FXCM Full Review

FXCM Full Review

FXCM is a forex and CFD broker that was originally founded in the US. in 1999. After about 10 years, there was an acquisition in 2010 and its headquarters moved from NYC to London in the UK. FXCM has over 200,000 traders worldwide and is regulated by top-tier financial authorities like FCA, the Financial Conduct Authority and CySEC, the Cyprus Securities and Commission Exchange. FXCM has no commissions on shares and low trading fees as well as non-trading fees.

Disclaimer: CFDs have a high risk of losing money rapidly. About 80% of retail investor accounts lose money due to leverage when trading CFDs with this provider. Please note that CFDs are not complying with the islamic religion. And if you want to trade in CFDs you should consider a swap-free account to follow islamic rules. Learn more about CFDs for Muslims.

FXCM Full Review - Key Statistics

Safety

Offering of Investments

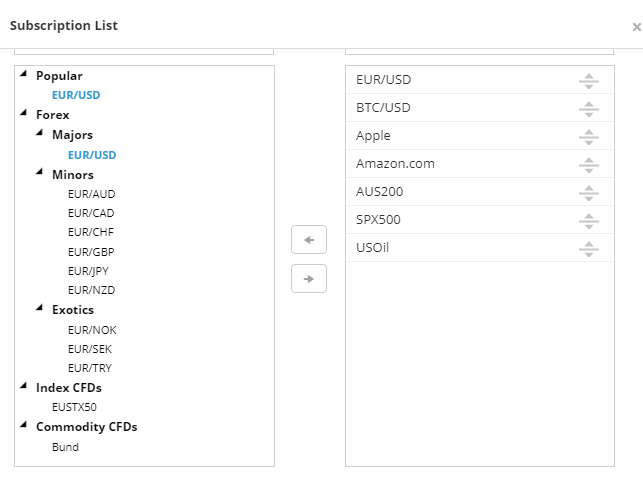

FXCM has a variety of products in different categories like forex, CFDs, baskets, commodities, and cryptocurrencies. On the other hand, there’s no ETFs, futures, or mutual funds trading. Disclaimer: CFDs have a high risk of losing money rapidly. About 80% of retail investor accounts lose money due to leverage when trading CFDs with this provider. Please note that CFDs are not complying with the islamic religion. And if you want to trade in CFDs you should consider a swap-free account to follow islamic rules. Learn more about CFDs for muslims. FXCM Offering of Investments

Note: Please note that some of the trading options may depend on your account type and / or your country of residence according to the governmental rules. Countries that can not trade on Forex

|

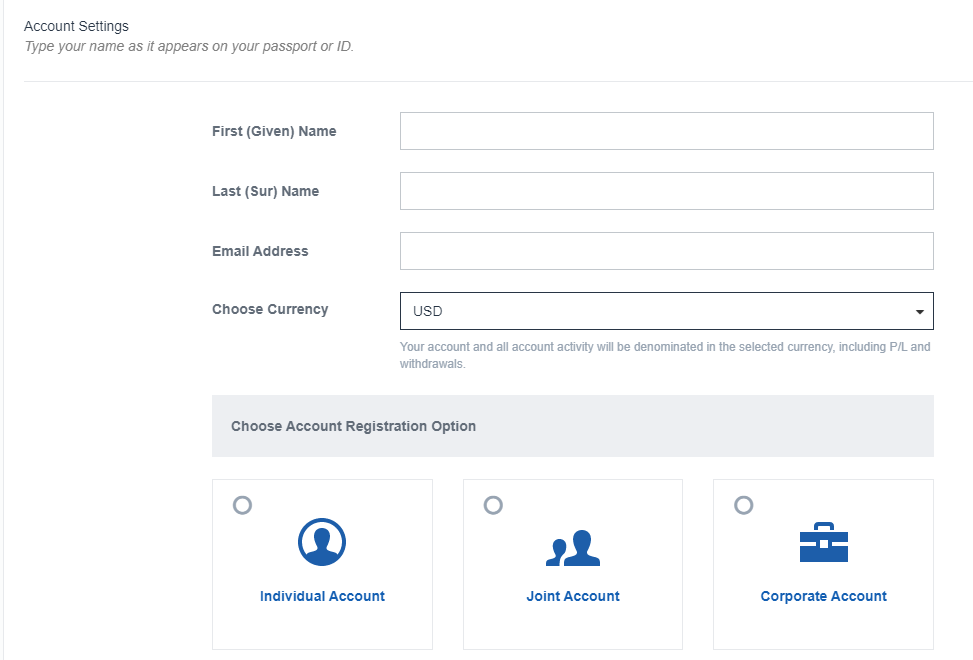

Account Opening

Countries availableFXCM is available in a lot of countries around the world. There are a few exceptions including, but not limited to the USA, Japan, Brazil, Turkey, Hong Kong, Iran, Cuba, Russia, New Zealand, Syria and South Korea. Please note that FXCM is not available for the US residents as it was banned from United States markets for defrauding its customers. Account typesFXCM has 3 account options which are:

Each one of them has its features and specifications. For example, the standard account is mainly for the traditional traders who does not trade a lot, but for the Active trader Account, it’s directed to the traders who trade with high volumes and need some additional features like:

In addition to the previous account type which is the Corporate account type for larger organizations. Please note that there’s a fee of $300 if you opened this account type and it will be deducted from your first deposit. FXCM also provides a demo account with 0 fees if you want to experience the trading platform with no risk. Min depositThe minimum deposit differs according to the account type,and country of residence as the following.

