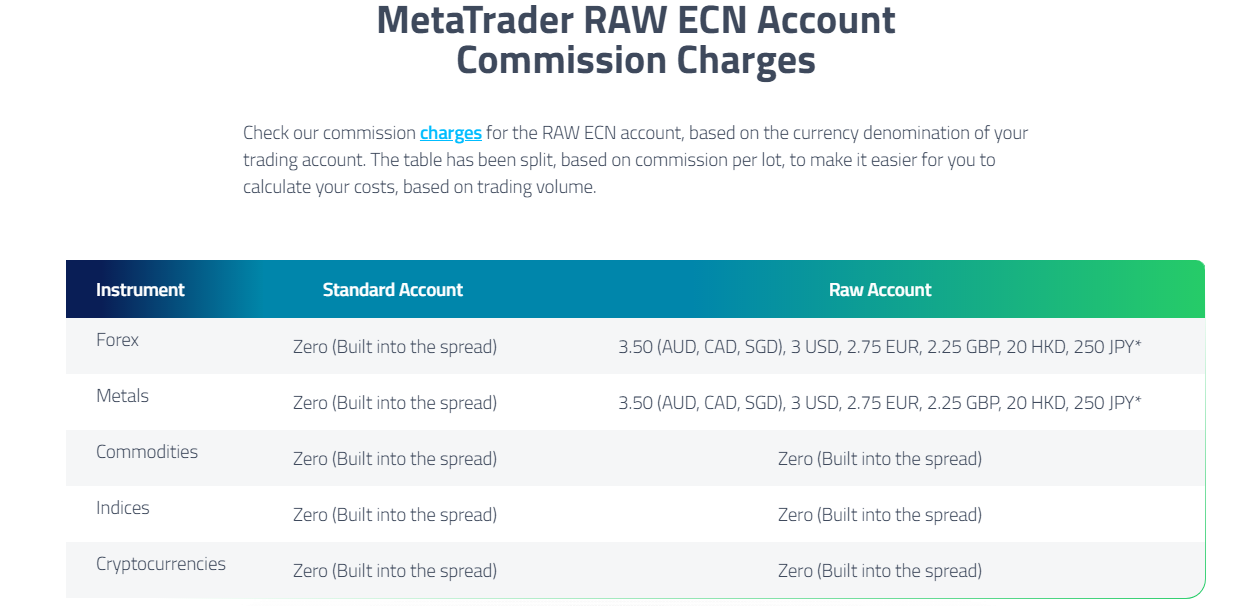

FP Markets have competitive trading fees and no inactivity fees within all brokers. CommissionsFP Markets does charge no commission when trading forex whether you have a standard or islamic account which is very competitive.

FP Markets - Commissions Trading FeesThe trading fees of FP Markets differ from one account type to another as the following: Forex fees

Metals

Indices

Disclaimer: CFDs have a high risk of losing money rapidly. About 80% of retail investor accounts lose money due to leverage when trading CFDs with this provider. Please note that CFDs are not complying with the islamic religion. And if you want to trade in CFDs you should consider a swap-free account to follow islamic rules. Learn more about CFDs for muslims. Commodity fees

Cryptocurrencies

Non-trading fees

(you can check the full withdrawal fees in withdrawal fees section)

|

Deposit and Withdrawal

Account CurrenciesThe FP Markets account has a number of base currencies like EUR, GBP, USD, AUD, CAD, SGD, HKD, JPY, NZD, CHF. Notes:

