- أغسطس 11, 2021

- Posted by: ForexTradeOn

- Category: Robinhood Full Review

Ranks (of 5):

- Safety: 3.5

- The offering of investment: 2

- Account opening: 5

- Fees: 4.5

- Deposit and withdrawal: 3

- Platforms and languages: 4

- Research: 4

- Customer service: 1.5

- Education: 2

- Overall: 3.2

Pros

Regulated by top-tier financial authorities, have 18 million clients, client protection, shares and ETFs trading, fast and fully digital account opening, no minimum deposit required, low trading fees, no deposit and withdrawal fees, no inactivity fees, and good research tools.

Cons

No negative balance protection, not listed on the stock exchange market, limited trading instruments, no demo account, only one base currency available, no Credit/ Debit cards or electronic wallets available, not available on the MT4 and MT5, limited customer support options, and no sufficient educational materials.

Introduction

Robinhood is a US-based broker with over 18 million clients that trust in it. It’s regulated by top-tier financial authorities and has client protection amounts. It also has +8 years of trading experience. Robinhood’s major instruments are stocks, options, gold, mutual funds, and cryptocurrencies. You can also use third-party services to have a Shariah-compliant investment platform. Robinhood is also famous for having good trading platforms and free deposits.

Safety

|

Pros |

Cons |

|---|---|

|

|

Is Robinhood regulated?

The Robinhood broker is regulated by many financial authorities like:

- SEC: The Securities and Exchange Commissions

- FINRA: The Financial Industry Regulation Authority

Is Robinhood a scam?

Robinhood safety is divided into 2 parts, the safety of the broker itself and the safety of the client.

Broker safety

Robinhood has had a long trading journey for over 8 years. It has passed through different financial disasters up till now. The thing is that it has over 18 million active users in this period which makes Robinhood much trustworthy. The negative part is that Robinhood is not listed on the stock exchange.

Client protection

The Robinhood broker has a client protection amount to prevent its clients’ funds from going insolvent. As a member of SIPC, Robinhood has a $500,000 ($250,000 cash limit) on client funds. On the other hand, there is no negative balance protection. This is not counted as a big deal as Robinhood doesn’t have Forex or CFD instruments that have a high risk of losing money.

Offering of Investments

|

Pros |

Cons |

|---|---|

|

|

Robinhood has limited trading instruments including shares, ETFs, options, Gold, and cryptos. Other instruments are not available as Forex, CFDs, mutual funds, etc.

Robinhood Offering of Investments

|

Product |

Number of Products |

|---|---|

|

Forex |

No |

|

CFD |

No |

|

Stocks/ shares |

Yes |

|

Options |

Yes |

|

Metals |

Gold |

|

ETFs |

Yes |

|

Mutual Funds |

No |

|

Crypto |

Yes |

Note:

Please note that some of the trading options may depend on your account type and/or your state of residence according to governmental rules.

Account Opening

|

Pros |

Cons |

|---|---|

|

|

Countries available

Robinhood is available only in the US. Unfortunately, Robinhood is not available at this moment in any other country, but it prepares to expand in the future.

Account types

Robinhood has 3 account types that you can choose from:

- Instant

- Cash

- Gold

Each one of them has its features among others as the following table shows.

Robinhood – Account comparison

|

Instant Account |

Cash Account |

Gold Account |

|

|---|---|---|---|

|

Demo Account |

No |

No |

No |

|

Instant Deposits |

Up to $1,000 |

No Instant Deposit (takes 4-5 days) |

Up to $50,000 |

|

Margin |

Limited margin account |

Not a margin account |

True margin account |

|

Trades Per Week |

3 |

Unlimited |

3 |

|

Day Trading |

Limited Day Trading |

Unlimited Day Trading |

Limited Day Trading |

|

Extra |

– |

– |

Live market data (NASDAQ level II) Additional research tools |

|

Fees |

No |

No |

$5 monthly fee |

Robinhood does not provide a demo account option to trade freely with no risk.

Min deposit

The minimum deposit to open a Robinhood account is $0.