$50 (for non-EU customers)

How to open an accountYou can open an FXCM account in minutes through these steps:

FXCM - Account Opening |

Fees and Commissions

CommissionsFXCM applies commissions on forex currency pairs according to the account base currency. For example, this is the commissions on trading EUR/ USD per 100K trade per side according to the base currencies:

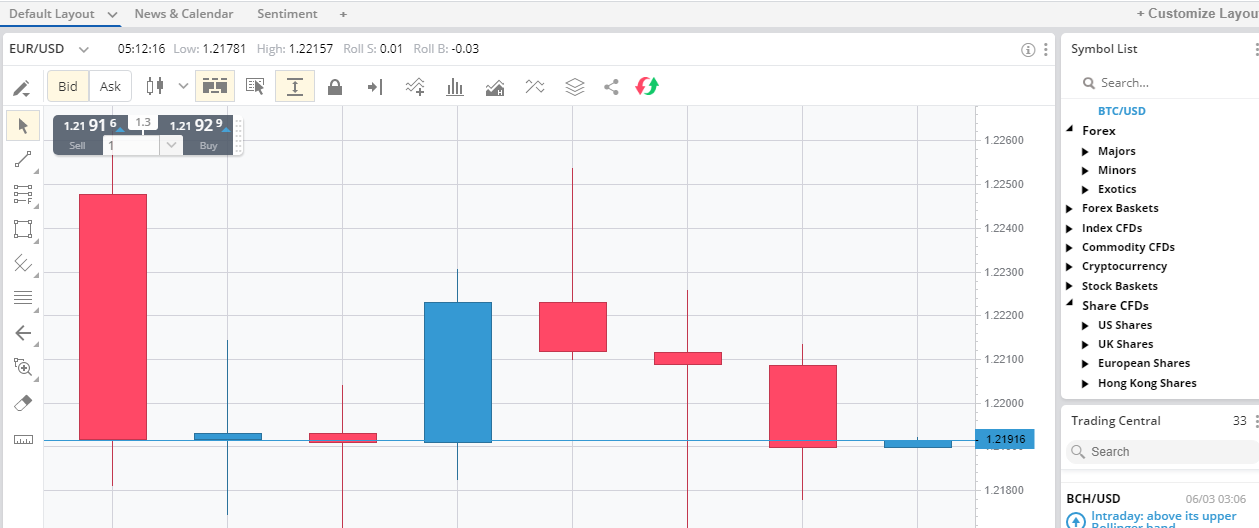

Trading FeesForex feesThe average spread of trading EUR/ USD is 1.3 pips per lot. Index CFDsThe average spread of trading SPX 500 is 5 pips per lot. Disclaimer: CFDs have a high risk of losing money rapidly. About 80% of retail investor accounts lose money due to leverage when trading CFDs with this provider. Please note that CFDs are not complying with the islamic religion. And if you want to trade in CFDs you should consider a swap-free account to follow islamic rules. Learn more about CFDs for muslims. Commodity feesThe average spread of trading US Oil is 4 pips per lot. Stock and SharesThe average spreads of trading Apple and Amazon shares are 13 and 211 pips per lot respectively. CryptocurrenciesThe average spread of trading BTC/ USD is 40 pips per lot. Non-trading fees

(you can check the full withdrawal fees in withdrawal fees section)

|

Deposit and Withdrawal

Account CurrenciesThe FXCM account has 7 main base currencies which are:

Notes:

Deposit1. OptionsFXCM supports depositing using different electronic wallets such that:

FXCM Deposit Methods

2. FeesAll the deposit options are fee-free although your bank may charge you with additional fees that are deducted from the deposit amount. 3. TimeThe time required to receive your money into your FXCM trading account varies from a deposit method to another as the following table shows. FXCM Deposit Options and Time

Withdrawal1. OptionsFXCM provides the same options of depositing for withdrawals which are:

FXCM withdrawal methods and fees

2. FeesFXCM withdrawals are free of charge for all options except for the bank transfers that have a $25 fee if the beneficiary account is located in the UK and a fee of $40 for international banks. 3. TimeIt takes 1 to 2 business days for credit/ debit cards and electronic wallets. Bank transfers may take from 3 to 5 business days to proceed. |

Platforms and Languages

|

FXCM works on a number of trading platforms like:

Each one of the previous trading platforms has its own specifications and features that are different from the others. For example: the ZuluTrade trading platform which is a platform in which you can copy trades and strategies from successful traders. In this section we will dig deeper into the FXCM own trading platform and the MT4 as well in detail. Unfortunately, FXCM is not available on the MetaTrader 5 platform which is a newer version of MT4. Web Trading Platform

LanguagesThe FXCM web trading platform is available in 9 main languages which are: Arabic, German, greek, English, Spanish, Italian, French, Chinese and Japanese.

FXCM - Web Platform - Languages User interface (UI)The UI of the web trading platform is very user friendly and easy-to-use. You can find all the functions you want in their right places without any problem. Also, the functions work seamlessly without any problems.

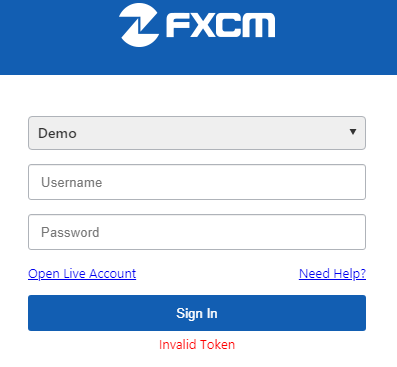

FXCM - Web Platform - UI Login and SecurityThe FXCM web trading platform lacks the two-factor authentication method and only has a one-step verification by the account number and password.