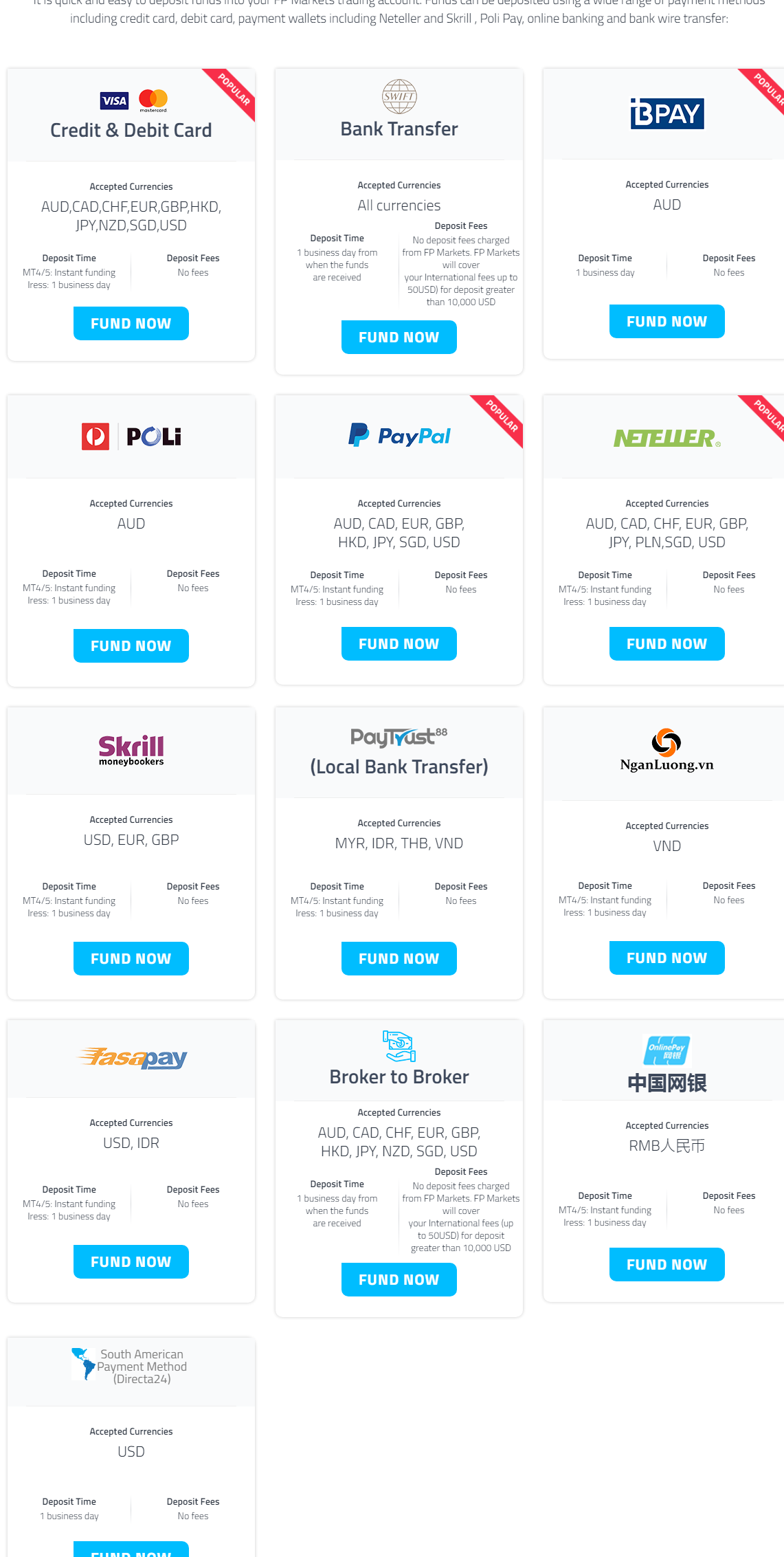

Deposit1. OptionsFP Markets deposit methods

FP Markets supports depositing using different electronic wallets such that:

In addition to the previous deposit options, FP Markets offers an option to transfer your money from another broker as you want. 2. FeesFP Markets does not charge any deposit fees except for the bank transfers, FP Markets will cover your International fees (up to 50USD) for deposits greater than 10,000 USD. 3. TimeAll of the deposit options happen instantly except for some options that may take about 1 business day to be completed.

FP Markets - Deposit Options and Fees Withdrawal1. OptionsFP Markets withdrawal methods and fees

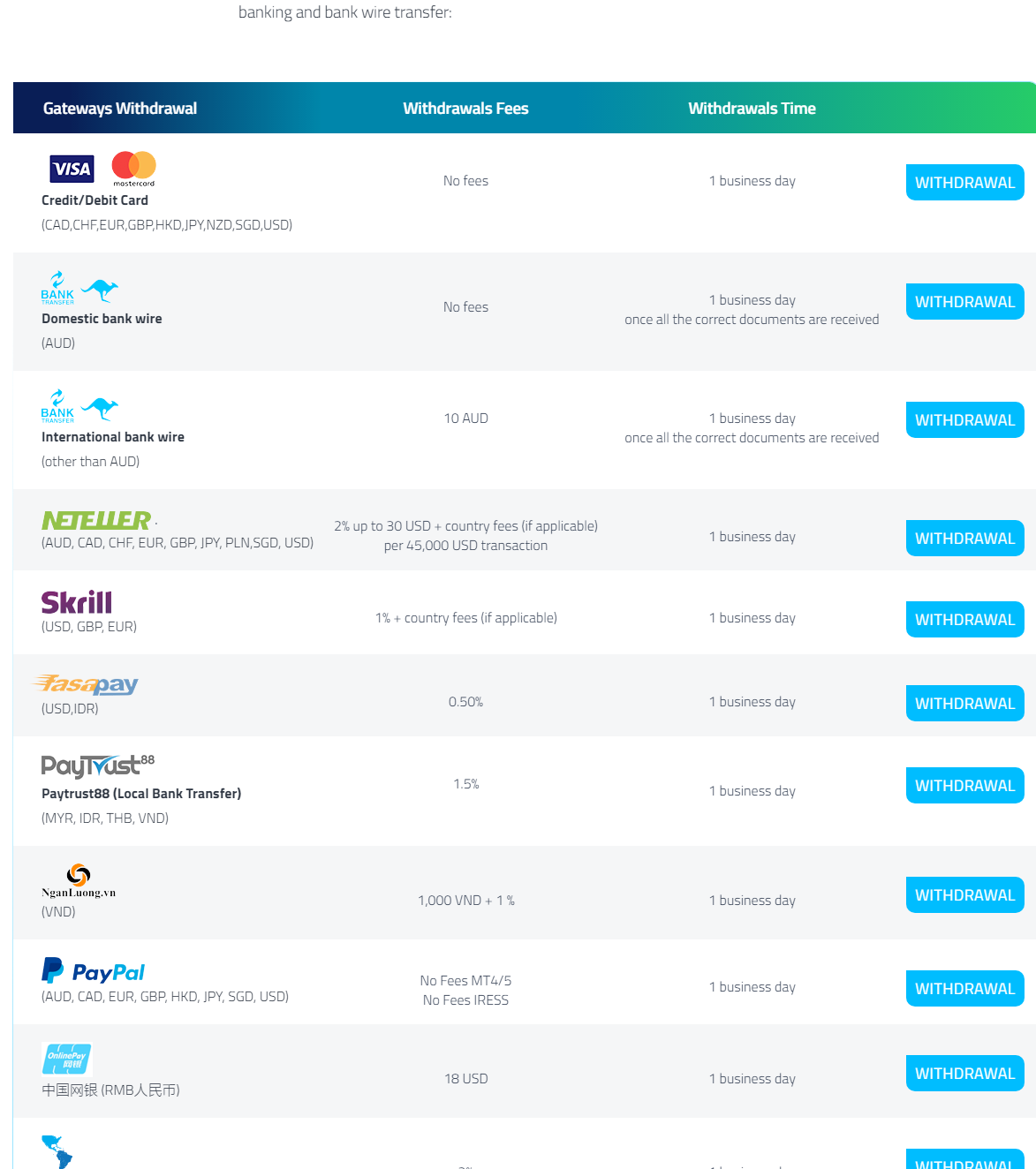

Notes: Please note, the withdrawal amount will need to be the same amount as your deposit and via the same withdrawal method. Once deposits have been withdrawn, you can use an alternative method to withdraw profits. 2. FeesThe FP Markets Withdrawal fees are as the following: FP Markets - Withdrawal Options

