- يونيو 27, 2021

- Posted by: ForexTradeOn

- Category: saxo Broker review

Introduction

Saxo Bank is one of the most popular investment banks all vr the world. It’s originally founded in 1992 in Denmark. It’s also regulated by top-tier financial authorities like the FCA, the Financial Conduct Authority in the UK. Saxo Bank has over 40,000 trading products in several categories like forex, CFDs, commodities, ETFs, and more. It also has low trading fees, with a good trading experience through its customized trading platforms. Saxo Bank also has several third party research tools that help you trade smart with the least effort and create your own trading strategies.

Saxo Bank works on 3 main platforms which are:

- SaxoTraderGo (Web Trading Platform)

- SaxoTraderPro (Desktop Trading Platform)

- SaxoTraderGo (Mobile Trading Platform)

In addition to these platforms, Saxo Bank is available on the MetaTrader 4 platform. In this section, we will discuss each one of these trading platforms in detail.

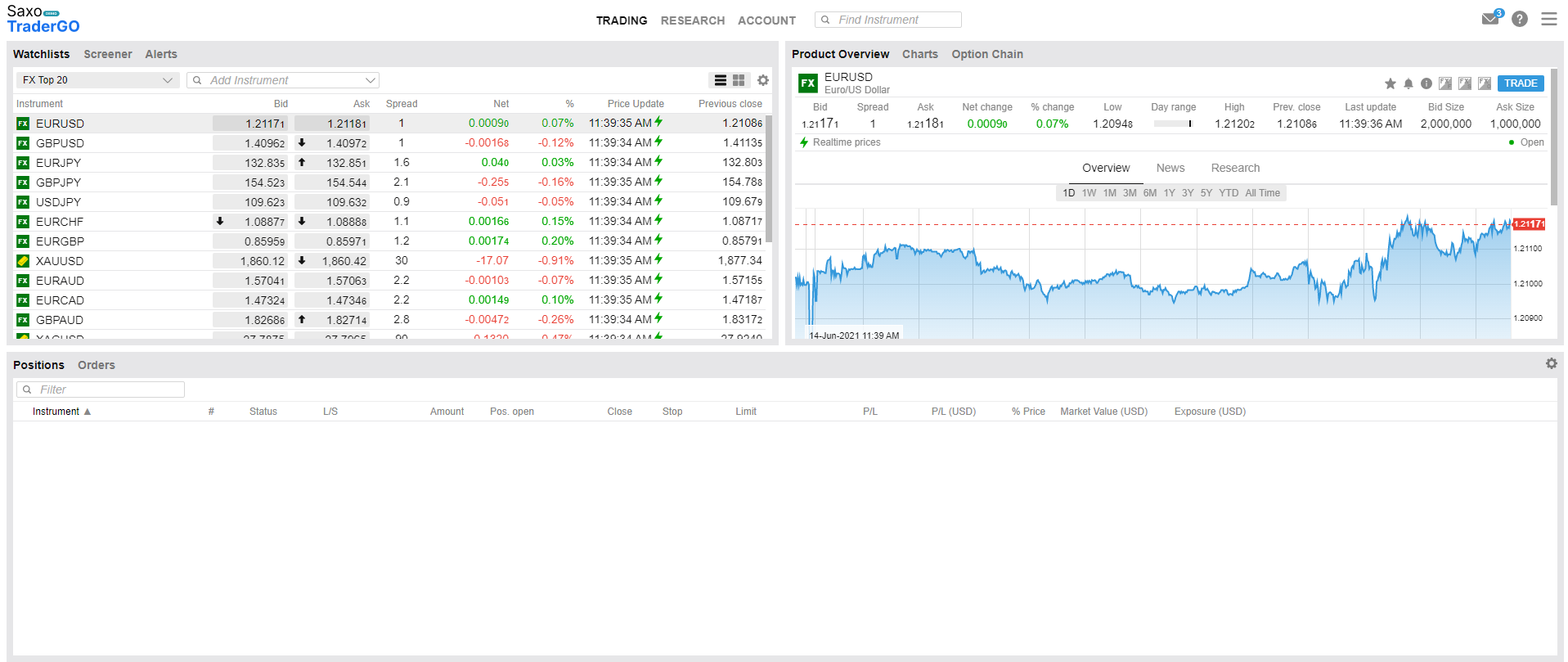

SaxoTraderGo (Web Trading Platform)

|

Pros |

Cons |

|

None |

Languages

SaxoTraderGo is available in over 30 languages including major languages like Arabic, English, Chinese, and German.