FXCM - Web Platform - Login SearchingThe searching function within the web trading platform of FXCM works very well. You can explore through the categories of the products as well as searching for any product you want by easily typing the first letters of it.

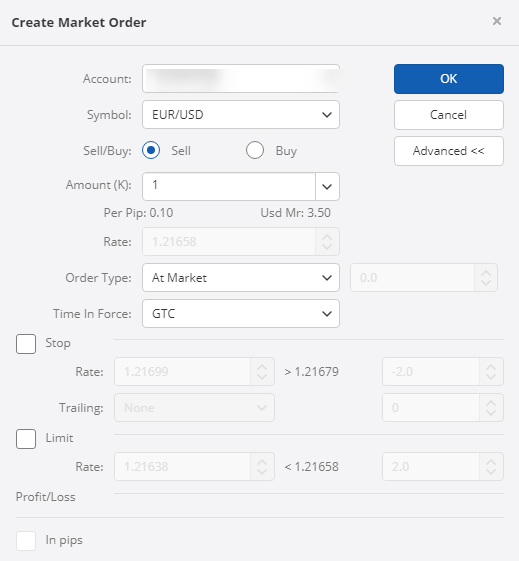

FXCM - Web Platform - Search Placing ordersThere are 5 types of orders:

The web trading platform also has an order confirmation method that saves you and your money from trading risky.

FXCM - Web Platform - Place Order Notifications and alertsAs a negative point, FXCM does not have any notification or price alerts function. Portfolio and reportsThe platform has clear fee and portfolio reports which you can use in order to track your activities on the platform. Desktop Trading Platform

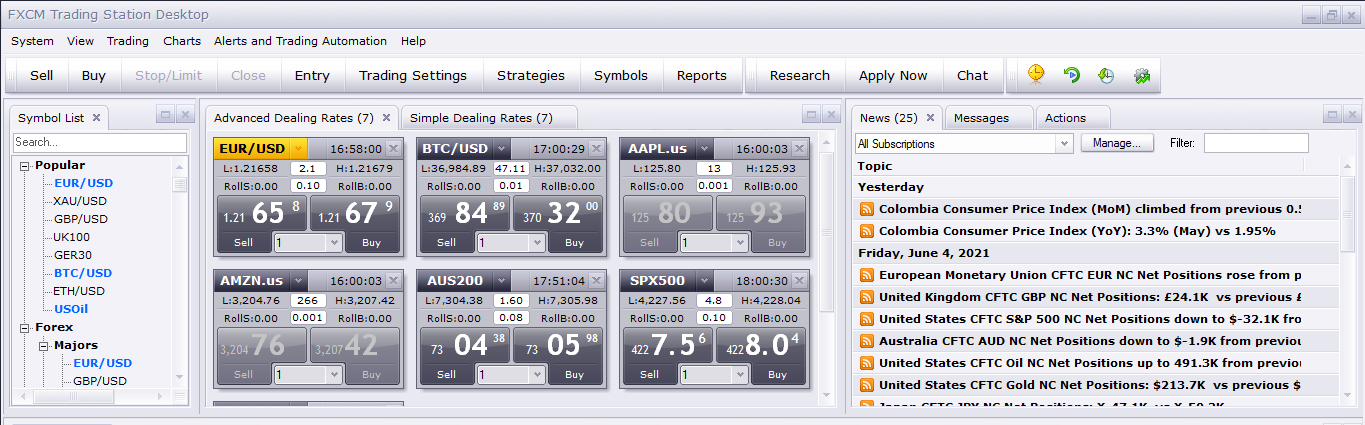

LanguagesThe FXCM web trading platform is available in 17 languages which are: English, Chinese (Simplified), Chinese (Traditional), Russian, Japanese, French, Spanish, German, Arabic, Korean, Italian, Turkish, hebrew, Greek, Portuguese, Polish, and Hungarian. User interface (UI)The UI of the desktop trading platform is simple. Beginner traders may find it hard-to-use in the beginning, but they will familiarize themselves with it after a while. The desktop trading platform is also well designed and has a good charting options.

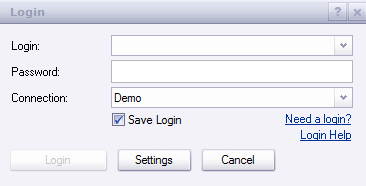

FXCM - Desktop Platform - UI Login and SecurityLike the web platform, there’s no two-step verification method for login.

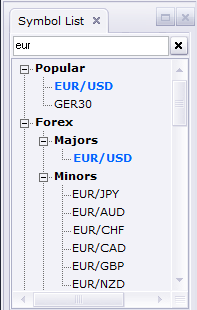

FXCM - Desktop Platform - Login SearchingThe searching function within the desktop trading platform is good with an option to explore product categories as well as searching for assets.

