Trade Nation Full Review

Trade Nation Full Review

Trade Nation is a UK forex and CFD broker that’s regulated by top-tier FCA. it’s founded in 2014 and has trading instruments like forex, CFD, bonds, commodities, and real stocks.

Disclaimer: CFDs have a high risk of losing money rapidly. About 80% of retail investor accounts lose money due to leverage when trading CFDs with this provider. Please note that CFDs are not complying with the Islamic religion. And if you want to trade in CFDs you should consider a swap-free account to follow Islamic rules.

Learn more about CFDs for muslims.

Trade Nation Full Review - Key Statistics

Safety

Offering of Investments

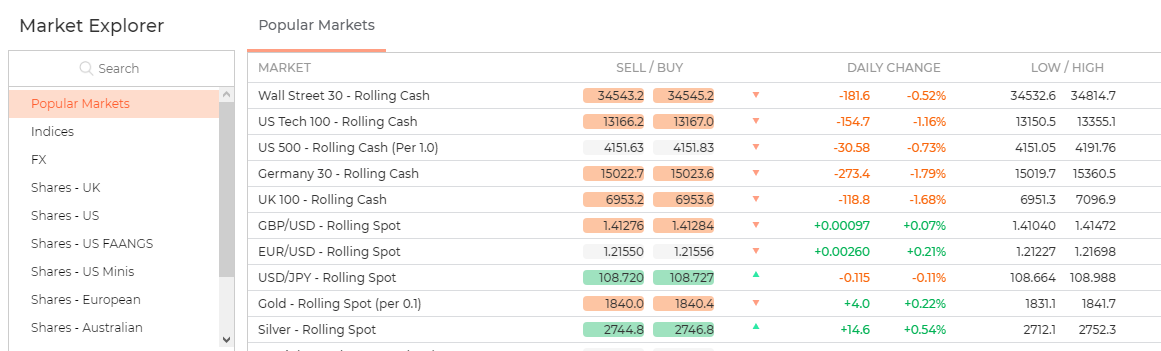

Trade Nations has a variety of trading assets like forex, CFD, metals, bonds, ETFs, commodities, energies, and cryptocurrency. on the other hand, there’s no opinions, futures, real stocks, or mutual funds trading. Disclaimer: CFDs have a high risk of losing money rapidly. About 80% of retail investor accounts lose money due to leverage when trading CFDs with this provider. Please note that CFDs are not complying with the islamic religion. And if you want to trade in CFDs you should consider a swap-free account to follow islamic rules. Learn more about CFDs for muslims. Trade Nation Offering of Investments

Notes:

|

Account Opening

Countries availableTrade Nation operates out of the United Kingdom, Australia, South Africa and the Bahamas. On the other hand, Trade Nations does not accept traders from the US, Iran, Syria or North Korea Account typesTrade Nation provides 2 types of accounts which are:

On the other hand, there’s no islamic account option on Trade Nation. Trade Nation also provides a demo account with 0 fees if you want to experience the trading platform with no risk. Min depositTrade Nation provides a $0 minimum deposit option on the individual account. How to open an accountYou can open an Trade Nation account in minutes through these steps:

Trade Nation - Account opening |

Fees and Commissions

Trading FeesForex feesThe fixed spread of EUR/ USD is 0.6 pips per lot. CFD feesFor S&P 500 CFD, the spread is 0.7 pips per lot. Disclaimer: CFDs have a high risk of losing money rapidly. About 80% of retail investor accounts lose money due to leverage when trading CFDs with this provider. Please note that CFDs are not complying with the islamic religion. And if you want to trade in CFDs you should consider a swap-free account to follow islamic rules. Learn more about CFDs for muslims. Non-trading fees

(you can check the full withdrawal fees in withdrawal fees section)

|

Deposit and Withdrawal

Account CurrenciesThe Trade Nation account has several account currencies like:

Notes:

Deposit1. OptionsTrade Nation supports depositing using different electronic wallets such that:

Trade Nation deposit methods

2. FeesTrade Nation deposits are free of charge so that you can make deposits without a $0 fee. 3. TimeIt takes about 1 to 2 business days to make a deposit through bank transfers while depositing using credit cards and electronic wallets happen instantly. Withdrawal1. OptionsTrade Nation has the same options for the withdrawal like the deposit which are:

Trade Nation withdrawal methods and fees

2. FeesTrade Nation’s withdrawals are free of charge. On the other hand, the minimum withdrawal amount is 50 units of the base currency (i.e., $50 if your account currency is USD.) 3. TimeIt takes about 2 to 3 days to withdraw your money from Trade Nation. |

Platforms and Languages

|

Trade Nation works on its customized web platform Cloud Trade as well as its mobile trading platform Trade Nation. Trade Nation also works on the MT4 trading platform as well. In this section, we will discuss each one of them in detail. Cloud Trade (Web Platform)

LanguagesCloud Trade is available in a variety of languages like English, Hungarian, French, German, Spanish, Danish, Slovenian, Swedish, Portugese, Norsk, Catalan, Italian, and Vietnamese. User interface (UI)The UI of Cloud Trade looks beautiful with all its functions in the right place.

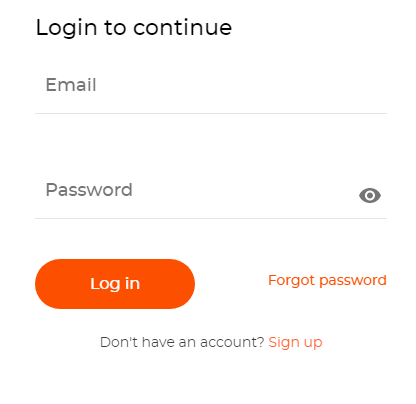

Trade Nation - Cloud Trade - UI Login and SecurityUnfortunately, Cloud Trade has no two-factor authentication method for login.

Trade Nation - Cloud Trade - Login SearchingThe searching function within the Cloud Trade Platform works fine with the ability to search by category as well as the asset name.

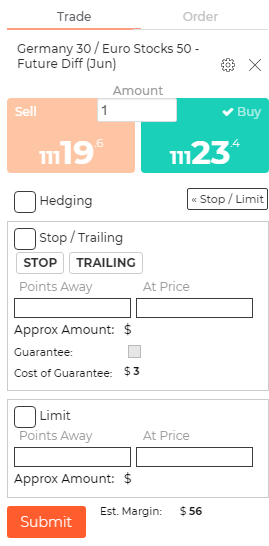

Trade Nation - Cloud Trade - Searching Placing ordersThere are several types of orders at Cloud Trade like:

In addition to those types, there’s another order which is the time limit ‘Good ‘til time’ or GTT.

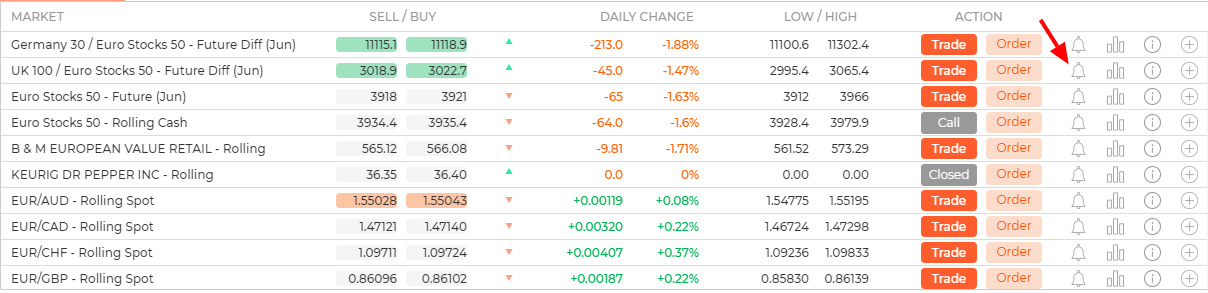

Trade Nation - Cloud Trade - Place Orders Notifications and alertsCloud Trade allows its clients to set price and notification alerts on assets in order to be updated regularly.