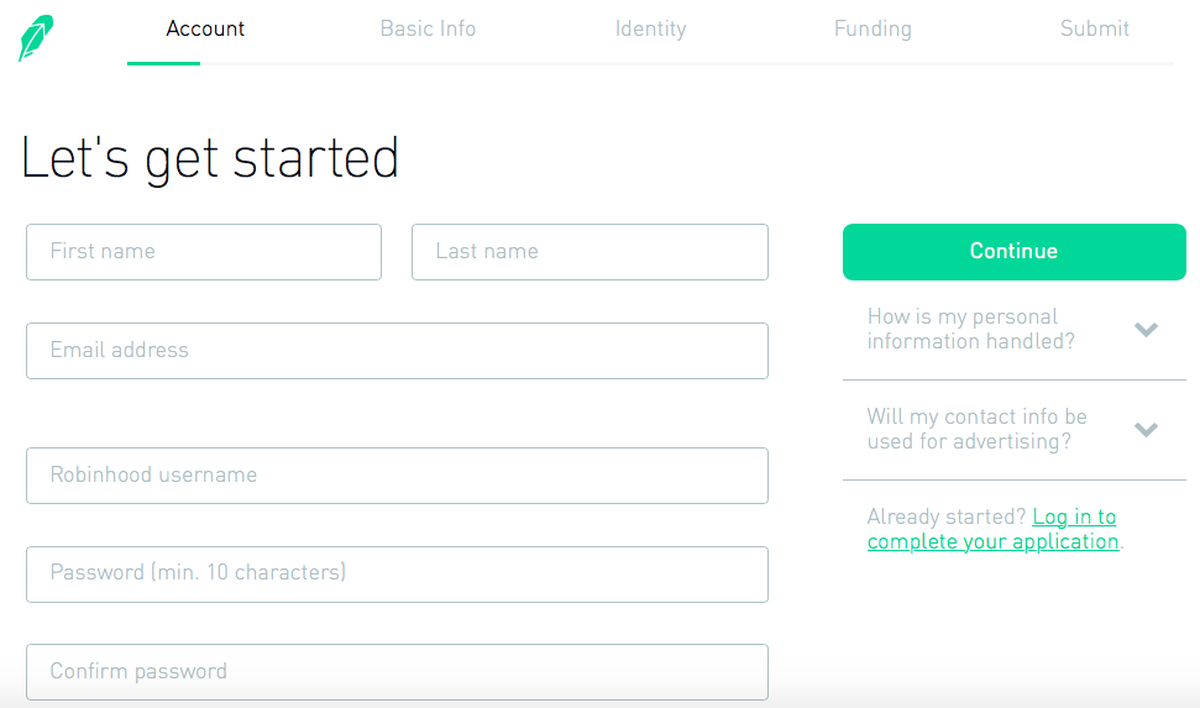

How to open an account

You can open an Robinhood account in minutes through these steps:

- Fill in your personal information (i.e. address, date of birth, and social security number)

- Answer short questions relating to your trading experience

- Verify your identity with your driver’s license/identity card/passport. A photo of the documents taken with your mobile will do

Robinhood – Account opening

Notes:

The verification process takes 1 business day.

Fees and Commissions

|

Pros |

Cons |

|---|---|

|

|

Commissions

Stocks and ETFs

Robinhood charges no commissions on US stocks and ETFs.

Options fees

There’s no commission on trading options with Robinhood.

Cryptocurrencies

Cryptocurrencies are free of charge in almost all US states. Further states will be added in the future.

Non-trading fees

- Account fee: $0

- Deposit fee: $0

- Withdrawal fees: International clients – $50 on wire transfer, US clients – $25 on wire transfer, and ACH (Free of Charge)

(you can check the full withdrawal fees in the withdrawal fees section)

- Inactivity fee: $5/ month (for Gold Account only)

Deposit and withdrawal

|

Pros |

Cons |

|---|---|

|

|

Account Currencies

The Robinhood account has only one base currency, the USD.