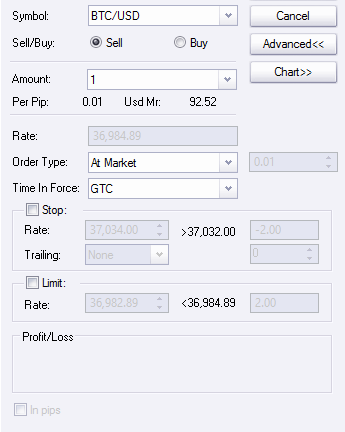

FXCM - Desktop Platform - Search Placing ordersThere are 6 types of orders:

FXCM - Desktop Platform - Place Order Notifications and alertsThe desktop trading platform has a notification and alerts option in order to never miss a chance to trade. Portfolio and reportsFXCM desktop platform has a clear portfolio and fee reports with an ability to track the account activity since its opening. FXCM Mobile Platform

LanguagesThe mobile trading application in 11 languages which are: English, Spanish, Italian, Russian, Turkish, French, Greek, Chinese and Japanese. User interface (UI)The mobile trading application of FXCM is simple and easy to use. You can also find most of the functions and options in their places with an ability to customize the platform as you want.

FXCM - Mobile Platform - UI Login and securityUnfortunately, the mobile trading platform as well as the desktop and web platform do not have a two-step verification method for login.