SaxoTraderGo – Languages

|

Arabic |

Bulgarian |

Chinese (simplified) |

Chinese (traditional) |

Croatian |

|

Czech |

Danish |

Dutch |

English |

Estonian |

|

Finnish |

French |

German |

Greek |

Hungarian |

|

Italian |

Japanese |

Latvian |

Lithuanian |

Norwegian |

|

Polish |

Portuguese |

Romanian |

Russian |

Slovakian |

|

Slovenian |

Spanish |

Swedish |

Turkish |

User interface (UI)

The UI of SaxoTraderGo platform has a user-friendly UI with a simple structure and easy-to-use functions within the platform.

Saxo Bank – Web Application – UI

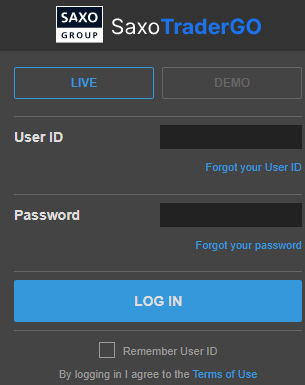

Login and Security

As Saxo Bank cares for its clients’ safety, the web trading platform has a two-step authentication for login.

Saxo Bank – Web Application – Login

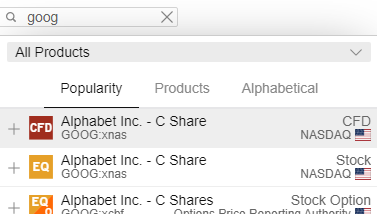

Searching

The searching function of the web platform is very helpful finding the right instrument you’re searching for. You can browse by category as well as typing the instrument name.

Saxo Bank – Web Application – Search

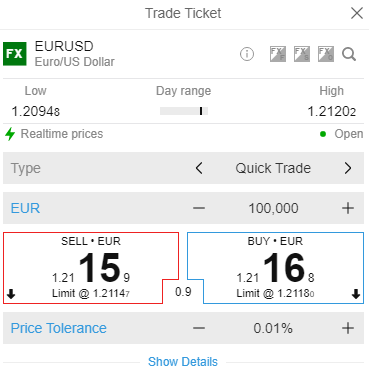

Placing orders

There are 6 types of orders in the web trading platform of Saxo Bank:

- Market

- Limit

- Stop limit

- Stop

- Trailing stop

- One-cancels-the-other (OCO)