3. TimeThe withdrawal happens within 1 business day for all the options.

FP Markets - Withdrawal Options and Fees |

Platforms and Languages

|

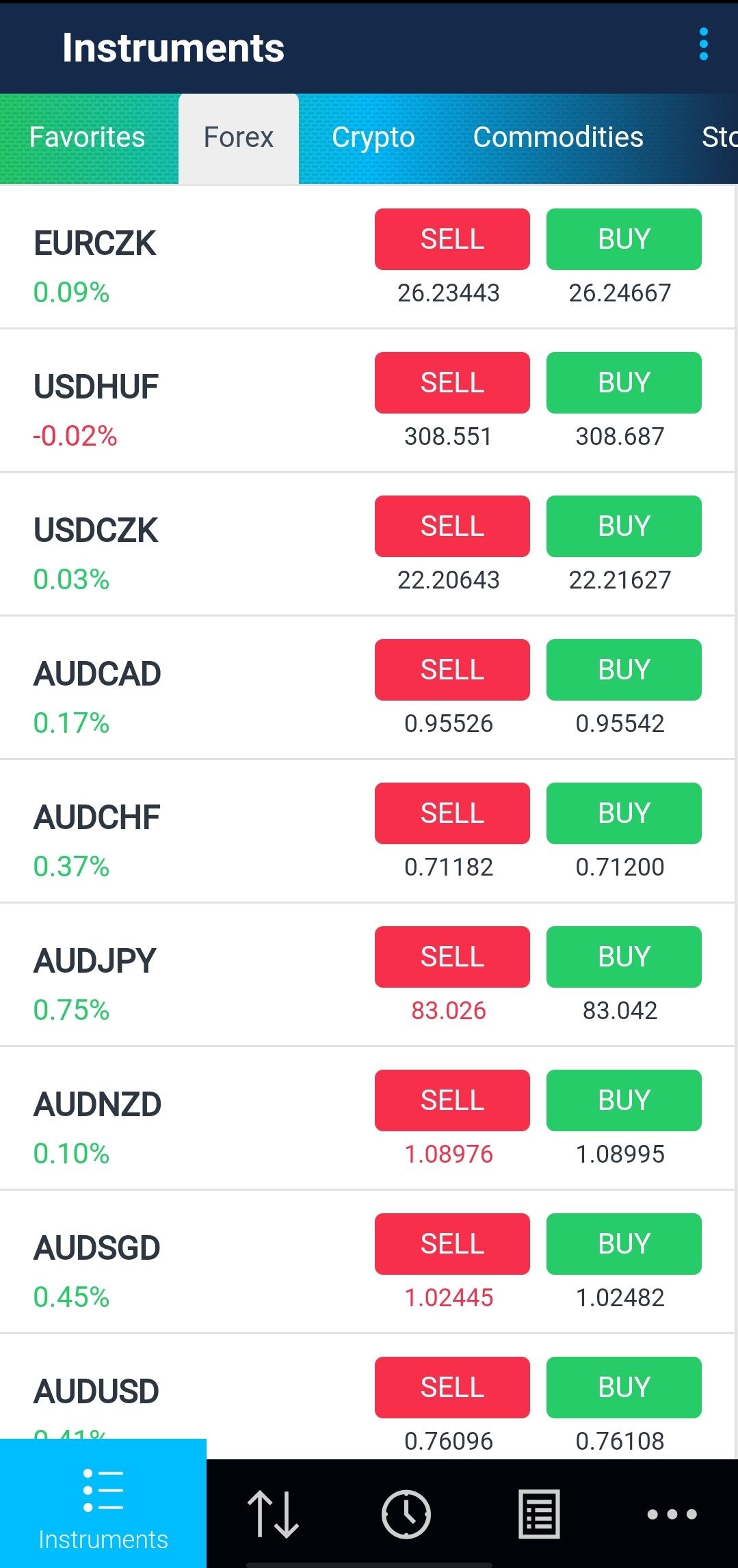

You can trade on FP Markets on different platforms like MT4 / MT5 and there’s a new mobile trading platform as well. FP Markets - Mobile Platform (New)

LanguagesFP Markets mobile platform is available in a number of languages as the following table shows. FP Markets - Mobile Platform - Languages

User interface (UI)The UI of FP Markets mobile trading platform is very user-friendly with a great ability to navigate between sections smoothly.