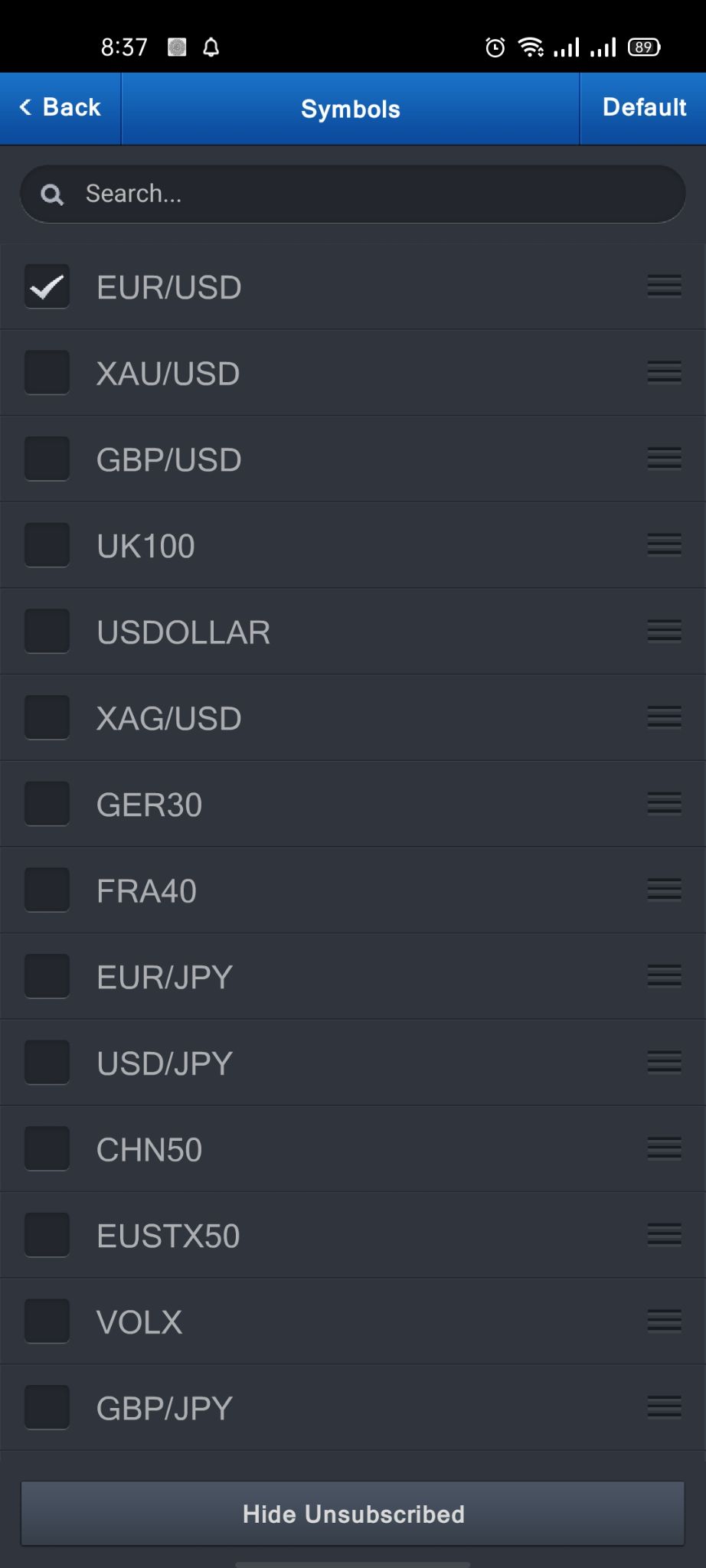

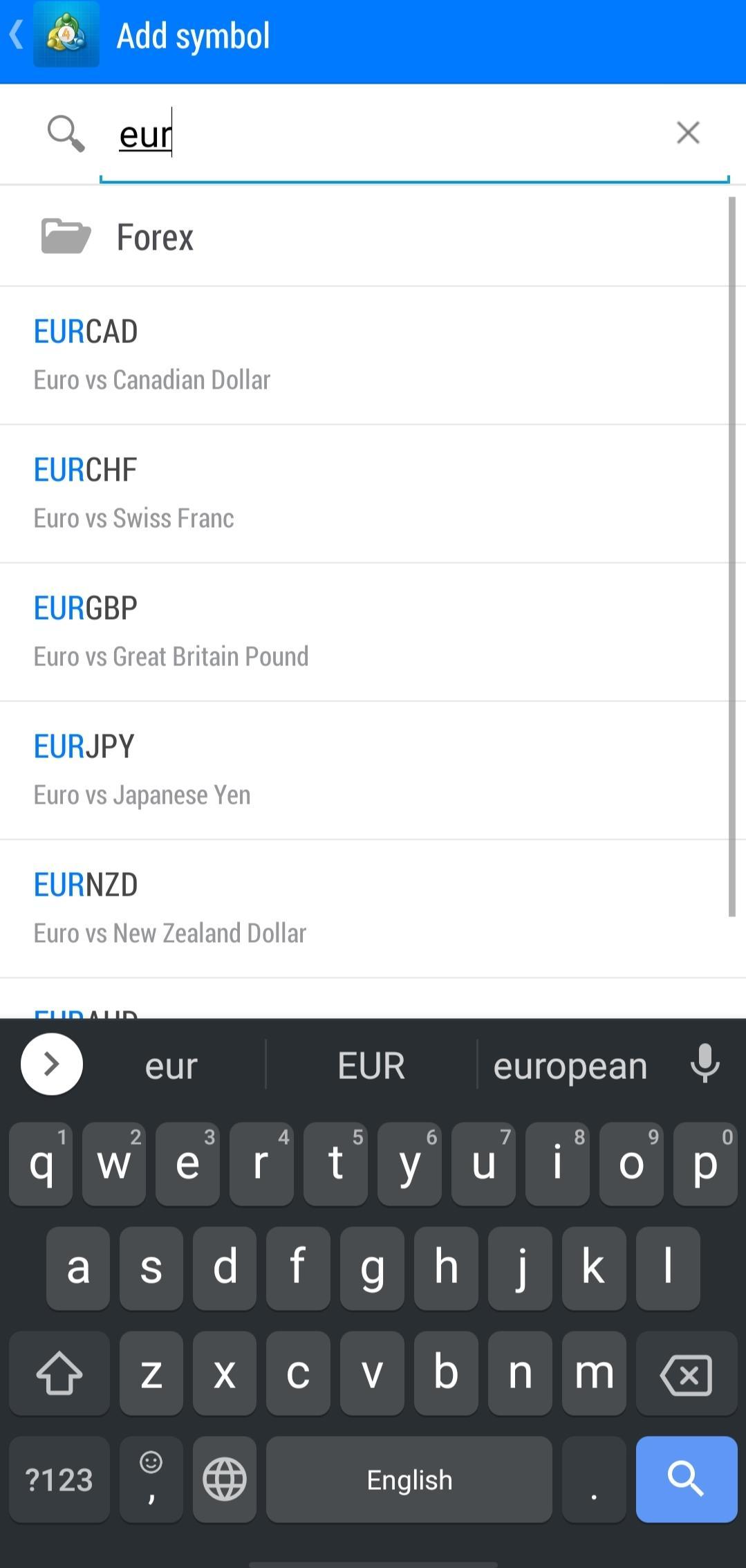

FXCM - Mobile Platform - Login SearchingYou will struggle while searching for the search function within the application as you will not be able to find it easily. This is counted as a negative point for the UI of the mobile application as it should be user friendly and all functions should be put in a common place. The search function is located in Settings -> Symbols as you see in the image below.