Saxo Bank – Web Application – Place Order

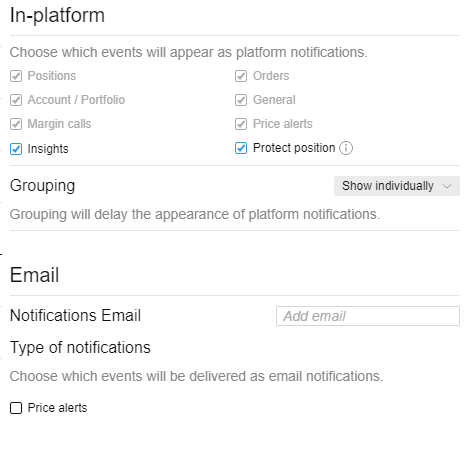

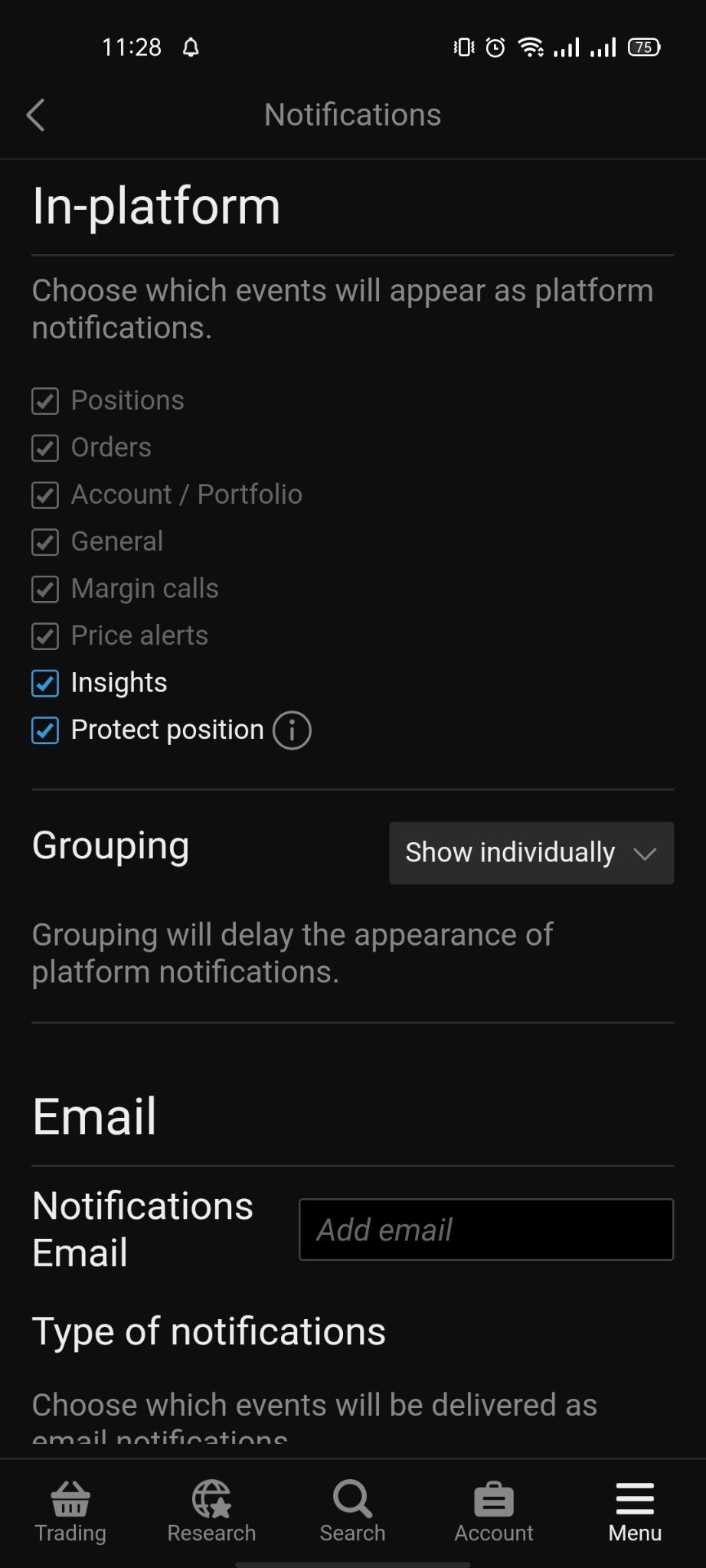

Notifications and alerts

The web trading platform has a variety of alerts or notifications about:

- Price

- Positions

- Margins

- Orders

You can also set an email notification alert to follow up with changes in prices and more.

Saxo Bank – Web Application – Notifications

Portfolio and reports

SaxoTraderGo has a good fee and portfolio reports that you can find in the ‘Account Summary’ section.