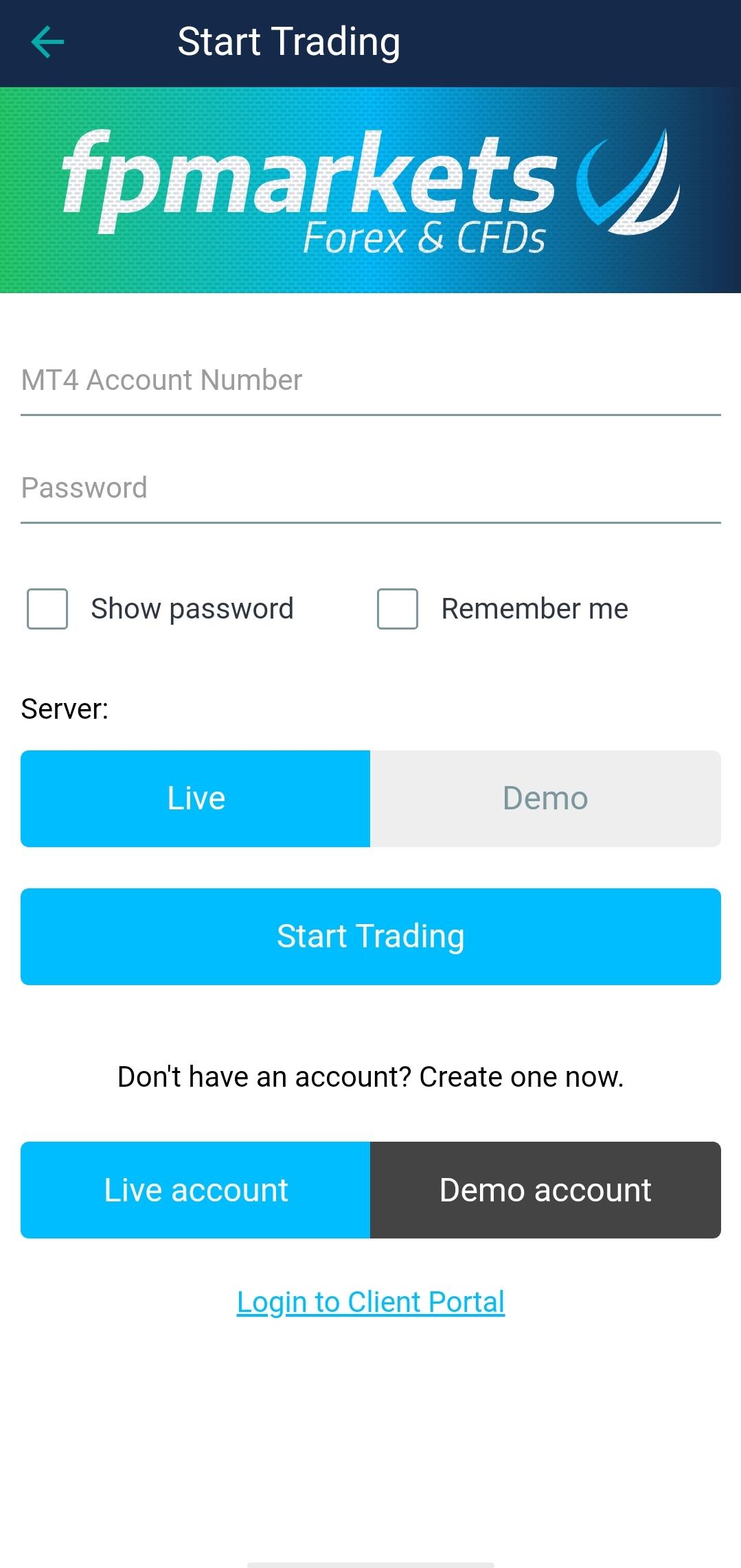

FP Markets - Mobile Platform - UI Login and SecurityThe mobile platform does support two-step verification login method nor Touch/ Face ID.

FP Markets - Mobile Platform - Login SearchingUnfortunately, there’s no search option in the platform. Placing ordersThere are 2 types main types of orders:

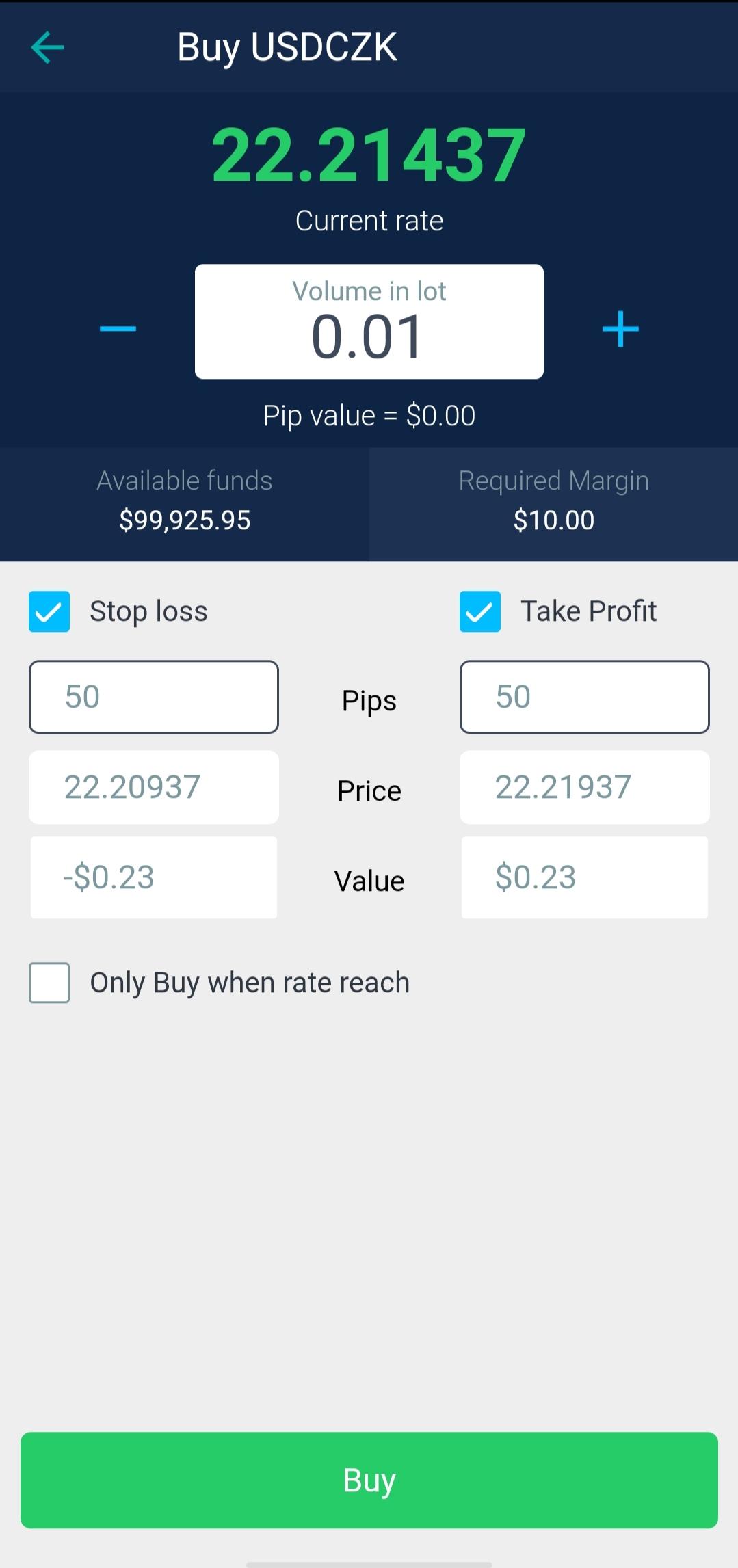

FP Markets - Mobile Platform - Place Orders Notifications and alertsThere’s no option to set alerts or notifications in the FP Markets mobile trading platform. Portfolio and reportsFP Markets has clear portfolio and fee reports. You can easily see your profit-loss balance and the commissions you paid. MT4 Platform