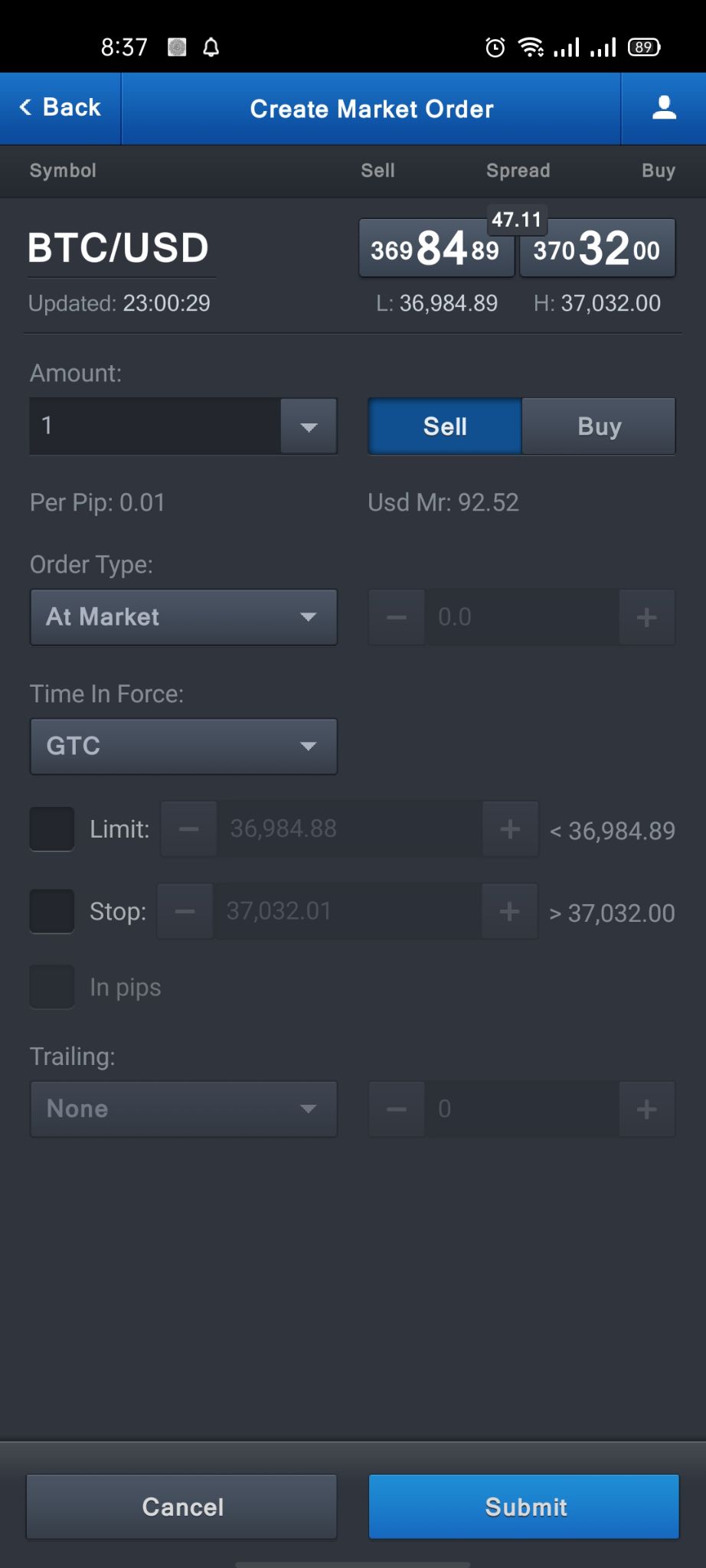

FXCM - Mobile Platform - Search Placing ordersThe mobile trading platform has the same order types like the web trading platforms which are:

FXCM - Mobile Platform - Place Order Notifications and alertsUnusually, the mobile trading platform of FXCM has no notifications or alerts options. Portfolio and ReportsThe portfolio and reports within the applications look good and have all the data you want. MetaTrader 4

LanguagesMetaTrader 4 is available in a number of languages like: MT4 Languages

User interface (UI)MT4 has a very customizable UI that you can adjust according to your needs and preferences. On the other hand, it seems hard to find some of the features inside.

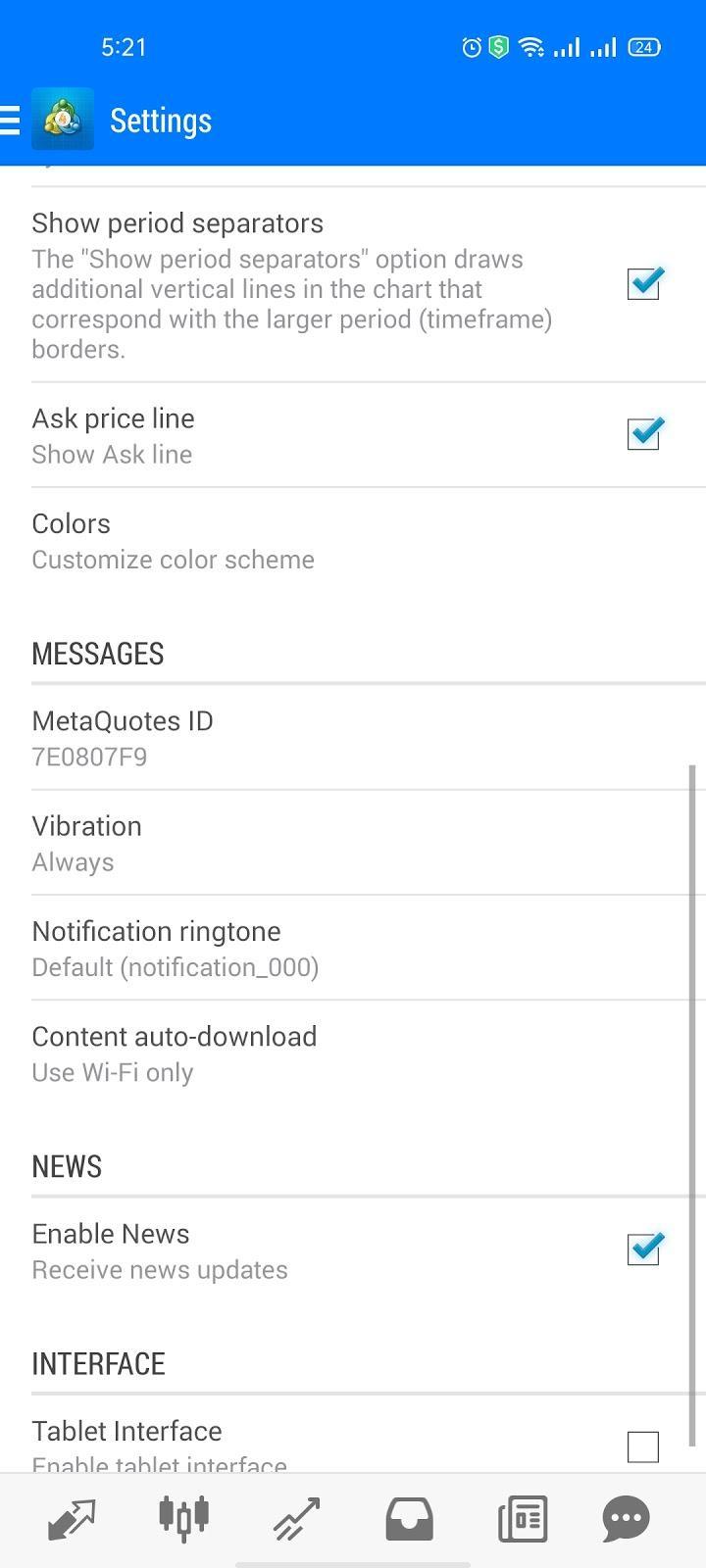

MT4 - Mobile Version - UI Login and SecurityUnfortunately, the MT4 does not provide a two-step verification method for logging in, and it does only support a one-step login. SearchingSearching using the MT4 platform has two different options:

MT4 - Mobile Platform - Search Placing ordersMT4 has a simple order types which are:

In addition to those 4 types, there are other orders which are the time limit ‘Good ‘til time’ (GTT) and ‘Good 'til canceled’ (GTC). There’s also an order confirmation feature in MT4. Notifications and alertsUnfortunately, the MT4 web trading platform does not have an option to set price alerts and notifications unlike the desktop and mobile versions.