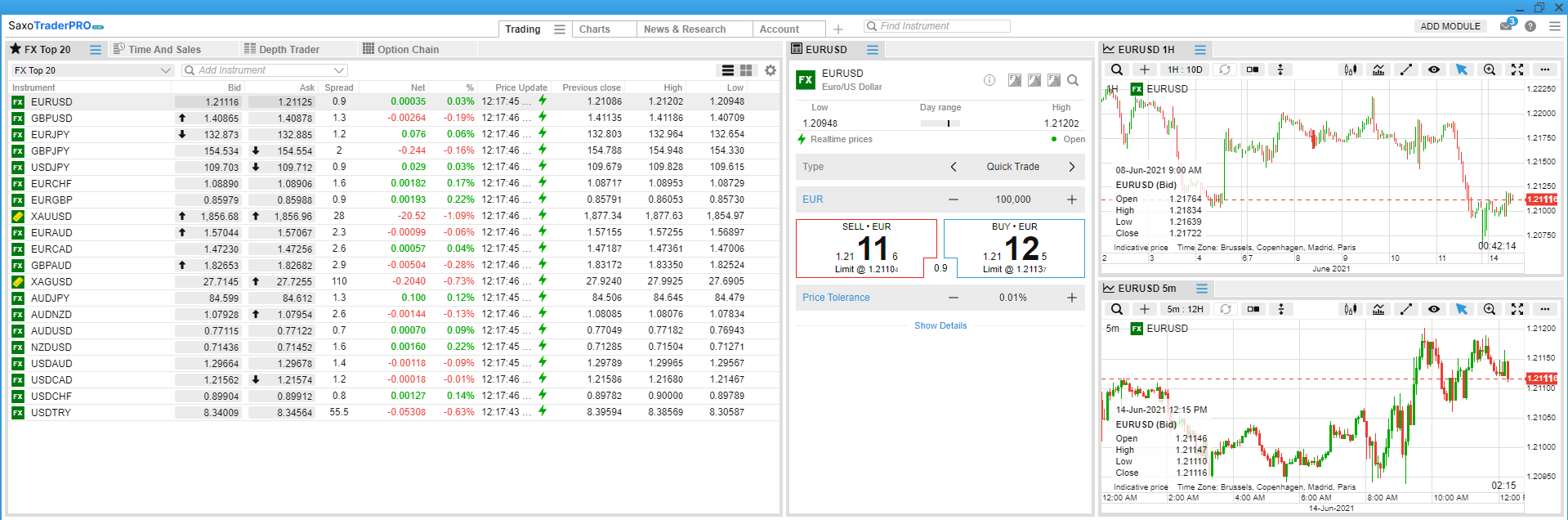

SaxoTraderPro (Desktop Platform)

|

Pros |

Cons |

|

|

The desktop trading platform looks very similar to the web trading platform with the same functionalities in the same places. SaxoTraderPro platform is available in the same languages as the web trading platform SaxoTraderGo.

Saxo Bank -Desktop Application – UI

SaxoTraderGo (Mobile Trading Platform)

|

Pros |

Cons |

|

|

Languages

The mobile trading platform in the same 30 languages as the web and desktop trading platform including Arabic, English, German, and Chinese.

Saxo Bank – Mobile Application – Languages

User interface (UI)

The UI of the mobile trading app is very simple and high response rate with all functions in their places without any complication.

Saxo Bank – Mobile Application – UI

Login and security

The mobile trading platform has a two-factor authentication method for login with the ability to set TouchID/ FaceID for more safety to your trading account.