LanguagesMetaTrader 4 is available in a number of languages like: MT4 Languages

User interface (UI)MT4 has a very customizable UI that you can adjust according to your needs and preferences. On the other hand, it seems hard to find some of the features inside.

MT4 - Mobile Version - UI Login and SecurityUnfortunately, the MT4 does not provide a two-step verification method for logging in, and it does only support a one-step login. SearchingSearching using the MT4 platform has its pros and cons.

Placing ordersMT4 has a simple order types which are:

In addition to those 4 types, there are other orders which are the time limit ‘Good ‘til time’ (GTT) and ‘Good 'til canceled’ (GTC). There’s also an order confirmation feature in MT4. Notifications and alertsUnfortunately, the MT4 web trading platform does not have an option to set price alerts and notifications unlike the desktop and mobile versions.

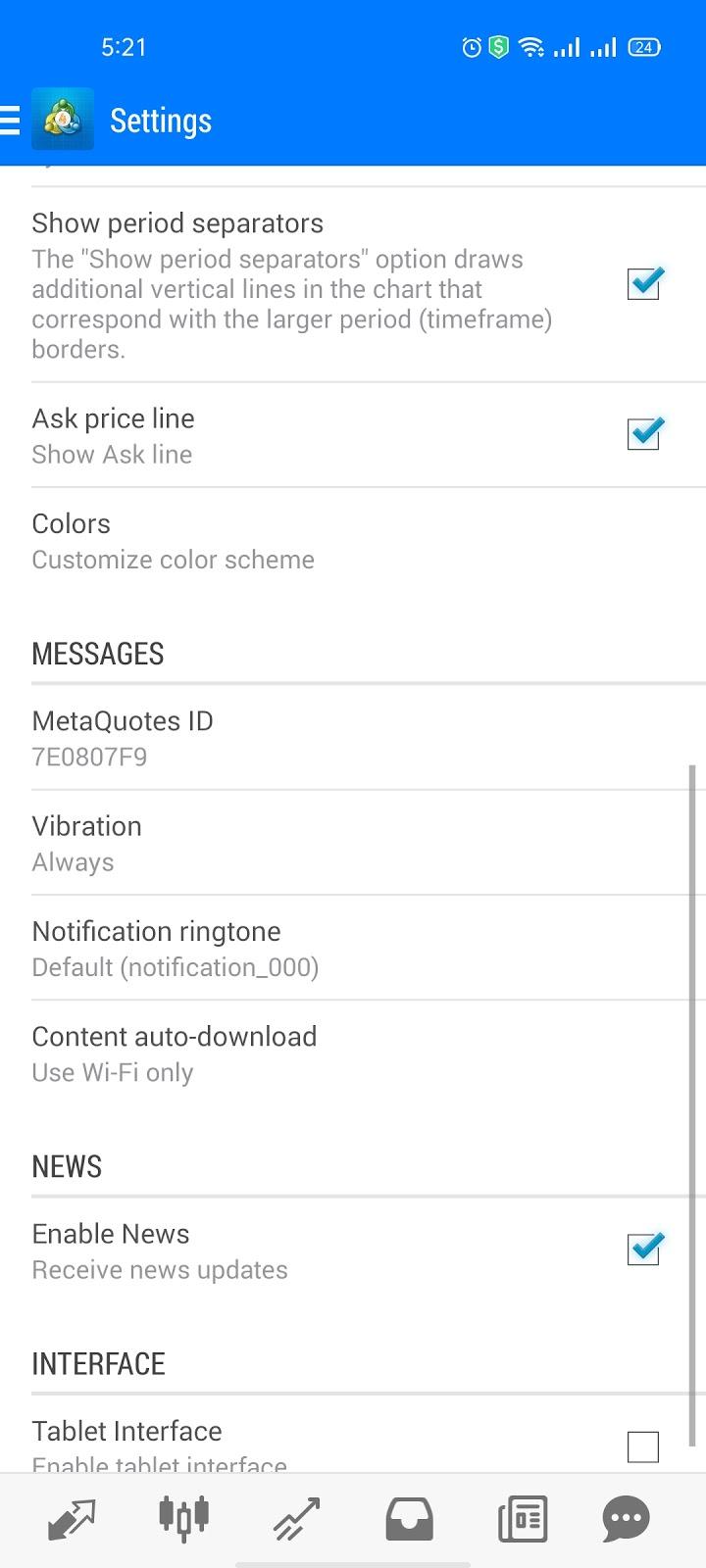

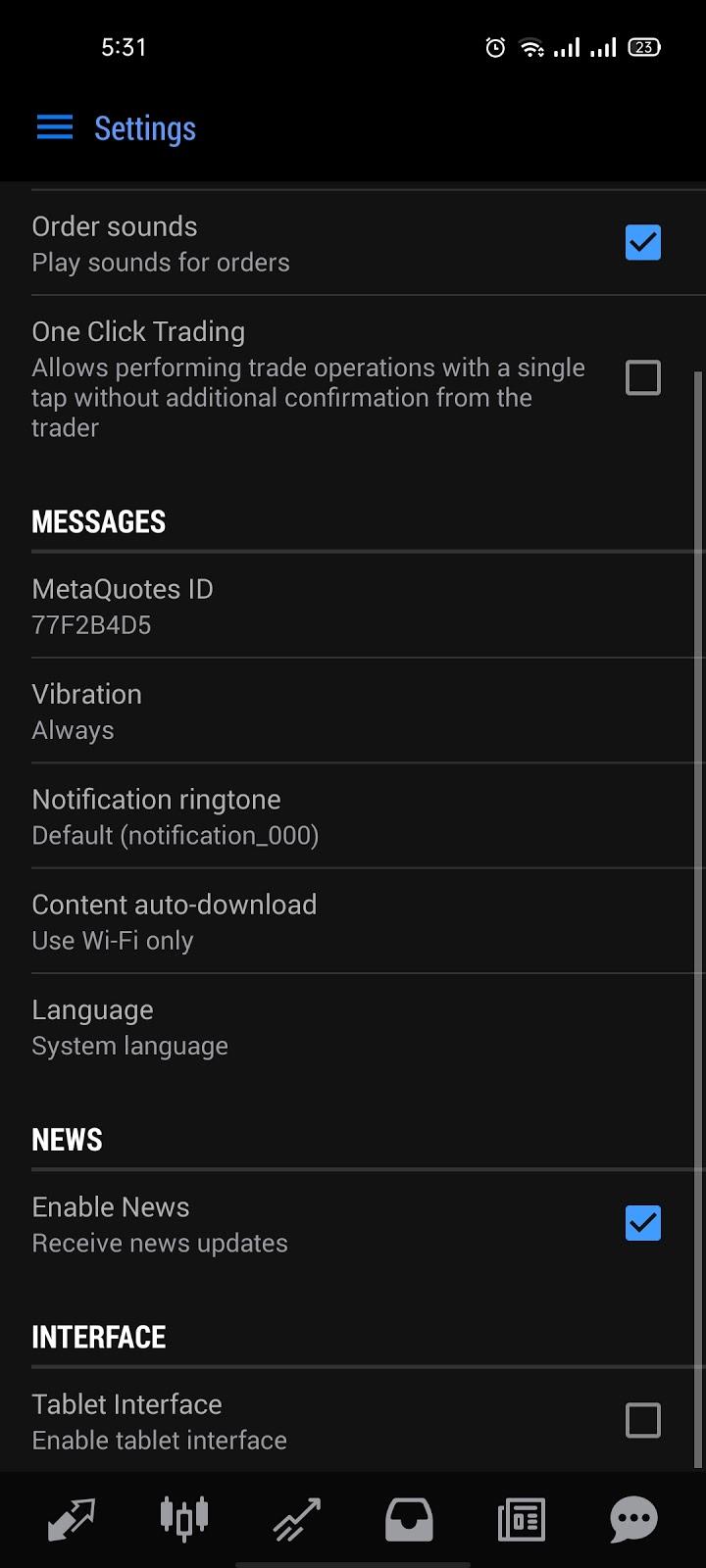

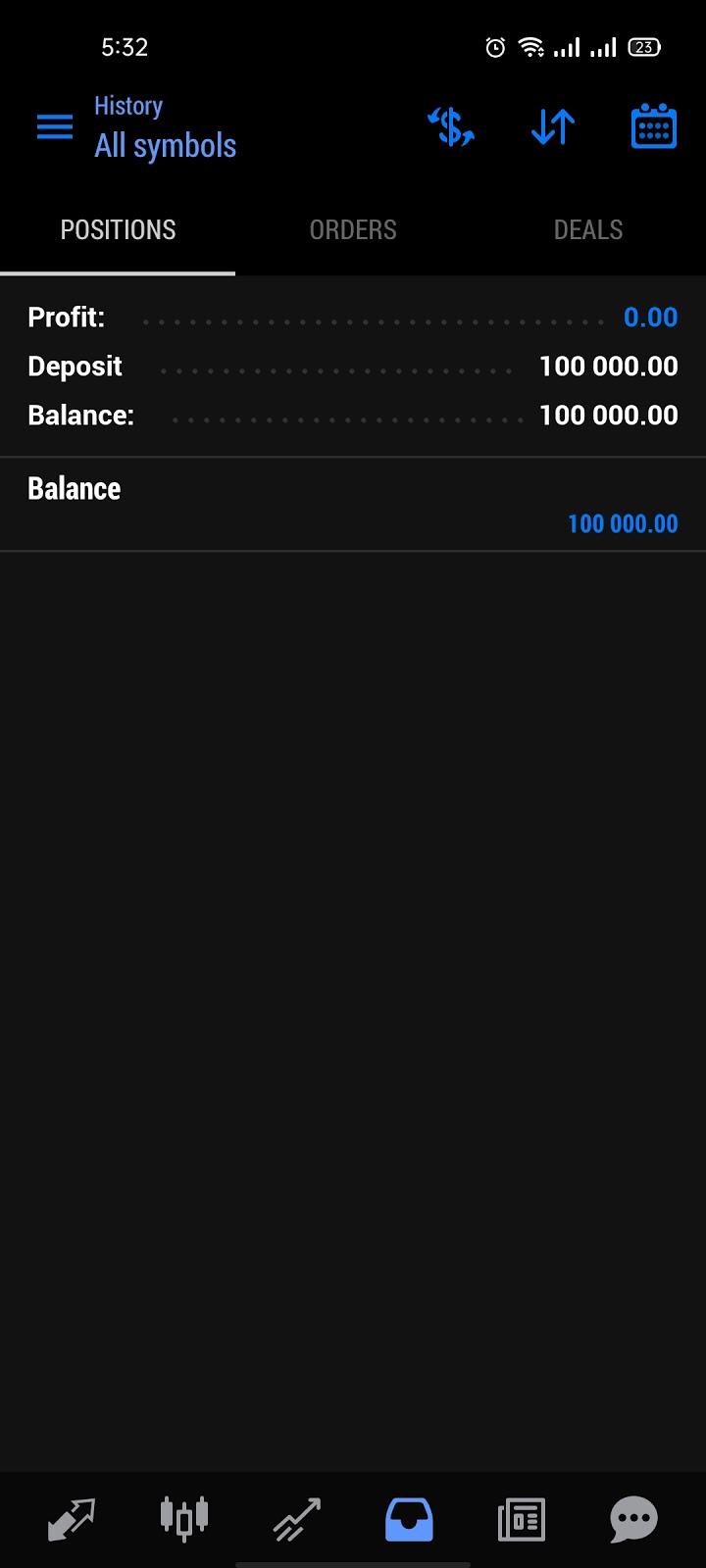

MT4 - Mobile Version - Notifications Settings Portfolio and reportsUnder the ‘History’ tab, you can find your portfolio reports with a clear fee description.