Notes:

- You will not be charged with conversion fees if your account has the same currency as your bank account or when you trade assets with the same currency of your account.

- If you want to avoid being charged with conversion fees, you can open a multi-currency bank account at a digital bank.

Deposit

1. Options

Robinhood supports depositing using only bank wire transfers.

Robinhood deposit methods

|

Robinhood |

|

|---|---|

|

Credit cards |

No |

|

Bank Transfers |

Yes |

|

Electronic wallet |

No |

2. Fees

Robinhood charges no deposit fees.

3. Time

Deposits arrive at your account in no time if you choose to deposit instantly. For the instant account, the maximum amount to transfer instantly is $1,000. For the Gold account, the maximum amount to transfer is $50,000.

If you exceed any of the limits, your deposit will reach your trading account within 4 to 5 business days.

Withdrawal

1. Options

Robinhood allows withdrawal using only bank transfers.

Robinhood withdrawal methods and fees

|

Robinhood |

|

|---|---|

|

Bank Transfers |

Yes |

|

Credit cards |

No |

|

Electronic wallet |

No |

|

Fee |

Yes |

2. Fees

The fee depends on the method you choose for withdrawal as the following:

- International clients – $50 on wire transfer

- US clients – $25 on wire transfer

- ACH (Free of Charge)

3. Time

Withdrawals take about 3 business days to reach your account.

Platforms and Languages

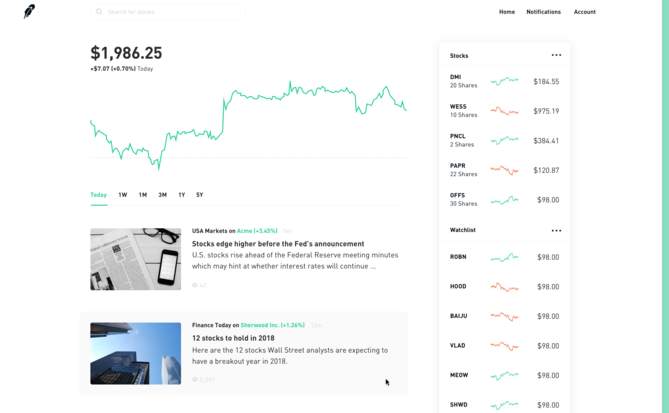

Robinhood works on its customized trading applications through web and mobile platforms.

Web

|

Pros |

Cons |

|---|---|

|

|

Languages

The main language of the platform is English.

User interface (UI)

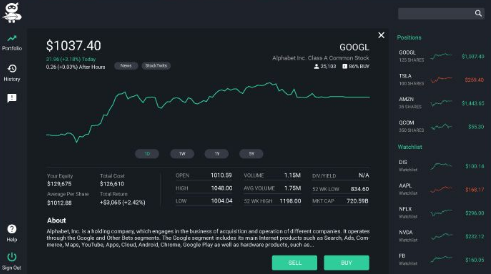

The UI of the Robinhood web trading application is very clean and easy to use. You can discover all of its features easily with no problem very seamlessly. Also, the charts are not customizable like other trading platforms.

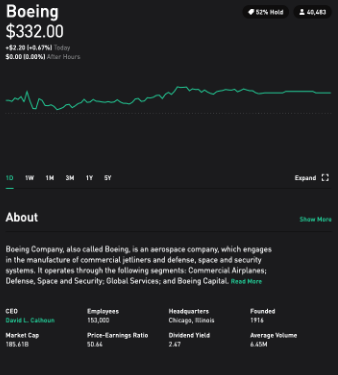

Robinhood – Web Application – UI

Login and Security

Robinhood use a two-factor authentication within its web platform for more safety instead of the usual username and password login.