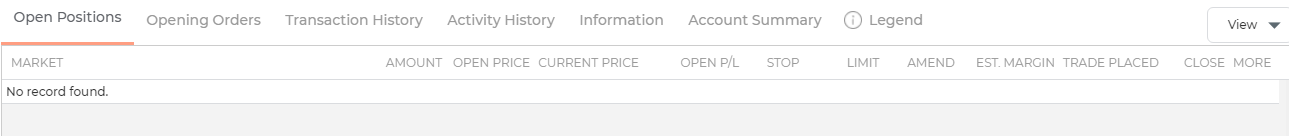

Trade Nation - Cloud Trade - Price Alerts Portfolio and reportsThe portfolio and reports within Cloud Trade platform are clear and there are a number of helpful reports available like:

Trade Nation - Cloud Trade - Portfolio and Reports Trade Nation (Mobile Platform)

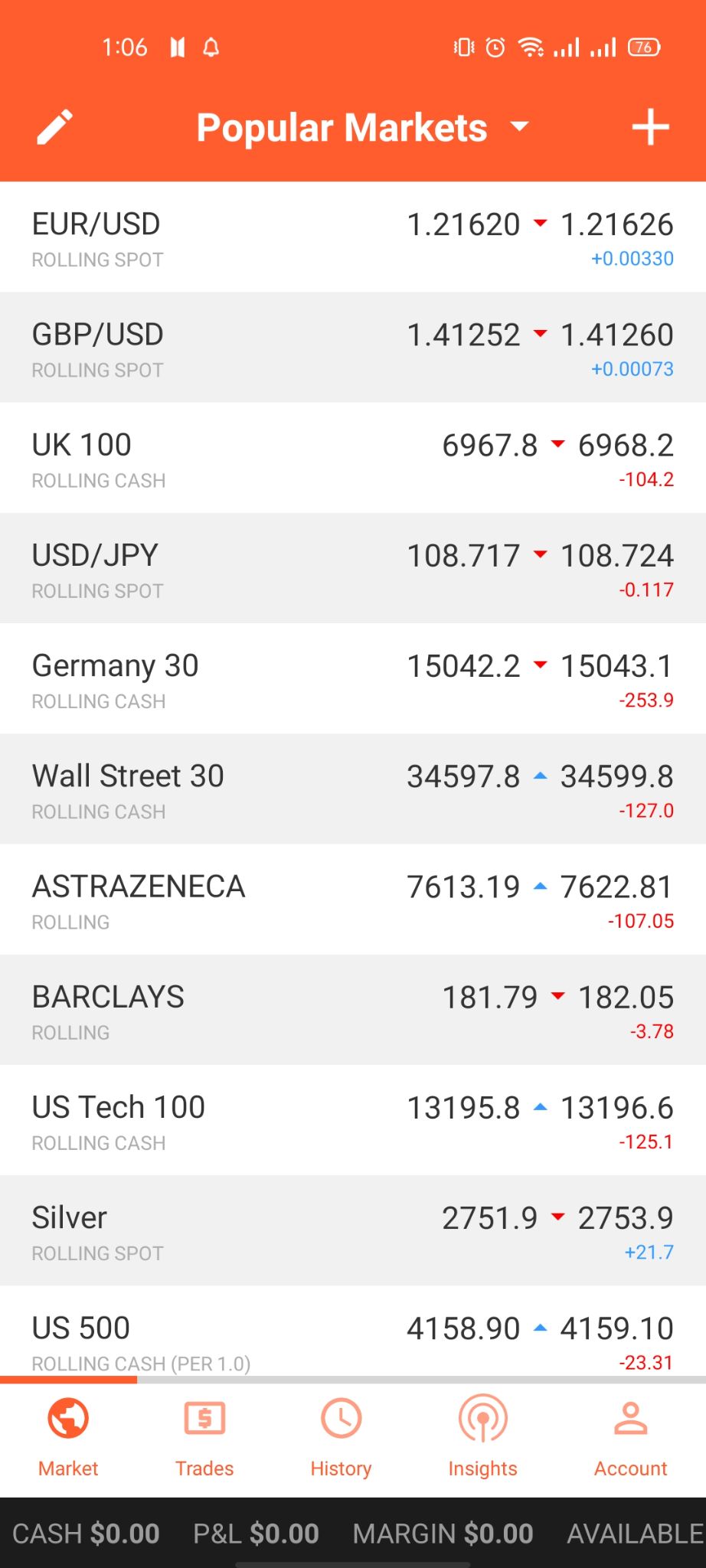

LanguagesThe only available language in the Trade Nation mobile platform is English. User interface (UI)The UI of Trade Nation Mobile Platform looks good and user-friendly as well.