MT4 - Mobile Version - Portfolio MT5 Platform

LanguagesMT5 is available in 7 main languages: English, Russian, Spanish, Portuguese, Bulgarian, Chinese and Italian. User interface (UI)MT5 has a very customizable UI that you can adjust according to your needs and preferences with the dark theme option. On the other hand, it seems hard to find some of the features inside.

MT5 - Mobile Version - UI Login and SecurityUnfortunately, the MT5 does not provide a two-step verification method for logging in, and it does only support a one-step login. SearchingSearching using the MT5 platform has its pros and cons.

MT5 - Mobile Version - Search Placing ordersMT5 platform has a simple order types which are:

There’s also an order confirmation feature in MT5. Notifications and alertsUnfortunately, the MT5 web trading platform does not have an option to set price alerts and notifications unlike the desktop and mobile versions.

MT5 - Mobile Version - Notifications Settings Portfolio and reportsUnder the ‘History’ tab, you can find your portfolio reports with a clear fee description.

MT5 - Mobile Version - Portfolio |

Research Tools

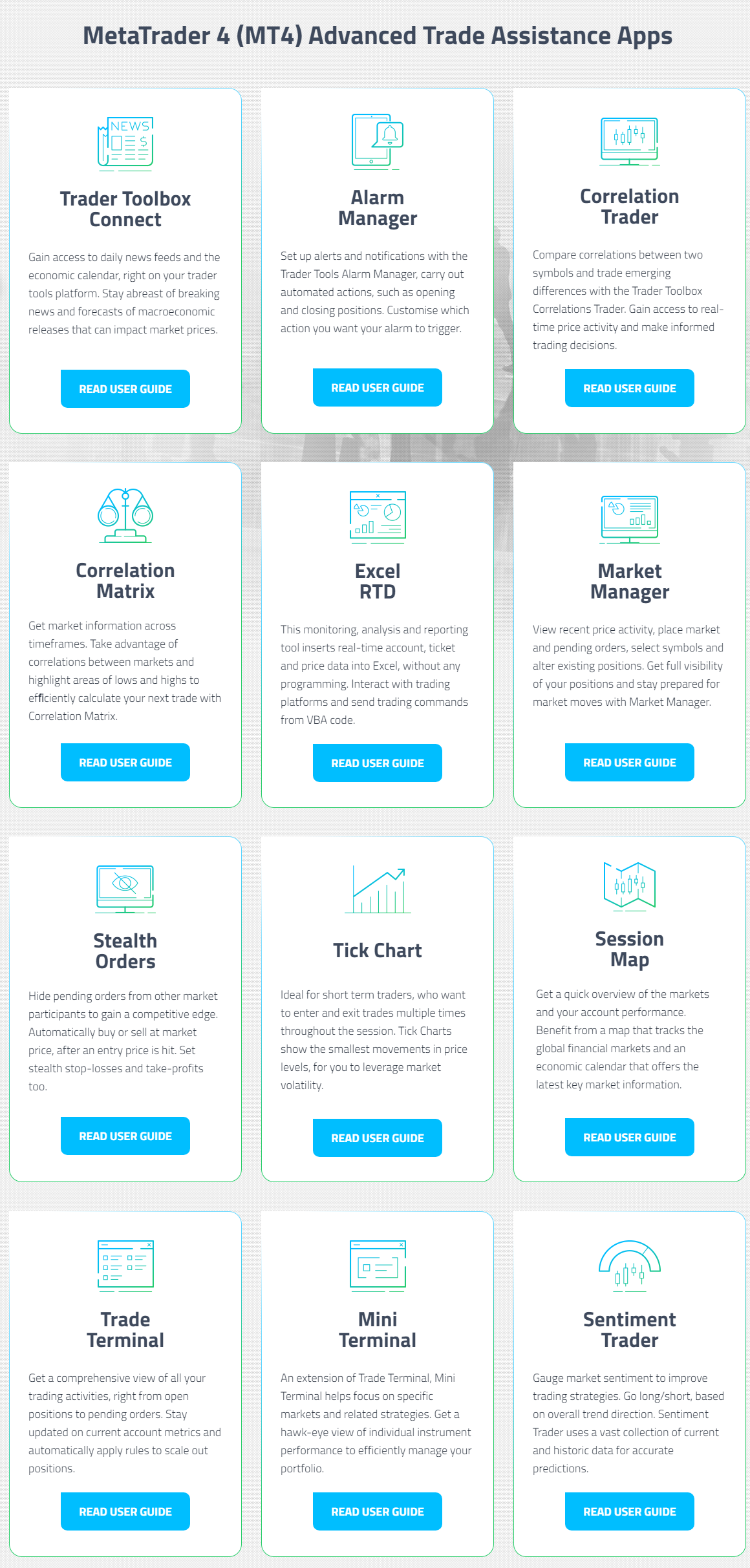

FP Markets provides a useful toolbox for the MT4 traders which can give them the most from the platform and enhance their trading experience. This toolbox includes a number of online tools, each with its features and advantages.