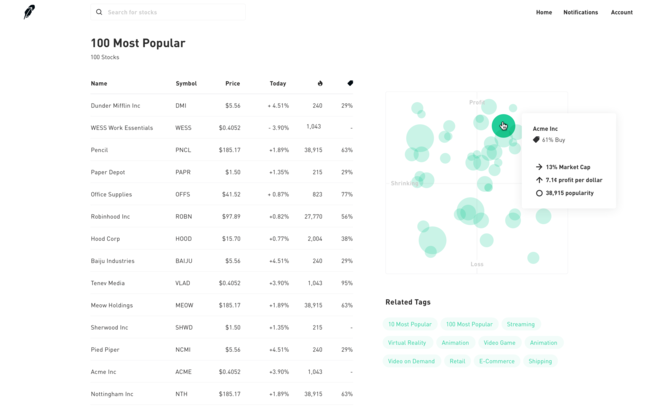

Searching

The searching function within the web platform works very fine. You can type the first letters of any product to find it easily.

Robinhood – Web Application – Search

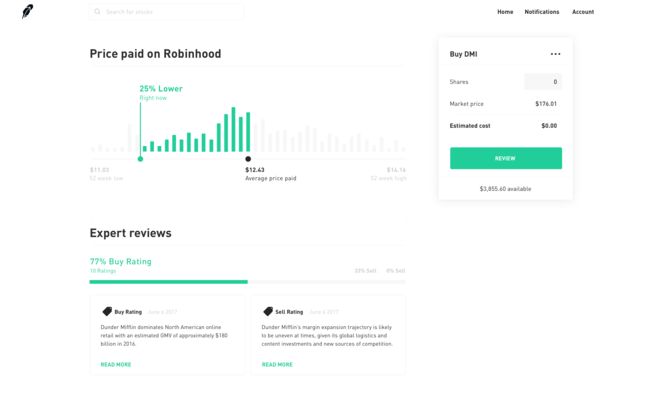

Placing orders

There are several types of orders in the web platform which are:

- Market

- Limit

- Stop Loss

- Stop Limit

- Trailing Stop

Robinhood – Web Application – Place Order

Notifications and alerts

The web platform has notification and alert options to notify you for payments, price changes, and more.

Portfolio and reports

The platform has a clear fee and portfolio reports in an easy way to understand.

Desktop

Unfortunately, Robinhood does not have a desktop trading application.

Mobile Platform

|

Pros |

Cons |

|---|---|

|

|

The mobile application of Robinhood is very similar in functionality as the web platform. There are a few differences like the login in the mobile application has an additional biometric authentication beside the 2FA.

Robinhood – Mobile Application – UI

Research Tools

|

Pros |

Cons |

|---|---|

|

|

Sources

The research tools come from Robinhood’s own trading platform as well as the mobile application.

Trading ideas

Robinhood provides a useful Analyst Rating that helps you know best chances to trade according to experts’ opinions.

Robinhood – Research – Analyst Rating

Fundamental data

The fundamental data provided by Robinhood to each product makes you know better about this product. It also provides a useful summary for each one of them.

Robinhood – Research – Fundamental Data

Charting

The charting tool at Robinhood is not very customizable like other charts, but it can help you plot graphs within specific time periods. Robinhood also provides a variety of technical indicators to choose from while plotting your own chart.

Robinhood – Research – Charting

Newsfeed

You can find the Newsfeed within the Robinhood trading applications by clicking on a specific product and view all related news about it.