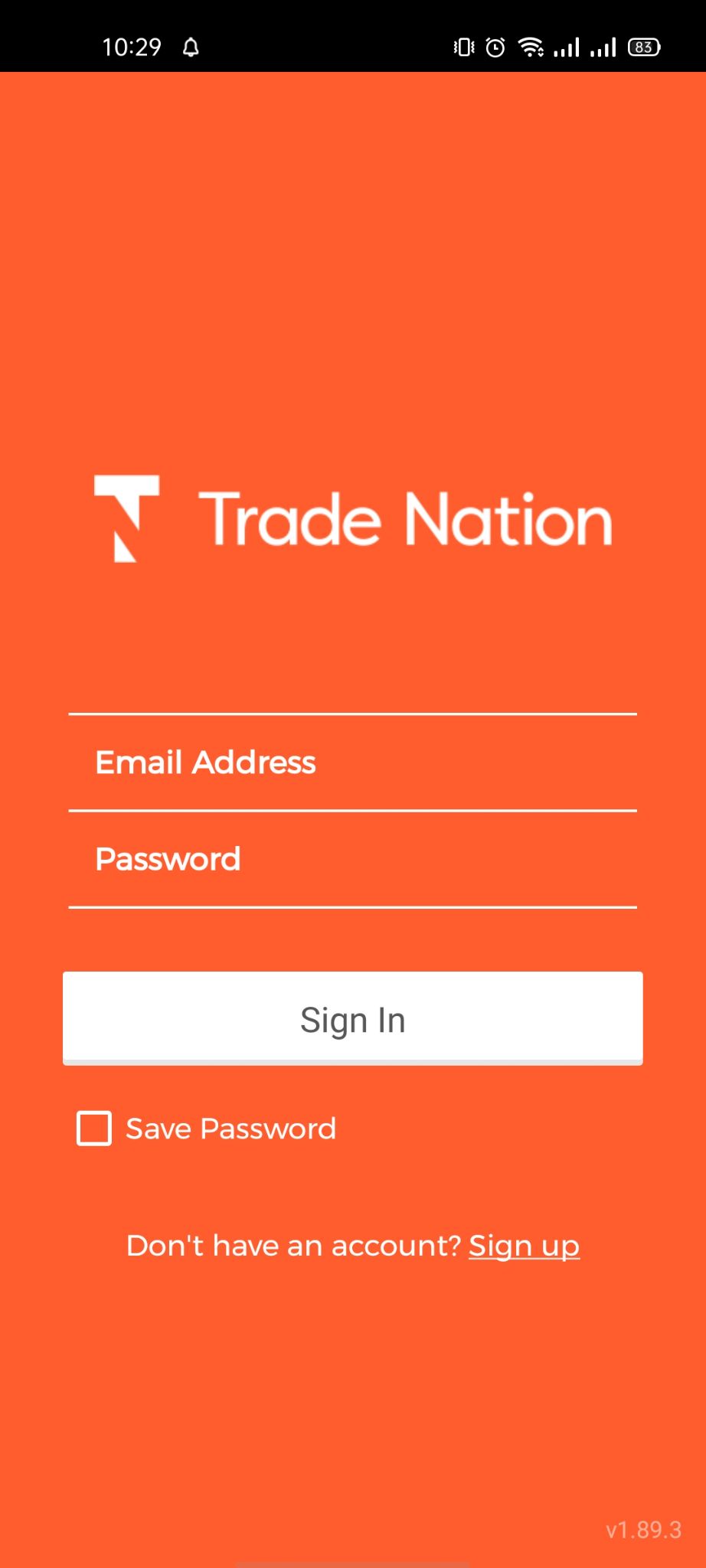

Trade Nation - Mobile Platform - UI Login and securityUnfortunately, the Trade Nation mobile application supports only a one-step verification method for login.