Trader Toolbox ConnectThis tool provides you with the latest news and forecasts as well as the seeing the upcoming events in the economic calendar. You can then apply a filter and make edits as you wish in the newsfeed. There is also a specific tab to access educational content from this tool which is kinda useful. Alarm ManagerThis tool helps you get notifications about the latest updates in the market as well as the ability to send automatic updates to your followers on Twitter account. Correlation TraderThis tool shows you the correlation between two or more symbols over a timeframe and this correlation is measured between -100 and +100.

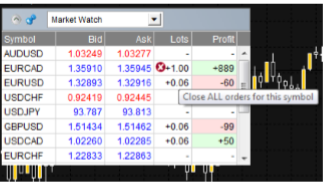

FP Markets - Research - Correlation Trader Excel RTDUsing this tool. You can display real-time data in excel Market ManagerThe market manager app shows you a watchlist of symbol prices and the open positions with the ability to close positions and open new one.

FP Markets - Research - Market Manager Stealth OrdersThe stealth orders allows you to hide your entry and exit levels from the market. The thing is that the stealth orders are only processed if the app is running and connected to your broker. Tick ChartsThis is mainly a charting tool where you can show tick charts in a variety of styles.

FP Markets - Research - Tick Charts Session MapThe session map shows your current local time in relation to “sessions” during the trading day,

FP Markets - Research - Session Map Trade TerminalWith trade terminal tool, you can access 5 main features which are:

Sentiment TraderThe Sentiment Trader helps you by displaying information about current and historic long/short sentiment which is the percentage of traders who currently have (or had) an open buy or sell position in a symbol.

FP Markets - Research - Sentiment Trader Other ToolsThere are other useful tools within FP Markets like:

You can use a variety of calculators to measure pips, currencies, margins, and profits.

It allows you to understand the trading opportunities in real time by providing real-time trade setups for beginner and experienced traders alike. |

Customer Service

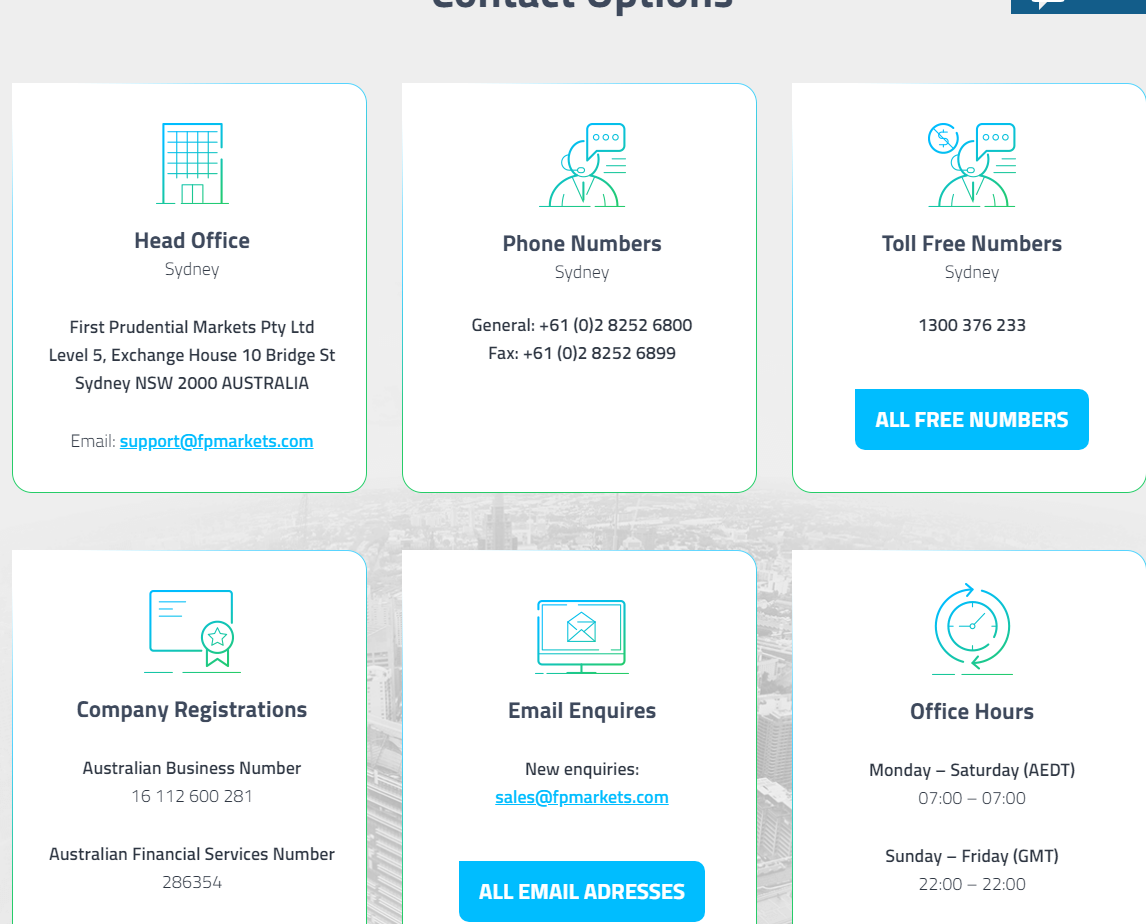

OptionsFP Markets supports different customer service channels like:

FP Markets - Customer Support Options LanguagesThe languages available for customer service are many with the support of major languages as the following table shows: FP Markets - Customer Support Languages

Experience

Unfortunately, the customer support works only for 24/5. |

Education

FP Markets provide great educational materials like:

In addition to the previous options, there’s an option to open a demo account and trade with %0 risk.

FP Markets - Education |

FAQs

1. Go to ‘Settings’ 2. Click on 'Manage Accounts' or 'Settings' 3. Then click on the small plus sign or select 'New Account' 4. Then select 'Log in to an existing account' 5. Search for the broker name 6. Select the server your account was set up on 7. Enter your login credentials and password 8. Click on 'Sign In'

Conclusion:

|