- يونيو 28, 2021

- Posted by: ForexTradeOn

- Category: CMC Markets review

|

Pros |

Cons |

|

|

Introduction

CMC Markets, is a UK forex and CFD broker that was founded in 1989 and has over 80,000 clients worldwide. CMC markets is also regulated by top-tier financial authorities like FCA, the Financial Conduct Authority in the UK. With over 11,000 trading instruments, CMC Markets beats a lot of other brokers in the number of products.

Countries Available

CMC Markets is available in over 80 countries including, but not limited to Australia, Cyprus, and the UK.

On the other hand, CMC Markets is not available in the USA.

CMC Markets – Countries Available

|

Albania |

Algeria |

Australia |

Austria |

Bahamas |

Bahrain |

Barbados |

Belgium |

|

Bermuda |

Bosnia And Herzegovina |

British Virgin Islands |

Brunei Darussalam |

Bulgaria |

Canada |

Cayman Islands |

Chile |

|

Croatia |

Cyprus |

Czech Republic |

Denmark |

Estonia |

Falkland Islands |

Fare Islands |

Finland |

|

France |

French Guiana |

French Polynesia |

Georgia |

Germany |

Gibraltar |

Greece |

Grenada |

|

Guadalupe |

Guernsey |

Hong Kong |

Hungary |

Iceland |

India |

Ireland |

Isle of Man |

|

Italy |

Jersey |

Jordan |

Kuwait |

Latvia |

Liechtenstein |

Lithuania |

|

|

Luxemburg |

Macedonia |

Malaysia |

Malta |

Martinique |

Mauritius |

Maytte |

Moldova |

|

Mnac |

Netherlands |

New Caledonia |

New Zealand |

Norway |

man |

Panama |

Peru |

|

Philippines |

Pland |

Portugal |

Qatar |

Republic of Korea |

Réunin |

Rmania |

Russian Federation |

|

Saint Barthélemy |

Saint Martin |

Saint Pierre And Miquelon |

Saudi Arabia |

Seychelles |

Singapore |

Slovakia |

Slovenia |

|

Spain |

Sweden |

Switzerland |

Taiwan |

Turkey |

United Arab Emirates |

United Kingdom |

Wallis And Futuna |

Account Types

CMC Markets provides three main account types which are:

- Spread Betting

- CFD

- Corporate

Each one of the three has its own specifications and features as the following table shows.

CMC Markets – Account comparison

|

Spread Betting |

CFD |

Corporate |

|

|

Demo Account |

Yes |

Yes |

No |

|

Spread |

From 0.3 points |

From 0.3 points |

From 0.3 points |

|

Commissions |

No |

From $10 (shares only) |

From $10 (shares only) |

|

Min deposit |

£0 |

£0 |

£0 |

|

Negative Balance Protection |

Yes |

Yes |

Yes |

|

Base Currencies |

GBP, EUR |

GBP, EUR, USD, AUS, CAD, NOK, NZD, PLN, SEK, SGD |

GBP, EUR, USD, AUS, CAD, NOK, NZD, PLN, SEK, SGD |

|

Islamic account option |

|||

|

Market Data Fees |

No |

Yes |

Yes |

|

Dormancy Fees |

Yes After one year of inactivity |

Yes After one year of inactivity |

Yes After one year of inactivity |

CMC Markets also provides a demo account with 0 fees if you want to experience the trading platform with no risk using any account type.

Unfortunately, there’s no islamic account option as CMC Markets to trade CFDs with a swap-free option.

In addition to the previous account types, CMC Markets also provides another account type which is the Professional Account which you should meet some specifications to register for it. These specifications are:

- Placed 10 relevant trades of a significant size per quarter in the last year

- Your financial instrument portfolio exceeds €500,000?

- Worked in the financial sector for at least one year

This account type offers you a number of features that are available in any other account type like the Cash rebates for shares.

There’s an option to join the CMC Markets affiliate partner program if you want as well.

Min Deposit

The minimum deposit for spread betting, CFD, and the corporate account is $0.