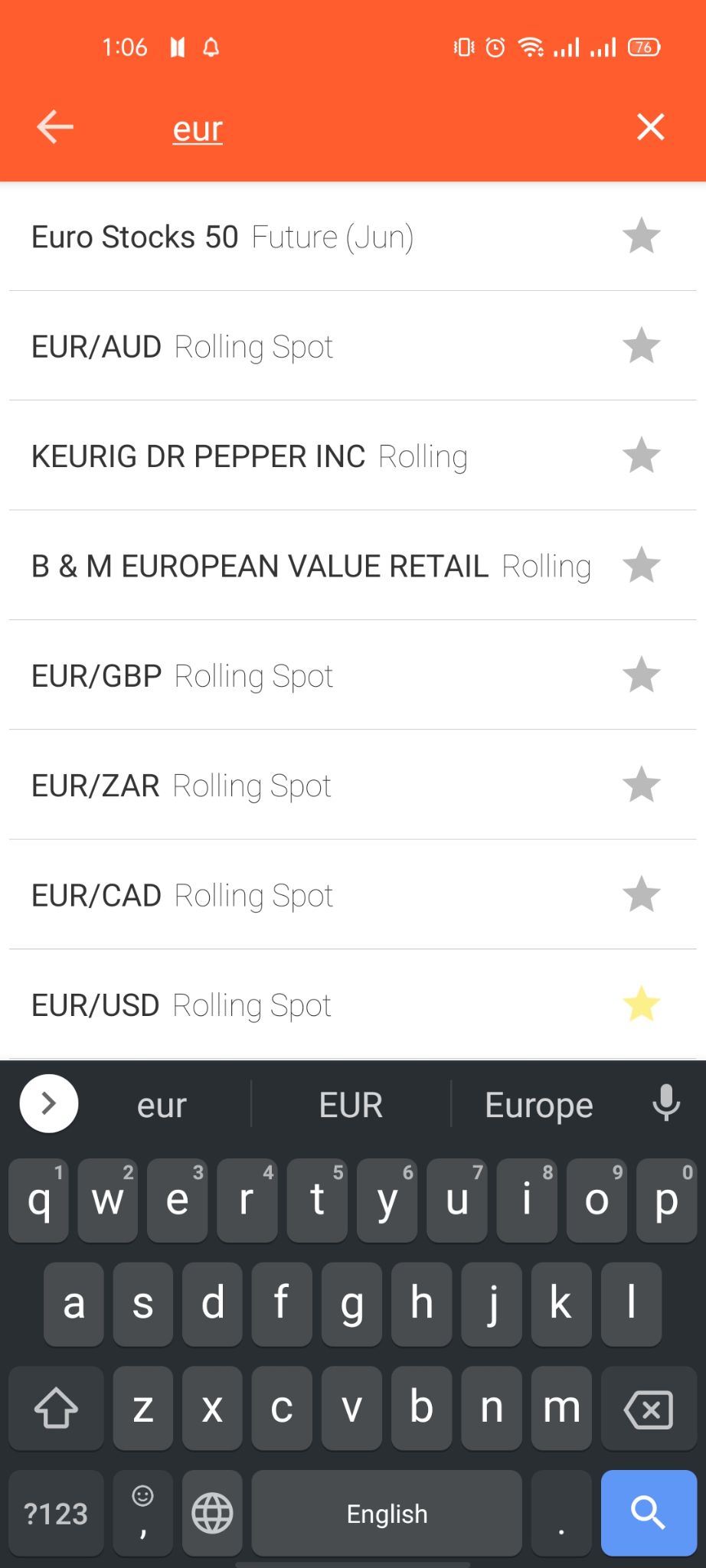

Trade Nation - Mobile Platform - Login SearchingThe mobile application of Trade Nation has a structured searching function. Using this function, you can search for asset categories or by the asset name itself.