MT4 - Mobile Version - Notifications Settings Portfolio and reportsUnder the ‘History’ tab, you can find your portfolio reports with a clear fee description.

MT4 - Mobile Version - Portfolio |

Research Tools

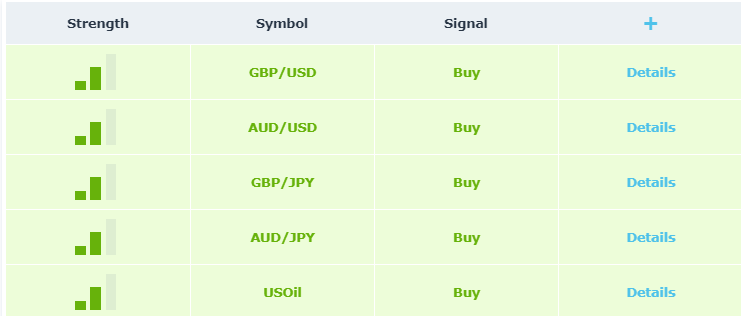

SourcesFXCM has great research and analysis tools whether on their platform, or the MT4 trading platform. Those tools help you trade smartly and analyze your performance easily and create new strategies. Trading ideasFXCM has a great trading signals tool that helps you get a great look at the market trends and take the chance of buying and selling products at their peak times. This tool is available under the name of ‘Market Scanner’ and there’s another tool called ‘Trading SSignals’ in the FXCM Pro program.

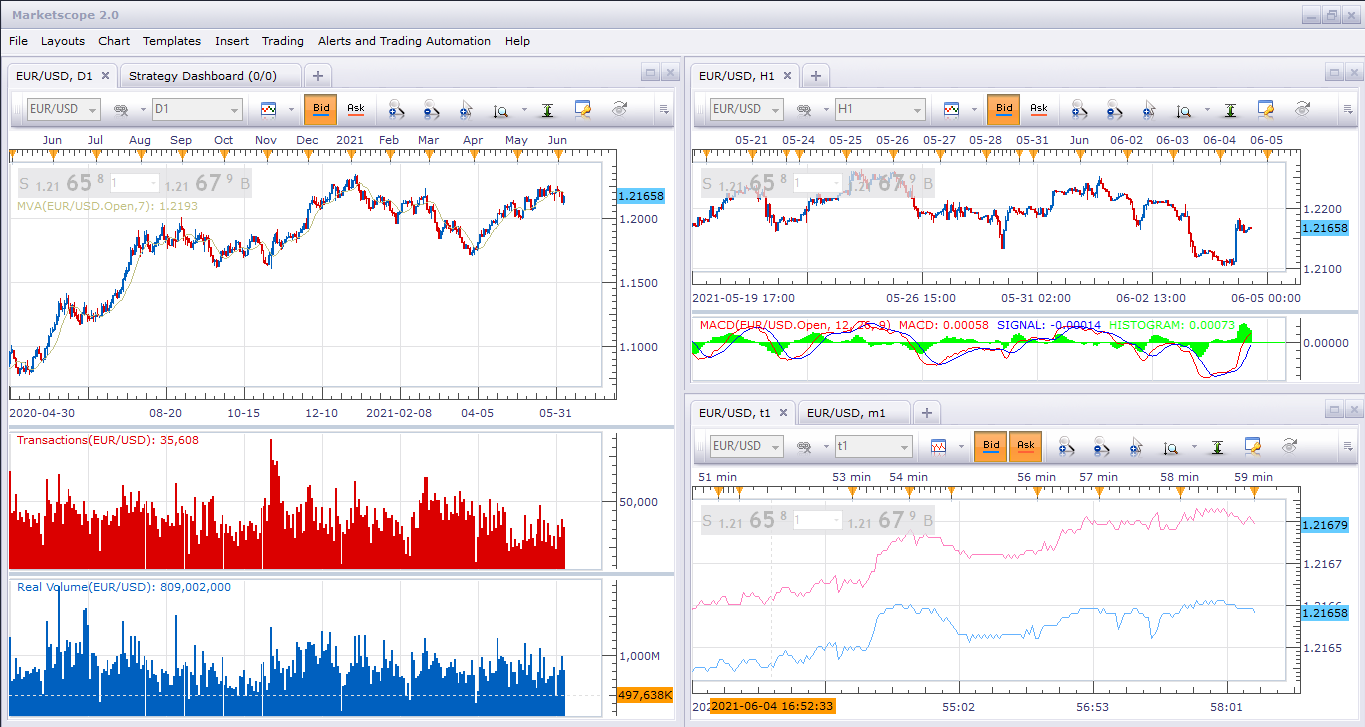

FXCM - Research - Market Scanner Fundamental dataUnfortunately, there’s no fundamental data available on FXCM broker. ChartingFXCM offers a great charting tool that helps you get an overview of the market, search for market trends, discover trading patterns of some products and predict its peak times within a timeframe with a variety of indicators.

FXCM - Research - Charts NewsfeedIf you like keeping up with market news, FXCM provides you a great News Feed of the market to never miss any important update.