How to Open Account

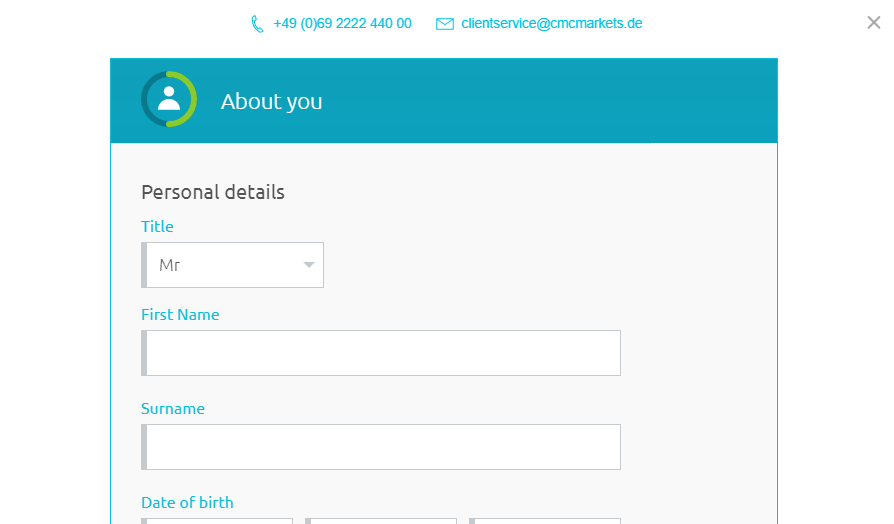

You can open an CMC Markets account in minutes through these steps:

- Enter your country, email, and password.

- Verify your email by entering the security code sent to your email.

- Choose the account type, currency, and the type of the account.

- Provide some personal information like your name, phone number, and date of birth.

- Add your address and finances information.

- Verify your identity.

- Fund your account and start trading.

CMC Markets – Account opening

Notes:

- Due also to the requirements of the regulatory bodies that supervise CMC Markets, it is necessary that in order to operate with your account you send them a proof that proves your identity and another proof that proves your current address :

- Identity document : You must send a copy of your ID, your passport or driving license . It has to be an official document that clearly shows your identity and that it is valid (the document you send cannot be expired). You can scan any of these documents and send it in PDF, JPG, GIF, or take a photo with your mobile if it is more comfortable for you. In any case, the image must have good quality and be completely readable, otherwise it may give you problems to verify it.

- Proof of address : This is to send a document that shows your current address . You will have to send a recent utility bill (not exceeding 3 months) for electricity, water, gas, landline or Internet (many brokers do not accept, for example, mobile phone bills). You can scan and send it in PDF, JPG, GIF, or take a photo with your mobile. Like the previous document, all the data must be legible and have sufficient quality.

FAQs

- How long does it take to verify my account?

- It takes about 1 to 2 business days to verify your CMC Markets account.

- Can I open more than one trading account?

- Yes, you can.

- Does CMC Markets allow bot trading?

- Yes, it does.

- Does CMC Markets give a bonus?

- Yes. you can get a bonus of $250 when you refer a friend to CMC Markets and both you and your friend will earn a bonus when your friend trades on a newly opened CFD account.

- Does CMC Markets allow scalping and hedging?

- Yes, it does allow scalping and hedging.

- Where is my money held?

- They’re held in separate bank accounts.

- What happens to my funds if the bank which holds my funds goes insolvent?

- If this happens, please notify your bank as soon as possible. Once you’ve done so, please contact the Client Management team who will arrange to remove those cards from your account.

- Is my money products with CMC Markets?

- Under our FCA obligations we comply with Client Assets (CASS) rules to ensure all client funds are protected. As such, we distinguish your money from our own and hold it in separate bank accounts.

- Does CMC Markets have a swap-free account option?

- Unfortunately, CMC Markets does not provide such an option.

- How do I login using the MT4 mobile platform?

- Steps:

1. Go to ‘Settings’

2. Click on ‘Manage Accounts’ or ‘Settings’

3. Then click on the small plus sign or select ‘New Account’

4. Then select ‘Log in to an existing account’

5. Search for the broker name

6. Select the server your account was set up on

7. Enter your login credentials and password

8. Click on ‘Sign In’

- When will my demo account expire?

- It will not expire even if you open a live account as you can test your strategies in the demo account.

- When trading forex, will you lose more than your initial deposit?

- Both our MetaTrader 4 and CMC Markets platforms are set to automatically close your positions when your margin requirement reaches 100% (stop out level).

- Please note that this process is automated and is not a guarantee that your account will not enter into a negative equity situation and you should keep a balance amount in your account above your required margin.

- Can I login to more than one account from the same computer?

- Yes, you can do such a thing by using the MT4 Multi Terminal.

- Can I login to the same account through different devices?

- No, you can not do such a thing with your CMC Markets account.

- Does CMC Markets accept payments from third parties?

- No, as payments should be under your name.

- Why do you ask for my personal financial and employment information?

- As a UK regulated financial services firm, CMC Markets is required to comply with industry ‘Know Your Customer’ (KYC) requirements to identify its customers and check they are who they say they are.

- Where can I open a spread betting account?

- If you’re resident in the UK or Ireland, you can do that.

- Can I access the platform when I go abroad?

- Yes, you can as long as you have a good internet connection.

- Can I log into my account via your website and my mobile device at the same time?

- No. You are only able to access your account through either the website or your mobile device at any one time. If you attempt to log in to both platforms at the same time you will be disconnected from your previous session.

- Does CMC Markets offer monthly cash rebates?

- For professional clients, CMC Markets offers competitive monthly cash rebates for eligible clients who trade in high volumes.