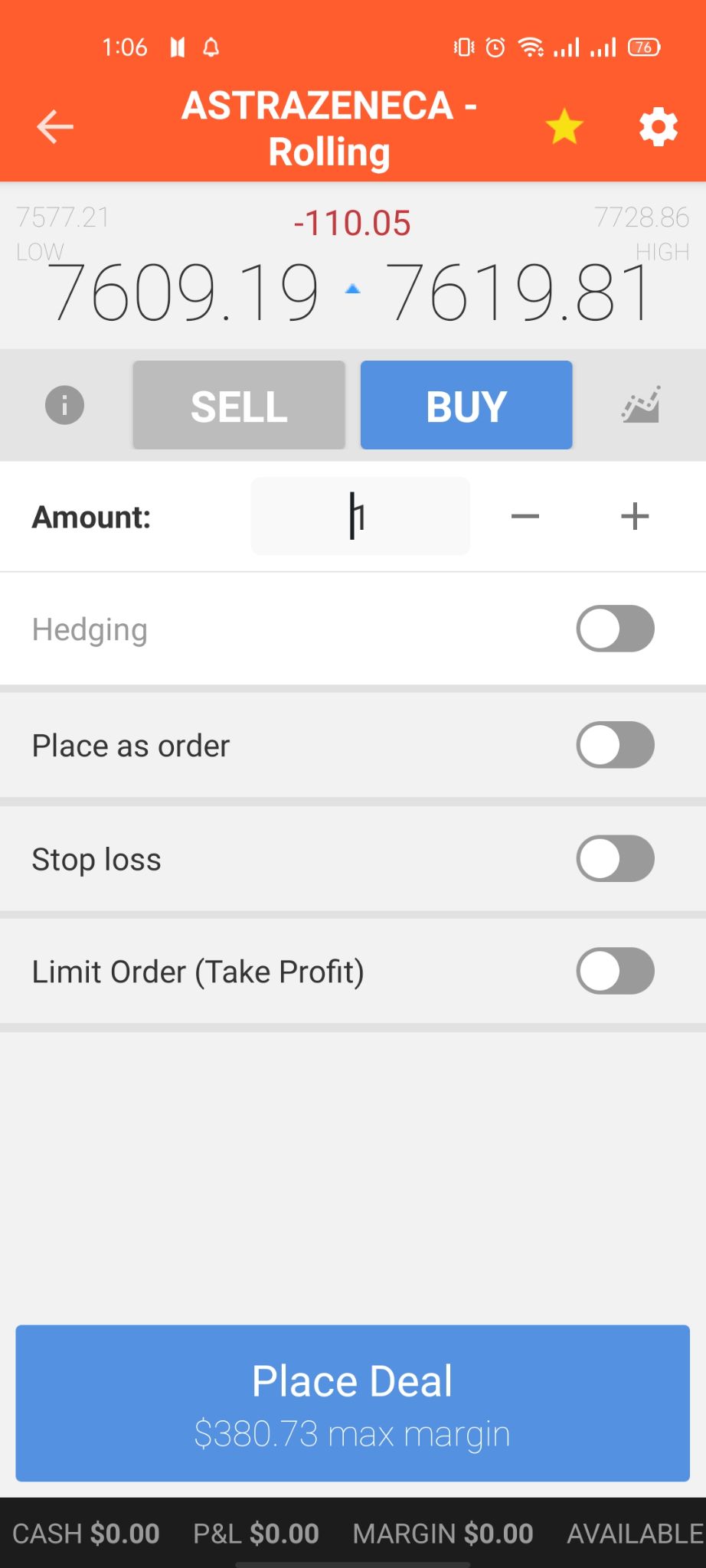

Trade Nation - Mobile Platform - Searching Placing ordersSame as the web platform, There are several types of orders at Cloud Trade like:

In addition to those types, there’s another order which is the time limit ‘Good ‘til time’ or GTT.