Customer Support

|

Pros |

Cons |

|---|---|

|

|

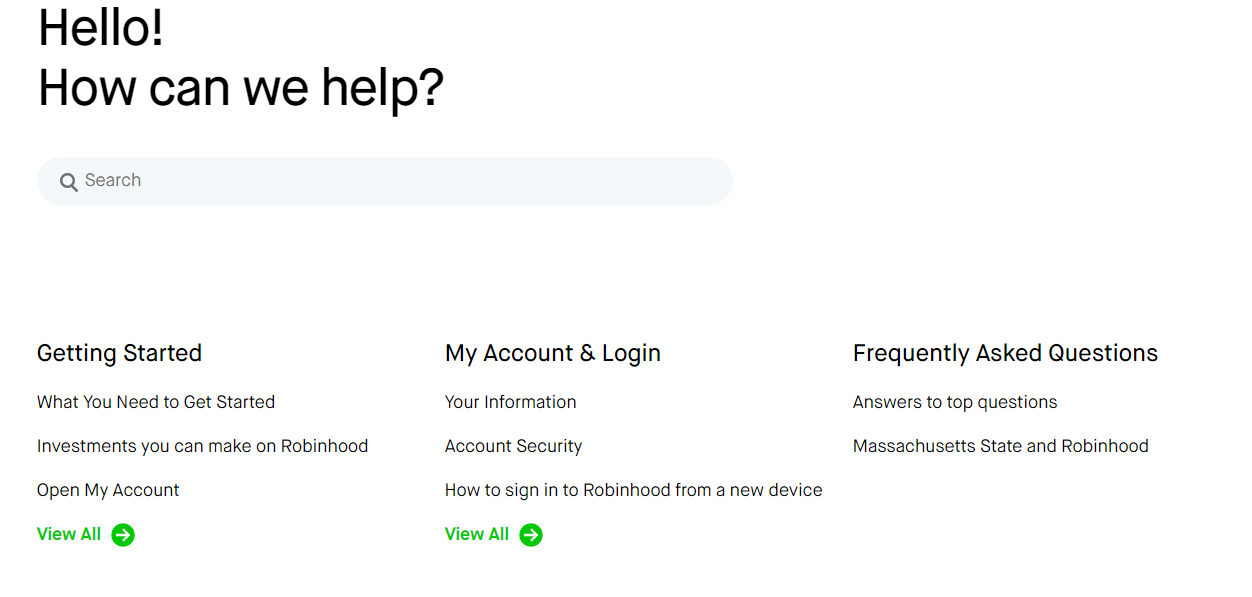

Options

Robinhood supports customer service via only emails. There are no phone or live chat support. The email support is available only 24/5.

Robinhood – Customer support

Education

|

Pros |

Cons |

|---|---|

|

|

Robinhood’s educational materials are very limited as you can find only articles to read and learn.

Robinhood – Education

FAQs

-

- How long does it take to verify my account?

- It takes about 1 business day to verify your Robinhood account.

- Can I open more than one trading account?

- No, Robinhood allows you to open only one account.

- Does Robinhood allow bot trading?

- Yes, it does.

- How to activate the two-factor authentication (2FA) method?

- To enable 2FA, you have 2 options: via SMS or via the authenticator app (i.e., Google Authenticator). After that, Follow these steps:

- Tap the Account (person) icon in the bottom right corner

- Tap the three bars in the top right corner

- Tap Settings

- Under Security, tap Two-Factor Authentication

- Toggle the feature to the On position

- Tap the authentication app you’d like to use

- Tap Open App to add your key to the authentication app

- Open your authentication app, and confirm that you’d like to add Robinhood

- Copy the verification code generated by your authentication app and paste it into Robinhood when you’re prompted.

- You’ll receive an emergency backup code from Robinhood that allows you to log in if you ever lose access to your device. We recommend saving this code in a secure place, such as within a password manager, saving a screenshot in a password-protected folder, or writing it down and locking it in a safe.

-

- Does Robinhood give a bonus?

- There is an approximately 98% chance of the stock bonus having a value of $2.50-$10.00 after opening an account on Robinhood.

- Does Robinhood allow scalping and hedging?

- It does allow hedging, but scalping is not allowed.

- Does Robinhood have a demo account?

- No, it doesn’t.

- Can I log in to the same account through different devices?

- Yes, you can log in from the trusted devices listed on your account.

- Does Robinhood accept payments from third parties?

- Your payments should be from a bank account that holds the same name as yours.

Conclusion:

- Pros: client protection, no minimum deposit, no inactivity fees

- Cons: not listed on the stock exchange, no demo account

- Best for: professional traders

- Regulated by: SEC and FINRA

- Headquarters: US

- Foundation year: 2013

- Min Deposit : $0

- Deposit and withdrawal methods: bank transfers

- Deposit and withdrawal fees: $0

- Base currencies: USD

- The offering of investments: shares, ETFs, options, gold, cryptocurrencies

- The number of users: 18 million