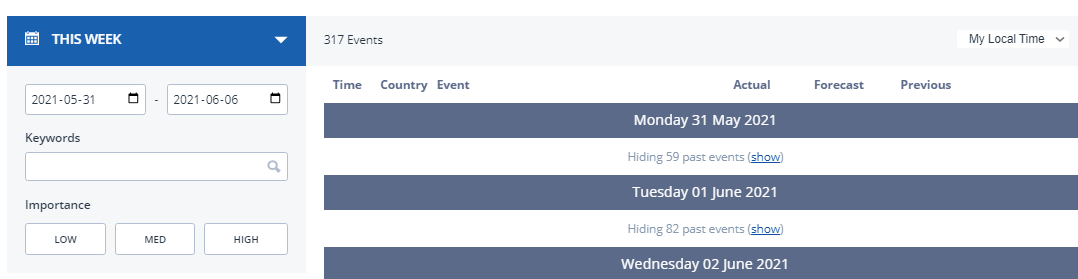

FXCM - Research - Newsfeed Economic CalendarFXCM provides an economic calendar tool that helps you track financial events and get a good idea of the market.

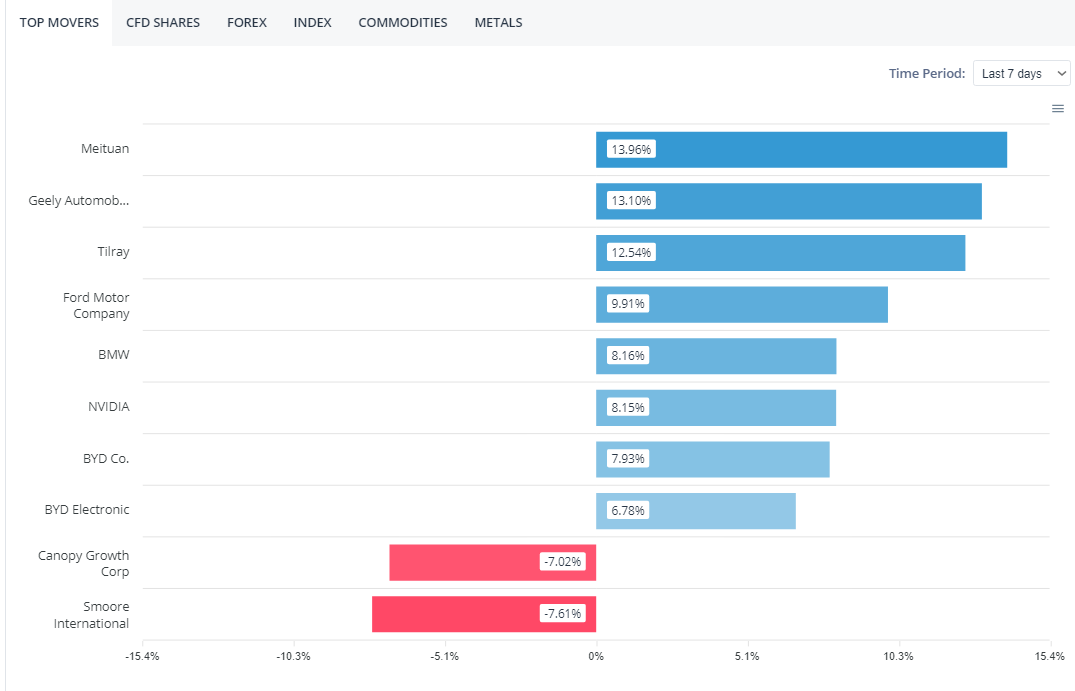

FXCM - Research - Economic Calendar HeatmapsThe Heatmap is a good tool provided by FXCM that helps you track the market movements visually at a glance.

FXCM - Research - Heatmaps Other toolsFXCM also has a subscription service called ‘FXCM Plus’. This service is free to try for the first 14 days, then you can pay for it if you like it. The service has a collection of other good tools and features like:

|

Customer Service

OptionsFXCM supports different customer service channels like:

Contact InformationYou can call the FXCM customer support team through phone from 42 different countries as the following table shows below. FXCM - Phone Support

|

Education

FXCM provides good educational materials on how to trade forex as well as other materials like video libraries, guides and articles, and free SMS trade alerts. In addition to that, there is a demo account option in case you want to trade virtually with no risk.

FXCM Education |

FAQs

1. Go to ‘Settings’ 2. Click on 'Manage Accounts' or 'Settings' 3. Then click on the small plus sign or select 'New Account' 4. Then select 'Log in to an existing account' 5. Search for the broker name 6. Select the server your account was set up on 7. Enter your login credentials and password 8. Click on 'Sign In'

|

FXCM Full Review - Reviews

FXCM Full Review - Review Conclusion

- Pros: negative balance protection, islamic account option, free deposits and withdrawals

- Cons: few trading instruments, not available on MT5, no 24/7 customer support

- Best for: beginners and professionals

- Regulated by: FCA, CySEC, BMS, ASIC, FSCA, FSP

- Headquarters: London, UK.

- Foundation year: 1999

- Min Deposit : $50 (for non-EU customers)

- Deposit and withdrawal methods: credit/ debit cards, electronic wallets, bank transfers

- Deposit fees: $0

- Withdrawal fees: $0 (except for bank transfers as it has a fee up to $40)

- Base currencies: EUR, USD, GBP, CHF, NZD, CAD, JPY

- Offering of investments: forex, CFDs, bonds, commodities, shares, cryptocurrencies

- Number of users: over 200,000