Trade Nation - Mobile Platform - Place Orders Notifications and alertsSurprisingly, there’s no option to set price alerts or notification in the mobile trading platform of Trade Nation. MT4

LanguagesMetaTrader 4 is available in a number of languages like: MT4 Languages

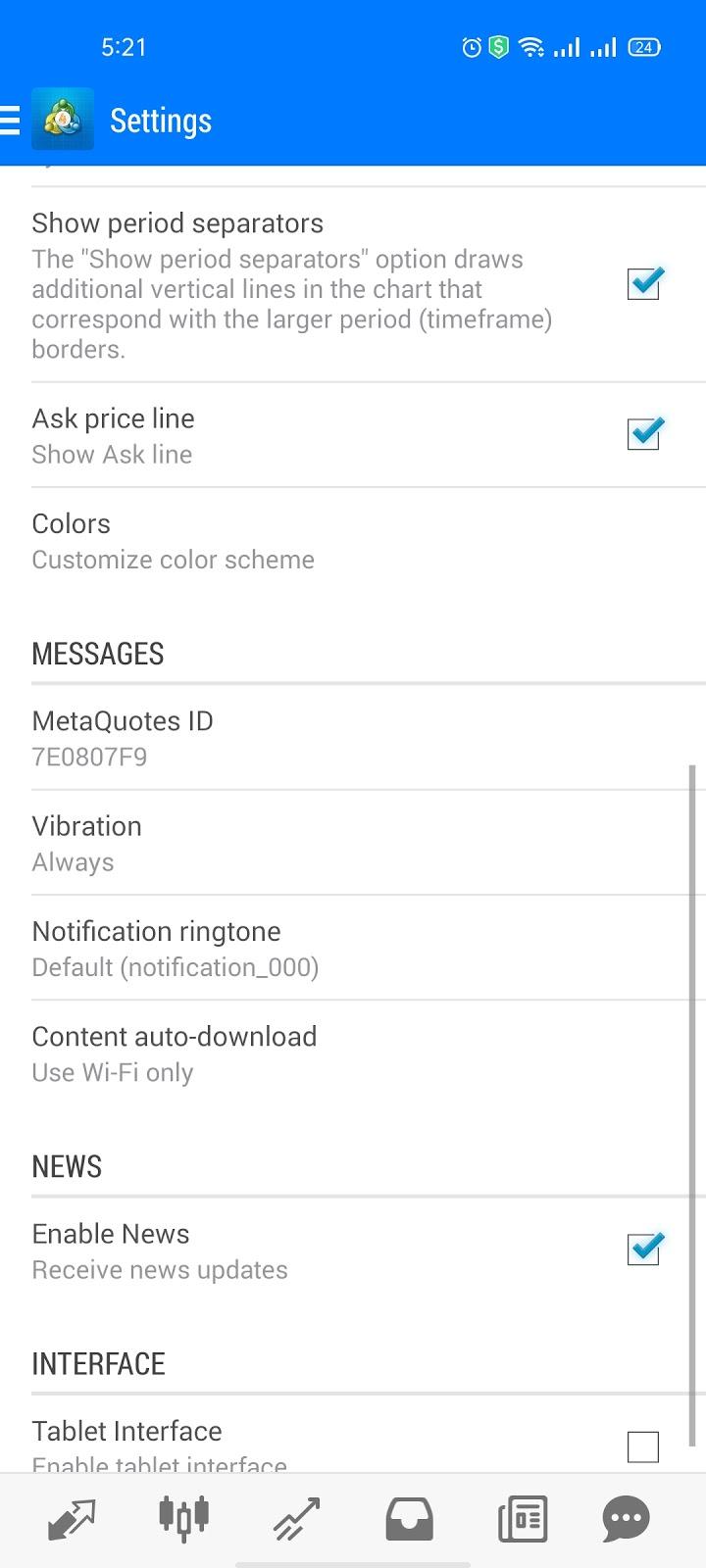

User interface (UI)MT4 has a very customizable UI that you can adjust according to your needs and preferences. On the other hand, it seems hard to find some of the features inside.

MT4 - Mobile Version - UI Login and SecurityUnfortunately, the MT4 does not provide a two-step verification method for logging in, and it does only support a one-step login. SearchingSearching using the MT4 platform has its pros and cons.

Placing ordersMT4 has a simple order types which are:

In addition to those 4 types, there are other orders which are the time limit ‘Good ‘til time’ (GTT) and ‘Good 'til canceled’ (GTC). There’s also an order confirmation feature in MT4. Notifications and alertsUnfortunately, the MT4 web trading platform does not have an option to set price alerts and notifications unlike the desktop and mobile versions.

MT4 - Mobile Version - Notifications Settings Portfolio and reportsUnder the ‘History’ tab, you can find your portfolio reports with a clear fee description.