Saxo Bank – Mobile Application – Login

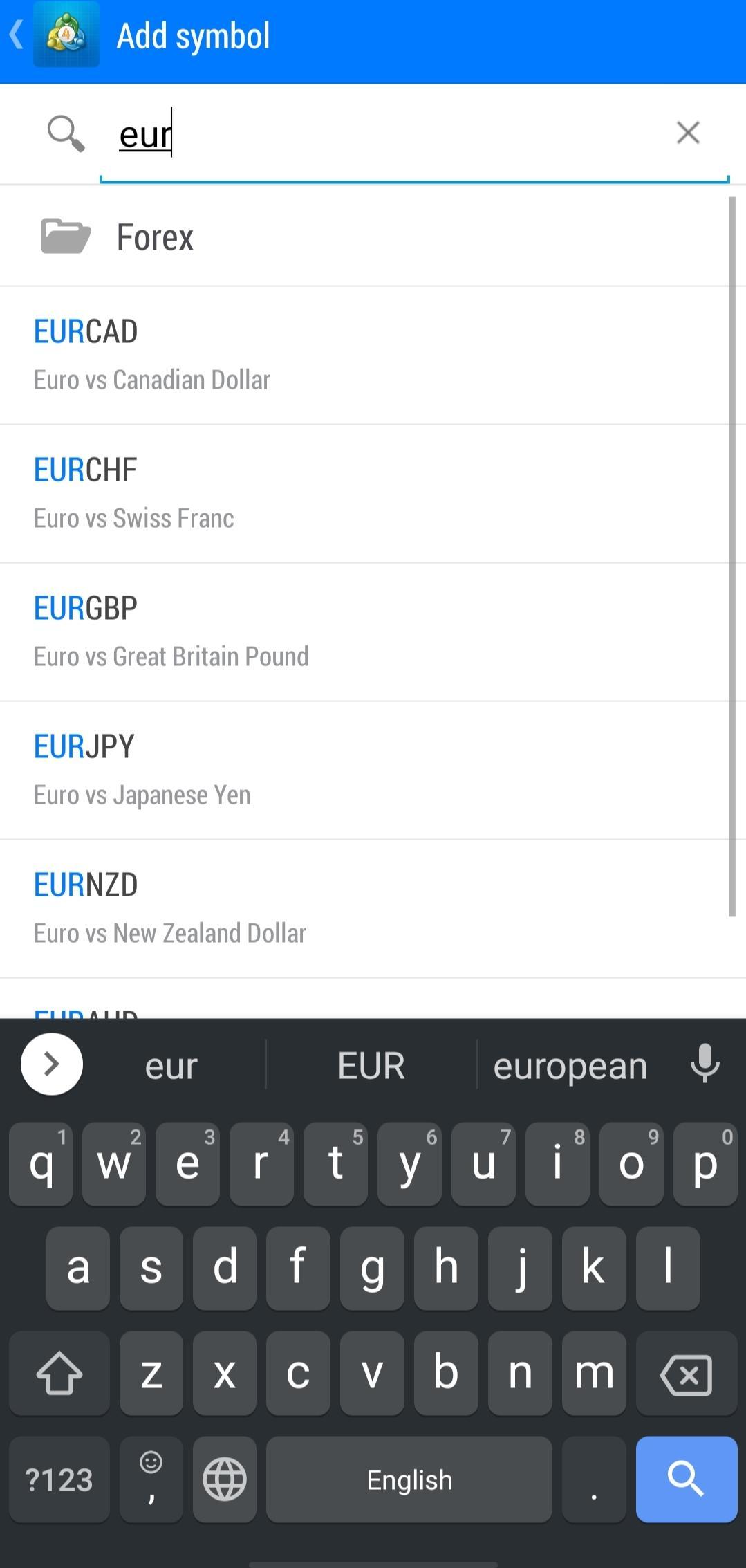

Searching

The searching function has the same stability like the web and desktop platform. You can search using the asset name or by category.