MT4 - Mobile Version - Portfolio |

Research Tools

SourcesThe research tools comes from 2 different sources which are:

Trading ideasThe trading ideas of Trade nation comes from the trading signals tool provided by the Signal Centre. This tool helps you find out patterns and predict losses and benefits in order to take actions.

Signal Centre Fundamental dataThere’s no fundamental data available at Trade Nation broker. ChartingTrade Nation has a good charting option with a variety of indicators to choose from.

Trade Nation - Research - Charting NewsfeedFrom the ‘News & Analysis’ section at Trade Nation’s website, you can be updated with a news flow of the financial market.

Trade Nation - Research - Newsfeed |

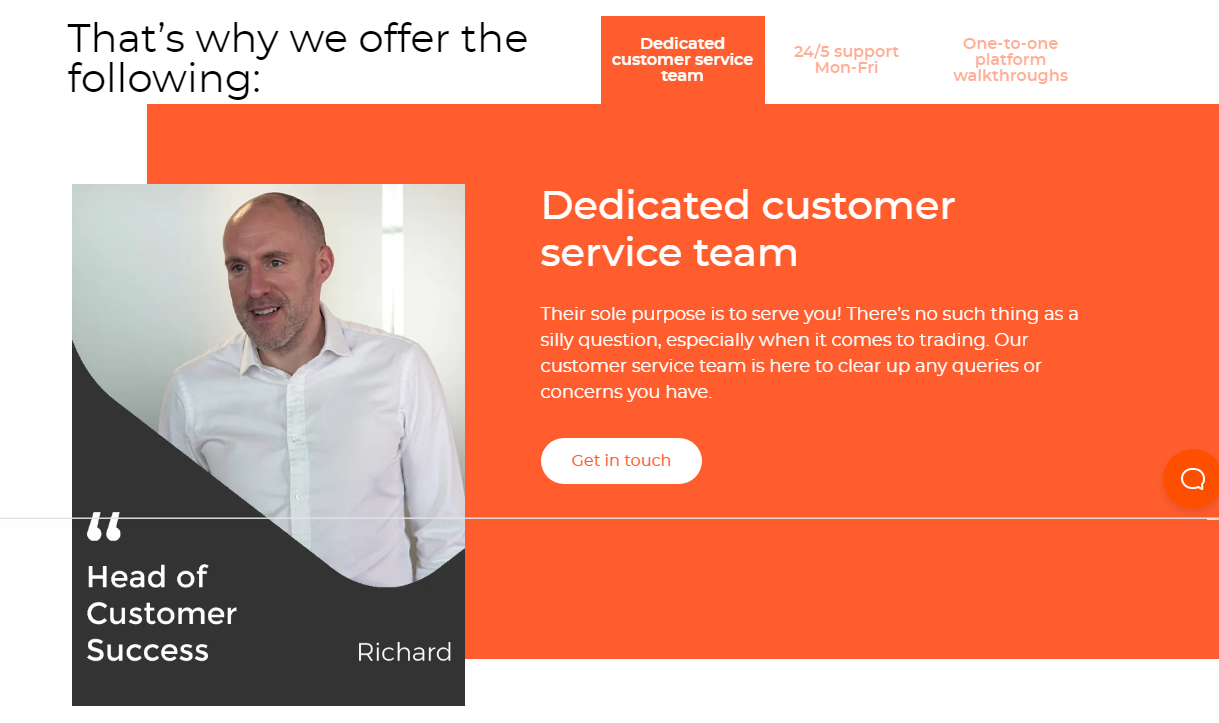

Customer Service

OptionsTrade Nation supports different customer service channels like:

Trade Nation - Customer Support |

Education

Nation Trade has helpful educational guides and videos for those who want to learn trading and know more about the broker and how it works.

Trade Nation - Education |

FAQs

1. Go to ‘Settings’ 2. Click on 'Manage Accounts' or 'Settings' 3. Then click on the small plus sign or select 'New Account' 4. Then select 'Log in to an existing account' 5. Search for the broker name 6. Select the server your account was set up on 7. Enter your login credentials and password 8. Click on 'Sign In'

Conclusion:

|