Saxo Bank – Mobile Application – Search

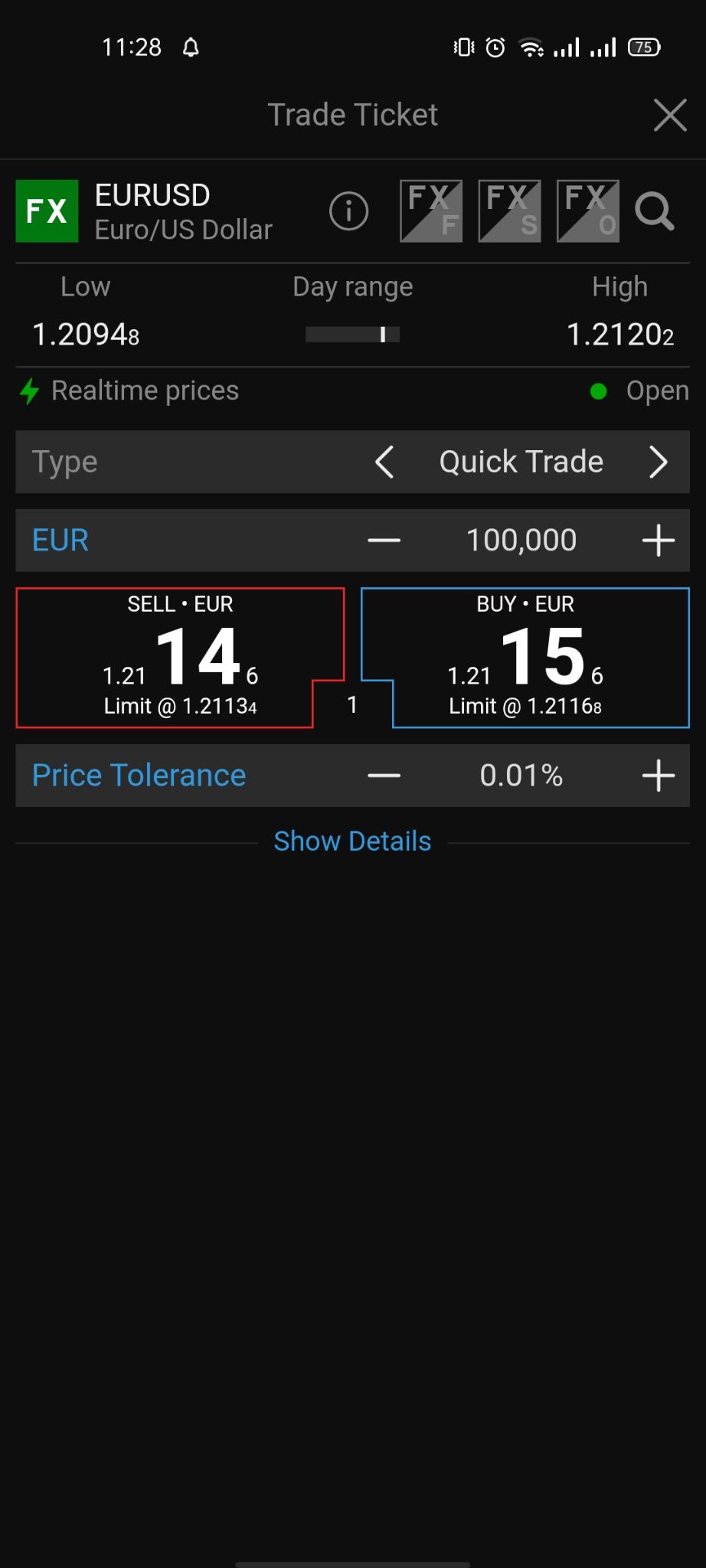

Placing orders

Same as the web platform, there are 6 types of orders:

- Market

- Limit

- Stop limit

- Stop

- Trailing stop

- One-cancels-the-other (OCO)

Saxo Bank – Mobile Application – Place Trade

Notifications and alerts

The mobile trading platform has an option to set notifications and alerts in order not to miss any opportunity and avoid risks.

Saxo Bank – Mobile Application – Notifications

MT4 Platform

|

Pros |

Cons |

|

|

Languages

MetaTrader 4 is available in a number of languages like:

MT4 Languages

|

Arabic |

Bulgarian |

Chinese |

Croatian |

Czech |

Danish |

|

Dutch |

English |

Estonian |

Finnish |

French |

German |

|

Greek |

Hebrew |

Hindi |

Hungarian |

Indonesian |

Italian |

|

Japanese |

Korean |

Latvian |

Lithuanian |

Malay |

Mongolian |

|

Persian |

Polish |

Portuguese |

Romanian |

Russian |

Serbian |

|

Slovak |

Slovenian |

Spanish |

Swedish |

Tajik |

Thai |

|

Traditional Chinese |

Turkish |

Ukrainian |

Uzbek |

Vietnamese |

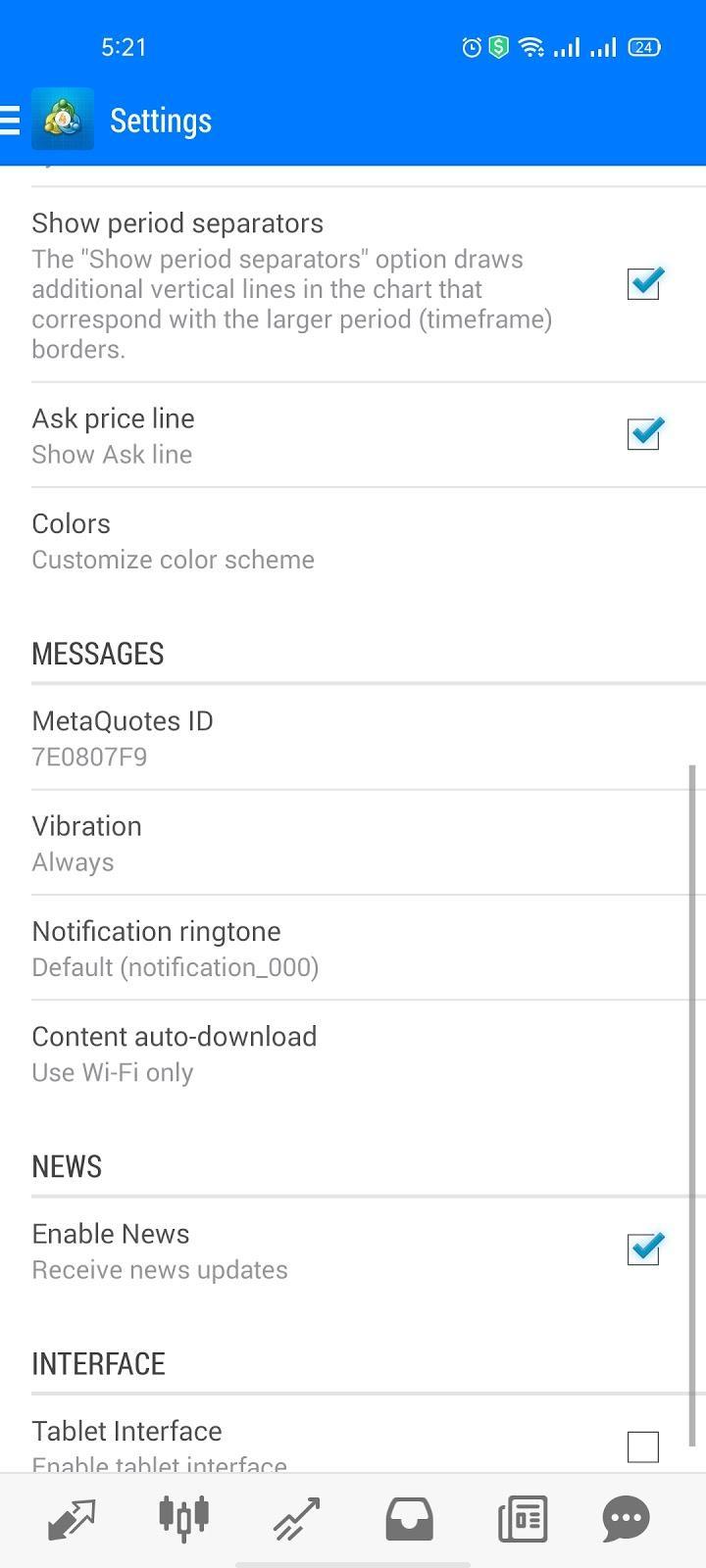

User interface (UI)

MT4 has a very customizable UI that you can adjust according to your needs and preferences. On the other hand, it seems hard to find some of the features inside.

MT4 – Mobile Version – UI

Login and Security

Unfortunately, the MT4 does not provide a two-step verification method for logging in, and it does only support a one-step login.

Searching

Searching using the MT4 platform has two different options:

- You can search by categories and find assets.

- You can also type the name of the asset and search for it manually.

MT4 – Mobile Platform – Search

Placing orders

MT4 has a simple order types which are:

- Market

- Limit

- Stop

- Trailing stop

In addition to those 4 types, there are other orders which are the time limit ‘Good ‘til time’ (GTT) and ‘Good ’til canceled’ (GTC).

There’s also an order confirmation feature in MT4.

Notifications and alerts

Unfortunately, the MT4 web trading platform does not have an option to set price alerts and notifications unlike the desktop and mobile versions.

MT4 – Mobile Version – Notifications Settings

Portfolio and reports

Under the ‘History’ tab, you can find your portfolio reports with a clear fee description.

MT4 – Mobile Version – Portfolio

3. FAQs

- How long does it take to verify my account?

- It takes about 1 to 3 business days to verify your Saxo Bank account.

- Can I open more than one trading account?

- You may open several different types of accounts with Saxo (e.g. an individual, joint, corporate), but not more than one of each account (i.e. you may not open multiple individual accounts in the same name).

- Does Saxo Bank allow bot trading?

- Yes, Saxo Bank allows bot trading through API trading options.

- What is the minimum and maximum amount for credit/debit card funding?

- Following transaction limits apply to card payments (for non-UK residents):

- Minimum 1 USD and maximum 5,000 USD per transaction

- Max. 50,000 USD per 30 days.

- Does Saxo Bank give a bonus?

- Yes, Saxo Bank does offer a loyalty program in which you earn points each time you make a trade on Saxo Bank platform. Also, these points help you upgrade your account level as well as have better pricing. The points required to join each program are:

- Classic: 0 points

- Platinum: 120,000 points

- VIP: 500,000 points

As said above, the points you earn depend on the trade volume you have. The following table will help you know more information about how much you should trade in order to get points.

Saxo Bank – Reward Points

|

Product |

Volume |

Points |

|

FX spot trade |

EUR 10,000 |

30 |

|

FX option trade |

EUR 10,000 |

40 |

|

CFD index trade |

EUR 10,000 |

20 |

|

CFD equity trade |

EUR 10,000 |

180 |

|

CFD all trade |

EUR 10,000 |

30 |

|

CFD exp. trade |

EUR 10,000 |

20 |

|

Stock trade |

EUR 10,000 |

160 |

|

Stock option trade |

1 |

50 |

|

Non-stock option trade |

1 |

110 |

|

Contract future trade |

1 |

110 |

|

Contract options trade |

1 |

110 |

|

Bonds investment |

EUR 10,000 |

320 |

- Does Saxo Bank allow scalping and hedging?

- Saxo Bank does allow scalping, but it does not allow hedging on its platform.

- When will my demo account expire?

- After 20 days.

- When trading forex, will you lose more than your initial deposit?

- The Saxo Bank trading platforms are set to automatically close your positions when your margin requirement reaches 100% (stop out level).

- Please note that this process is automated and is not a guarantee that your account will not enter into a negative equity situation and you should keep a balance amount in your account above your required margin.

- Does Saxo Bank accept payments from third parties?

- Saxo does not accept payments from accounts that are not in your name (3rd party payments).

- Does Saxo Bank have a referral program?

- Yes. You can introduce a friend to Saxo, then your friend opens an account, makes a deposit, and places three trades and you will get your rewards. (Conditions may vary from country to country)

- Do I retain access to my Demo account after opening a live account?

- Yes, clients retain access to their Demo accounts after opening live accounts. Clients are also able to extend their Demo access by contacting their account representative.

- How are my funds protected with Saxo?

- While Saxo is a member of the Danish Guarantee Fund, the client deposits are guaranteed by the fund with up to EUR 100,000 for cash deposits. Cash deposits are calculated as the net free deposit after deduction of any debt to the bank.

- How many individuals can open a joint account?

- Saxo Bank accepts joint accounts between two persons only and only between first line family members defined as: spouse, siblings, parents and children.

- How do I transfer money between sub-accounts?

- Go to Menu > Deposits and Transfers > Sub-account transfer.

- Then select:

- The account you wish to transfer funds from

- The receiving account

- The amount

- Click Transfer

Please note that Saxo Bank does not charge any fees on transferring money between sub-accounts, but there is a conversion fee that’s deducted from the deposited amount for currency conversion.

- How do I open a sub-account?

- You can open a sub account from Saxo Bank trading platforms as the following:

- SaxoTraderGo/ Pro:

> Contact support > Create a support request > Sub-account request

> Contact support > Create a support request > Sub-account request - SaxoInvestor:

> Contact Support > Submit ticket > Sub-account request

> Contact Support > Submit ticket > Sub-account request - SaxoTraderGo (Mobile): Menu > Support > Contact Support > Submit ticket > Sub-account request

- Can I fund my account in a different currency other than the account base currency?

- Yes, you can. But there will be a conversion fee deducted from the deposited amount.

- Can I be logged into my account on more than one platform simultaneously?

- Unfortunately, no.

- Does Saxo Bank offer an islamic (swap-free) account?

- Yes, it does.

- Can I use two different accounts simultaneously on the same PC?

- If you have two accounts (i.e., individual and joint account) you can login simultaneously from the both, one of them on the SaxoTraderGo, and the other on SaxoTrader Pro.

- How many instruments can I have in my Watchlist?

- 250 trading instruments.

- What is the minimum trade size for Crypto FX on Saxo Bank?

- The minimum trade size for Crypto FX pairs varies depending on which pair you trade:

- Trading in Bitcoin pairs starts from a minimum of 0.01 BTC.

- Trading in Ethereum pairs starts from a minimum of 0.1 ETH.

- Trading in Litecoin pairs starts from a minimum of 1 LTC.

- Do I need a crypto wallet to trade cryptocurrencies with Saxo?

- A crypto wallet is not required because you do not own the underlying coins when trading ETPs or Crypto FX pairs.

- Does Saxo charge fees for their trading platforms?

- Saxo does not charge any fees for using the trading platforms. There are no fees to use SaxoTraderGO, SaxoTraderPRO or the SaxoTrader mobile App.